Unlocking value in Asian short duration bonds: Yield with resilience

Understanding duration risk: Why shorter Is often safer

One of the key considerations in bond investing is duration risk — a measure of how sensitive a bond or a bond portfolio is to changes in interest rates. Short duration bonds, which exhibit lower sensitivity to interest rate fluctuations, tend to offer investors reduced volatility and more stable performance compared with long duration bonds, particularly in environments marked by significant interest rate swings. Historical performance data supports this view, showing that short duration bonds typically deliver more consistent returns with lower annualized volatility. This trend is illustrated in the table below, which compares the performance of the short duration Asia Dollar Corporate Index against its longer duration counterparts. For instance, the ICE BofA 1-3 Year Asian Dollar Corporate Index posted a 5-year cumulative return of 2.00% with an annualized volatility at 2.59%, whereas the corresponding 10+ Year Index decline 7.73% with significantly higher annualized volatility at 8.68%.

|

Effective Duration |

YTM |

1 Year |

3 Year |

5 Year |

10 Year |

||||

Return |

Volatility |

Return |

Volatility |

Return |

Volatility |

Return |

Volatility |

|||

ICE BofA 1-3 Year Asian Dollar Corporate Index |

1.71 |

4.83% |

6.15% |

1.15% |

19.13% |

1.99% |

2.00% |

2.59% |

26.29% |

2.10% |

ICE BofA Asian Dollar Corporate Index |

4.63 |

4.99% |

6.05% |

2.98% |

19.85% |

3.68% |

2.80% |

3.63% |

35.56% |

3.17% |

ICE BofA 10+ Year Asian Dollar Corporate Index |

12.73 |

5.49% |

2.92% |

8.40% |

18.01% |

9.18% |

-7.73% |

8.68% |

52.95% |

8.00% |

Source: Bloomberg, data as of August 22, 2025. Volatility is annualized.

Strategic positioning of short duration bonds in rate cut cycles

Short duration bonds could be well-positioned to capture capital appreciation from rate cut cycles, as their yields are more closely aligned with short-term or risk-free rates. This alignment would enable them to capture capital appreciation more effectively when rates decline. Notably, over the past year, amid an ongoing rate cut cycle, the Asian short duration bond index has consistently outperformed its long duration counterpart, delivering higher absolute and risk-adjusted returns. In our view, this outperformance underscores the defensive characteristics of short duration bonds, particularly during periods of heightened market volatility.

Short duration bonds also tend to demonstrate greater resilience during periods of market stress — particularly when investor confidence in the long-term viability of credit issuers is challenged. A notable example occurred during the market dislocation following “Liberation Day,” when elevated tariffs imposed by US President Trump triggered widespread uncertainty. While long duration bonds experienced significant price declines, short duration bonds remained relatively stable, reinforcing their role as a more defensive allocation in uncertain environments.

Source: Bloomberg, data as of August 22, 2025.

Improving credit fundamentals across Asian markets

It is our view that the current macroeconomic environment in Asia presents a constructive backdrop for credit performance. Most Asian countries maintain relatively low inflation levels providing central banks with greater flexibility for monetary easing. Additionally, healthy sovereign debt levels across the region could also create room for fiscal stimulus, further supporting economic stability.

Major Asian sovereign and investment grade corporate issuers continue to demonstrate improving credit fundamentals. In the high yield segment, Asia — excluding China property developers — has exhibited a notably lower default rate compared to peers in the US and Latin America. Since 2022, the upgrade-to-downgrade ratio by major rating agencies has shown a positive trend, reflecting stronger balance sheets, disciplined fiscal management, and enhanced credit quality across the Asian credit universe. The following charts illustrate these trends.

Source: Moody’s, S&P and Fitch Ratings, data as of March 2025.

Source: BAML, data as of May 31, 2025.

Technical strength and yield advantage in Asian short duration bonds

The Asian USD bond market has experienced subdued new issuance in recent months, resulting in lower supply risk for investors. Concurrently, demand from local investors for high-quality bonds remains strong. This combination of limited new supply and robust demand provides solid technical support for the broader Asian bond market.

