The case for senior loans - quarterly update

Q4 2025 market update

Investors are increasingly reassessing the health and positioning of the bank loan asset class amid a backdrop of macroeconomic uncertainty and headline-driven volatility. Recent events such as the volatility within the software sector have amplified concerns around credit risk and the resilience of corporate issuers. We view these developments as meaningful, but not uniformly negative for the loan market. Rather, they reinforce the longstanding need, in our view, to differentiate between issuers with durable competitive positioning. Against this backdrop, three key questions have emerged:

1) How are underlying bank loan issuers performing in the current market?

2) What is the impact of falling interest rates on loan returns?

3) What is the outlook for the loan asset class?

This piece provides our view on the current market environment and attempts to answer these critical questions.

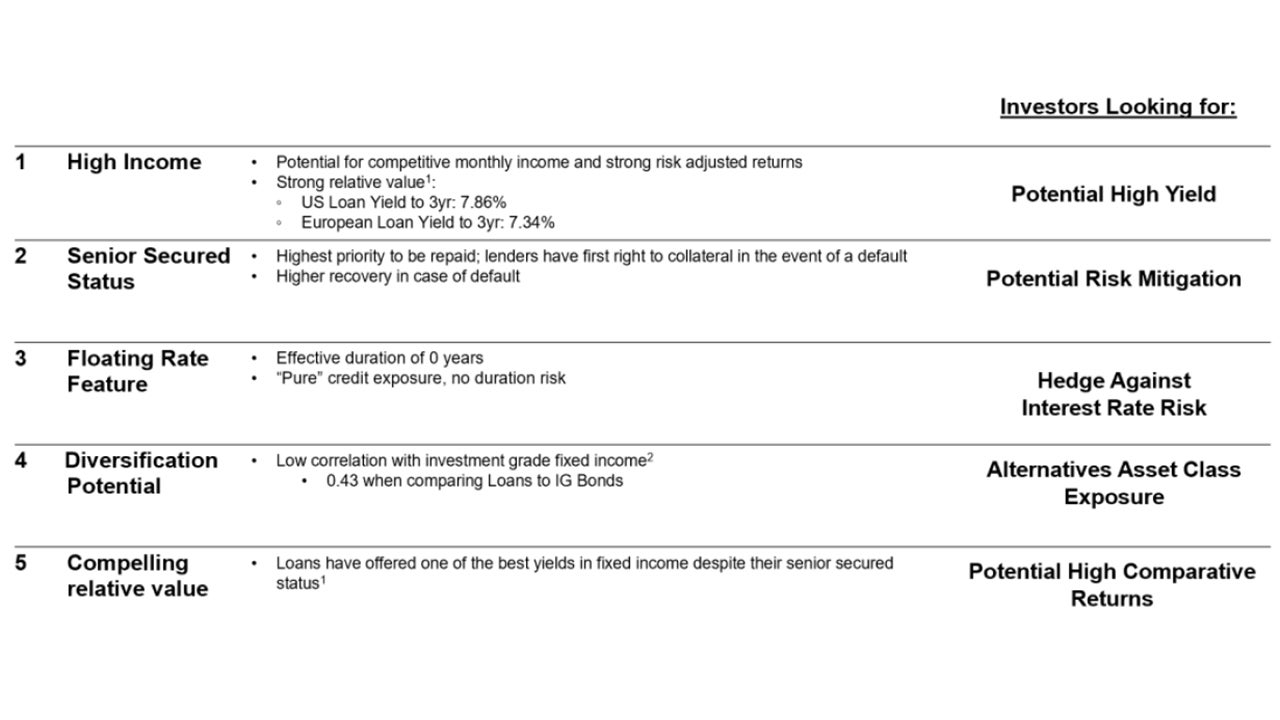

Why loans now?

In our view, there are three compelling reasons to consider investing in senior secured loans today:

