China outlook for 2026: Growth hits 5 % as AI investment emerges as a key driver

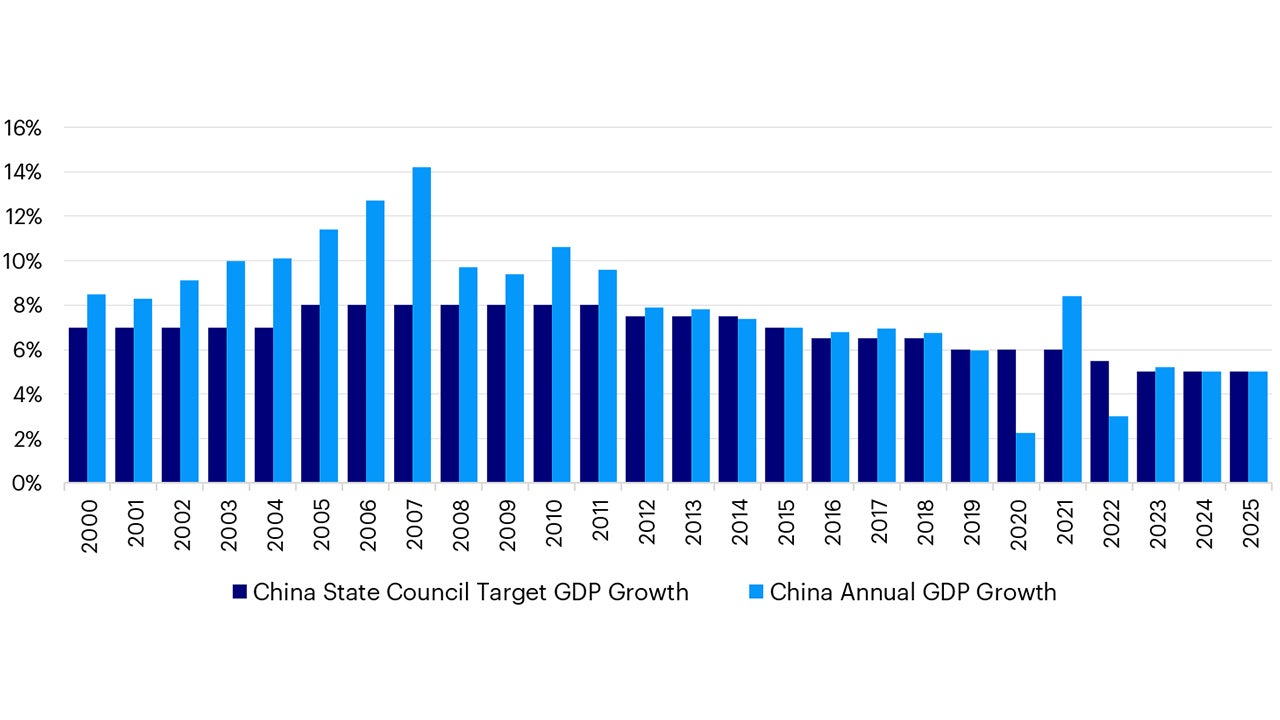

China’s GDP growth for 2025 came in at 5.0% year over year1, in line with the government’s target (chart 1).

Growth was led by resilient manufacturing activity and strong exports, an outcome made more notable by the unprecedented trade frictions over the past year and underscoring policymakers’ preparedness to deploy supportive measures to ensure the growth objective is met.

While Q4 growth moderated to 4.5% year-over-year (y/y) from 4.8% in the prior quarter1, December saw a bit of recovery, with stronger exports, services and industrial production.

For example, exports rebounded strongly in December, rising 6.6% y/y in USD terms1, more than double market consensus expectations.

Retail sales, investments and the property market continue to be in a soft patch. Still, high-frequency data since the start of 2026 indicate growth has held up, though Chinese New Year effects will increasingly distort near-term readings.

Outlook: AI-related investment could be a key driver in 2026

Going forward, I expect export and trade resilience underpinned by competitiveness in selected manufacturing segments and an increasingly diversified export base. I also expect a bit of recovery in private investments.

The goal of stabilizing the property sector and improving domestic demand was highlighted in the December 2025 Central Economic Work Committee.

Thus, it’s likely that we could see more supportive measures to help stabilize the property market and near-term measures to invigorate household consumption, such as a stepped-up trade-in program.

Source: China National Bureau of Statistics (NBS). Annual data as of 2025 as at 19 January 2026.

While exports are less likely to prop up growth in the coming year, I continue to make an out-of-consensus call for Chinese growth to be around 5% y/y in 2026, bolstered by increasing AI-related investment and supportive measures to boost investments and domestic consumption.

Investment implication – A positive outlook for both A‑ and H‑share markets

Chinese equities and the renminbi have posted an impressive start to the year, and I believe further outperformance still lies ahead.

The early‑year strength has been driven primarily by ample liquidity support across both A‑ and H‑share markets.

The People's Bank of China (PBOC) has already begun easing monetary policy, and we expect additional policy rate cuts over the course of the year, reinforcing a supportive backdrop for Chinese risk assets.

Beyond liquidity conditions, several structural factors point to continued relative outperformance. Equity valuations remain reasonable, particularly compared with global peers, while the initial public offering (IPO) pipeline appears robust, helping to underpin market depth and investor interest.

At the same time, foreign investor sentiment remains subdued. That backdrop creates an environment for positive surprises. I see increasing scope for re‑engagement as policy support gains traction and growth visibility improves.

2026 could mark the year in which global investors begin to meaningfully rebuild exposure to Chinese equities and the RMB.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.