Applied philosophy: Strategist from East of the Elbe – Q3 2024

The dispersion of asset returns in Central and Eastern EU member countries (CEE11) narrowed during Q2 2024, especially in government bonds. The pace of disinflation stalled, and interest rate expectations rose at the same time as global economic growth seemed to have slowed. We expect growth to reaccelerate towards the end of 2024 both within and outside the region, but remain below average, allowing inflation to fall. In our view, this outlook should support both government bonds and equities in our CEE11 universe.

Temperatures are rising in Europe and the region is going through its first major heatwave of the season. Thoughts naturally turn towards summer holidays, and with schools closed until September, a sense of stillness and stasis sets in. Emerging Market (EM) assets outperformed in local currency terms during Q2 (see Figure 6) as major Developed Market (DM) central banks started easing monetary policy and hopes increased that the US Federal Reserve is moving closer to rate cuts.

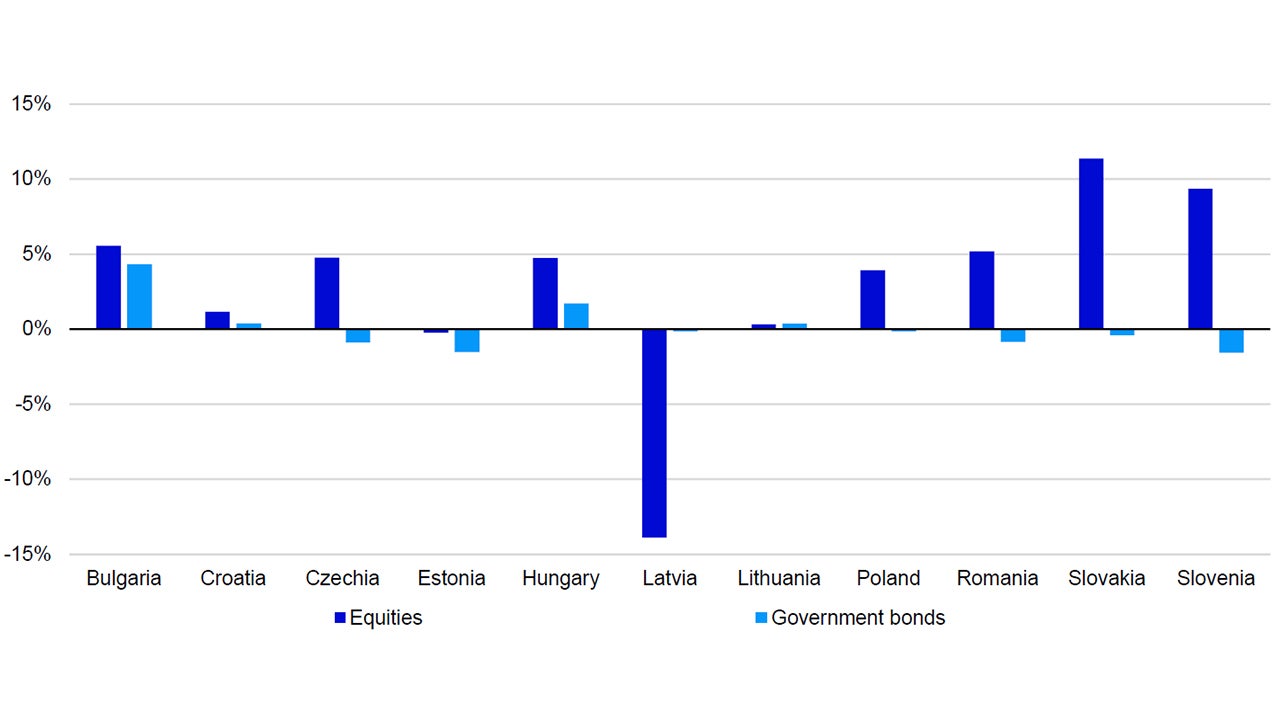

Returns in the CEE11 countries within our universe have been mixed since the end of March 2024. Within equities, we highlighted Slovakia and Slovenia as our most preferred markets in our last edition, while we thought Lithuania and Romania were likely to underperform (see here for the full detail). As shown in Figure 1, Slovakia and Slovenia were among the best performers. At the same, while Lithuania was among the weaker performers, Romanian returns were close to the average within the region.

Government bond returns were mostly negative (apart from Bulgaria, Croatia, Hungary and Lithuania) partly driven by concerns that disinflationary trends have slowed. Although we highlighted Bulgaria as one of our most favoured in our last edition (it was the best performer between 31 March and 30 June 2024), we thought Croatia would underperform (it was the third best performer). On the other hand, Estonian government bonds, our other most favoured, performed worse than we expected, while Latvia had stronger returns. Having said that, returns in most countries were close to zero within a relatively narrow range.

