Anxiety over US dollar assets and FX market volatility

There have been some growing market fears that US assets have become inherently riskier assets. This may reflect the market’s anxiety surrounding the growth headwinds to the US economy or President Trump’s trade policies and threats.

Our base case for how the tariffs plays out, is that we can expect a combination of escalation and de-escalation scenarios. It’s possible to see risk-on rallies in US equities and USD strengthening whenever a positive headline is released – especially since US assets have gotten hit disproportionately hard since the start of the year.

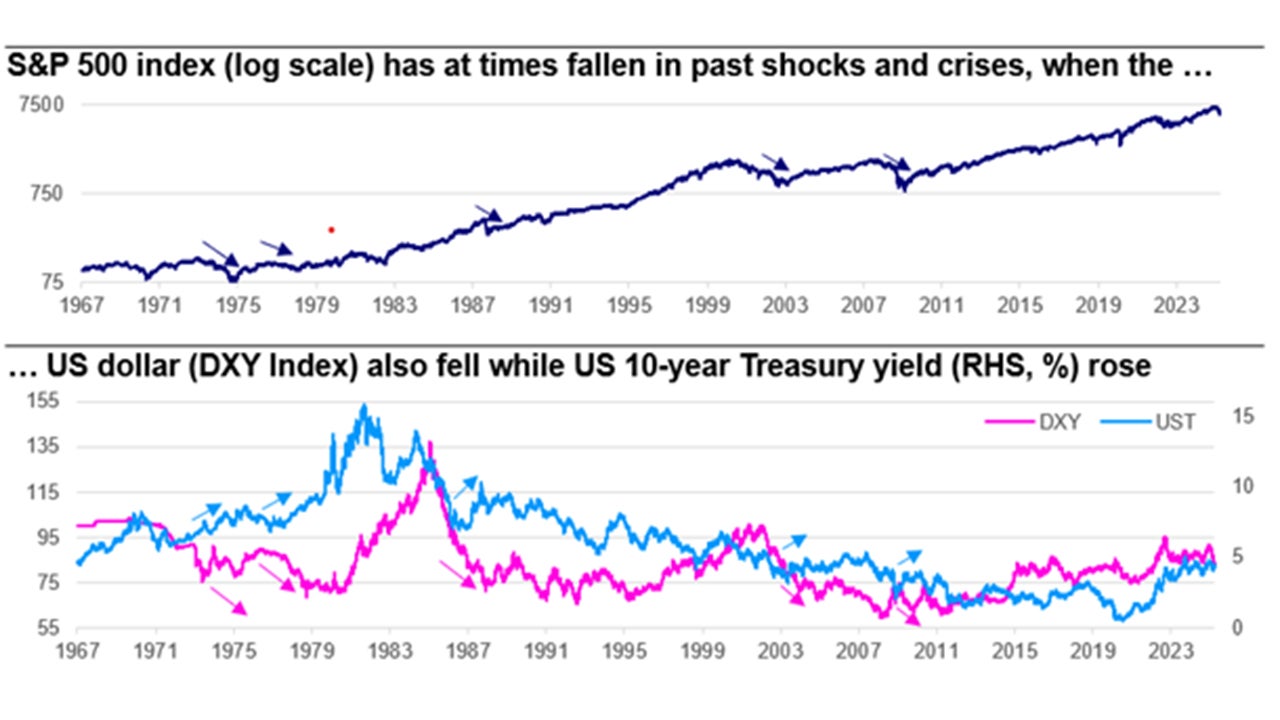

Note: DXY, broad nominal dollar index against other major liquid developed market currencies. S&P 500 Index rebased to 100 in 1967.

Sources: Bloomberg, Macrobond, and Invesco. Daily and monthly data (DXY) as at 25 April 2025

There have been several crises in the past when the USD, S&P index and US Treasures were all hit at once. The most recent examples have been during the 2008-2010 GFC (Global Financial Crisis) and the 2003 dot-com bubble burst.

Still, a key doubt investors may have, is whether the recent, across-the board selloff reveal cuts in portfolio allocations due to declining growth prospects for the US or the beginning of the end of the US as a perceived global “safe-haven.”

