Applied philosophy: Price momentum has…momentum

Equity markets seem to have become less sensitive to tariff-related news in recent weeks. With the full impact of higher tariffs yet to come, this may seem complacent. Economic data has been softening in the US, while “green shoots” may start appearing in Europe. I look under the hood of their respective equity markets with the help of our factor indices. Price momentum has been among the best performers year-to-date. Can it continue to have momentum?

Equity markets just shrugged and moved on after the deadline passed for the introduction of “reciprocal” tariffs”. Have we been desensitised? Are we more confident the global economy can take it in its stride? Perhaps there is an element of both, although evidence of the full impact of tariffs on the US economy is still to come. I think H2 2025 will be when the rubber hits the road, and we will see how corporate margins, inflation and consumer spending is affected.

For now, there is little in the economic data to suggest more than a mid-cycle slowdown in the US. Despite the weaker-than-expected labour market data, there has been no sudden fall in activity. Nevertheless, concern about the near future has been reflected in US business sentiment with the gradual slide in the new orders component in the ISM surveys in recent months, while the prices paid component rose. There is little sign of anything similar occurring in the Eurozone, where growth has been weak, but improving based on PMI surveys with no concern about inflation.

At the same time, the probability of a US recession has decreased despite some softening of the labour market. Thus, US equities reacted as I would have expected, albeit the recovery since April has been narrow. After underperforming Europe for most of the first half of 2025, US stocks have caught up in local currency terms (Figure 4). Having said that, the composition of their respective returns has been different. Whereas the bulk of year-to-date returns has come from earnings growth in the US with multiples changing little, the opposite has happened in Europe (as of 14 August 2025 based on Datastream Total Market indices in US dollars for the US and euros for Europe). Analyst consensus points to this differential to widen further in the next 12 months after most companies have reported results for H1 2025. It implies diminishing hopes for sustained European outperformance over the US and would settle the debate about “American exceptionalism”.

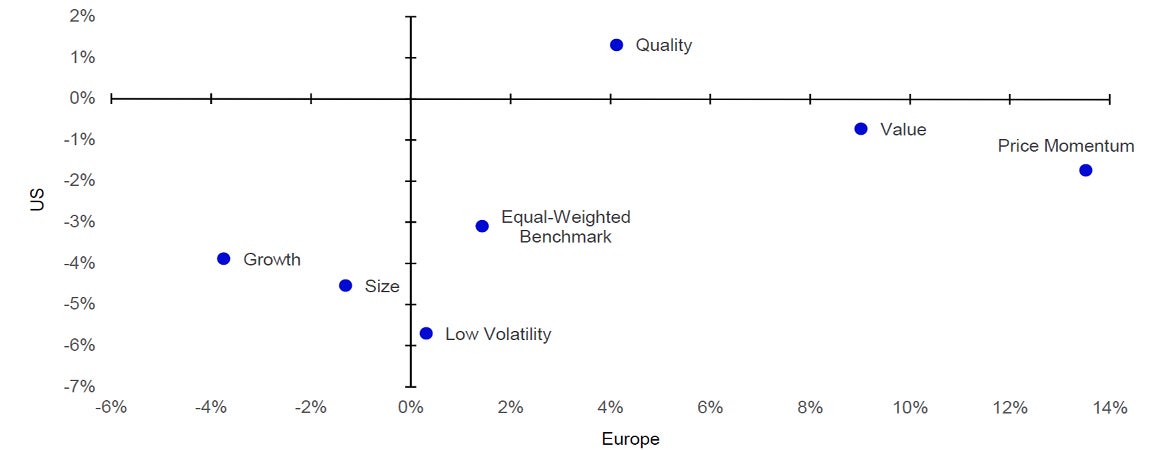

Nevertheless, I think there is little risk of the current market cycle ending, and our expectation that economic growth will reaccelerate once tariff clouds disperse, I am not surprised by the year-to-date performance of our factor indices: price momentum is third best in the US and at the top in Europe (see Figure 1) and the best performer in both regions in the last 12 months (Figures 6a and 6b). This is consistent with my idea of how the mid-cycle stage should develop and why quality and value have also performed better than growth, size (small caps) and low volatility.

Notes: Data as of 14 August 2025. Past performance is no guarantee of future results. Showing total returns of factor indices and the equal-weighted regional benchmark relative to the S&P 500 index in the US and the Stoxx 600 index in Europe since 31st December 2024. See appendix for factor index definitions.

Source: LSEG Datastream and Invesco Global Market Strategy Office.

I think that further outperformance by price momentum relative to most other factors could depend on its sector exposure in both regions. The US index is dominated by technology, industrial goods & services, financial services and travel & leisure, which account for 55% of the index (as of 31 July 2025, based on number of constituents). It seems to have the largest overlap with growth, which has three of these sectors within its top four (with energy instead of financial services completing the list). On the other hand, the European index seems less diversified not only because the top four sectors account for 62% of the index, but also because three of those sectors are financials (banks, financial services and insurance) plus industrial goods & services (as of 31 July 2025, based on number of constituents). In contrast to the US, this has the largest overlap with our quality index.

