Bitcoin – where do we go from here?

Bitcoin’s rally has plateaued in recent days. Many investors are wondering how much further prices may have to run. Real bitcoin prices (adjusted for US CPI readings) may be a helpful starting point. Recent peaks in prices, last registered in early- and late-2021, saw real bitcoin prices as high as $75,0001. By this metric, we’re not far from the top. But new factors—particularly sustained bitcoin ETF-driven buying and the upcoming “halving” in mid-April—may push prices beyond $75,000.

A halving event occurs every four years and reduces the rate of which new coins can be mined, thus lowering the amount of new supply2. Bitcoin has historically fared well after halving events - the last time a halving event occurred was in May 2020 – a year later, Bitcoin more than trebled3. Since the next halving is just around month away4, this could mean that the rally may have room to extend further.

Sources: Bloomberg and Invesco, daily data as at 16 March 2024. Past performance does not guarantee future results.

As a note to remember, there is only a finite number of Bitcoin supply, 21 million to be exact. Currently, there is already 19.6mn bitcoins that have been mined5. In a world that central banks have printed plethora amounts of fiat currency since 2020, Bitcoin’s limited supply could be a reason why investors view this cryptocurrency has a good store of wealth.

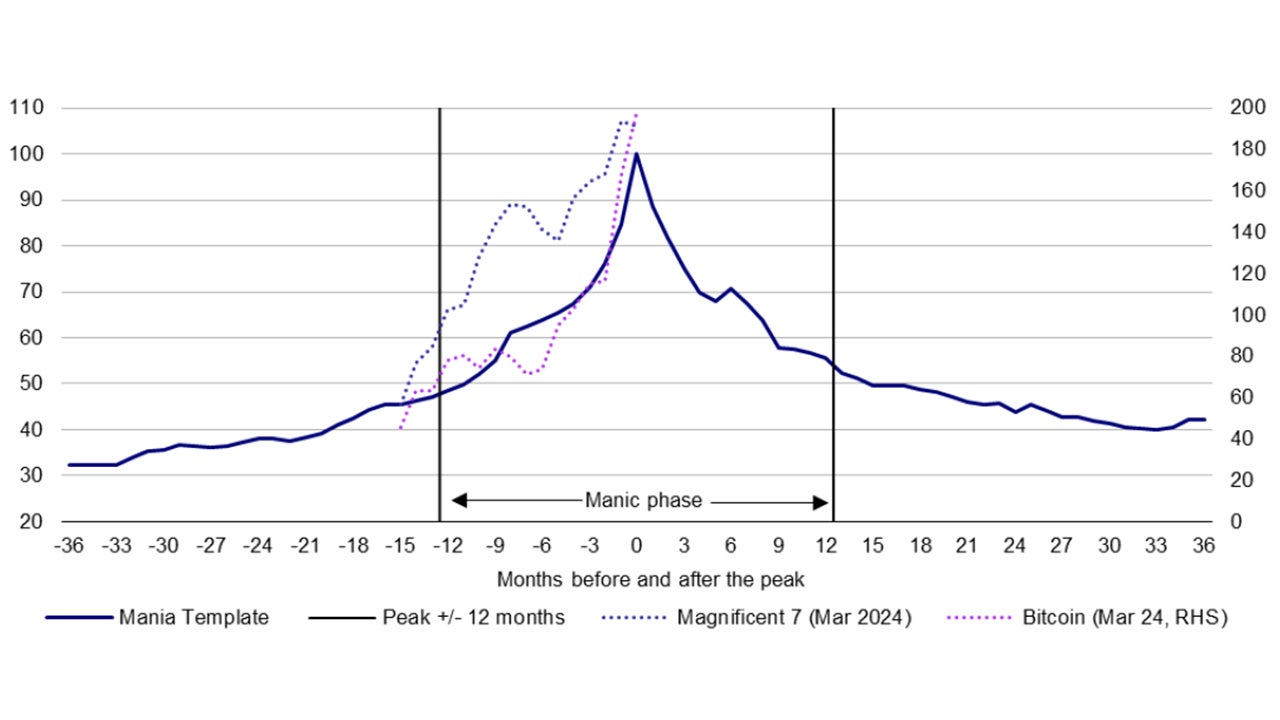

Still, there’s no doubt that Bitcoin has approached elevated levels. Questions abound on whether Bitcoin and other assets such as the Magnificent 7 stocks in the US have reached “bubble” territory. How does the recent rise in bitcoin price compared to other “mania” assets? In the graphic below, we use the Mania Template, which is based on monthly data during 15 historical manias. For each mania, the relevant asset price is indexed to 100 at the peak (month zero) and is shown over the three years before and after that point. The template shows the average of the 15 manias at each point in time (appendix).

Note: Past performance is no guide to future returns. Based on monthly data. “Magnificent 7” is based on the Bloomberg Magnificent 7 total return index (see appendices for definition). “Magnificent 7” and “Bitcoin” are constructed assuming peak levels were achieved in March 2024 (as of 11 March 2024). See appendices for methodology of and sources for “Mania Template”. Source: Bloomberg, Global Financial Data, LSEG Datastream and Invesco Global Market Strategy Office.

There is always a kernel of truth behind manias, but the compelling logic gets pushed to an extreme with prices following an exponential path. The analysis for Bitcoin starts in December 2022 (the bottom of it’s previous cycle).Bitcoin seems to have moved rapidly into bubble-type behavior in the resulting months.

This doesn’t mean that Bitcoin has peaked but recent price behavior is suggestive of the irrationality that comes at the end of a mania.

With contributions from Ashley Oerth and Paul Jackson

Investment risks:

There are specific risks involved with investing in cryptocurrencies exchange-traded funds/products. Investing in cryptocurrencies is high risk. Cryptocurrencies do not have any intrinsic value and may become worthless. Cryptocurrencies are subject to extreme price volatility and the price of cryptocurrency can be affected by factors such as global or regional political conditions and regulatory or judicial events.