An investor’s guide to US Section 899 tax proposals

This document serves as a concise guide to Section 899 and its potential implications. As the legislation is still pending finalisation, our insights remain provisional. We are not tax experts and urge readers to seek professional advice. Nevertheless, we address the primary considerations for investors and highlight key areas of uncertainty.

Summary

The situation remains fluid but we believe certain foreign individuals, corporations and government entities in a wide range of countries may face higher withholding taxes on income from US interest, company dividends and rental payments and also on gains from some real estate dispositions. Corporate profits may also be impacted, particularly for non-US multinational corporations (though some US firms may also suffer). As US federal and municipal bonds are generally not taxable, we believe they are out of scope for Section 899. It is also our understanding that capital gains are out of scope (except for real estate).

It may appear that the US government is trying to penalise foreign owners of US assets but our understanding is that policymakers in Washington are trying to compel a change in foreign taxation of US companies. The Senate’s version of Section 899 lessened the tax burden, clarified the application of the tax, and pushed back the implementation date from 2026 to 2027, which leads us to think it could be used as a tool for negotiating with other countries.

We believe the Senate will pass their version of the bill shortly, with reconciliation with the House’s version passing both chambers before the August recess.

What is Section 899?

President Trump’s One Big Beautiful Bill Act (The Bill) includes a new Section 899 to the US Internal Revenue Code. Section 899 could increase the taxes imposed on individuals, businesses, governmental and other entities based in countries deemed to impose unfair taxes on US individuals and businesses.

The Bill passed through the US House of Representatives on 22 May 2025. Then on 16 June 2025, the Senate Finance Committee released its version, which is now being considered by the full Senate, before an attempt to reconcile with the House of Representatives version. It is not clear The Bill will be passed out of the Senate ahead of 4 July 2025 (as targeted). It is also not clear if the Senate will negotiate their version of the bill with House leadership prior to final passage out of the Senate, or if the House will opt to revise the Senate version after passage, further extending debate into late July.

Who may be affected?

While the intent of Congress is to protect US business interests overseas and address discriminatory foreign taxes, Section 899 will penalise investors and businesses from countries deemed to impose unfair taxes such as digital services taxes (DST), undertaxed profits rule taxes (UTPR) or diverted profit taxes (DPT). These “unfair” taxes are used by governments to ensure that large multinational corporations pay some taxes in the countries where value is created, often under the Organisation for Economic Co-operation and Development’s Global Tax Deal (which the US was implementing until President Trump withdrew in 2025).

The Senate version of the bill takes a narrower approach to withholding tax. It applies only to countries that impose “extraterritorial taxes,” such as UTPR and DPT. In contrast, the House version extends its scope to also include residents or businesses majority-owned by residents of countries that impose “discriminatory foreign taxes” such as DST.

However, when it comes to the Base Erosion and Anti-Abuse Tax (BEAT), both versions align. The Senate’s “Super BEAT” provisions, like those in the House version, would also apply to companies from counties that impose discriminatory taxes.

Below we show a selection of countries that we think may currently be in scope for Section 899. It appears likely to cover a wide range of European countries and a good selection of Asia and Pacific region countries. Under the House version, a broader range of countries could be targeted with higher withholding taxes (Canada and India would be added, for example).

Undertaxed Profits Rule Taxes (House and Senate versions)

Australia, Austria, Belgium, Bulgaria, Croatia, Curacao, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Indonesia, Ireland, Italy, Japan, Luxembourg, Netherlands, New Zealand, North Macedonia, Poland, Portugal, Qatar, Romania, Slovenia, South Korea, Spain, Sweden, Thailand, Turkey and the United Kingdom.

Diverted Profits Taxes (House and Senate Versions)

Australia and the United Kingdom.

Digital Services Taxes (House version only for withholding tax, House and Senate for Super BEAT)

Austria, Canada, Colombia, Denmark, France, Guinea, Hungary, India, Italy, Kenya, Nepal, Poland, Portugal, Rwanda, Sierra Leone, Spain, Switzerland, Tanzania, Tunisia, Turkey, Uganda, the United Kingdom and Zimbabwe.

What could be the consequences?