On the first dynamic, US growth is likely to fade in the coming months and quarters. The “hard” data is likely to follow the weakening “soft” data. US consumers and business owners are worried about higher prices from the tariffs. And while our base case still assumes no US recession, growth headwinds have certainly amplified.

The main driver for this has been the limited visibility that businesses and households have for the coming future. Trump’s tariffs and his recently renewed attacks on Fed Chair Powell coupled with his rapid reversals such as retracting threats to fire Powell or pausing tariffs, leave many scratching their heads. I wouldn’t be surprised if we will soon see major capex spending, household consumption and hiring decisions slow or even stop. This is a stark pivot from the beginning of the year when investors piled in on the US growth exceptionalism trade.

Secondly, in our view, investors with a longer-term horizon such as reserve managers, may reconsider their large USD holdings due to the unpredictable and volatile decision making under a Trump presidency. Already, US assets – equities and the USD – are expensive both on a historical and relative basis. Expensive valuation, coupled with the US economy’s large twin deficits – could lead to a longer, more protracted decline for the USD as global investors search for other stable stores of wealth and investment opportunities elsewhere.

According to the IMF COFER data1 reserve managers around the world have been reducing their USD exposure for a while. Currently, global FX reserves in USD represent around 58% of total reserves, which is down from 65% in 2016. The currencies that have gained over the years have been JPY, CNY and “other”.