The decline in government bond yields may have paused for now, but we expect them to fall in the next 12 months. After a period of divergence in the last 2-3 quarters, we think that monetary policy is converging and will continue to do so as more DM central banks join their EM counterparts in easing policy. In our view, the global economy is going through a phase of weak growth, in which high interest rates may increasingly seem inappropriate. In CEE11, GDP growth has remained positive, but below average in every country except Croatia, and we expect that to remain the case in the next year.

Notes: Past performance is no guarantee of future results. Data as of 30 June 2024. We use Datastream Total Market indices for equity returns. Government bond returns for Czechia, Hungary and Poland are based on Datastream 10-year benchmark government bond indices. We create a monthly index of government bond returns for all other countries by calculating the net present value of coupon payments and capital repayment based on redemption yields.

Source: LSEG Datastream and Invesco Global Market Strategy Office

However, inflation has stayed higher than central bank targets apart from Hungary (if only by a whisker), Latvia, Lithuania and Poland. Even so, based on data for May, inflation is now below 3% in seven countries within CEE11, and there are only two countries where it is above 4%: Croatia and Romania. In our view, barring a major commodity supply shock, sluggish economic growth could limit any significant uptick even as supportive base effects fade.

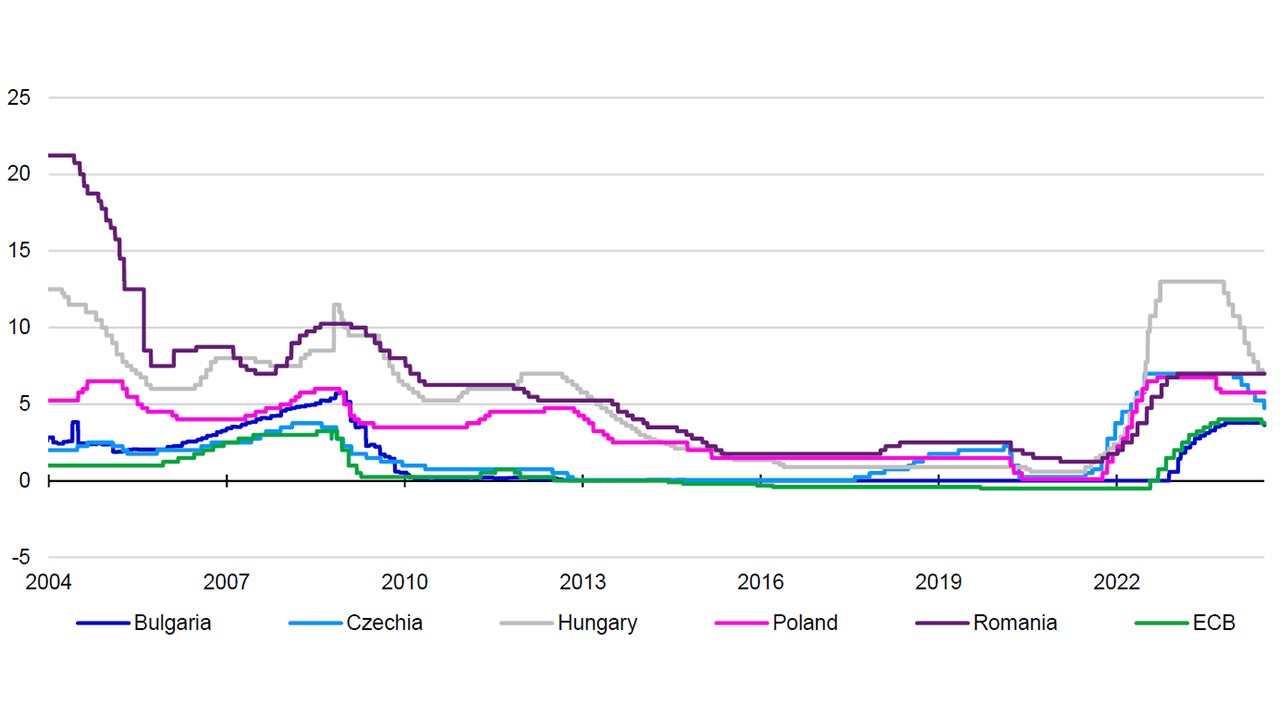

At the same time, the spread between central bank target rates has continued to narrow (see Figure 2). However, we think that the pace of rate cuts may slow in the region, especially if major DM central banks ease policy gradually. Countries outside the Euro Area must be mindful of further currency weakness potentially counteracting disinflationary forces if they continue cutting rates at their current pace. Poland and Romania have maintained their target rates so far this year, while the Czech and Hungarian central banks indicated a slower pace of rate cuts in the second half of 2024.

