Trump's policies and the impact on emerging markets

Overview

- We expect a constructive environment for emerging markets (EM) in 2025.

- The second Trump administration’s impact on EM will likely be felt through the same channels as during his first term: the US dollar, US interest rates and trade policy.

- The net impact of Trump policies on EM rates and currencies is still uncertain, but the challenge for 2025 will likely be faced by the more externally vulnerable countries with trade and financing deficits.

- While this environment may be more challenging for EM market beta, it has improved the opportunity set for active management, in our view. Diverging individual country dynamics should offer compelling total return opportunities.

Market commentary

The US Federal Reserve (Fed) cut rates by 25 basis points in December but indicated that the pace of cuts may slow this year. This stance incentivized a few EM central banks to continue their cutting cycles but not accelerate their pace. Central banks in Mexico and Colombia cut rates by 25 basis points in December. Chile joined them with another 25 basis point cut, while Brazil made a strong statement with a 100 basis point hike and forward guidance indicating similar hikes in the next two meetings. In Asia, the only December action was in the Philippines, with a 25 basis point cut. In the Central and Eastern European Middle East Africa countries (CEEMEA), only Turkey acted, cutting its rate from 50% to 47.5%. This move kicked off Turkey’s easing cycle, following sequential declines in monthly inflation and expectations of continued disinflation in 2025.

EM yield curves generally steepened in 2024, mostly driven by rallies at the front end. Following the election of President Trump, yield curves have generally shifted upward, as his expected policies have created uncertainty and likely favor a stronger US dollar, at least initially. This has led EM central banks to be more cautious, and was reflected in 2024 EM local market performance, which showed an unusual and significant divergence between rates and foreign currency performance. Local bonds rallied - mostly ahead of the election - while currencies remained under pressure throughout the year, accelerating post-election. The typical positive correlation between rates and currency performance varies among EMs and depends on the depth of the local market. Countries that are less vulnerable to external financing (often lower yielders) tend to show a lower correlation. However, we believe the challenge in 2025 will be for the more externally vulnerable countries; how much room will they have to continue their cutting cycles if their currencies are under pressure, inflation expectations edge up and growth slows?

Overall, global growth and disinflation remained on track in 2024, although they slowed toward the end of the year. We believe economic and policy divergence across both developed and emerging markets will persist in 2025, creating different market backdrops. This environment may be more challenging for market beta but has improved the opportunity set for active management, in our view, as diverging individual country dynamics should offer compelling total return opportunities.

In the spotlight: What does the Trump administration mean for EM?

President Trump’s certification ended election uncertainty, but policy uncertainty over tariffs and immigration muddy the economic and market outlook. The US dollar, US yields and US equity markets surged higher in response to Trump’s win. We believe there will also be some short-term volatility in EM, but we believe the long-term impact of Trump’s victory on EM will be different compared to his first election victory in 2016. The greater uncertainty for EMs, and the further dispersion of their returns, are likely to emerge in the second half of 2025. Market outcomes will likely depend not only on the Fed’s reaction to various US policies, but also to counter reactions of US trading partners.

US macroeconomic outlook

The US economy was resilient in 2024, and we believe American exceptionalism in economics and markets will continue for much of this year. Easing financial conditions at the end of 2024 not only boosted investor confidence, but also decreased concerns about a hard landing. Trump’s November victory and the Republican sweep in Congress boosted overall US market sentiment.

Though the Fed cut rates in December, it adopted a more hawkish stance, signaling fewer cuts in 2025 due to stronger than expected growth and higher than expected inflation. We believe the Fed will continue to ease this year, although at a slower pace than anticipated at the start of the easing cycle. Given solid economic growth and a robust labor market, we believe there is limited room for further rate cuts.

US labor market strength was highlighted in December with 256,000 new jobs created during the month, beating market expectations of 160,000 jobs1. The higher-than-expected increase supports the Fed’s cautious approach to further rate cuts. However, the incoming Trump administration has signaled strict immigration limits and harsh deportation policies, which could slow the pace of labor market growth. The extent to which Trump’s policies will be implemented, their timing and impact remains uncertain. We believe job creation will remain robust in the first half of 2025, with hiring gaining momentum after last year’s soft patch.