1) Potential high level of current yield

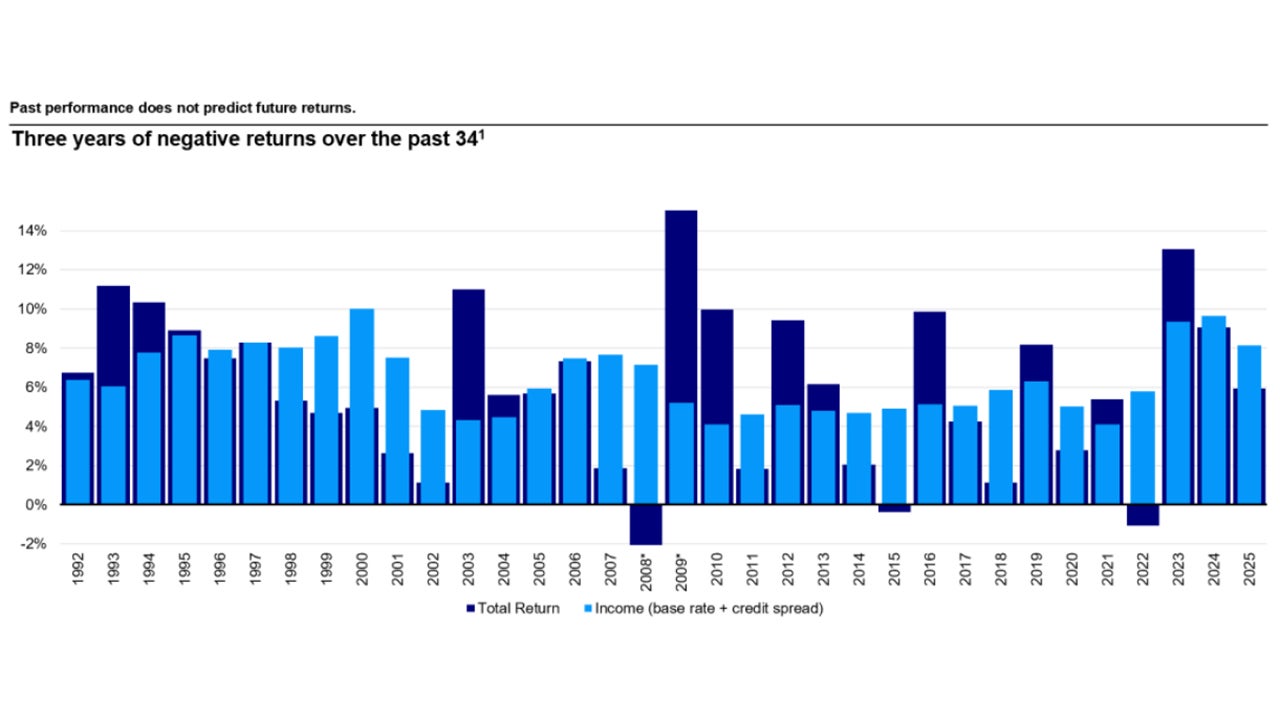

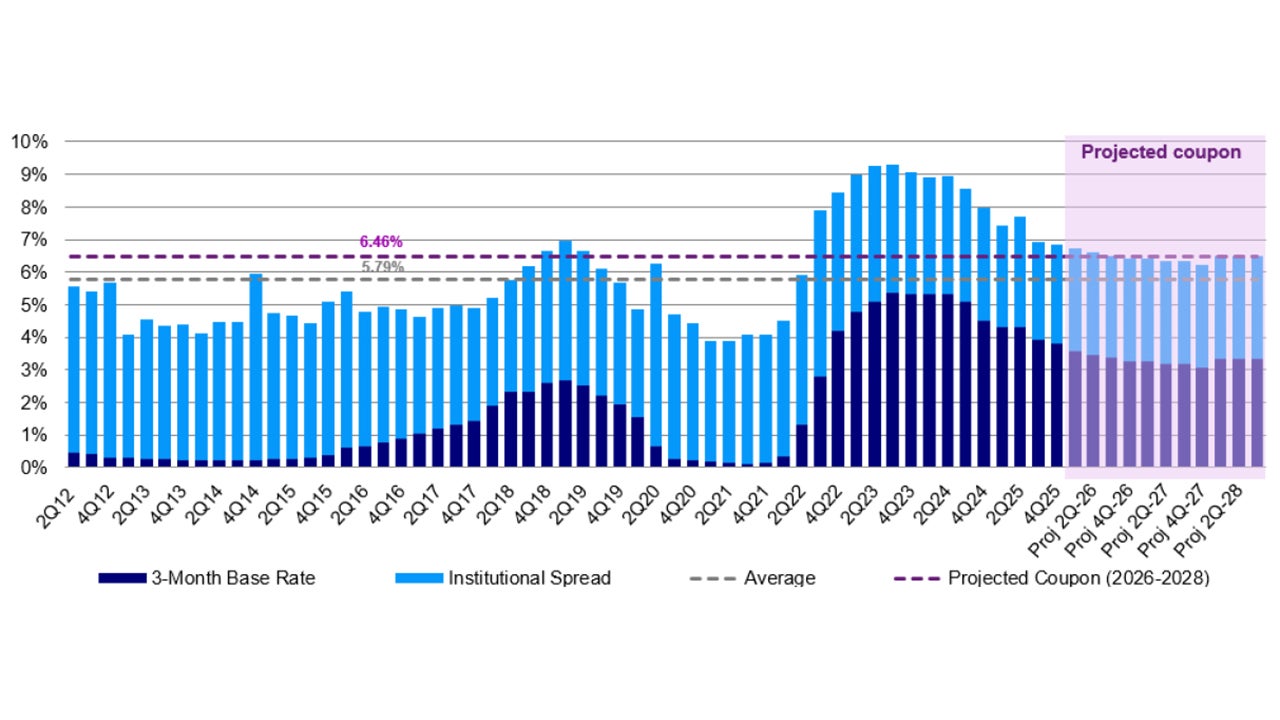

Yield is driven by two primary components: income and price appreciation. For loans, the income component remains particularly compelling. Higher-for-longer base interest rates and persistently wide credit spreads support elevated income levels allowing loan yields to remain attractive relative to historical norms. Market expectations continue to point to interest rates staying above pre-2022 levels reinforcing this income advantage. In addition, loans are currently trading at an average price of approximately 95, providing incremental potential for price appreciation alongside income1. Historically, leveraged loans have delivered consistent and relatively stable returns across a range of market environments, including recessionary periods and cycles of declining rates.