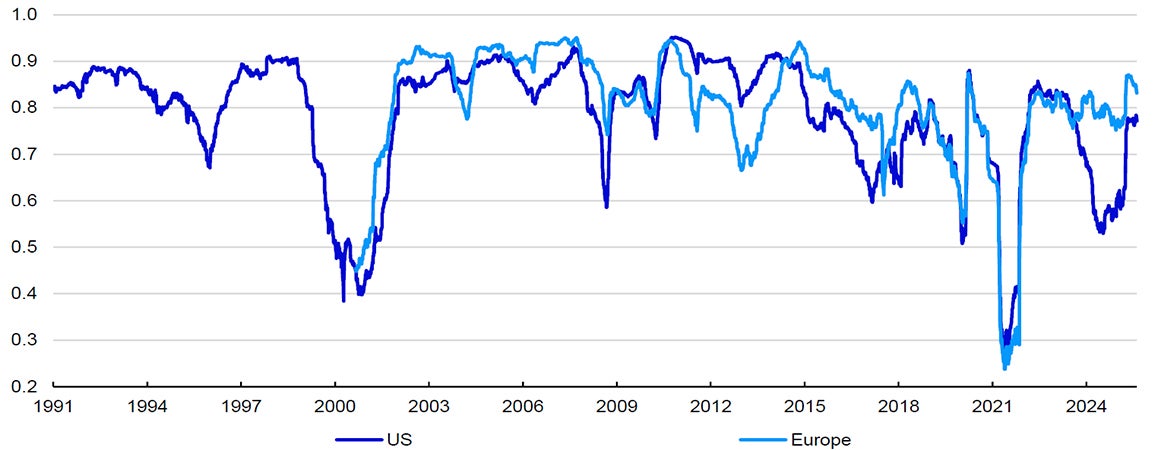

On the surface this could signal some doubt over the economic cycle in the US. Although I consider growth a cyclical sector, quality is more defensive, in my view. Thus, the fact that quality was the best performing factor in the US, as well as the underperformance of size implies some concern over economic growth. At the same time, the correlation between our price momentum and value indices has remained high in Europe throughout 2025 so far, while it recovered in the US after a wobble in early April. Low correlation between these two factors coincided with periods of stock market weakness in the past (Figure 2). Taken together, I am getting mixed signals from the market in both regions.

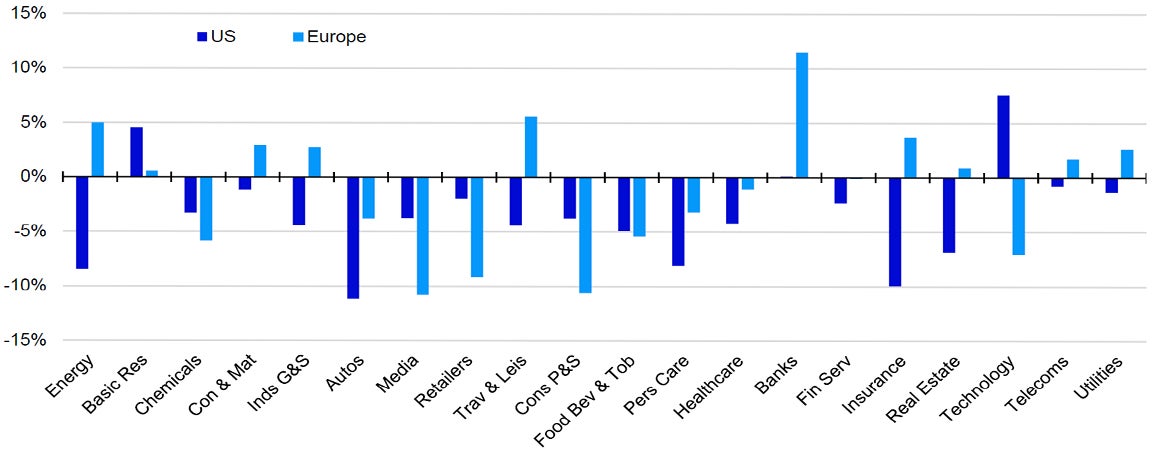

In any case, it seems to me that Europe has had a more cyclical rally year-to-date with value outperforming not far behind price momentum, while only growth and size underperformed (Figure 1). Sector returns also support this view, with more broad-based outperformance by cyclicals including resource-related sectors, industrials, travel & leisure and banks (Figure 3). In the US on the other hand, the outperformance of only quality with all other factors underperforming shows the dominance of technology mega-caps in year-to-date returns (our factor indices are equal-weighted). At the moment there seems to be a contrast between the underlying narrative of fiscal support in Europe and the AI-driven rally in US.

If we are right about a reacceleration of economic growth in the next 12 months, we should see a broadening of the rally in the US driven by the value factor. More supportive monetary policy in the US in the form of rate cuts by the Fed alongside financial de-regulation and a steepening yield curve could boost not only banks, but other cyclical sectors, as well. In theory, a lower discount rate could also benefit the growth factor, but I suspect that an awful lot of good news is in the price.

Higher growth also implies that we remain in the mid-cycle phase of the market cycle, where I would expect price momentum to be among the best performers, thus maintaining its momentum in Europe. At the same time, while there may be a period of underperformance in the US if there is a rotation out of growth sectors into value, I would expect price momentum to outperform over the next 12 months.

Notes: Data as of 14 August 2025. Showing the one-year correlation of daily total returns between our price momentum and value factor indices. The data starts on 1st January 1991 for the US and 1st September 2000 for Europe. See appendix for factor index definitions. Past performance is no guarantee of future results.

Source: LSEG Datastream and Invesco.

Notes: Data as of 14 August 2025. Past performance is no guarantee of future results. Returns shown are for Datastream sector indices versus the total market index. The benchmarks used are the Datastream Total Market United States index for the US and the Datastream Total Market Europe Excluding Emerging Markets index for Europe. Basic Res = basic resources. Telecoms = telecommunications. Autos = automobiles & parts. Cons P&S = consumer products & services. Inds G&S = industrial goods & services. Con & Mat = construction & materials. Trav & Leis = travel & leisure. Pers Care = personal care, drug & grocery stores. Food Bev & Tob = food, beverage & tobacco.

Source: LSEG Datastream and Invesco Global Market Strategy Office.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.