AI revolution: What does it mean for developed and emerging markets?

We believe that both developed market (DM) and emerging market (EM) economies are undergoing a Fourth Industrial Revolution involving digitization, big data, automation, and AI. Unlike the first three industrial revolutions, many EMs are adopting and even pushing the technological frontier – notably China, India, and Israel. The clear world leader is the US, Europe may be lagging unlike in the first two. The labor-saving nature of technical progress can boost productivity growth and displace jobs. The composition of jobs and productivity gain prospects suggest that the transitional risk of job displacement is greater in DMs, but the longer-term challenge is that highly skilled socioeconomic groups in both DM and EM countries gain from AI, while others do not.

The so-called Great Divergence between DM and EM productivity widened partly because of differences in the speed of adoption of labor-saving technologies in the first three Industrial Revolutions. The first two industrial revolutions improved productivity by substituting capital for blue-collar work, while the third substituted for white-collar effort. Ultimately, more jobs were created, but the transitional threat of job losses during the first two industrial revolutions was challenging, contributing to socialist revolutions and the creation of the welfare state.

AI has become a critical driver of economic transformation and future output growth. Indeed, analysts estimate a 7% increase to global output over the next decade, powered by AI.1 Investors and businesses alike have taken note, as reflected in earnings calls, private fundraisings, and internal discussions. Growing global data volumes combined with falling computing costs have helped accelerate AI innovation, allowing the technology to become increasingly accessible and affordable.

While much of the AI story has focused on its effects on DMs, we also anticipate meaningful but less pronounced effects for EMs. EMs generally have younger demographics, greater labor supply, less capital-intensive industries, less developed human capital, and more manufacturing-centric economy. In general, we view AI as a labor-saving, capital-intensive technology that is especially relevant in information-focused tasks. Therefore, where labor is abundant and economies more manufacturing- or professional services-led (as opposed to personal services oriented), we anticipate a lesser impact from the AI — as is the case in many EMs.

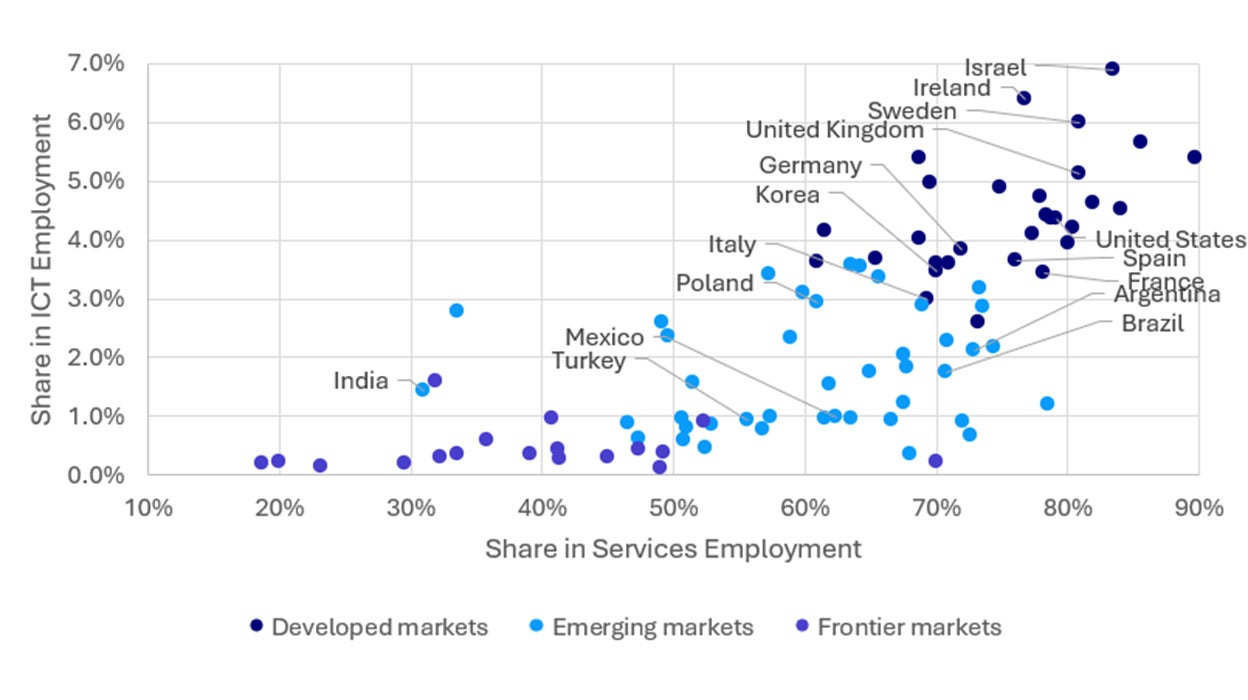

According to International Monetary Fund (IMF), 60% of jobs in DMs are likely to be impacted by AI, far higher than the 40% of jobs estimate in EMs and 26% in low-income countries.2 In other words, the economic and occupational make-up of emerging markets suggests a lesser effect from AI (lower chart).