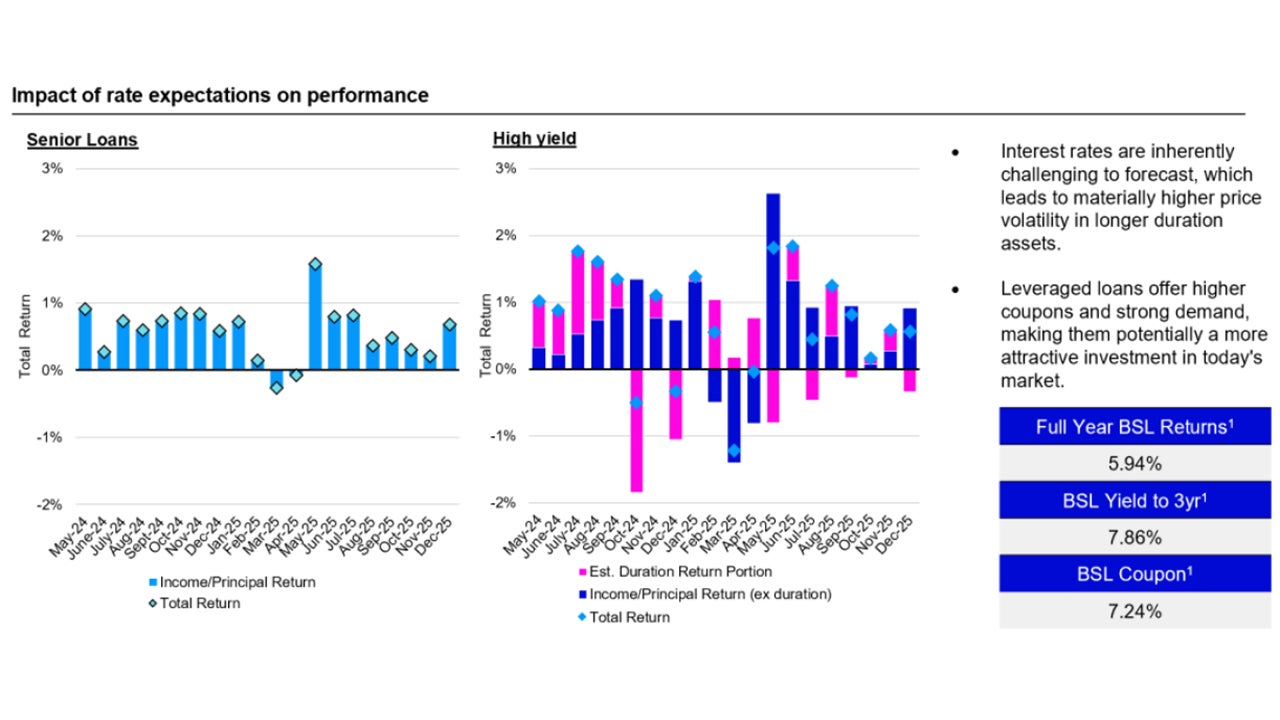

2) Resilience to interest rate changes

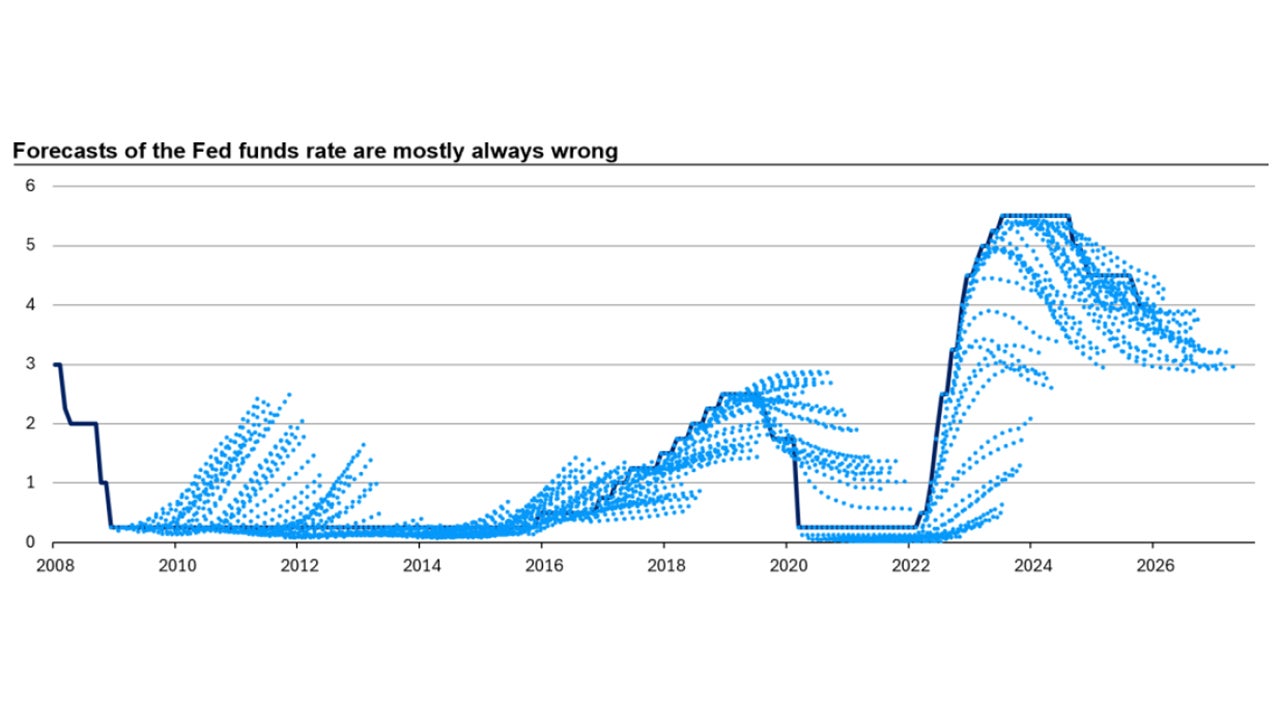

Bank loans are uniquely positioned in today’s market to deliver high income regardless of the direction of interest rates. As floating-rate instruments, their coupons reset regularly to SOFR potentially helping insulate investors from the price volatility that affects traditional bonds. Whether rates rise or fall, loan prices are not directly linked to interest rate volatility and continue to generate attractive income.

