Applied philosophy: Strategist from East of the Elbe – Q2 2024

Central and Eastern members of the European Union (CEE11) have had a wide dispersion of returns since the end of October 2023. We think one of the main drivers has been diverging monetary policy and a return to a narrowing rally within markets (especially equities). Our assumption of reaccelerating global growth, declining inflation and lower developed market central bank rates could boost returns in risk assets. In our view, this outlook should support both CEE11 government bonds and equities.

Our universe of Central and Eastern European members of the European Union (CEE11) had mixed fortunes since our last publication in November 2023. More positive sentiment towards risk assets has not been uniform even outside the region, with the US and Japan towering over other regions within equities. At the same time, within government bonds, Emerging Markets were the best performing region, but that strength did not seem to have boosted the returns of the CEE11.

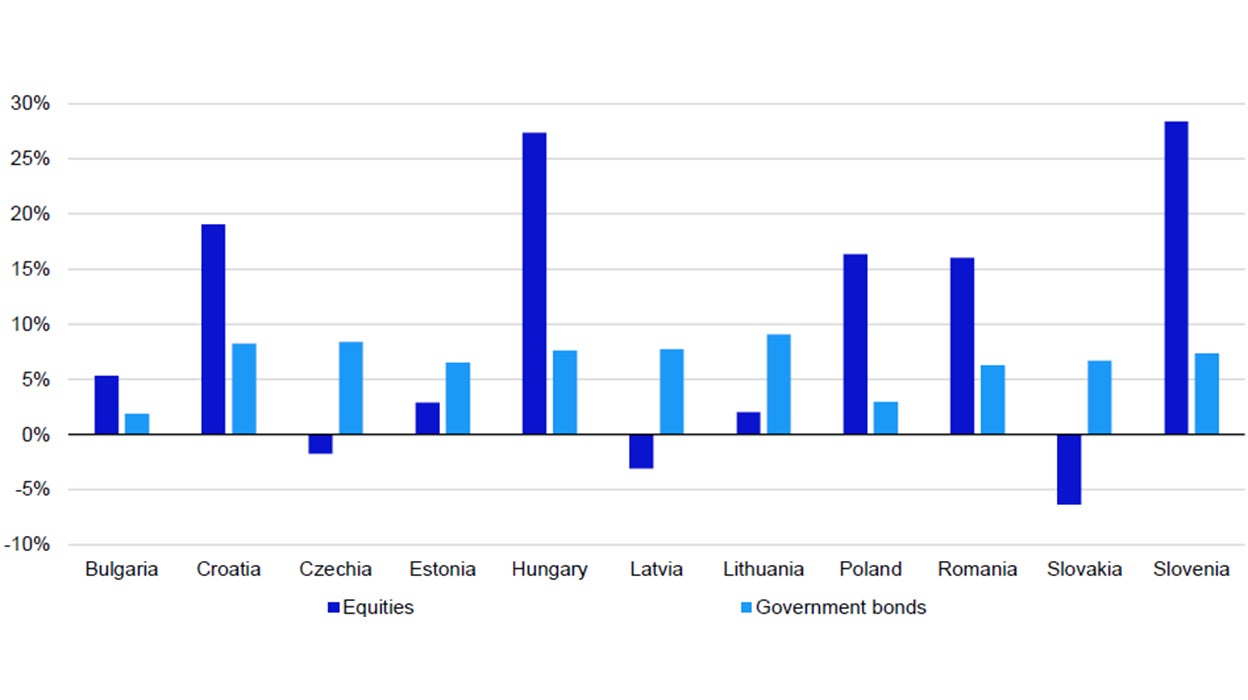

We highlighted Hungary and Slovenia as our most preferred equity markets within the region, while we thought Romania and Lithuania were likely to underperform. As shown in Figure 1, Hungary and Slovenia were indeed the best performers between 31 October 2023 and 26 March 2024. In fact, they outperformed not only broader EM, but also global equities (in both local currency and USD terms). On the other hand, Romania had solid double-digit returns in the same period. Lithuanian equities were among the weaker performers, but the worst returns were posted by Latvia and Slovakia.

However, government bond returns did not shape up in the way we envisaged. We had Czechia and Slovakia on our most preferred list, and while Czechia was the second best performer in the four months to the end of February, Slovakia underperformed. Our least preferred list included the fourth and fifth best performing markets: Hungary and Latvia respectively. Strong returns in Hungarian government bonds were mostly driven by aggressive monetary easing and partially by the release of a €10bn tranche of previously frozen cohesion funds, in our view (although plans by the European Parliament to sue the Commission over this may dampen sentiment in the near term).

The diverging path of monetary policy within the region may have driven these mixed returns, which may also reflect trends within global financial markets during the last four months: a broader rally at the end of 2023 gave way to a narrower and more reluctant rise in risk assets as inflation proved stickier than expected, especially in the US, driving interest rate expectations higher, while European economies slowed.