While the new administration may enact changes that could create volatility, we do not expect them to have an immediate impact and believe they will take time to affect the economy. We expect growth to continue in the first half of the year but slow in the second half due to tariffs and a deceleration in labor force growth.

Market outlook

In 2016, the initial effects of Trump’s victory included higher US equity prices and interest rates, a stronger US dollar, trade and foreign policy instability and higher US deficits. However, the state of the US economy is different today than it was when Trump first entered office. In 2016, the US had considerable fiscal flexibility following the fiscal cliff showdown in 2013. Today’s starting point is very different with a US fiscal deficit of around 6.4% of GDP and a current account deficit of 4.2% of GDP2. Valuations of US equities are also already high, the US dollar is strong and US interest rates are high.

The global market impact of a second Trump administration will likely be felt through similar channels this time: the US dollar, US rates and trade policy. The impact will likely affect both emerging and developed market countries, depending on the severity and breadth of the policy moves, especially when it comes to changes in trade policy.

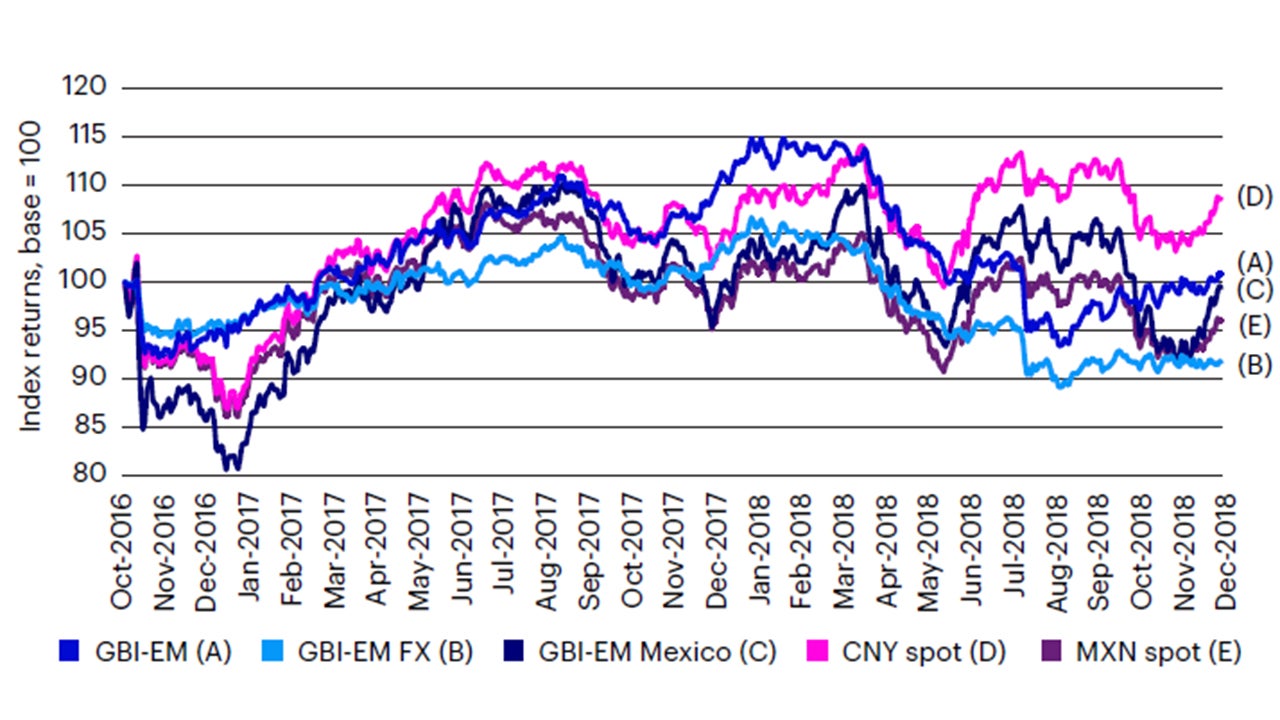

Source: JP Morgan. Data as of Nov. 26, 2024. GBI- EM represented by JPMorgan Government Bond Index-Emerging Markets (total returns in USD), GBI-EM FX represented by JPMorgan Government Bond Index- Emerging Markets FX (Spot returns vs. USD). GBI-EM Mexico represented by JPMorgan Government Bond Index-Emerging Markets Mexico returns (total returns in USD), CNY and MXN (spot returns vs. USD), all indices rebased to a base value of 100 starting Oct. 31, 2016.

Past performance is not a guarantee of future results. An investment cannot be made directly into an index.

Impact on the US dollar and rates

Trump has been vocal about favoring a weaker US dollar, however, his proposal to increase US trade tariffs across the board, including on China, would suggest otherwise. Traditionally, higher US tariffs have resulted in a stronger US dollar, which was the case in the first half of the 2018-2019 trade wars between the US and China, until the Fed eased.

As in 2016, the Republicans have gained control of the Senate and House of Representatives. The Republican sweep has been a major factor in the US dollar’s strength, reflecting expectations of deregulation, tax reform and other pro-business policies. Nonetheless, the question remains whether Trump will, and can, introduce tariffs across the board. Higher tariffs would likely weaken trading partners’ currencies against the dollar, though at the same time, Trump may attempt to talk the dollar down, as he has hinted he would. Trump has argued that a weaker US dollar would boost American manufacturing and reduce the trade deficit by making US products more competitive internationally. Although there are signs of a manufacturing revival in the US, especially in high technology and certain supply chains, the cost advantage of Asia’s vast manufacturing base, especially China’s, means that US dollar depreciation may not be sufficient to move the needle significantly on US manufacturing competitiveness.