Importantly, interest rate movements are notoriously difficult to predict. As a floating rate asset class, when rates rise, coupons increase; when rates fall, loans reset lower but still offer competitive yields relative to other fixed income segments such as high yield bonds. Moreover, declining rates ease interest express burden on borrowers, improving issuer fundamentals and reducing default risk. This flexibility makes loans a reliable source of income in both rising and falling rate environments, making this worth considering in portfolios.

3) Compelling relative value

Loans have consistently provided some of the most attractive yields in the fixed income market, while also offering downside risk mitigation due to their senior position in the capital structure and being secured by a company’s assets.

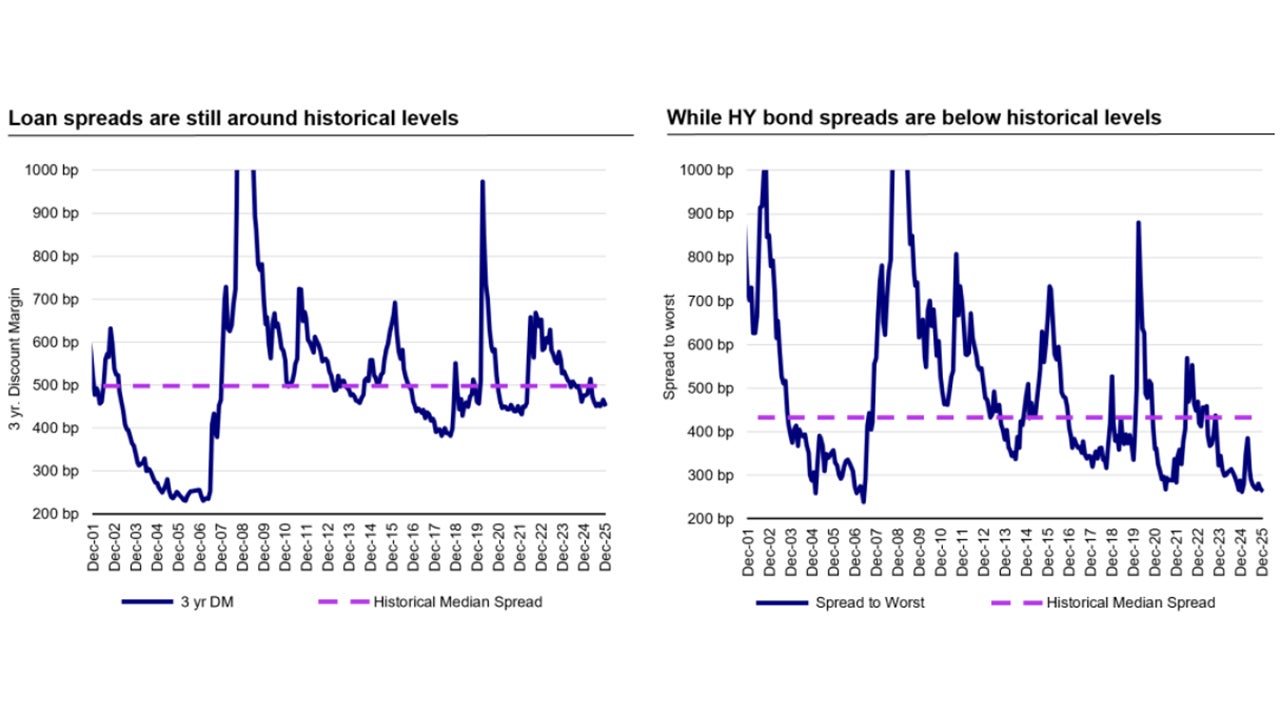

In 2025, high yield bonds outperformed loans largely driven by the longer duration of high yield bonds benefiting from rates falling1,2. However, much of that duration trade is now priced in. High yield bond spreads have compressed to historically tight levels limiting forward return potential. In contrast, loan spreads remain near their long-term averages, and loans continue to trade at a discount, creating a potentially appealing entry point and price-upside opportunity as spreads normalize.

Loans also offer these high yields with potentially lower risk. In a recessionary scenario, loans can provide further downside risk mitigation due to their senior secured status, which gives them the highest priority for repayment in the event of default. Historically, this seniority has translated into stronger recovery rates and lower credit losses during economic downturns reinforcing their role as a resilient asset class with historically positive annual returns.

A unique combination of appealing characteristics

Source: 1S&P UBS Leveraged Loan Index data through December 31, 2024, updated annually. *Denotes returns in excess of the axis. 2008 returns were –28.75%, 2009 returns were 44.87%.

Source: PitchBook Data, Inc. as of December 31, 2025, updated quarterly. Base rate reflects the average during the quarter. Uses three-month LIBOR (prior to 2023) or SOFR (2023 or later) plus the weighted average institutional spread. (Purple) Forecasted coupon for future rolling 3-month data as applicable using average trailing 4 quarters spread levels and forward 3m SOFR rates as of January 8, 2026. 2025-2028 represented by the forecasts as of January 8, 2026. With dashed purple line representing average projected coupon in 2025-2028. There can be no assurance that any projected coupons can be realized.

