China Q3 GDP and September Monthly Economic Data

China’s quarterly GDP and monthly economic data reveal a bumpy path towards an economic rebound.

GDP grew 3.9% y/y, beating consensus expectations of 3.3%, up significantly from the 0.4% recorded in the prior quarter as the economy emerged from restrictions related to the Omicron wave.1 To put it in context, economic output in Q3 is around 1.2% higher than Q1 of this year.1

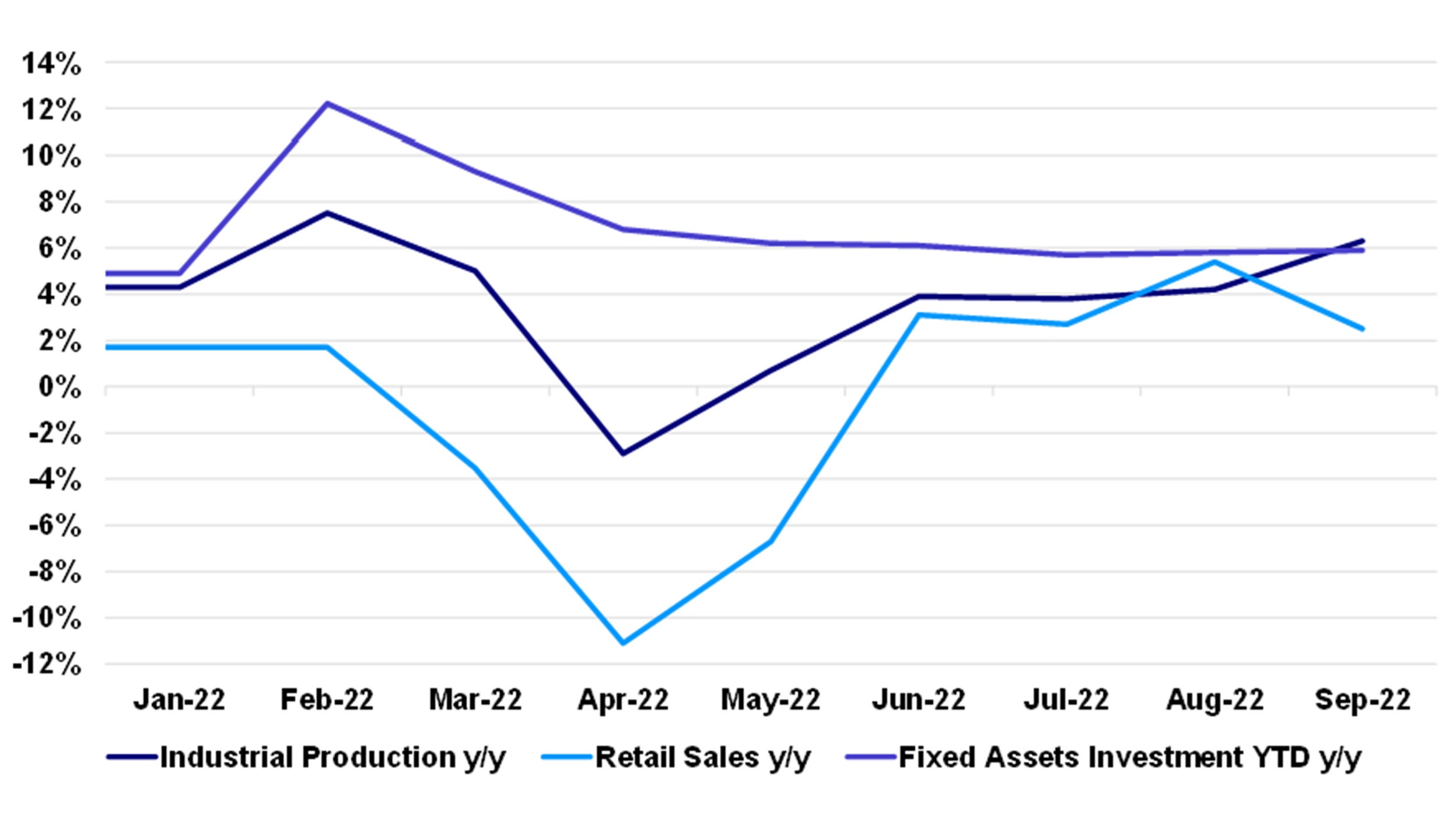

Source: National Bureau of Statistics of China, as of Oct 24, 2022

A surprisingly resilient export environment

The bright spot in the data came from industrial production, which accelerated to 6.3% y/y in September due to a surprisingly resilient export environment. Exports rose 5.7% y/y in USD for the month while imports growth was 0.3% y/y in USD terms – reflecting a continued soft patch in domestic demand.1

I believe it’s possible for manufacturing and exports to do well for the rest of the year though the global economy is facing recession pressures, which could dampen the appetite for Chinese products.

Services industries impacted by virus disruptions

While the industrial side of the economy has been holding up, the services side of the economy continues to be impacted by virus disruptions, with services output falling to 1.3% y/y and retail sales growth declining to 2.5% y/y from 5.4% in the prior month.1

Investments grew 5.9% YTD y/y in September and showed some sequential improvement due to a pickup in manufacturing capex and infrastructure investments. This helped to offset the -8.0% y/y decline in property investments. 1

Outlook

Some of the bumps in the rebound may surface in October, as the number of cities reporting outbreaks has reached levels seen during the peak of the last Omicron wave.

Already, high frequency indicators such as property and car sales show slowing momentum while passenger and freight traffic have contracted in October.

That said, I don’t expect any meaningful changes to the COVID-zero policy for a while though policymakers have instructed local officials to balance virus containment with stabilizing growth, which could mean targeted lockdowns that have less onerous impacts on the economy.

I continue to expect growth to improve sequentially for the final quarter of this year, though virus disruptions could continue to affect household demand and the property market has yet to find a bottom.

The most important domestic political event in 5 years has concluded which means I believe policymakers are able to re-focus on instituting more monetary and fiscal stimulus to stabilize growth.