Individuals, businesses, governmental and other entities in target countries could face an increase in various taxes. We believe there will be no implications for capital gains tax.

a. Withholding tax

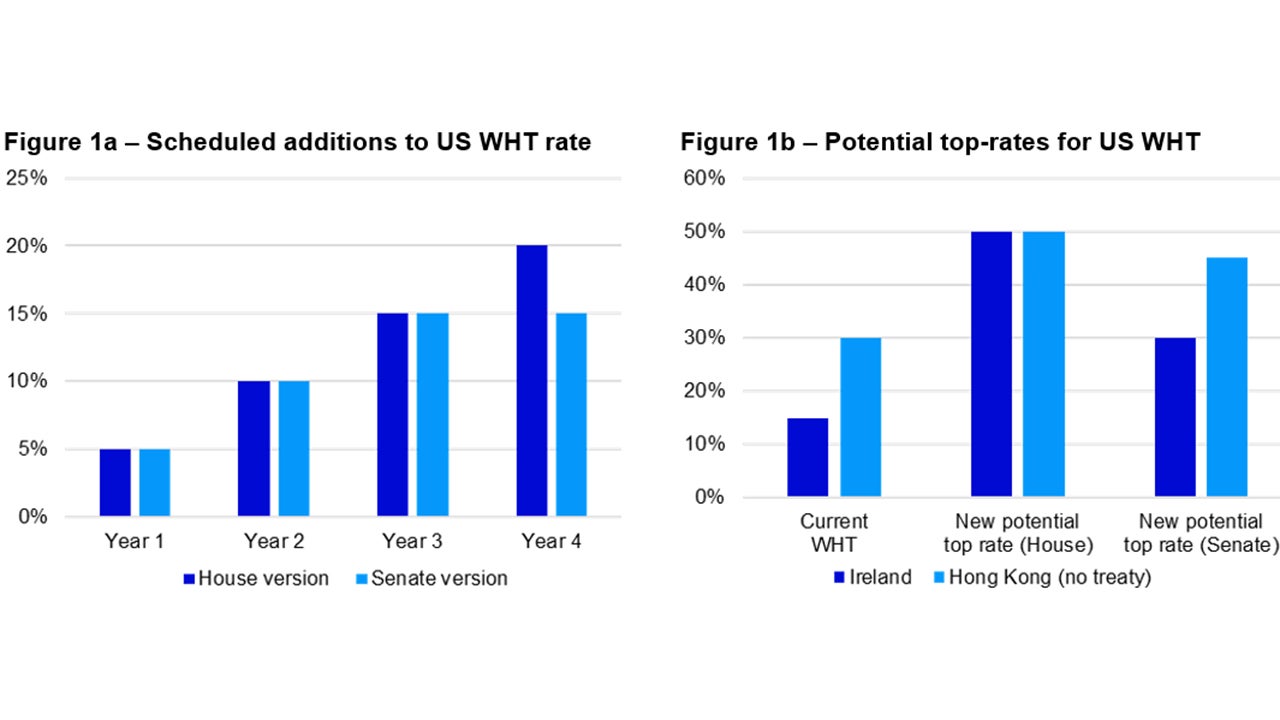

Withholding tax on income (for example, dividends, interest, rent and royalties) and on certain dispositions of US real estate would rise by 5% per year up to a maximum increase of 15% versus existing rates under the Senate version. Under the House version, the rate would rise by 5% per year up to a maximum of 20%above the applicable statutory rate. Hence, under the House version, if residents of a country currently face a reduced withholding tax rate, the 5% annual increases will continue until the rate reaches 50% (the 30%statutory rate plus 20%). Figure 1 shows that we believe the House version would be more punitive.

Interest earned on US federal and municipal bonds is not covered (as they are tax exempt). The Senate version exempts original issue discount, portfolio interest (on bond funds, say), interest on deposits and certain interest-related dividends received from a regulated investment company. We believe that Qualified Foreign Pension Funds would continue to be exempt from withholding tax on sales of real estate.

There is currently an exemption from tax for passive income generated by foreign governments (including sovereign wealth funds). Under the House version of The Bill, this exemption would be eliminated, while under the Senate version it would only be eliminated for governments of countries with an extraterritorial tax.

a. Super BEAT

The Base Erosion and Anti-Abuse Tax (BEAT) was introduced by President Trump in 2017, when the US moved from a worldwide to a territorial tax regime. It was designed to capture tax revenue from foreign and domestic corporations operating in the US that transfer revenues/profits to low tax regimes. The tax rate was set at 10% but only applied to companies with US gross receipts of at least $500 million and where payments made to related foreign corporations exceed 3% of total deductions taken by the company (base erosion percentage threshold).

