China’s golden week holiday – an uneven consumption recovery

China's 8-day golden week vacation just concluded. Because this year’s Mid-Autumn festival and national day holidays fell on concurrent days, it made for an exceptionally long holiday and thus, a good barometer of China's reopening progress.

Golden week did not produce all-around golden economic results. While the travel data reveals that household consumption is headed in the right direction especially in the services sectors, property sales disappointed.

The “two speed consumption recovery” means that China’s path towards economic normalization could take longer than originally anticipated though certainly opens the door for more government support, especially to nudge the residential real estate market along.

A deep dive into the travel and consumption data

During the holiday period, expectations ran high that domestic tourism and spending would rebound strongly.

The government initially projected domestic travel volumes during the holiday period to increase +13% over pre-COVID levels in 2019 and that tourism spending would increase +5%.1

While travel and tourism volumes largely missed the government and private sector projections, I believe that expectations were just a bit too optimistic.

Objectively, the travel data wasn’t bad – it shows that the willingness for Chinese household to consume has returned to pre-COVID levels, though any kind of pent-up consumption from the pandemic that could lead to further bursts of activity has most likely been realized already.

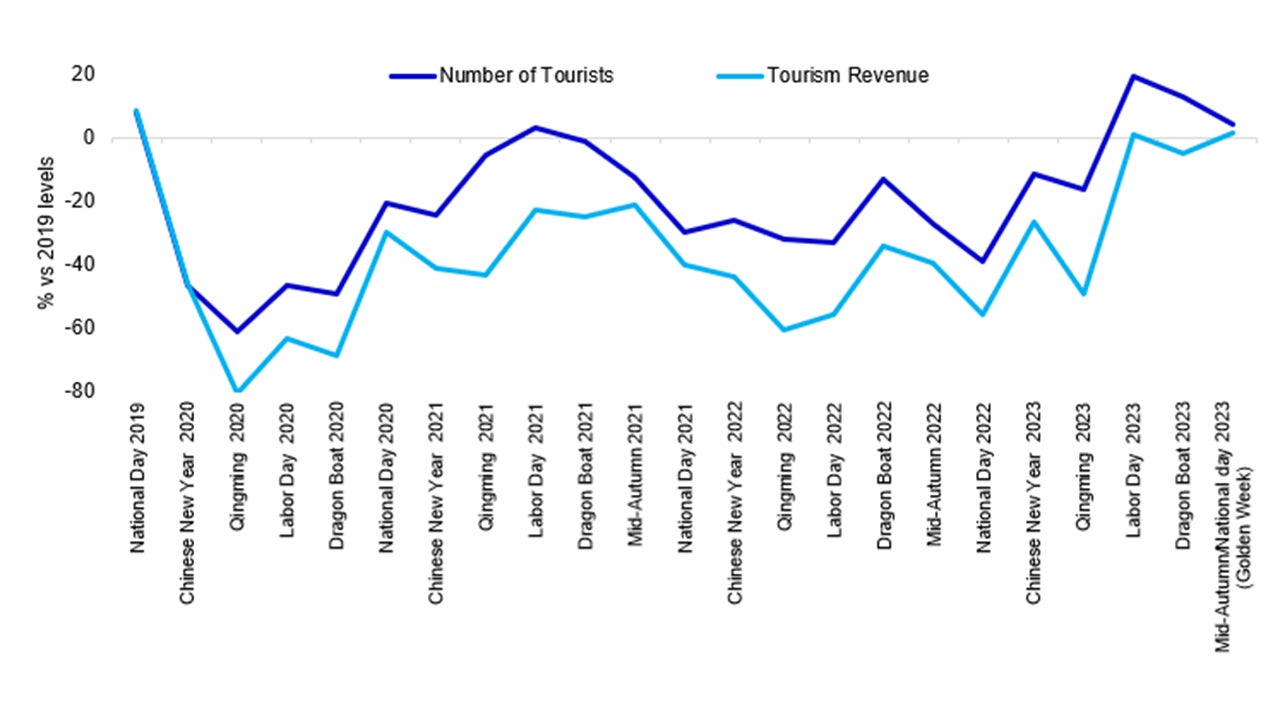

Source: China Ministry of Culture and Tourism and Invesco. Data as of 6 October 2023.

Domestic travel was 4.1% higher from 2019 levels (vs the +13% projection) and travel spending increased by only 1.5% 2 (vs the 5% projection).