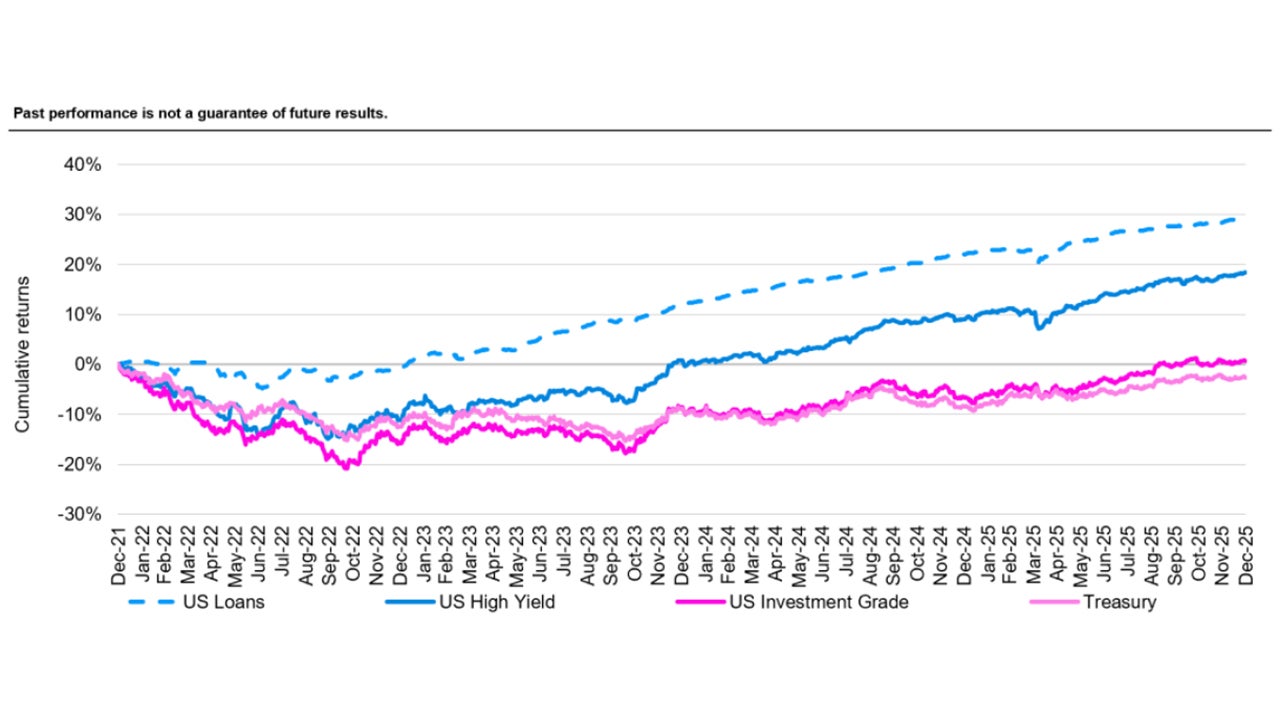

Since 2022, loans have been one of the best-performing asset classes—mitigating downside risk in 2022 and benefiting from rising rates in 2023—resulting in two of the strongest years for the asset class since the Global Financial Crisis3. Loans have offered amongst the highest yields in fixed income and are expected to remain elevated as the market anticipates a higher for longer interest rate environment4.

Steady US loan returns stood in stark contrast to other risk assets

Sources: PitchBook Data, Inc.; Bank of America Merrill Lynch; Bloomberg as of December 31, 2025. The S&P UBS Leveraged Loan Index represents US Loans, the Bloomberg US Corporate HY Index represents US High Yield, the Bloomberg US Corporate IG Index represents US Investment Grade, the Bloomberg US Treasury Index represents Treasury. An investment cannot be made directly in an index.

While high yield bonds outperformed loans by roughly 250 basis points in 2025, much of that upside may already be priced in the market. The duration trade has largely run its course, and looking ahead, we believe senior loans may be better positioned to deliver higher income especially since forecasting interest rate moves remains inherently difficult. Loans’ floating rate structure offers built-in flexibility making loans a strategic component in diversified portfolios particularly when the direction (and magnitude) of interest rates are uncertain.

Source: S&P UBS Leveraged Loan Index & Bloomberg US Corporate High Yield Index data through December 31, 2025. An investment cannot be made in an index. Past performance is not a guarantee of future results. Estimated duration return based on modified duration as of prior month end and basis point change in yields of 5-year treasuries. 1S&P UBS LLI index data as of September 30, 2025.

Forecasting is hard, especially about the future

Source: Invesco, Bloomberg, as of November 30, 2025. For illustrative purposes only. Solid line represents actual Fed funds rate while dotted blue lines represent point in time historical forecasts. Forecasts are not reliable indicators of future performance.

