2023 Investment Outlook – Asia Fixed Income: ESG

What's next for ESG investing in Asia?

2023 is set to be another exciting year for ESG investing, which is now mainstream in fixed income. We highlight a few key trends we expect to continue in 2023. Asia fixed income is uniquely placed to be able to give investors exposure to positive impact and we believe China is likely to outperform the Asia region in decarbonization and transition areas.

China to lead the way in decarbonization and transition

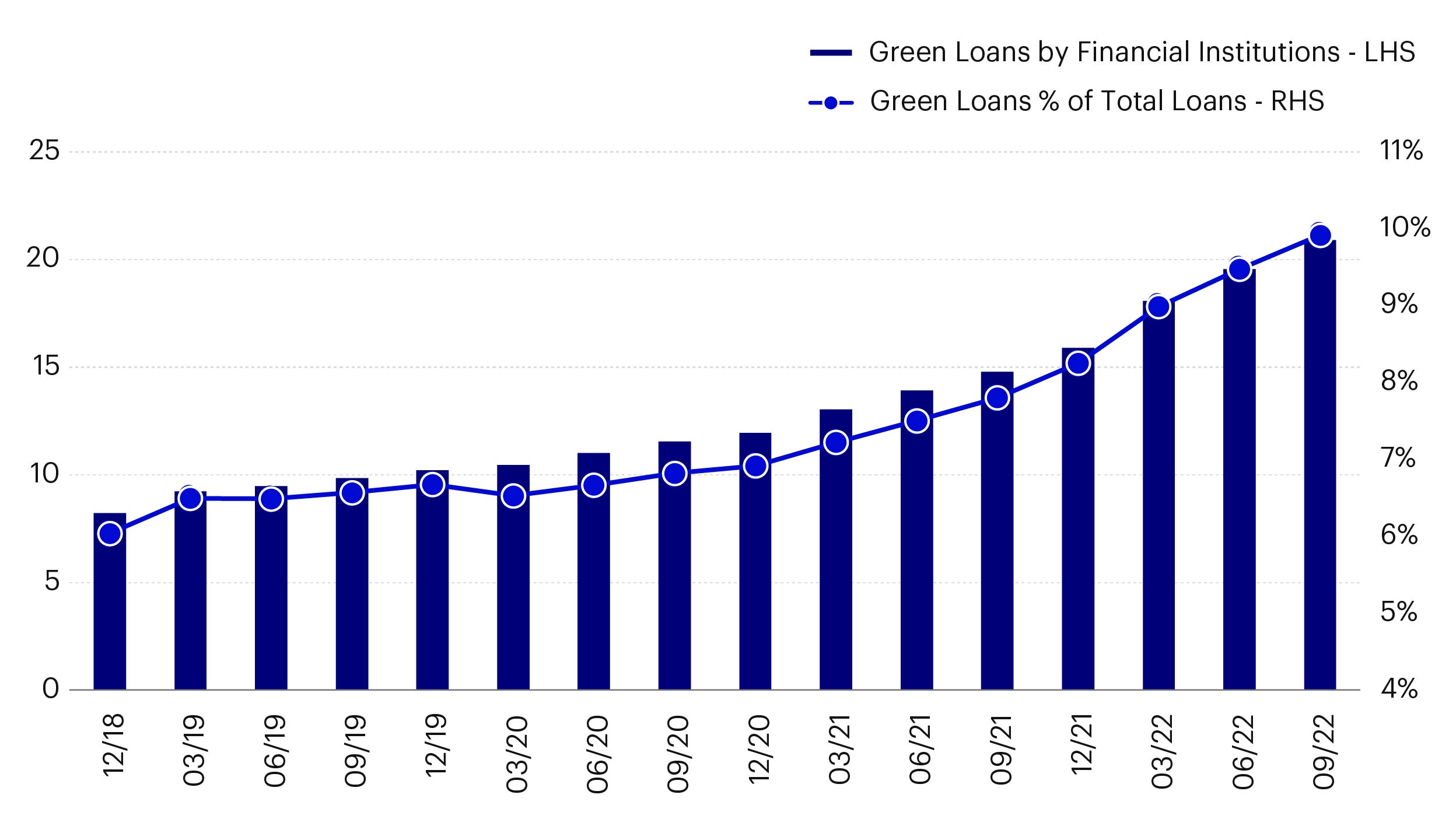

China’s ESG story continues to unfold as it structurally charts its pathway toward resilient, carbon-neutral growth, driven by a strong green finance policy agenda of peaking carbon emissions before 2030 and achieving carbon neutrality by 2060. This was recently reinforced by President Xi Jinping at the National Party Congress in October 2022. This trend is also evidenced by the rapid growth of green loans from Chinese financial institutions, which are now in excess of CNY 20 trillion (US$ 2.9 trillion).1

In 2022, we saw various new ESG related policy announcements such as the China Green Bond Principles, updated 2030 peak carbon plan for material emitting sectors, and the CBIRC’s (China Banking and Insurance Regulatory Commission) most recent green finance guidelines for banking and insurance sectors. Given this strong top-down policy impetus, we believe that China can lead Asia on its decarbonization journey. Financial flows with a carbon neutrality theme are a long-term mega driver in China that we anticipate can translate into real world emissions reductions.

Source: WIND, data as of 30th October 2022.

