After Jackson Hole: what’s next?

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” - Jay Powell, Fed Chair.

This was the most important sentence and signal from Powell’s Jackson Hole policy speech, and I like what I heard.

Powell has indicated that the Fed is shifting towards a more accommodative stance because new risks have arisen.

And I agree, because the Fed’s policy stance has been restrictive, it’s clear that the labor market or at least demand for labor, is slowing.

It’s clear to me that the Fed is a lot more concerned now with weakening employment data – the July nonfarm payrolls rose by only 73,000 vs estimates of 110,000.1

The slowdown in the payrolls number “is much larger than assessed just a month ago… if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

So while Powell did not definitely say that the Fed will cut rate in September, he set a low bar for one.

Recent tariff-driven price pressure is viewed as transitory

I know that there are persistent concerns about tariff related inflation and how that may evolve in the coming months – but the reality is that recent tariff-driven price pressure is viewed as transitory and inflation expectation is quite stable.

For example, the US bond market reflects confidence, with inflation breakeven across 1-, 3-, and 5-year horizons remaining well-anchored. To me, that’s a positive. These well-anchored inflation expectations suggest that the Fed should be working to offset any weakness in the US economy.

Investment implications

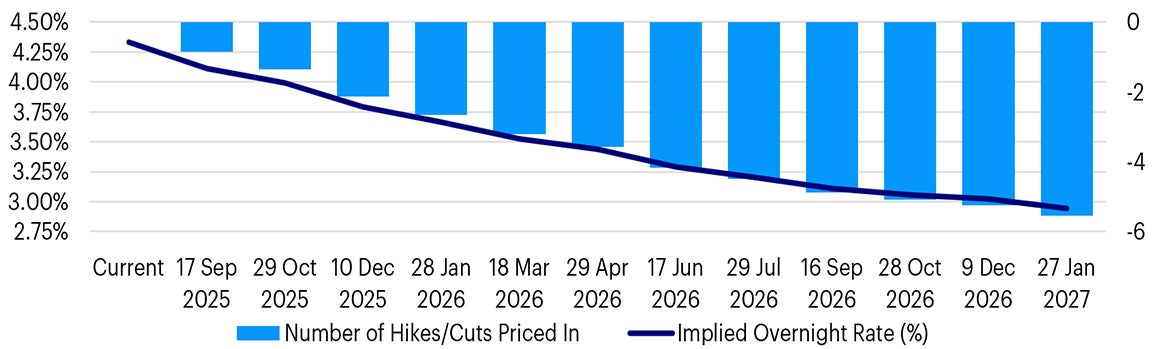

I fully agree with what I heard from Jay Powell at Jackson Hole and I fully expect a rate cut in September and at least one more closer to the end of the year.

With the Fed aligning more with market expectations for easing, this is likely a constructive development for risk assets. In this environment, I would be reluctant to fight the Fed.

With contribution from Brian Levitt

Source: Bloomberg. Data as of 25 August 2025.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.