Trade policy impact

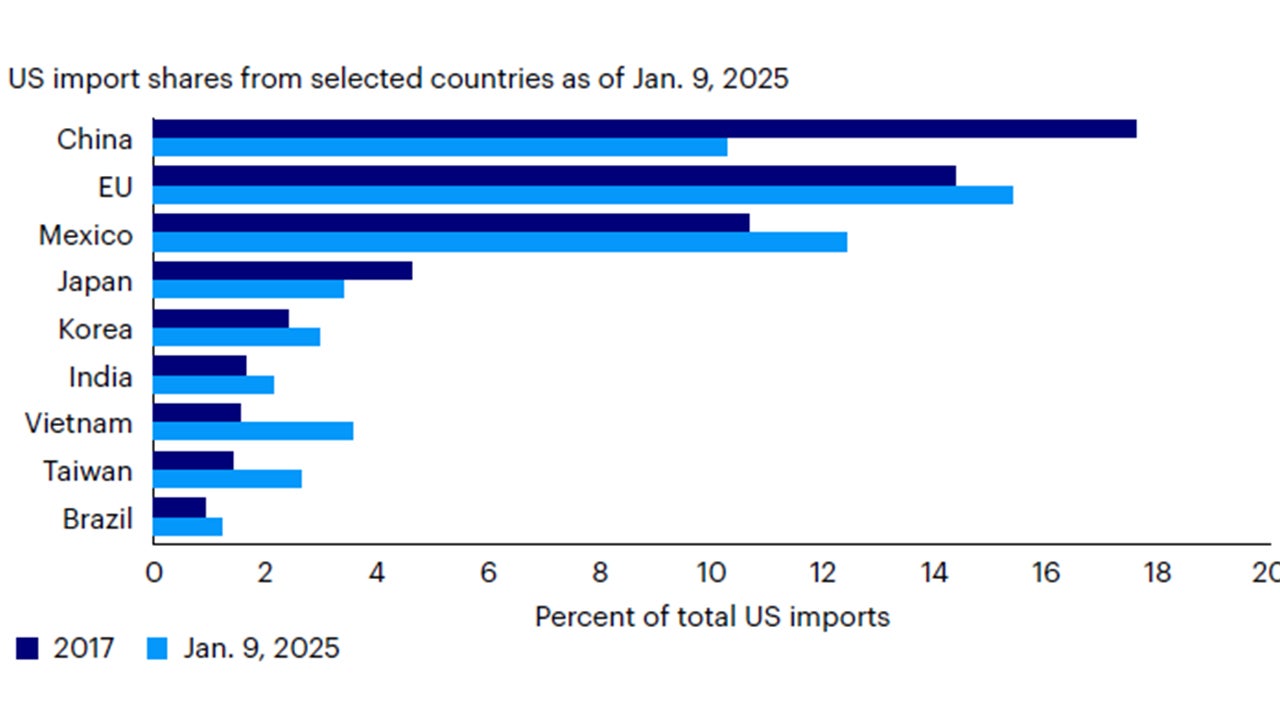

The potential impact of Trump’s second administration on trade policy is largely focused on China and Mexico, although he has also mentioned across-the-board tariffs on all US imports to finance his potential tax cuts. Notwithstanding this possibility, we view his current rhetoric on China and Mexico as an opening salvo for further negotiations.

Source: Macrobond. Data as of Jan. 9, 2025.

Impact on Mexico

Under a second Trump administration, the narrative surrounding Mexico will likely be different than in 2016. When Trump campaigned in 2016, he threatened to withdraw from the North American Free Trade Agreement (NAFTA), which created volatility in Mexican assets, as the US is Mexico’s largest trading partner. After taking office, Trump renegotiated and created the United States-Mexico-Canada Agreement (USMCA) to update and replace NAFTA. The USMCA still stands and will likely remain in place during Trump’s second term. However, Trump could seek to renegotiate the agreement, potentially using higher tariffs to extract more commitments from Mexico on border security. Another area of discussion is likely to be Chinese investments in Mexico, which aim to benefit from the lower tariffs of the USMCA. The impact of these negotiations would likely be most felt in the Mexican exchange rate.

Impact on China

Trump has proposed a 60% tariff on Chinese goods, which we believe is unrealistic and reflects his negotiation style. A 60% tariff across all Chinese exports would likely be prohibitive and lead to significant supply chain disruptions in the US. Nonetheless, expectations are that China would bear the brunt of any tariff hikes. Depending on the severity and magnitude of the tariffs, we would expect some depreciation in the renminbi, as during the first trade war. However, if the tariffs are increased to 60% on average from the current 20% level, we do not think China would allow a full pass-through to the exchange rate, since it could destabilize already fragile sentiment in China and undermine financial stability.