Perhaps in keeping with slower growth, inflation continued to decline in the region and most countries within our universe have central bank targets within sight. Indeed, three countries reported inflation rates at or below 2% in February (Czechia, Latvia and Lithuania), while only three countries had inflation above 4% (Croatia, Estonia and Romania).

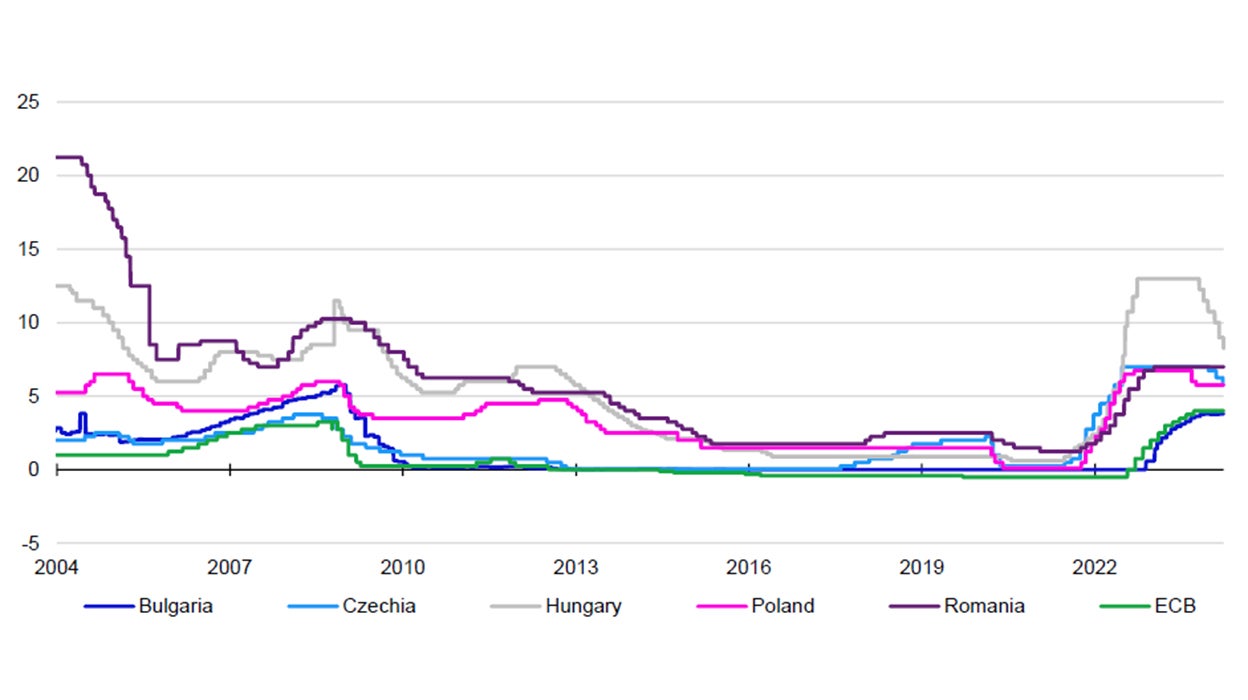

Nevertheless, central bank target rates stayed at the same level as at the end of October 2023 in Bulgaria (following the European Central Bank closely as a member of the Exchange Rate Mechanism), Poland, Romania, and most importantly for the European Central Bank (ECB). On the other hand, the Czech National Bank carried out its first rate cut of 25 basis points (bps) in this easing cycle in December 2023, followed by another 50bps each in February and March 2024. The Hungarian National Bank went the furthest reducing its target rate by a cumulative 475bps between October 2023 and March 2024 (even though inflation in Hungary remains above its target).

As we wrote in November, we think the political landscape will probably remain relatively stable in 2024. Although there will be parliamentary and presidential elections this year in both Croatia and Lithuania, we see limited potential for an upset, especially in terms of economic policy (both are members of the euro area). Although, a lot can change between now and the autumn when voting commences in the Lithuanian and Romanian general elections, we expect no significant influence on financial market returns in the next 12 months. We also maintain our view that the least impactful elections will be those for the European Parliament in May.

We think the global macroeconomic backdrop will be supportive of regional assets in general. In our latest The Big Picture,. we reiterated the view that inflation is likely to continue falling in most regions and countries, while prospects for growth may gradually improve as the year progresses. Even though we shifted to a more defensive stance (given recent strong returns), we maintained our preference for Emerging Markets as a whole. In CEE11 countries, we think growth will rebound after weakness in 2023 as real wage growth remains strong, while interest rates continue to decline. In our view, fiscal policy is likely to be neutral, although spending may be constrained somewhat by higher debt servicing costs.

Notes: Past performance is no guarantee of future results. Data as of 26 March 2024. We use Datastream Total Market indices for equity returns. Government bond returns for Czechia, Hungary and Poland are based on Datastream 10-year benchmark government bond indices. We create a monthly index of government bond returns for all other countries by calculating the net present value of coupon payments and capital repayment based on redemption yields.