The Bill contains a Super BEAT provision that will tighten some of the conditions and increase the tax rate for corporations that are majority owned by residents of countries with either “extraterritorial taxes” or “discriminatory taxes”. Both the Senate and House versions would eliminate the gross receipt requirement, so that even small businesses would be caught. The House version would also eliminate the base erosion percentage threshold, while the Senate version would reduce it to 0.5% (and to 2% for taxpayers not subject to Super BEAT). Hence, more corporations (especially foreign owned firms) would now have to pay this tax.

The tax rate will also rise. Under the House version it will rise from 10% to 12.5% (and 10.1% for taxpayers not subject to Super BEAT). The Senate version envisages the BEAT rate increasing to 14% (for all corporations, whether subject to Super BEAT or not). Further, both the House and Senate versions expand the amount of income subject to BEAT by treating some capitalised amounts as if they were deducted and by disregarding certain tax credits.

Note: “WHT” is withholding tax on investment income (interest, dividends, rent etc.). “House version” or “House” shows the rates under the US House of Representatives version of the One Big Beautiful Budget Bill Act (The Bill). “Senate version” or “Senate” shows the rates under the US Senate version of The Bill. Figure 1a shows the proposed timeline of additions to the US withholding tax rate for countries that have no tax treaty with the US. Figure 1b compares the current rate of withholding tax to the potential top rates for Ireland (which has a tax treaty currently limiting withholding tax to 15%) and Hong Kong (which has no tax treaty and currently faces a withholding tax of 30%).

Source: Invesco Global Market Strategy Office

When will the changes be implemented?

The House version’s increased withholding tax would apply to payments made during the first calendar year beginning 90 days after enactment (this could be 2026). Other increased rates of tax would likewise apply in the person’s first tax year beginning 90 days after enactment.

The Senate version would delay implementation, with the new tax regime starting in the first calendar year after the one-year anniversary of enactment (withholding taxes) and in the person’s first tax year after the one-year anniversary of enactment (for other taxes). This is likely to be 2027 for calendar year taxpayers

Uncertainties

Apart from the fact we don’t know what the reconciled version of The Bill will contain, there are many uncertainties surrounding this bill. First, and foremost, it is not clear that it will be implemented. It may simply be used as tool for negotiation with other countries and the provisions may never come into force for those countries that come to a tax agreement with the US (remember that the Senate version imagines tax changes occurring in 2027).

Second, it is not clear that The Bill can simply override treaty obligations with other countries (to increase withholding tax rates, for example).

Third, it is not clear how overseas domiciled funds will be treated, especially those managed by US firms. Nor is it yet clear how synthetic ETFs will be treated.

Fourth, when it comes to the Super BEAT provisions (that in theory could reduce the post-tax earnings of multi-national corporations, especially those deemed to be domiciled in offending countries), it is not clear how residency will be decided. As the residency question is to be determined by whether or not a firm is majority owned by the citizens of a targeted country, this could be very complicated (and this applies to the parent company and not the subsidiary that may be operating in the US).

We are not tax experts and it is important that readers seek independent tax advice to determine how they may be impacted by any changes, especially given the uncertainties outlined above.

Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. It is not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding tax penalties that may be imposed on the taxpayer under U.S. federal tax laws. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax advisor for information concerning their individual situation.

All data as of 20 June 2025, unless stated otherwise.

References

A&O Shearman: Proposed Section 899 – Analysis of both the House and Senate Bills (17 June 2025)

BDO: Understanding the OECD’s Pillar Two Framework

Davis Polk: Senate tax bill retains provision targeting “unfair foreign taxes” with delayed effective date (18 June 2025)

K&L Gates: Proposed retaliatory US taxes would impact cross-border transactions (10 June 2025)

Linklaters: Section 899: US House Advances Legislation Targeting “Unfair Foreign Taxes” (28 May 2025) Mayer Brown: US Senate Finance Committee makes changes to proposed Section 899 (18 June 2025) OECDPillars.com

Tax Foundation (TaxEDU website): Undertaxed Profits Rule (UTPR)

Tax Foundation (TaxEDU website): Base Erosion and Anti-Abuse Tax (BEAT)

Tax Foundation: Digital Taxation around the World (30 April 2024)

Tax Foundation Europe: Digital Services Taxes in Europe, 2024 (7 May 2024)

VATCalc: Digital Services Taxes DST global tracker (10 May 2025)

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.