One of China’s largest online travel operators also reported that domestic and outbound bookings fell short of projections for the holiday period.3

For example, one online operator initially expected domestic bookings to be 4x the number in 2019 though bookings came in only 2x higher whereas it expected outbound bookings to be 20x higher though it came in only at 8x the 2019 comparable period.4

Movie box-office sales were also disappointing and below 2019 sales.5

There were bright spots though. Per head spending rose significantly to the highest level since the pandemic and outbound travel has strengthened.6 The data suggests that foreign travel is close to 85% of 2019 levels (vs projections of 91%).7

Despite robust per capita consumption spending during the holiday period, this did not transfer to strong housing sales.

Property sales remains subdued

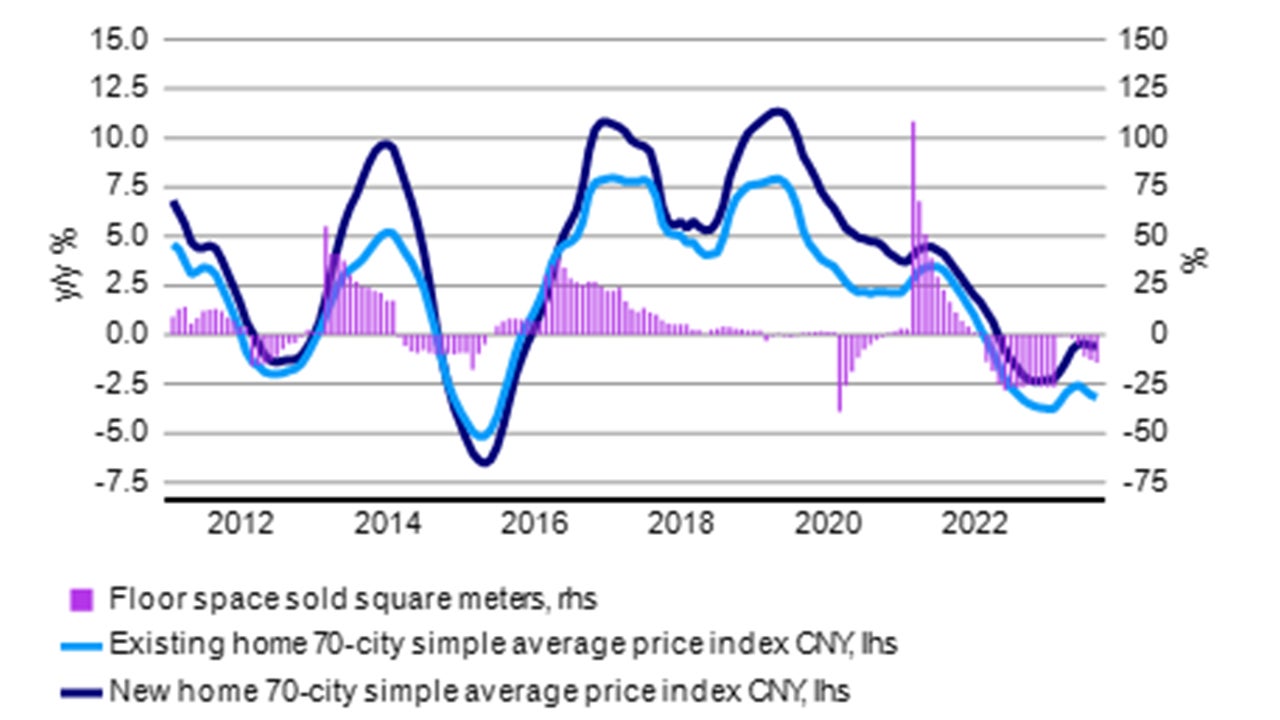

Data from China Real Estate Index System (CREIS) showed that overall transaction volumes in 35 cities during the holiday week fell around -24% compared to the same holiday period last year.8

This data supports the desultory sales trends already in September. For example, according to one Shenzhen real estate information platform, Shenzhen’s primary housing transactions in September fell -53% y/y.9

Over the holiday period, developers launched new projects and offered price discounts – this led to strong new home sales in places such as Shanghai and Guangzhou but sales in other cities remain muted.10

Source: China National Bureau of Statistics (NBS). Data as of Aug 2023.

While the government has already instituted a plethora of measures to boost sentiment towards the residential market, news of possible default by one of the country’s largest developers could affect confidence in the market.

For example, the number of secondary home sellers in Beijing has recently reached a new high11 though prices have remained relatively stable.

Outlook

Going forward, household consumption is likely to remain robust for high-income households, as outbound travel trends continue to pick up.

While for the middle-income households, the consumption spending outlook is very much predicated on the property market outlook and whether secondary home prices can quickly stabilize.

For lower-income households, the outlook is directly tied to their employment and income prospects, which appears to be improving with the drop in the unemployment rate last month.

Further policy support to boost household sentiment and the property market are likely. I believe that Chinese markets could be range-bound until we see stronger sequential growth momentum or more stimulus measures announced by the government.

With contribution from Chris Liu