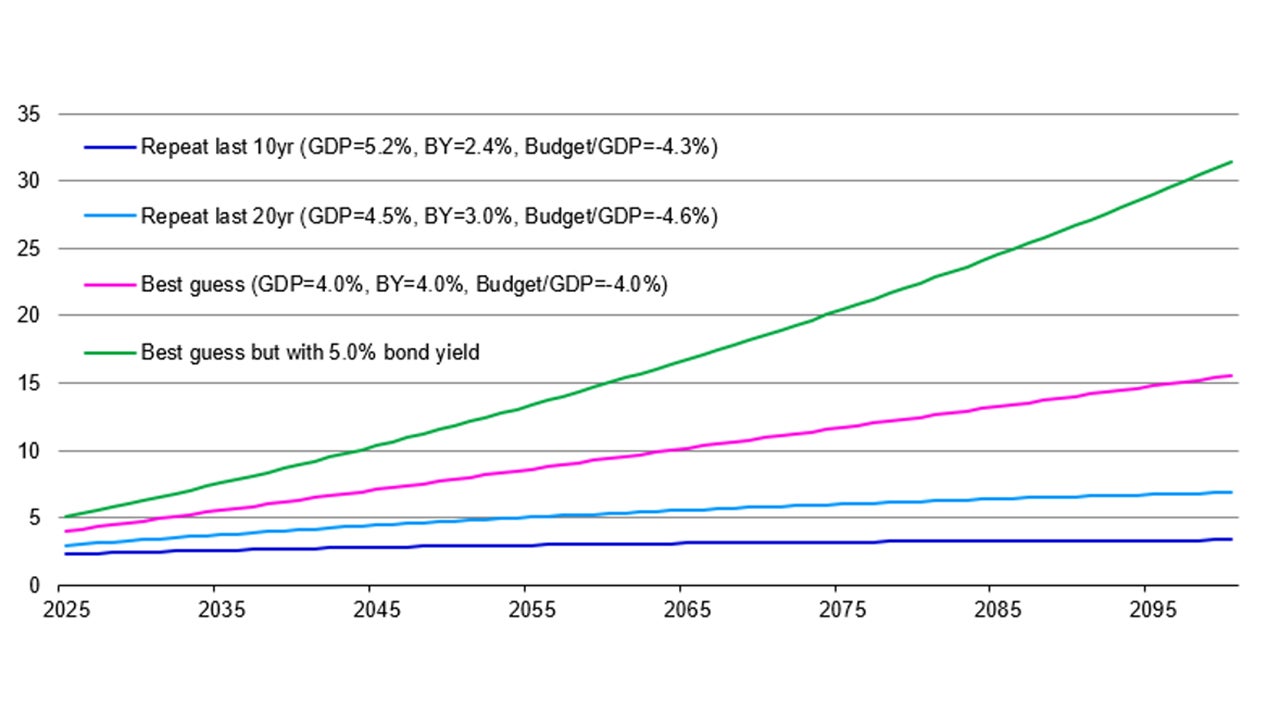

Note: Annual data from 2025 to 2100. Projections are based on a starting point of the net general government debt to GDP ratio in 2024 (using OECD data), with future debt to GDP depending on assumptions about primary budget deficits, nominal GDP growth and the average interest rate on US government debt (historical data provided by the US Department of the Treasury). “GDP” is nominal GDP growth. “BY” is bond yield (or assumed average interest rate on outstanding debt). “Budget/GDP” is the primary budget balance (i.e. before interest costs) divided by GDP. “Repeat last 10yr” is a scenario where all parameter values are in line with the average of the last 10 years. “Repeat last 20yr” uses the averages of the last 20 years. “Best guess” is our best guess of the future parameter values. For reference the US Congressional Budget Office estimates the net interest to GDP ratio will be 3.2% in 2025. These views may not come to pass. Source: OECD, US Department of the Treasury, US Congressional Budget Office, LSEG Datastream and Invesco Global Market Strategy Office

Thirdly, the USD fading coupled with treasury yields rising in recent weeks could also stem from investor worries about the path of government debt in the US. The Congressional Budget Office (CBO) recently projected that government debt could reach 220% of GDP in 2055 and that the net interest costs on that debt could be 8-9% of GDP. This seems unsustainable, especially if the 2017 tax cuts are made permanent rather than being reversed this year, as originally planned. But this outcome is not inevitable. Over the next few years, the US needs to reduce its deficit (higher taxes, lower spending), grow the economy at a higher pace (through immigration or productivity gains from AI) and lower its interest costs. These factors could stabilize debt and interest cost ratios.

Investors may be cutting their exposure to US assets in the near-term because of fears of recession and slower trend growth. The sharply higher tariffs and immigration curbs are likely to bring stagflation risks to the fore. However, if the challenges brought by White House's unpredictable trade policies are not addressed, they could negatively impact innovation, productivity, growth, and investment returns. And this is what we think could challenge the US’s global financial centrality.