The political landscape, on the other hand, is likely to be stable in the next 12 months. The Lithuanian presidential elections brought no change with the incumbent, Gitanas Nausėda, winning by a large margin. European Parliament elections produced no significant upsets in the region, although the relative underperformance of Fidesz in Hungary was notable. Although a lot can change between now and the autumn when voting commences in the Lithuanian and Romanian general elections, we expect no significant influence on financial market returns in the next 12 months. While the Polish presidential election of May 2025 could be impactful, especially as the current president, Andrzej Duda, is ineligible for re-election, it is still too far ahead to appear on the markets’ radar.

Notes: Past performance is no guarantee of future results. Data as of 30 June 2024. Using daily data from 1 January 2004. Source: LSEG Datastream and Invesco Global Market Strategy Office

We think the global macroeconomic backdrop will be supportive of regional assets in general. In our latest The Big Picture, we reiterated the view that inflation is likely to continue falling in most countries, while prospects for growth may improve towards the end of the year. Even though we shifted to a more defensive stance (given recent strong returns in risk assets), we maintained our preference for Emerging Markets as a whole.

In CEE11 countries, we think growth will stay higher than in DM as real wage growth remains strong, while interest rates continue to decline. In our view, fiscal policy is likely to be neutral, although spending may be constrained somewhat by higher debt servicing costs.

What does this imply for markets? The main question, in our view, is how far and how quickly growth reaccelerates after getting through its current soft patch, assuming the global economy avoids a significantly deeper recession. We think that markets may start anticipating stronger growth perhaps as early as Q3 2024 potentially boosting risk assets, although we may continue to see some weakness in the near term.

In general, we view this as a favourable environment for both equities and government bonds within CEE11 (we consider them risk assets within a global asset allocation context). Although this means that until we get more clarity on the outlook for growth (especially for the Euro Area) they may underperform EM and Global benchmarks. However, we think there is scope for catch-up if the DM monetary easing cycle starts in earnest reducing their attractiveness relative to CEE11.