Green bond volumes to take-off further

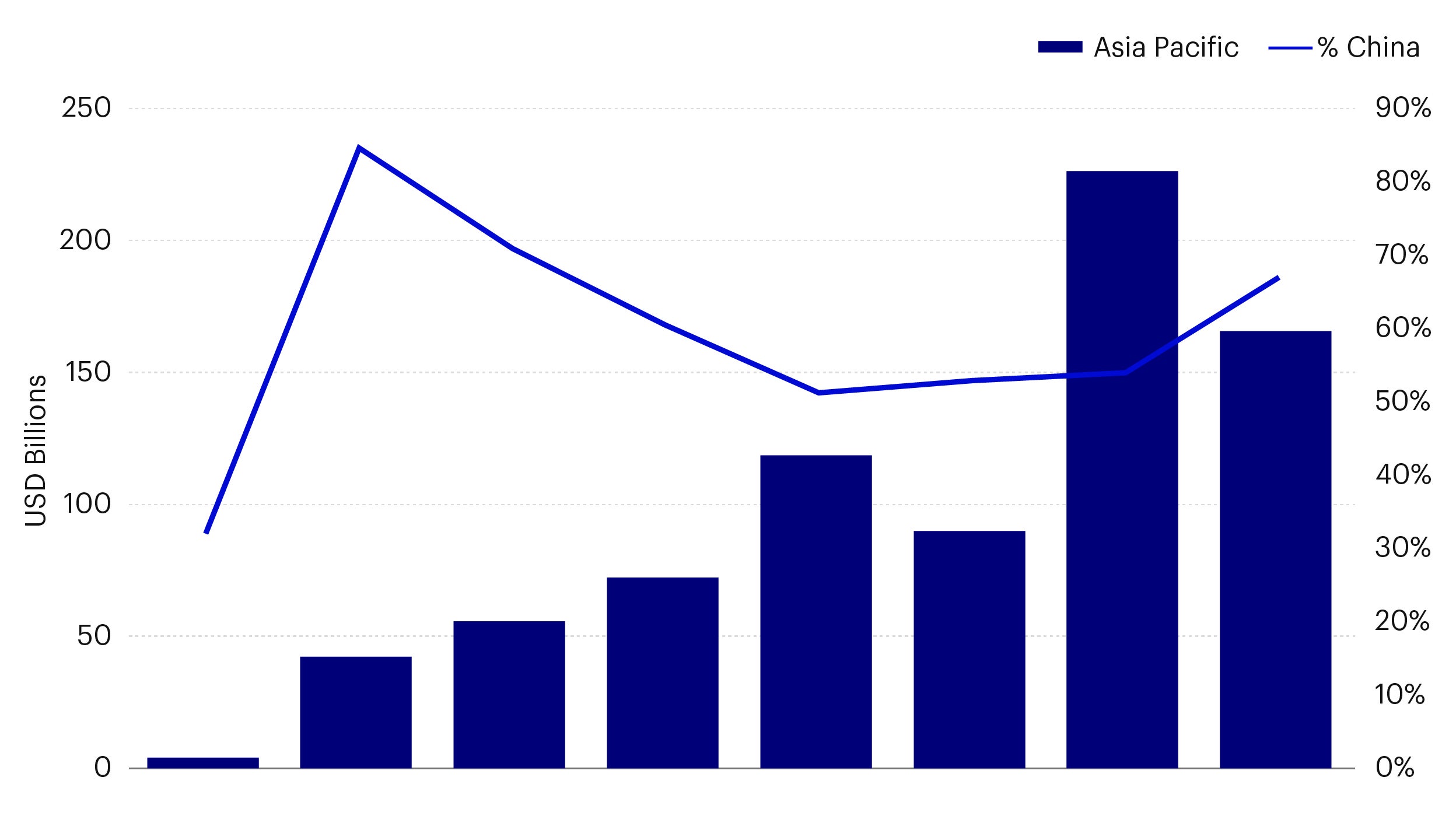

Despite the significant market volatility, sustainable labelled bond issuances year-to-date are the second highest ever.2 China is a key driver of this growth, accounting for almost 70% of total green bond issuances in 2022. China boasts the world’s second largest green bond market. With the application of the Common Ground Taxonomy (CGT) it is likely that 2023 will see further growth in the sustainable labelled bond space, accompanied by further improvements in post-issuance reporting by issuers.

Source: Climate Bonds Initiative, data as of 27th October 2022.

