China’s economic growth shows momentum, albeit uneven

The most recent monthly economic data from China surprised on the upside and show that the economy could be on surer footing.

Many indicators show that growth has stabilized after a disappointing second quarter and that the economy is set to improve over the coming month as stimulus measures take hold.

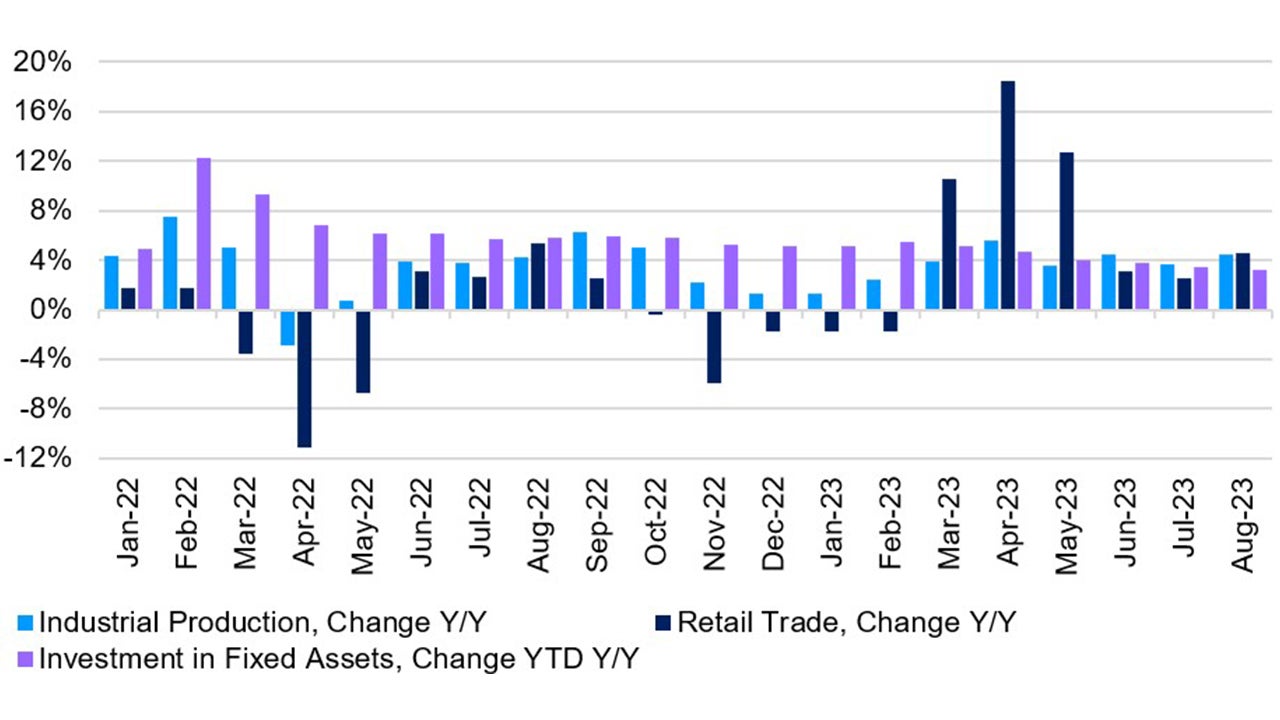

Sources: China National Bureau of Statistics (NBS), monthly data until August 2023. Data as at 18 September 2023.

Manufacturing and exports showed surprising resilience

Data for August reveal that manufacturing and exports showed surprising resilience, as industrial production grew +4.5% y/y (from 3.7% in the prior month).1

The sequential pickup largely came from strong domestic goods demand and an improvement in export sales, the latter of which stabilized after seeing a year of declines.

Even though exports are likely to continue facing stiff headwinds for the remainder of the year, the recent data suggests that we could be currently bumping along the bottom.

On the investment side, both manufacturing and infrastructure investment accelerated on a sequential basis, driven by strong fiscal support. Still, any meaningful investment benefit was whittled away by another drop-off in property investment.

Consumption becomes the bright spot

The bright spot in the month came from the pickup in consumption, which could suggest that household sentiment has started to turn.