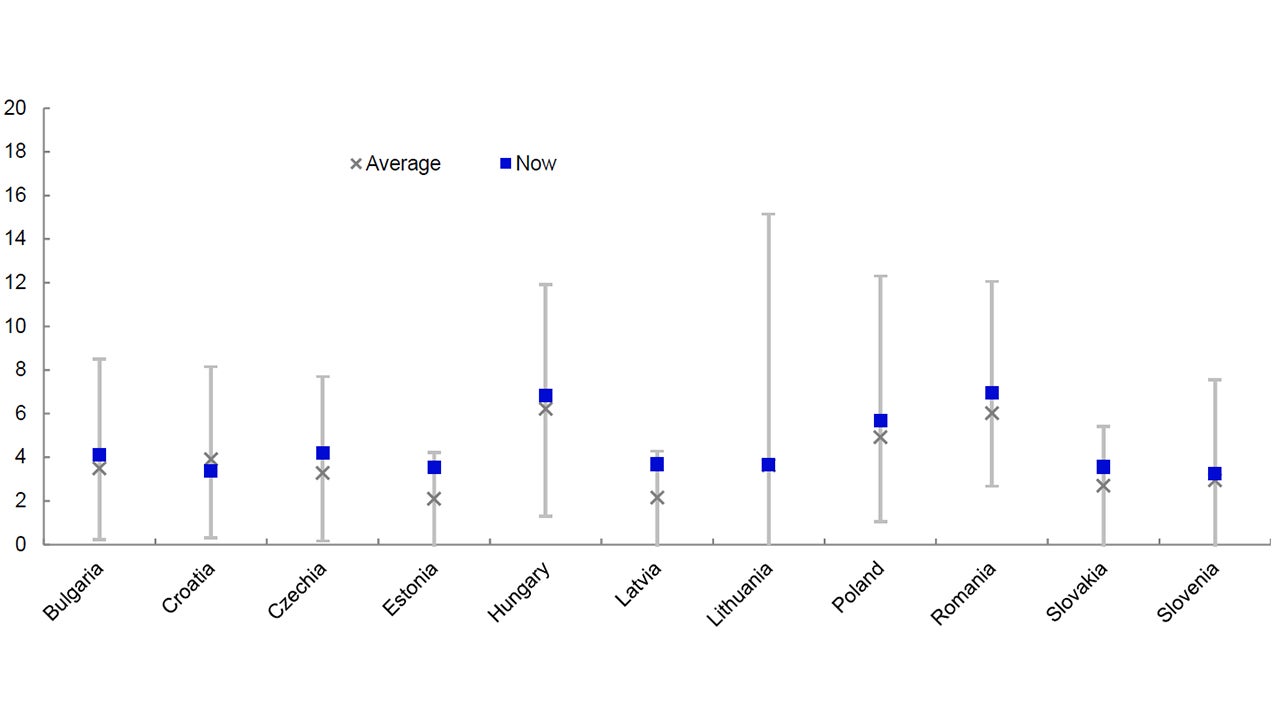

Notes: Past performance is no guarantee of future returns. Data as of 30 June 2024. Historical ranges and averages include daily data from 14 April 2006 for Bulgaria, 30 January 2008 for Croatia, 1 May 2000 for Czechia, 1 February 1999 for Hungary, 15 April 2003 for Lithuania, 1 January 2001 for Poland, 16 August 2007 for Romania, 7 January 2004 for Slovakia, 3 April 2007 for Slovenia and 24 November 2020 for Estonia and Latvia. We use Refinitiv Government Benchmark 10-year bond indices for Bulgaria, Croatia, Lithuania, Romania, Slovakia and Slovenia. We use Datastream benchmark 10-year government bond indices for Czechia, Hungary and Poland. We use S&P Sovereign Bond Index yields for Estonia and Latvia.

Source: LSEG Datastream and Invesco Global Market Strategy Office

For those markets outside the Euro Area, currencies may also play a major part in determining returns, especially within equities, where weakness may contribute to higher profits (up to a point). However, any potential strengthening of regional currencies could be dependent on how far they cut rates compared to the ECB and the Fed.

After a brief period of strengthening for the Hungarian Forint as rate expectations were recalibrated, the currency returned to its weakening trend. Meanwhile, the Czech Koruna strengthened until a surprise 50bps rate cut by the Czech National Bank on 27 June 2024, whereas the Polish zloty and the Romanian leu have remained in a tight range. We think that was partly driven by the expectation of ECB easing turning into reality. The road ahead may be more challenging, however, as DM central banks look to be in no hurry to cut rates. Rate futures and Reuters consensus forecasts indicate 25bps of cuts for Poland, 75bps for Hungary and Romania and 125bps of cuts for Czechia compared to 50bps for the ECB and the Fed until the end of 2024 (as of 30 June 2024). Thus, we expect some weakening of regional currencies, especially the HUF, the RON and the CZK, though the PLN could strengthen slightly.

We believe the biggest risks to regional returns are an escalation of geopolitical conflicts pushing up commodity prices (they may boost regional inflation more than in developed markets) and a deep economic slowdown (perhaps triggered by adverse events). For the moment, we see these as tail risks and we are positive on CEE11 government bonds, given the expectation of further monetary easing.

In absolute terms, the 10-year yields of Hungary and Romania at 6.8% and 7% respectively are the highest, which is not surprising given that they also have the highest central bank rates within the region (as of 30 June 2024 – see Figure 3). This is still lower than the 7.8% yield on the broader EM universe (based on the Bloomberg Aggregate Sovereign Bond Index in USD as of 30 June 2024) perhaps due to their structurally lower inflation and interest rate expectations.

In Hungary’s case, we think recent strong returns have partially priced in future rate cuts, which have seemed to be too optimistic themselves as inflation has remained high supported by strong wage growth and currency weakness, while the uncertainty of access to EU funds hangs over the country’s budget like the sword of Damocles. In Romania, elections this year may imply more cautious investor sentiment, especially as its valuations provide mixed signals, in our view.