Source: LSEG Datastream and Invesco Global Market Strategy Office

What does this imply for markets? The main question, in our view, is how far and how quickly growth reaccelerates after getting through its current soft patch, assuming the global economy avoids a significantly deeper recession. We still think that we may see some consolidation or weakness in the near term, especially in markets where returns may have run ahead of fundamentals (for example, Hungary, Slovenia, Croatia and Poland), followed potentially by stronger performance in the second half of 2024.

In general, we view both equities and government bonds in these markets as risk assets within a global asset allocation context. This means that until we get more clarity on the outlook for growth (especially for the Euro Area), both asset classes within the CEE11 may underperform EM and Global benchmarks. Nevertheless, we think there is scope for catch-up if the monetary easing cycle starts in earnest for developed markets reducing their relative attractiveness.

Notes: Past performance is no guarantee of future results. Data as of 26 March 2024. Using daily data from 1 January 2004. Source: LSEG Datastream and Invesco Global Market Strategy Office

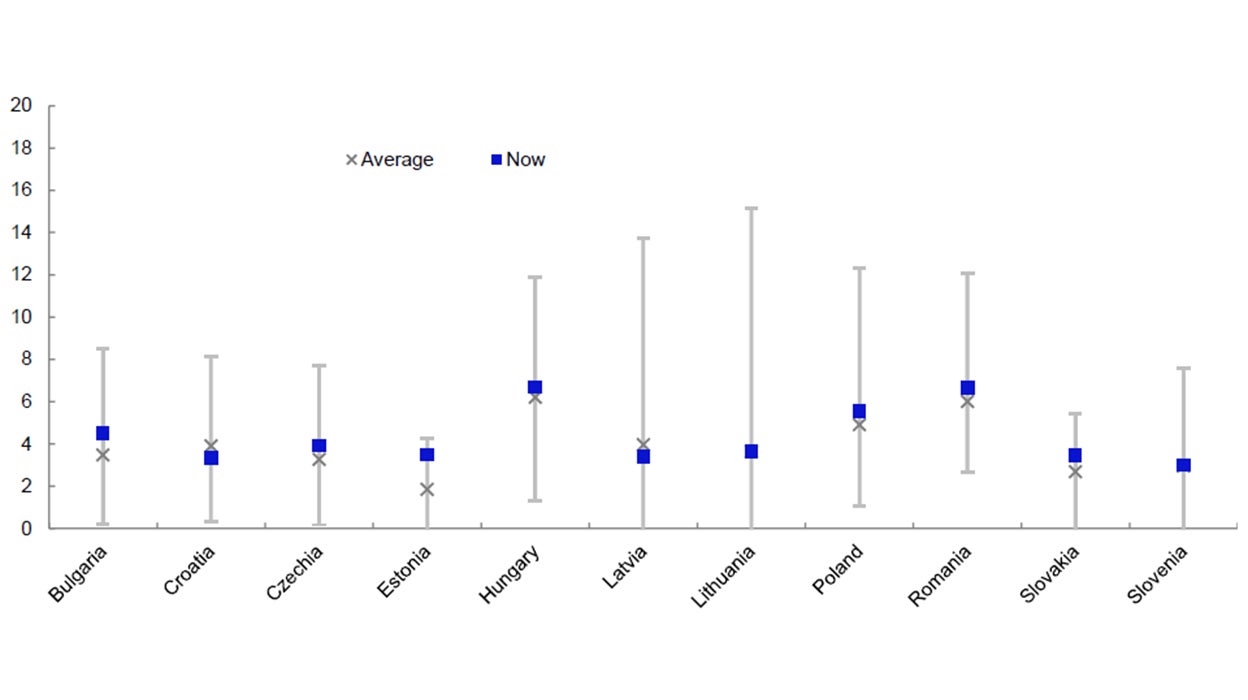

Notes: Past performance is no guarantee of future returns. Data as of 26 March 2024. Historical ranges and averages include daily data from 14 April 2006 for Bulgaria, 30 January 2008 for Croatia, 1 May 2000 for Czechia, 1 February 1999 for Hungary, 15 April 2003 for Lithuania, 1 January 2001 for Poland, 16 August 2007 for Romania, 7 January 2004 for Slovakia and 3 April 2007 for Slovenia. Historical ranges and averages include monthly data from 30 June 2020 to 30 September 2023 for Estonia and from 31 January 2001 to 30 September 2023 for Latvia. We use Refinitiv Government Benchmark 10-year bond indices for Bulgaria, Croatia, Lithuania, Romania, Slovakia and Slovenia. We use Datastream benchmark 10-year government bond indices for Czechia, Hungary and Poland. We use OECD 10-year government bond yields for Estonia and Latvia.

Source: LSEG Datastream and Invesco Global Market Strategy Office