Retail sales jumped to +4.6% y/y (vs estimates 3.0% and 2.5% in July). The robust sequential growth came from domestic goods purchases, boosted by auto sales +1.1% y/y (vs -1.5% y/y in July). 1

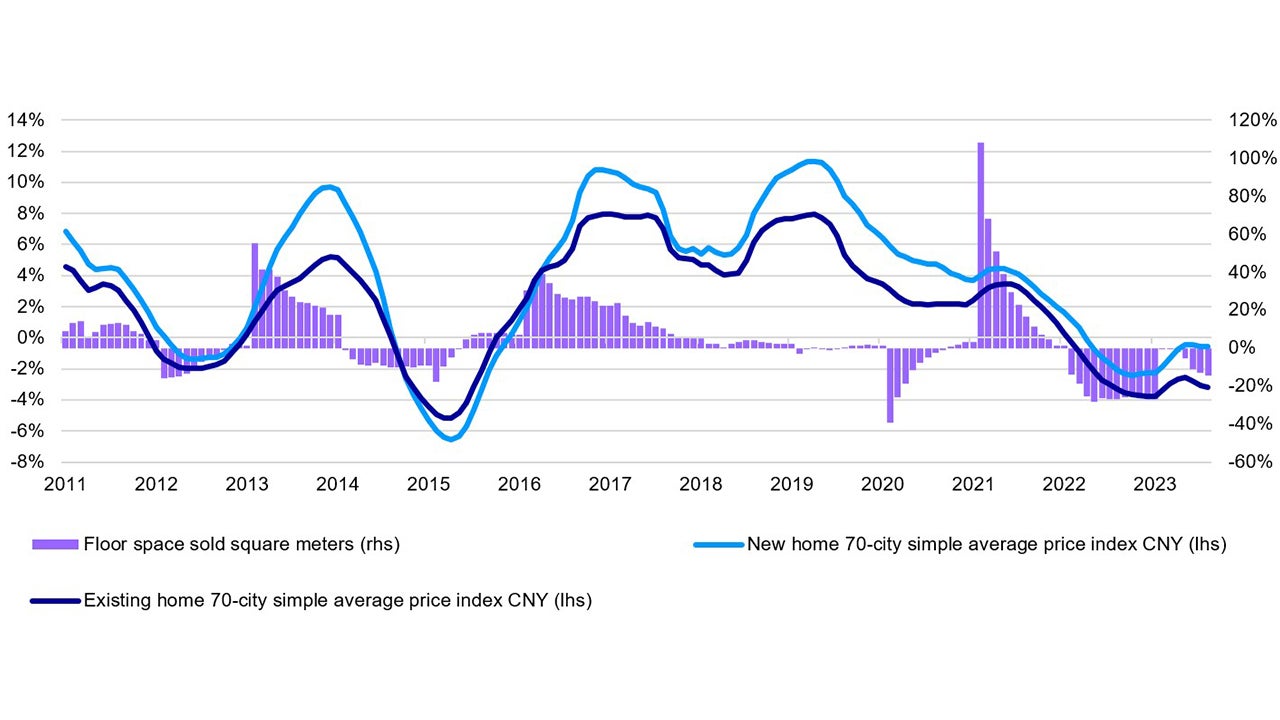

The biggest wild card for China’s economic growth trajectory this year, continues to be its floundering property market.

Stimulus measures have recently been introduced to put a floor to the market, such as a cut to the reserve requirement and deposit rates as well as reductions in the downpayment requirements and mortgage rates; this has resulted in some stability.

The deterioration of housing sales for the past 6 months has been arrested to a certain degree. Sales volumes in August were 57% of the same month in 2019, an improvement from the 54% in July.1

New housing starts have also stabilized and showed some sequential improvement.

Despite the improvement in the property market’s daily sales volumes in 30 cities and new housing starts, pricing has taken a turn for the worse.

Property price declines have accelerated again. This could create the feared negative wealth effect which could dent the nascent consumption rebound seen in the past month.

I believe policymakers are apt to take more aggressive actions to ensure the property market finds a firmer path.

More fiscal support measures are likely to be stepped up to boost infrastructure investment and further monetary easing is likely to support the property market.

Sources: China National Bureau of Statistics (NBS), monthly data until August 2023. Data as at 18 September 2023.

In all, it appears to me that the economy’s main propellers - manufacturing, investment and consumption - are starting to throw off a bit of the previous month’s malaise.

I believe that the worst may already be over and even without a stimulus bazooka, a recovery, albeit an uneven and shallow one, is already well on its way.