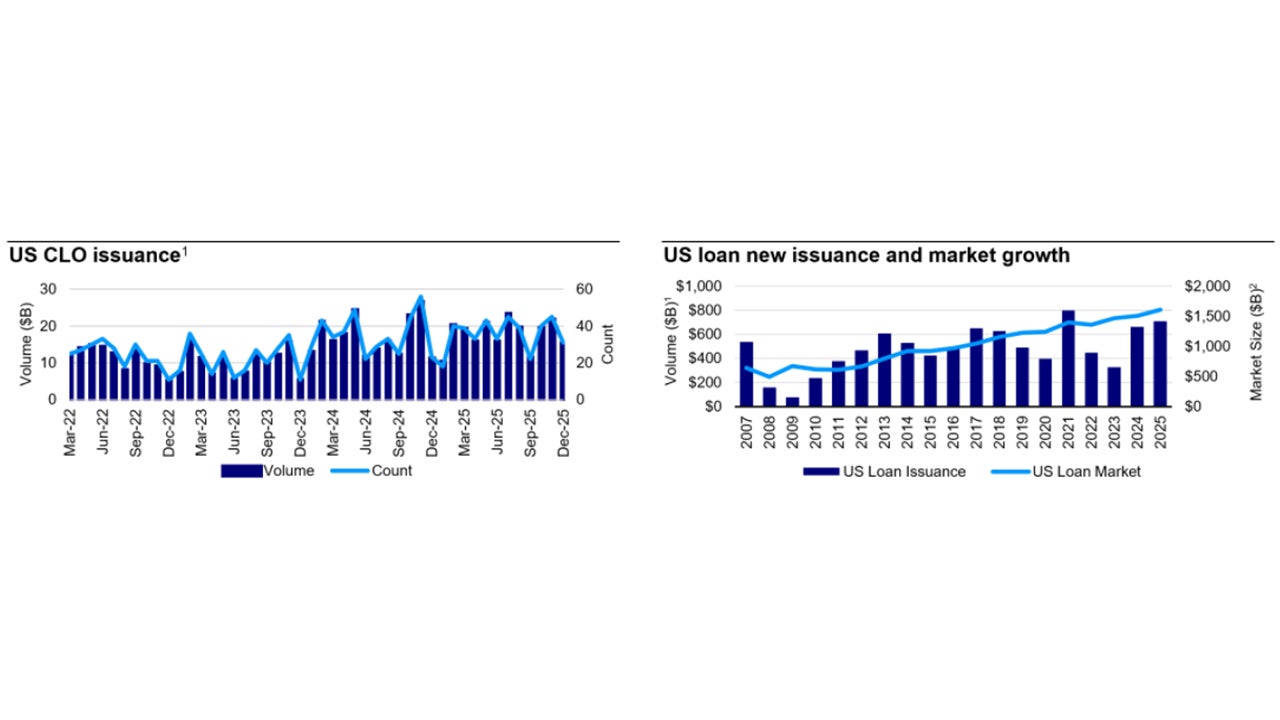

Market technicals

There has been a flow of new CLO creations through 2025. This indicates that there is still institutional investor appetite for loans. This steady CLO formation helped support the loan market technical despite retail outflows and macro concerns in early 2025, with CLOs representing over 71% of the investor base in the loan market.3 After new issuance of CLOs recorded its 2nd highest year on record in 2024 (just behind 2021), this pacing continued in 2025 with 428 CLOs pricing over $200B as of December 31, 2025.1 CLOs continue to be the major source of institutional demand, and historically, as demand for loans wanes, new loan issue supply will typically respond in kind to help re-establish equilibrium in the market. For example, year-end 2023 net issuance was $89.83bn, which is about -55% year-over-year3. As demand for loans increased throughout 2024 and 2025, net issuance increased to $167.68 and $198.99, respectively3. This dynamic interplay between supply and demand helps provide price stability in the loan market.

