Applied philosophy - The strange case of US factor returns

Equity factor returns in the United States have seemed unusual since the market trough in October 2022. Although definitions of normal can be subjective, we struggle to find historical precedents for this pattern in our analysis of factor returns during market cycles. Are US equities telling us that we are in a late-cycle environment? Or is this a “red herring” and we are in the early stages of a new market expansion?

Does the current US equity market environment feel normal? The answer to that question may depend on personal experiences. Perceptions of normal can be strongly influenced by the market environment that prevailed during the early stages of our careers, for example. All others then would be measured against that. We find some consistency in how stockmarkets ebb and flow, but each cycle is different which makes forecasting interesting (some say impossible). The formative years of my career coincided with the peaking of US equities ahead of the Global Financial Crisis and the subsequent bear market.

Thus, a market downturn when banks outperform during rapid interest rate increases amid high inflation and positive economic growth (as in 2022) feels odd. Things returned to what I would consider normal after the market trough in October when sectors, such as technology and consumer discretionary started outperforming and financials ran into stormier seas.

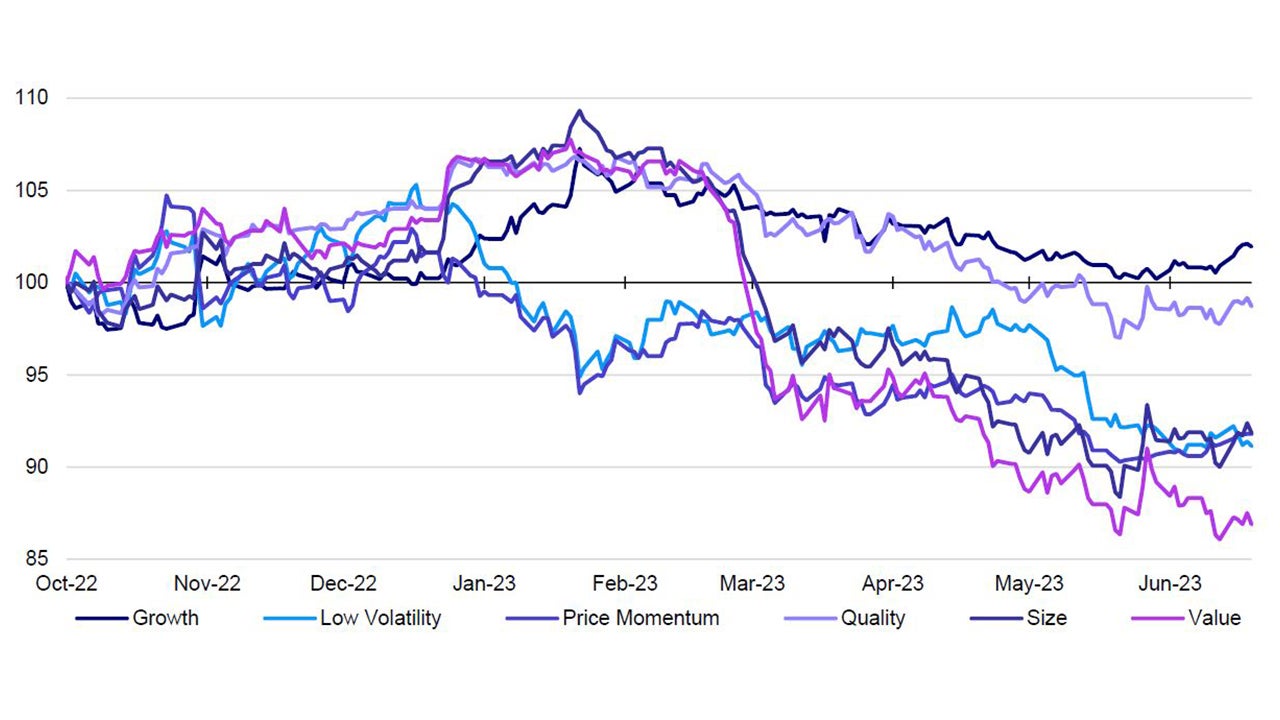

What may seem normal to me, however, looks strange compared to similar periods in the past, especially based on our assumptions of factor returns (Figure 11). First of all, the rally in the S&P 500 has been driven by a small number of large caps, which is unusual in early-cycle periods, when size (i.e. small caps) has tended to outperform. Apart from growth, all our factor indices, which are equal-weighted and therefore underweight large caps, underperformed the S&P 500 since the October low (Figure 1). The fact that quality was the second-best performer in the same period and value the worst may suggest a rather defensive mindset among investors, except that low volatility was the second-worst performer at the same time. A rather confusing picture at first glance, but maybe not so much considering investor expectations regarding the direction of monetary policy (although returns were closer to our expectations until the mini-banking crisis in the spring).

Second, we cannot be certain that the market downturn that started in early-2022 has finished. We suspect that a new market expansion started on 12 October 2022, but the uncertainty around inflation, economic growth and monetary policy makes us cautious. Nevertheless, factor total returns measured from the 3 January 2022 peak seem to be a closer reflection of what would be

“normal” in a bear market: low volatility and quality the best performers, while growth and value the worst performers. The only slight issue with it is that the S&P 500 is only 7% below its all-time high, which does not meet the traditional 20% bear market threshold.