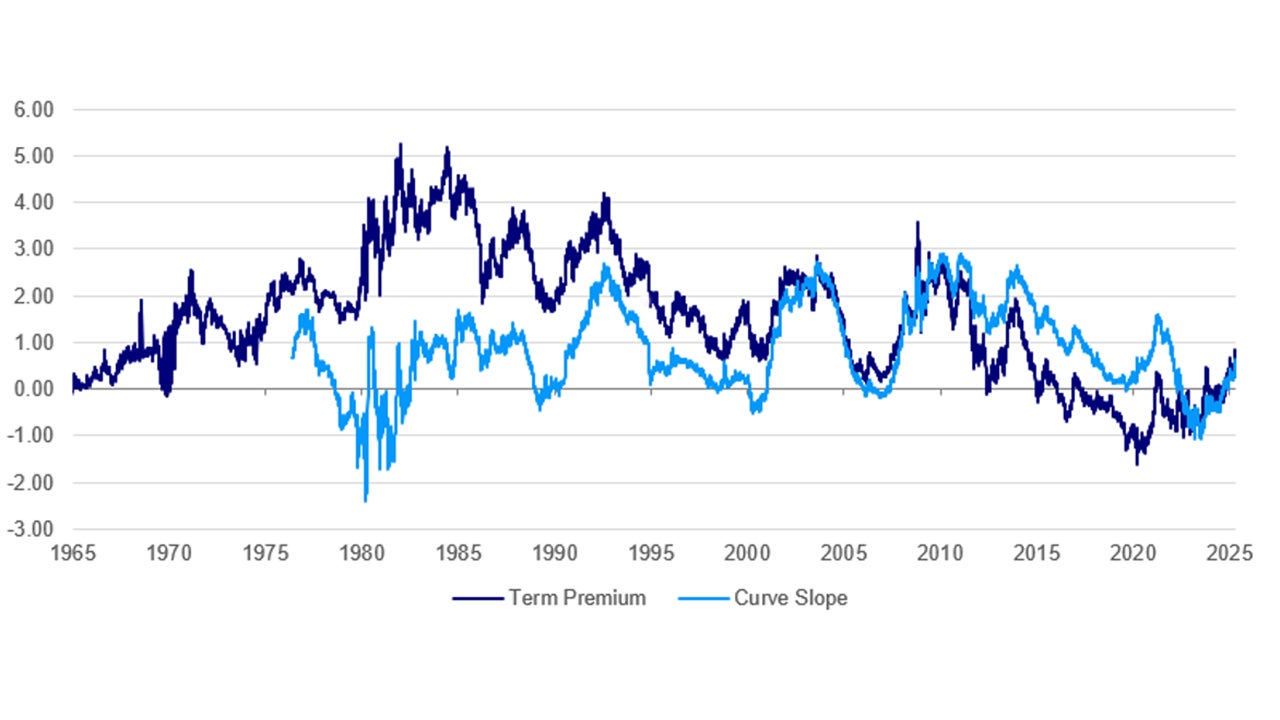

Note: The term premium is the incremental yield investors require to hold longer-term debt, instead of rolling over short-term debt. Sources: NY Federal Reserve Bank, Bloomberg, Macrobond, and Invesco. Daily data as at 25 April 2025.

Despite growth fears, the US yield curve slope and term premia are both rising. This happens normally when the economy is in recovery, such as in the early-90s, early-2000s, 2010s or early 2020s. But it’s pretty clear, that the economy is not currently in recovery. Instead, I think what the yields are telling us is that investors are fearing stagflation, as in the early/mid and late 1970s when oil embargoes caused economy-wide supply shocks. In the US under Trump, immigration curbs and sharply higher tariffs may now do the same – probably to the benefit of gold and other high-quality inflation hedges.

From a currency perspective, we continue to think the JPY is likely to be the outperformer this year – because the BOJ is likely to continue it’s rate-hiking schedule once the tariff overhang is removed and growth continues to firm up driven by domestic demand, we are also bullish on the AUD – longer-term investors could diversify away from the USD to the AUD and Australian super funds may need to increase their hedge ratios which is supportive of AUD, and bullish on the EUR – where the EZ (Eurozone) economies are deploying vast fiscal stimulus to inflate their economies. I think what’s challenging here, is that correlations within F/X (Foreign Exchange) can change. We live in a time punctuated by extreme levels of economic policy uncertainty which means that investors will soon find something else to worry about.

Among Asian currencies, in our view, the appreciation of TWD in early May has been particularly notable and may still have room to run. This upward trajectory is driven by several factors, including the easing of US-China trade tensions and more optimistic growth data. But the primary catalyst for the TWD's strength has been capital inflows, notably repatriation buying. Taiwan's substantial external surplus and the tendency of local exporters to be underhedged have prompted a rush to convert foreign currency exposure back into TWD. Additionally, demographic and structural factors have resulted in Taiwan's life insurance sector becoming a formidable force, holding approximately $1.7 trillion in overseas assets, predominantly in U.S. Treasuries. This has led to some volatility due to the mismatch between TWD-denominated liabilities and U.S. dollar assets. Still, the Central Bank of the Republic of China (Taiwan) may intervene more forcefully if they become uncomfortable with the rapid pace of TWD appreciation.

Asian assets have lagged behind their European and Latin American counterparts in terms of performance so far. The recent appreciation in Asian currencies might partly be a catch-up effect. The "sell U.S." trend is pushing investors to seek alternatives, and Asia naturally offers a compelling option for capital relocation with market depth, liquidity, and diverse exposure. Although speculative, there is some investor concern about the potential for a "Mar-a-Lago Accord" that could address currency valuations.

Gold is the asset of choice to hedge US policy or geopolitical uncertainty due to such a challenging transition, I think, given a lack of alternatives. IMF data suggest central banks are not aggressively buying gold now, but I’d expect private and official demand to persist, driving the gold price higher.

Now, there is a radical left field tail-risk scenario that investors may want to consider – a total shake-up of the US financial system and the return to the gold standard. This could happen due to run-away inflation, loss of confidence in central banks and investors looking for a more stable store of wealth. In our view, the price of gold could go as high as USD 9,051 per ounce if US gold reserves were to fully cover cash and notes in circulation and a whopping USD 22,085 if needed to cover bank reserves held at the Federal Reserve. I think there is little chance of this happening but we do live in strange times.

With contribution from Arnab Das, Paul Jackson

Investment Risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.