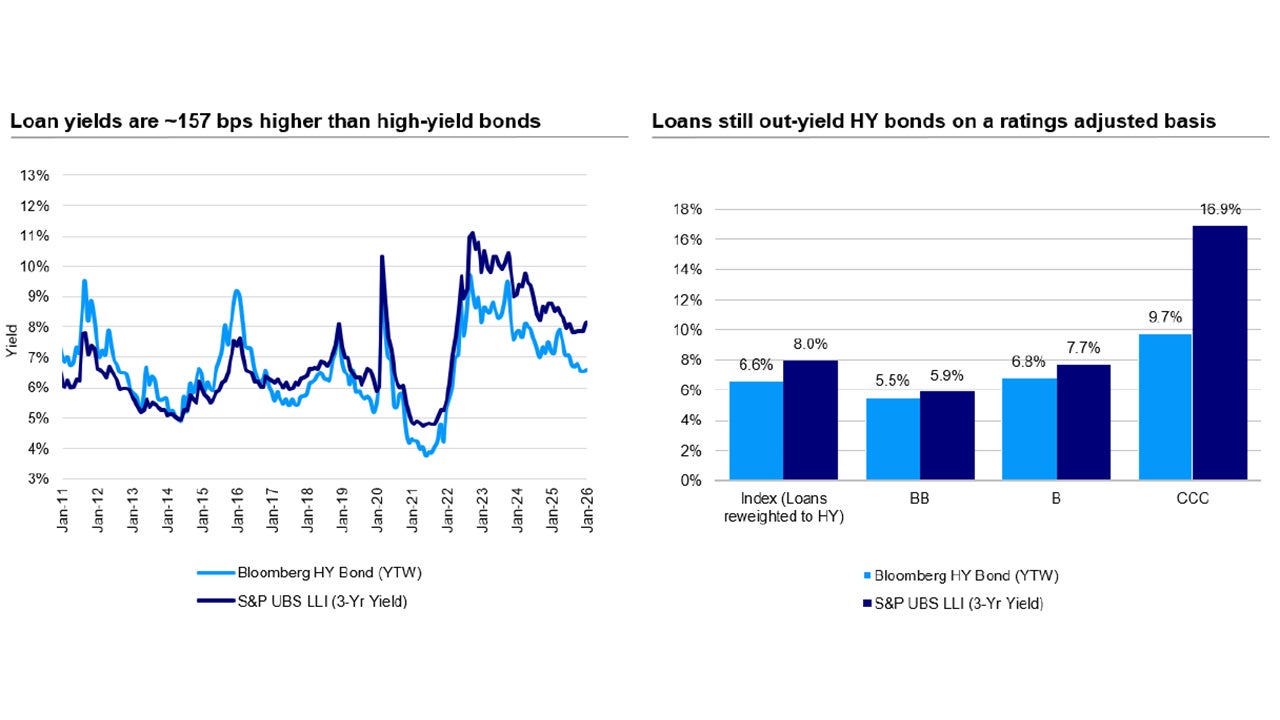

Relative valuations also favor bank loans compared to high yield bonds. Loan spreads are currently near their long-term average, while high yield bond spreads are at their tightest (expensive) since 2009. Loans have also been outyielding high yield bonds with loan coupons being historically high.

Source: S&P UBS Leveraged Loan Index & Bloomberg US Corporate High Yield Index as of December 31, 2025. Past performance is not a guarantee of future results. Long-term medians based on data starting from 01/31/2001. *Peak Senior loan 3yr DM of 1799 on 12/31/08 and HY spread of 1833 on 11/28/08.

Sources: S&P UBS Leveraged Loan Index & Bloomberg US Corporate High Yield Index as of December 31, 2025.

Market fundamentals

Market fundamentals for underlying loan issuers remain relatively strong.

Recent volatility in the technology sector has reflected investor concerns that rapid advances in artificial intelligence could accelerate the obsolescence of certain legacy software products and business models. Importantly, we do not view this as indicative of broader credit weakness or systemic stress in the loan market. While some software-focused lenders have experienced notable losses, the broader effects have remained contained. Overall, we maintain a constructive outlook on the loan market which continues to be supported by strong and resilient credit fundamentals. Importantly, this environment reinforces the importance of distinguishing between issuers with durable competitive advantages and those more vulnerable to technological disruption.

The US trailing twelve-month default rate including distressed exchanges at the end of December 2025 was 3.35%.3 While the risk of defaults remains the largest risk to loan investors, it is important to note that defaults are expected to have peaked and have been falling throughout 2025. Additionally, the senior secured nature of loans has historically provided a high recovery rate in the event of default. Furthermore, firms that go through liability management exercises tend to have higher recovery rates compared to those that do not.

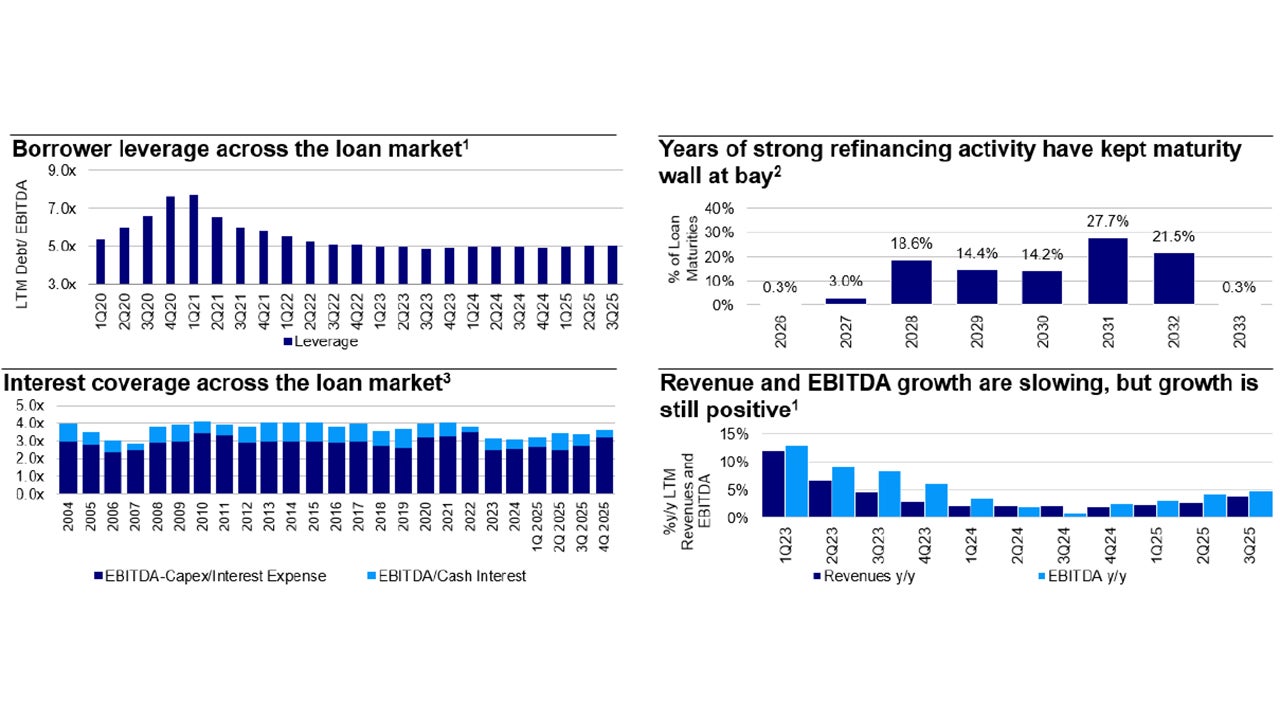

We still see the risk/return opportunity stronger in the loan market than in high yield which has seen spreads compress. The average leverage of companies in the leveraged loan market serves as an indicator of the financial health of bank loan issuers. The majority of borrowers continue to have healthy balance sheets, and average leverage in the market has returned to pre-pandemic levels. Borrowers have also pushed out their debt maturities with fewer than 1% of loans maturing in 2026. This leaves little refinancing risk in the market3.

