China’s recent economic data: strong but uneven recovery

Recent travel data from China’s first long holiday since the reopening point to a strong V-shaped services recovery. Still, new home sales, movie box office and goods sales lagged during the period and the recent manufacturing PMI miss suggest an uneven recovery.

These datapoints, coupled with the most recent Politburo meeting, suggest that policymakers are likely to keep monetary conditions loose to support growth and that the focus will shift from monetary and fiscal stimulus to targeted measures that could help boost household and private business sentiment.

The 5-day Labor Day holiday (ending 3rd May) unleashed pent-up domestic travel demand:

- The Ministry of Culture and Tourism reported revenues from domestic tourism grew +128.9% y/y, slightly above the same 2019 holiday1.

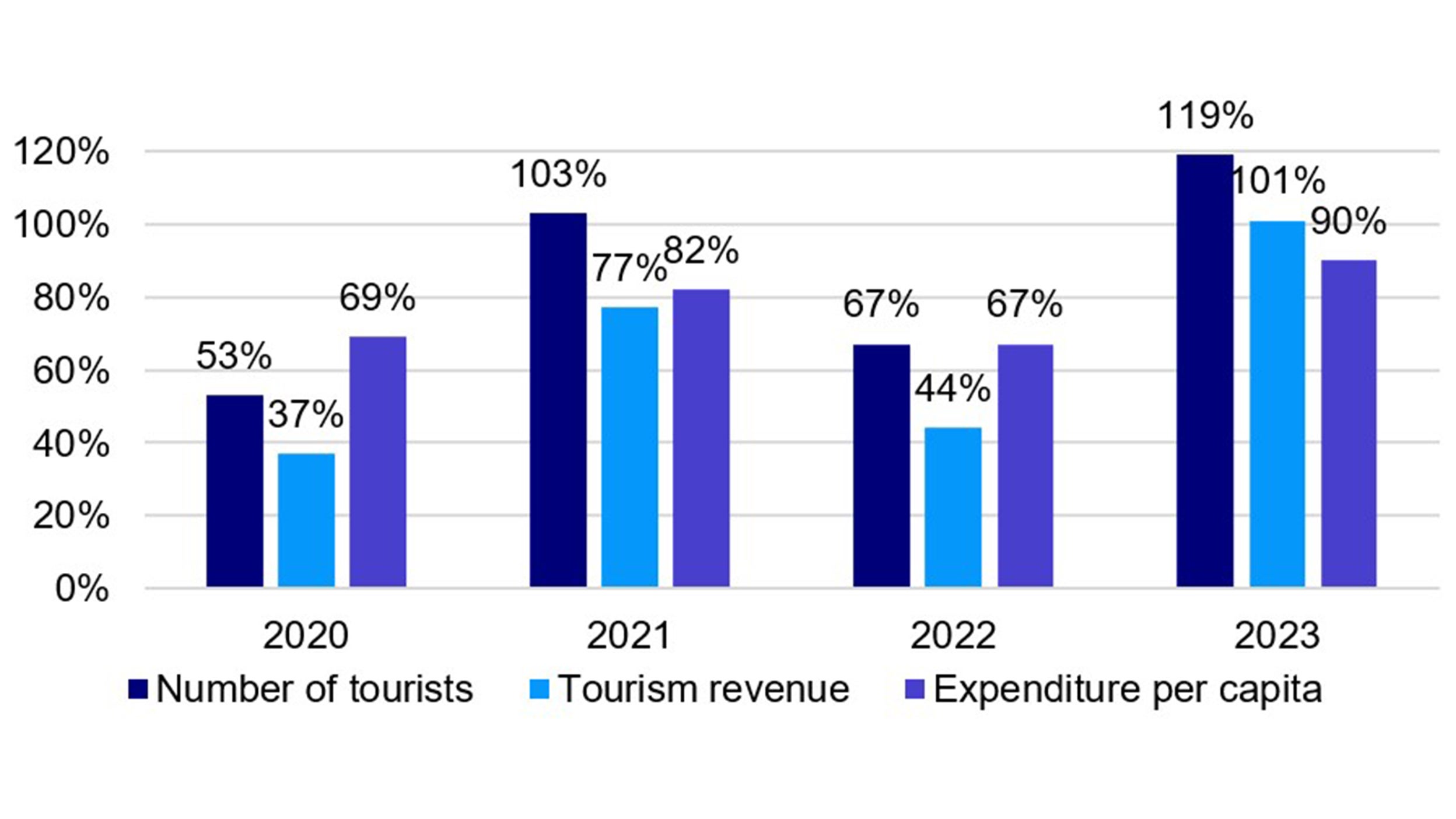

- Around 274mn domestic trips were taken, which is equivalent to 119.1% of 2019 levels and passenger traffic recovered to +104.5% of 2019 levels2. This is the first time that domestic trips and associated revenues have exceeded pre-pandemic levels.

Source: China Ministry of Culture and Tourism, JPM and Invesco. Data as of 5 May 2023.

A consumption-led recovery is on the way

China’s economic growth this year is highly geared to a consumption-led recovery, and the datapoints over the holiday period concretely point to this main propeller of the economy being on track. China’s services sector contributed to 70% of the economy’s growth in Q13 and the official services PMI in April remained above 55.

The April official manufacturing PMI miss of 49.2 vs consensus 51.4 suggests a softening global macro backdrop as exports and the property market slow4. Domestic demand for goods remains sluggish, as seen by the new orders sub-index, which fell to 48.8 from 53.6.

New home sales in April also fell (56% of April 2019 levels) after staging a strong Q1 start of the year (90% of Q1 2019)5.

China A-shares have recently given back some of the gains after a strong start to this year over geopolitical concerns and doubts over how sustainable the reopening story can be.

Looking ahead

Despite some of the mixed property and manufacturing data, I still think that this past week’s holiday spending data shows that the reopening story is on track.

Industrial profits have likely bottomed in Q1, -21% YTD y/y due to falling PPI and could stage an improvement over the course of the year6. This could be the positive sentiment boost that the A-share market is looking for.

I expect both household and A-share market sentiment to improve heading into the summer period. The next consumption-spending boom should come during the summer holiday period which should lead a stronger recovery in the labor market.

The big question is what impact there may be from a softening global macro backdrop and whether there may be any positive sentiment spillovers to the property market, which has recently started to soften again.

Stabilizing growth remains a top policy priority this year and it’s unlikely that we will see any policy tightening as authorities seek to expand domestic demand.

Additional Labor Day holiday economic datapoints

- Airfare prices during the period rose 39% compared to 2019 levels7 - inflationary pressures are forming as services capacity faces constraints though well anchored for now because of low food prices and a slack labor market. The high youth unemployment rate could start to tick down if the recovery further deepens and hiring in the services sector expands.

- Cross-border travel gained steam though is still meaningfully below 2019 levels. Places such as Hong Kong saw the most cross-border travel; according to the Hong Kong Immigration Department, more than 625k mainland tourists visited Hong Kong during the holiday period, roughly 56% of 2019 levels8. The number of outbound flights during the holiday period was only 38.4% of 2019 levels9.

- China’s leading digital payment platform shows that consumption expenditures rose by 70% over 2019 levels10.

- The movie box office totaled RMB 1.5bn, around 9% lower than 2021’s comparable period11.