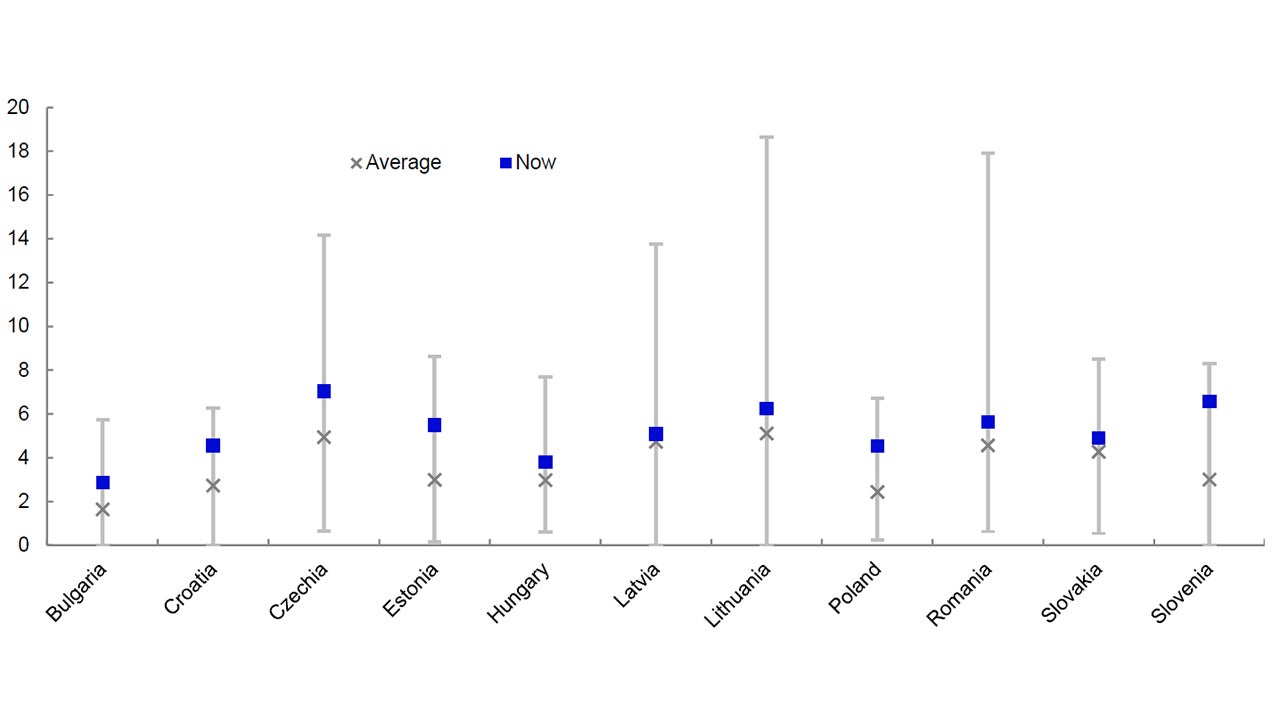

Notes: Past performance is no guarantee of future returns. Data as of 30 June 2024. Based on daily data using Datastream Total Market indices. Historical ranges and averages include daily data from 2 October 2000 for Bulgaria, 3 October 2005 for Croatia, 27 January 1994 for Czechia, 5 June 1997 for Estonia, 21 June 1991 for Hungary, 3 November 1997 for Latvia, 1 April 1998 for Lithuania, 1 March 1994 for Poland, 29 December 1997 for Romania, 1 March 2006 for Slovakia and 31 December 1998 for Slovenia.

Source: LSEG Datastream and Invesco Global Market Strategy Office

Thus, we think there may be better opportunities elsewhere, especially within the euro area, assuming further monetary easing by the ECB. The “Visegrád Four” (V4) countries (Czechia, Hungary, Poland and Slovakia) and Estonia and Latvia have yields and spreads versus German bunds above historical averages. Within that group, Czechia and Poland seem to have the most potential for outperformance with spreads 77bps and 61bps and yields over 80bps above historical averages. At the same time, Croatian and Lithuanian bonds seem to have the least attractive valuations with yields and spreads versus Bunds below or close to historical averages.

We also expect healthy equity returns in the region based on our assumption of a global economic recovery towards the end of 2024. Although there may be a few bumps on the road in the near term and around the US Presidential Election in the autumn, valuations look favourable in most markets within the CEE11. Apart from Bulgaria, they also offer higher yields in absolute terms than the 3.2% of the broader EM universe (using Datastream Total Market indices as of 30 June 2024). In our view, Slovenia continues to be in the sweet spot of having a dividend yield well-above historical norms and relative to its peers in the region (see Figure 4) despite almost 30% returns year-to-date. Polish dividend yields are also significantly higher than historical averages and the market has lower levels of concentration than other markets, while it provides exposure to cyclical sectors, which may outperform if economic growth picks up. At the same time, we still view Czechia as an attractive hedge against potential market volatility in the near term with its dominance by the country’s largest utility company.

On the other hand, after its strong performance year-to-date, the dividend yield on Slovakian equities fell close to long-term averages, while the yield premium compared to historical norms is now the second lowest within the region for Hungary, thus we view these markets as having the least potential for outperformance.

Figure 5 – Our most favoured and least favoured markets in Central and Eastern Europe

| Government bonds | Equities | |

| Most favoured | Czechia, Poland | Slovenia, Poland |

| Least favoured | Croatia, Lithuania | Hungary, Slovakia |