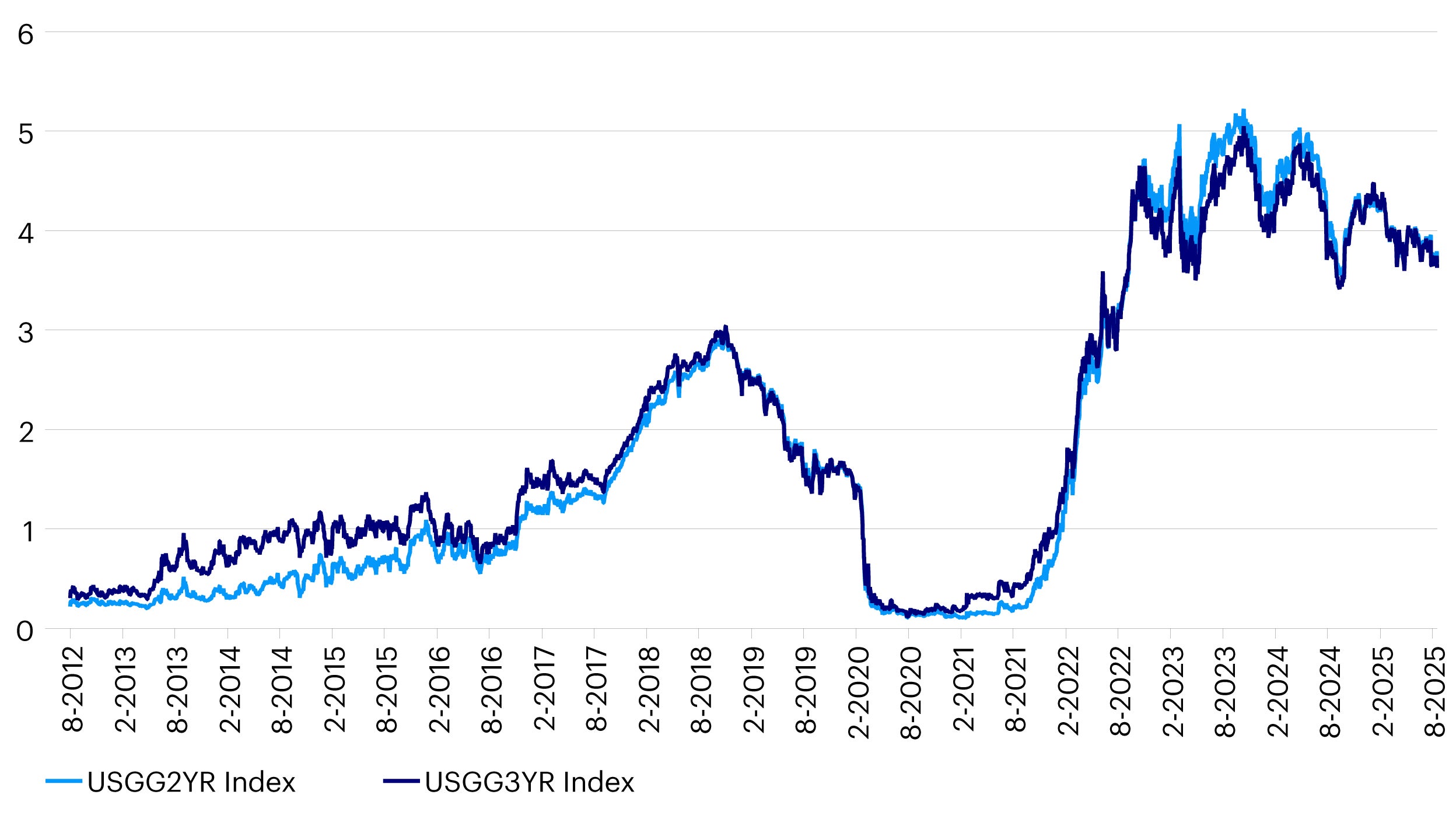

In our view, Asian short duration bonds are currently in a favorable position, underpinned by improving fundamentals, strong technical, and attractive yield levels. Yields on 2-year and 3-year US Treasury bonds are hovering at high levels. The yield on the Asian short duration bond index continues to trade at elevated levels compared to its historical ranges, despite showing signs of a downward trend. This environment could potentially present a compelling entry point for investors to secure higher yields and potentially benefit from price appreciation, particularly as further rate cuts and monetary easing take effect.

Source: Bloomberg, data as of August 22, 2025.