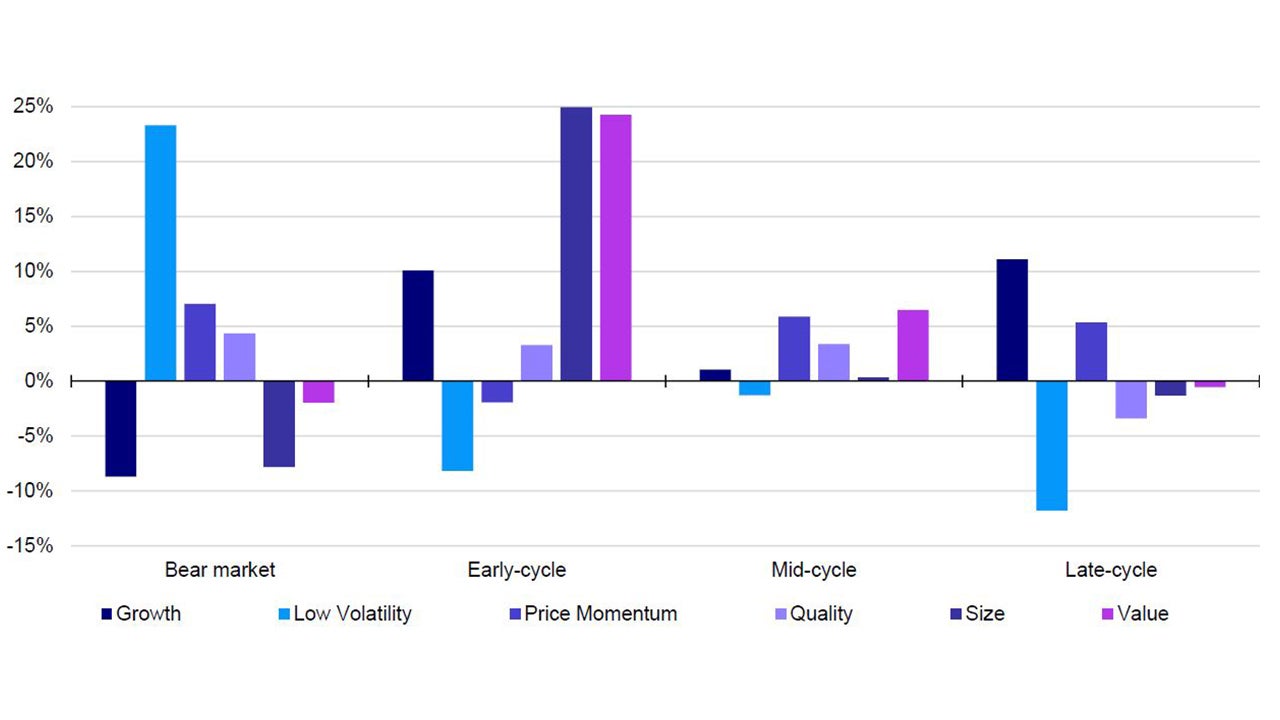

So, if we know which part of the market cycle we are in, we would be able to predict how factors would perform in the next 12 months. We can test this assumption by mapping our US factor indices to the market cycles we previously identified in Sectors through market cycles. Adjusting our previous analysis for the S&P 500 index, we identified four downturns and four expansions since October 1989 (the start of our factor index series) assuming that the trough in October 2022 marked the beginning of a new bull market (see Figures 8 and 9).

Notes: Past performance is no guarantee of future results. Data as of 30 June 2023. All indices use daily data from 12 October 2022 rebased to 100 on 12 October 2022. See Figure 5a for factor index definitions. Source: Refinitiv Datastream and Invesco

Unsurprisingly, the best performing and most consistent factor during major bear markets connected to economic downturns has been low volatility, followed by price momentum and quality (using annualised total returns relative to the S&P 500 – see Figure 2). They outperformed on average across the four market downturns in our sample, while value, size (small caps) and growth underperformed. The three underperformers were also the least consistent; they outperformed in two bear markets each and underperformed in the other two.

The best period for size and value has been the early-cycle phase (based on annualised total returns relative to the S&P 500). If we really are in the first 8 months of a market expansion it is really odd to see them underperforming. By contrast, the outperformance of growth and the underperformance of low volatility and price momentum would make sense.

The other thing that has confounded us (alongside most investors) has been the strong showing by large caps. That would be more characteristic of the mid-cycle period, when size outperformance tends to fade. This is also when price momentum usually starts to shine, although on average, value has remained the best performer. The rest of the factor indices tended to perform either just below or just above the S&P 500 on average except the odd double-digit relative return during the 2002-07 expansion.

Growth is the undisputed best performer and the only factor that has consistently outperformed during the late-cycle phase (this is true even in the final stage of the 2002-07 market expansion). The second most consistent outperformer has been quality (despite its underperformance in the final phase of the 1990-2000 expansion pulling its average relative return negative), perhaps foreshadowing concerns over the ending of the market cycle. All other factors have mostly underperformed in the final stages, although total returns of size and value were strong during the final stage of the 2009-22 cycle.

No wonder I feel a little lost if none of these describe factor returns since mid-October. The period most closely resembling the current one is the late-cycle phase of the 2002-07 expansion, but even that may be a stretch. Certainly, slowing economic growth, rising inflation and monetary policy tightening may point to that. This is possible, though I think that would imply a new cyclical peak in equities and a subsequent bear market followed by a recession. The underperformance of price momentum, however, suggests to me a turning point in the market cycle. Although COVID-19 has confused matters, I think it is most likely that the current period is the start of a new equity cycle (see Decomposing market cycles). Factor returns are notoriously hard to predict (see here), but, unless economic indicators deteriorate significantly, I think size and value will eventually outperform alongside growth.

Notes: Past performance is no guarantee of future returns. Data as of 30 June 2023. Using average annualised total returns of factor indices relative to the S&P 500 based on daily data from 16 July 1990 to 30 June 2023. See Figure 5a for factor index definitions and Figure 9 for dates of market cycles. Source: Refinitiv Datastream and Invesco