Another important investor concern is how current rates will impact issuers’ ability to service their debt. The average borrower has entered this cycle with a very strong ability to service their debt. Interest coverage ratios have remained robust and are now improving as rates decline, indicating that companies continue to have sufficient capacity to meet their interest obligations. We expect these ratios to strengthen further throughout 2026.

Conclusion

As we look ahead, we believe senior secured loans remain well positioned to deliver attractive risk-adjusted returns. While the broader credit landscape continues to evolve marked by shifting interest rate expectations, tighter spreads, and headline-driven volatility, loans can offer compelling value through high income, discounted entry points, and resilient credit fundamentals.

Loans have delivered a return of 5.94% fueled by 8.15% interest return and offset by -2.21% principal return though 20251. This highlights the asset class’s ability to generate meaningful income even in a volatile price environment. While total returns may moderate as interest rates drift lower and spreads compress, coupons are projected to remain above historical averages.

We believe the story of fixed income returns going forward is carry, not duration. With many loans trading at a discount to par, investors also have the potential to benefit from capital appreciation as loans mature at face value making now a potentially opportune time to invest in the asset class.

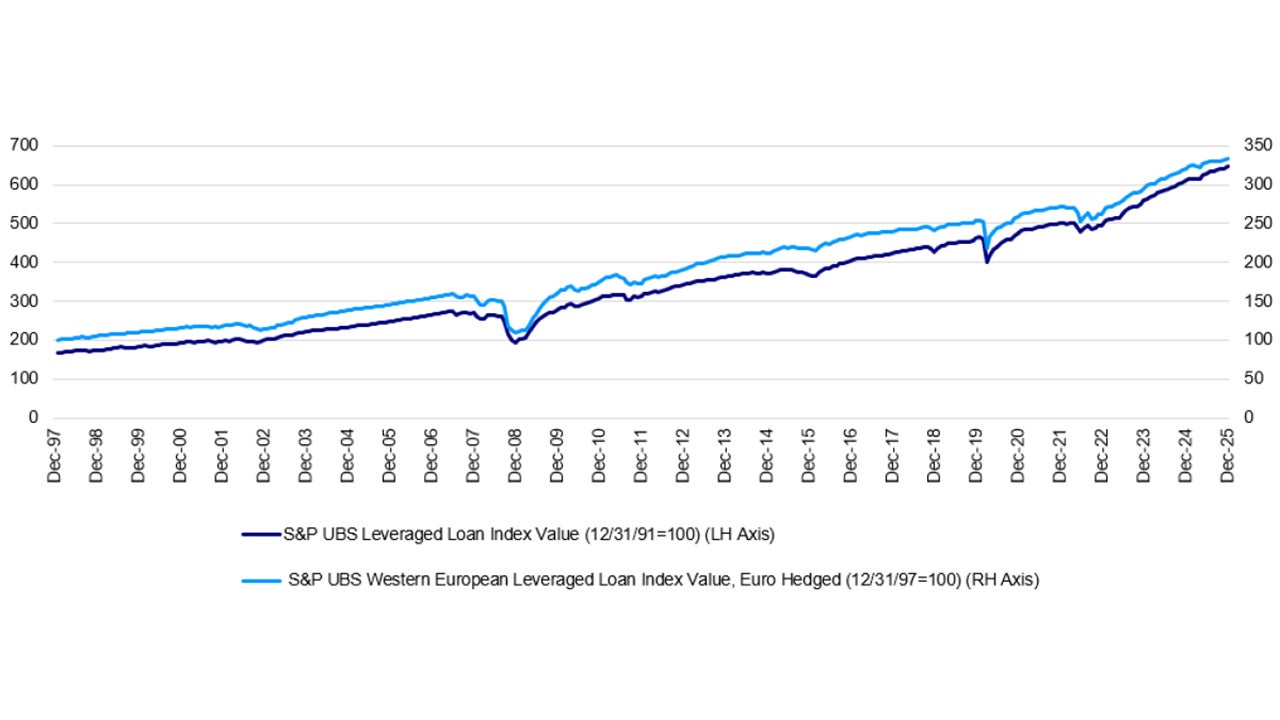

For investors seeking stability, yield, and resilience across market cycles, senior secured loans may continue to stand out as a strategic allocation. Loans have historically proven resilient across a range of economic environments offering an evergreen option for investors navigating market fluctuations. Recent volatility tied to the software sector, while notable, underscores this resilience. Sector-specific disruptions have not translated into broader systemic weakness within the loan market. As shown below, declines in loan values have typically been short-lived. Regardless of topical credit disruptions or a shifting interest rate environment, the loan asset class has consistently delivered attractive returns for investors.

Source: S&P UBS as of December 31, 2025.

Investment risks

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default. The market for senior loans remains less developed in Europe than in the U.S. Accordingly, and despite the development of this market in Europe, the European Senior Loans secondary market is usually not considered as liquid as in the U.S. The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.