ESG fixed income flows poised for takeoff in 2023

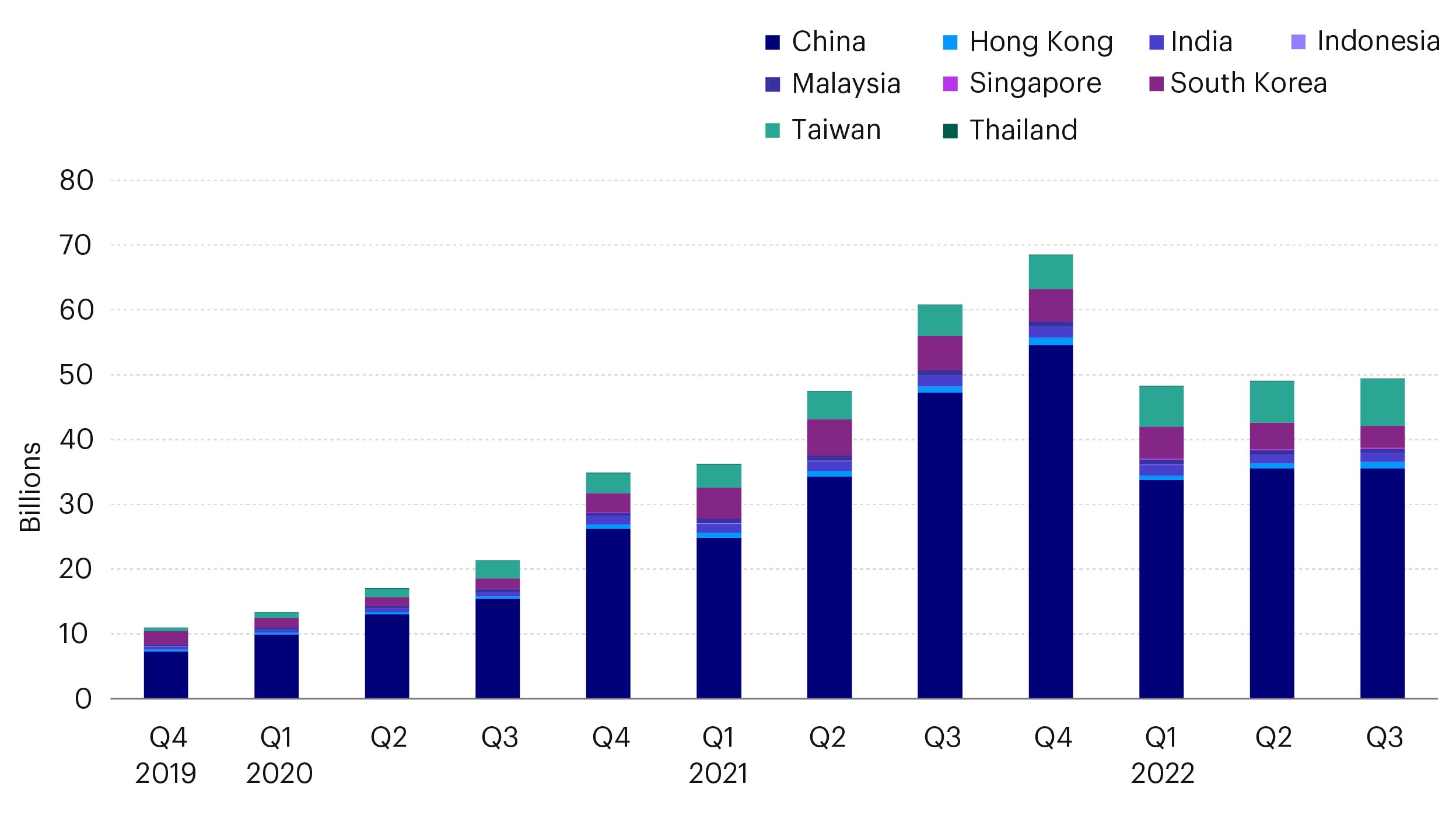

China remains the largest contributor to Asia-domiciled sustainable fund assets and from an asset class point of view, equities still makes up the lion’s share of this at 60%. With the fixed income proportion at just 5%, we believe this asset class is poised for take-off particularly given the more supportive policy backdrop.3 This is supported by the rapid growth of the fixed income sustainable investment universe with more corporates moving towards Net Zero alignment as well as increases in sustainable labelled bonds issuance.

Source: Morningstar Direct, Manager Research. Data as of September 2022.