Enhancing returns through curve roll-down strategies

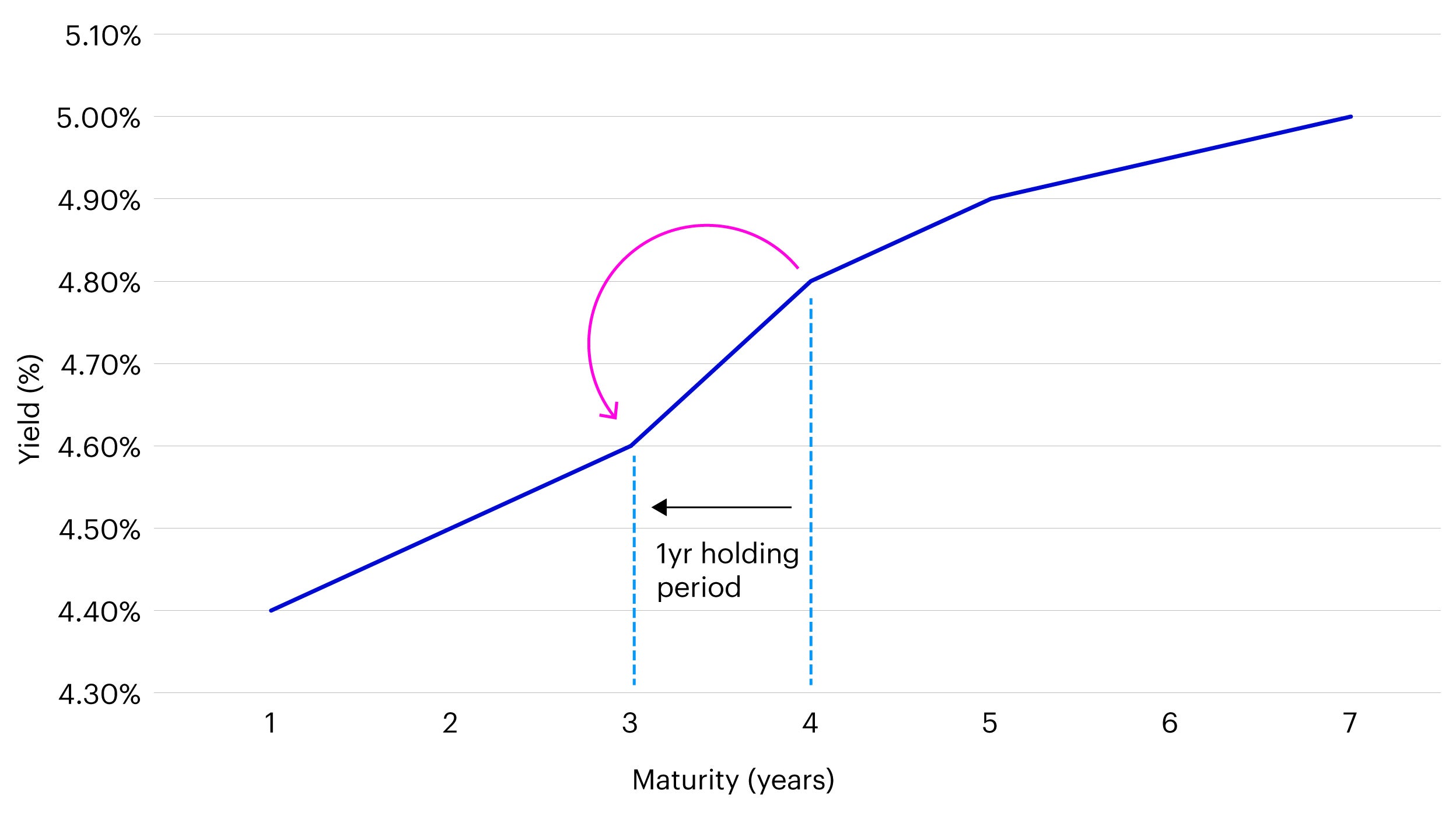

An additional advantage of considering short duration bonds lies in the potential for enhanced returns from curve roll-down. This strategy involves purchasing a bond with a longer maturity and selling it before maturity, benefiting from the price appreciation that occurs as the bond “rolls down” the upward-sloping yield curve toward a shorter maturity.

The approach capitalizes on the typical structure of a positively sloped yield curve, where longer-term bonds offer higher yields. As the bond’s maturity shortens over time, its yield tends to decline—assuming a stable curve—resulting in capital gains for the investor. Curve roll-down could potentially be a valuable tool for boosting total return, especially in environments where interest rates are expected to remain stable or decline.

How does this curve roll-down strategy work in practice? Consider purchasing a 4-year bond with a yield of 4.8% and holding it for one year. After one year, the bond effectively becomes a 3-year bond. If the 3-year bond from the same issuer is yielding 4.6%, and the yield curve remains stable, the bond's price will adjust upward to reflect the lower yield, resulting in capital appreciation. Based on a 4-year duration, this 20-basis-point drop in yield translates to approximately 80 basis points of capital gain, bringing the theoretical Holding Rate of Return (HROR) for that total one-year return to around 5.6%—higher than the original yield at purchase.

This calculation illustrates the importance of analyzing issuer-specific yield curves and actively considering curve slope and roll-down opportunities. By purchasing a bond with a longer maturity and selling it as it rolls down the curve, investors could, in our opinion, capture capital appreciation in addition to yield carry—without taking on additional credit risk. Strategically positioning within the steepest part of the curve could allow portfolios to generate higher returns while maintaining the same credit quality. This approach reinforces the value of active management in short duration strategies, particularly in environments where rate movements and curve dynamics present tactical opportunities.

Source: Invesco. This graphic is for illustrative purposes only and is not based on a specific security.

In summary, short duration bonds would be less exposed to uncertainties in long-end rates and long-term macro risk events, such as US fiscal and inflation outlook. Against the backdrop of elevated yield levels, healthy credit fundamental and strong technical support in Asia credit markets, we see the short duration Asia credit strategy—particularly one with active curve roll-down trades — could potentially offer investors a compelling opportunity to achieve robust and stable returns over the coming years.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.