China tends to respond to tariff hikes in a measured way, but there has been much soul searching and preparation for this round, and we expect China to respond in multiple ways. The simplest would be to draw on past experience and divert agricultural imports away from the US. However, most of this has already been done, and the marginal impact is not likely to be as important for the US economy, though it may hurt key rural support for the Trump administration. We believe the new area of retaliation will involve rare earth materials and minerals, and components of the battery production global supply chain, which China dominates. Recent export controls on graphite and antimony are good examples of how China may wish to use its dominance in these supply chains. In the medium term, however, as with “Trade War I”, we would expect this policy to lead to meaningful trade diversion, benefiting EMs in manufacturing hubs in Asia, Eastern Europe and Turkey and other agricultural good exporters, such as Brazil and Argentina.

Conclusion

We expect a constructive environment for EMs in 2025. Attractive income, healthy economic growth and favorable interest rate differentials relative to developed markets should all benefit the asset class. The incoming US administration will likely create some volatility, but we believe the market impact will be more limited compared to when Trump first took office in 2016. Performance drivers in EM debt are idiosyncratic and we believe individual country dynamics and trade policy implications under this new administration may offer compelling total return opportunities.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to risk of the issuer and meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Non-investment grade bonds, also called high yield bonds or junk bonds, pay higher yields but also carry more risk and a lower credit rating than an investment grade bond.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues. The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.