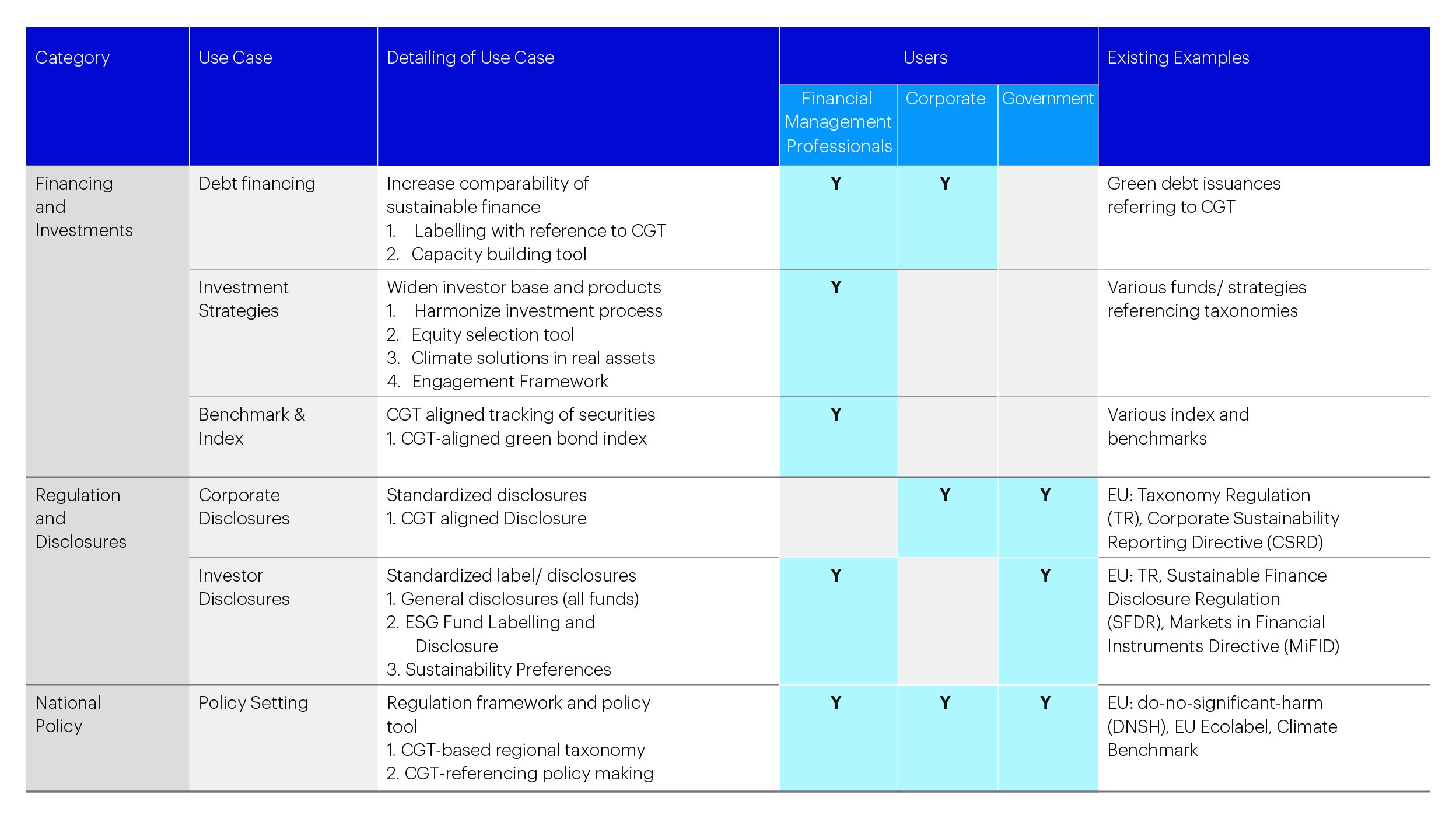

International alignment of Asian standards

With the development of regional taxonomies, we believe that the trend towards international alignment is certainly here to stay. The ASEAN Taxonomy references similar objectives to the EU Taxonomy. The further roll out of the Common Ground Taxonomy is likely to drive more cross border sustainable financing flows in both ESG funds and debt financing instruments, alongside improved ESG data disclosures.

Source: Understanding Use Cases of the Common Ground Taxonomy, September 2022, https://www.hkgreenfinance.org/wp-content/uploads/2022/09/CGT_Phase2reportENG_final.pdf

Is investing through an ESG lens additive for returns?

We believe that investing with an ESG lens can help to protect investors from downside risks with a focus on the governance factor, which is critical in avoiding credit events. The social and environmental factors can also help inform portfolios of ESG risks, especially on the transition front such as stranded asset risks. From a market technical perspective, investing with an ESG lens can also allow investors to take advantage of the expected long-term growth of the sustainable labelled bonds market in Asia and the trend of having a positive tilt towards issuers with strong ESG credentials. It is also likely that in a volatile market backdrop, investors and financial institutions are more likely to extend financing towards issuers that have a credible ESG transition strategy and can show their long-term thinking and inclusion of various stakeholders in their operations. This is evidenced by the significant sustainable financing targets set by many international banks in their ESG strategies in recent years.

Conclusion

ESG investing is here to stay and there are still areas that the region is working on in terms of decarbonization and energy transition. Further developments are likely to be driven by policy and Asia’s investment universe is incrementally playing its part to tackle climate adaptation and mitigation issues. We expect fixed income to play an important role in financing this transition, with measurable impact via sustainable labelled bonds and exercising engagement. Investing using an ESG lens can be additive to making a positive impact, alongside allowing for improved risk adjusted returns.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.