Note: High complementarity – roles where job functions may be aided by AI with a meaningful boost to worker productivity with less concern for outright automation. Low complementarity but high exposure indicates job roles where job functions are likely to be significantly replaced by AI tools and services and therefore see job displacement. Low exposure indicates job roles where AI will have little effect. Note that share of employment is calculated as the working-age-population-weighted average, as per IMF methodology. Source: IMF, ILO as of 16 January 2024.

Note: In our assessment, progression on the x-axis indicates greater exposure to AI impacts, and progression on the y-axis indicates potential to benefit under current economic structure. The upper-right quadrant is more exposed to AI but also stands to benefit more. The upper-left quadrant would indicate an economy with concentrated exposure to AI that stands to benefit (e.g. India). ICT = Information communication technology. As per the International Standard Industrial Classification of all Economic Activities revision 4, the definition of ICT here includes activities involving production and distribution of information and cultural products, provision of the means to transmit or distribute these products, as well as data or communications, information technology activities and the processing of data and other information service activities. Source: IMF, ILO as of 16 January 2024.

However, we still anticipate opportunities for EMs to benefit from the rise of AI.

To illustrate this, we divide the AI value chain into three components: enabling infrastructure, AI architecture, and adopters of AI. Within enabling infrastructure, AI requires specialized hardware and platforms with substantial capital costs. AI architecture describes the various tools and systems in place for the training and deployment of AI, and then AI adopters are those businesses and functions making use of AI, which we see as the highest value-capture opportunities.

A significant portion of the human capital and R&D expenses associated with AI development are borne by DMs. This allows EMs to embrace AI as a leapfrogging tool without the need to adapt existing infrastructure and incur large development costs. This has arguably been the case in India, Israel, Korea, and China. Infrastructure can also be developed, and data centers built with AI in mind, whereas aged DM infrastructure requires reinvestment, repurposing or replacement.

Finally, we note that the development and adoption of AI is likely to be defined by cultural and policymaker attitudes towards the technology. Some major EMs are already taking different values-based approaches on how to regulate and implement AI, whereas Western developed economies are taking a more privacy-minded approach to AI adoption. This may characterize the paths by which AI deployment may diverge across economies.

Real GDP growth has two key ingredients – demographics and productivity growth, more specifically labor input and capital invested, and efficiency in their usage. Demographics, it is often said, is destiny but in our view, policy choices make as much or more difference than other “endowment” factors such as population dynamics or natural resource endowments.

Investment Implications:

Tech sector

As mentioned, we are currently at the wake of the AI era, where the main drivers of this thematic market are in the enabling infrastructure and AI architecture components. Hence, the recent rally in semiconductor, semiconductor equipment, and data infrastructure equities. We believe that these sectors will continue to be the catalysts of the AI market across both DM and EM economies in the near term.

Despite the speculation that the potential tech bubble might be occurring with the largest US tech stocks surging to their record levels, we believe such scenario is unlikely, at least in the short-term. Developed Markets tech sector is hot, but not too hot – Magnificent 7 trades at the P/E ratio of nearly 40x, half of that of the Four Horsemen (Dell, Microsoft, Intel, Cisco) which traded at more than 80x trailing earnings during the peak of 2000s tech bubble. Top 6 by market cap used to trade at 64x P/E at the time.3

In addition, a prolonged AI bull has been supported by tech’s strong earnings. Recent market correction was imminent, but we do not think it is the reason to turn away from the AI theme. Rather, it should pave the way for more sustainable growth in the tech sector. Given the measures which suggest the improvement of domestic demand for AI infrastructure parts in the US and other DM countries, we are overweight in their respective equities.

Emerging Markets

In the emerging markets, we find Taiwanese and South Korean stocks as particularly favorable in the 2H of this year. Taiwanese AI-related stock valuations are not cheap, earnings are improving, and we would be buying on a meaningful dip to the market.

There has recently been a wide divergence in Taiwanese and South Korean markets with TAIEX and KOSPI going up by roughly 30% and 4% year-to-date respectively.4 Although both countries are leading the global chip supply, it seems that South Korean companies have not yet convinced investors to price the AI premium. This might be a palatable entry point into the Korean AI stocks.

Long-term fund flows and risk factors

From a long-term perspective, we are anticipating the direction of fund flows to shift from the AI equipment and infrastructure to AI-integrated software applications sector. As the proliferation holds, similar to when 4G was introduced, we believe that there will be a rise of the new era of app-based economies with AI as a centerpiece.

It is important to keep in mind that any new technology comes with risks. Given how powerful of a tool AI is, unprecedented cybersecurity cases might unfold soon. For this reason, we see prospects in the cybersecurity and IT consulting firms too.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.