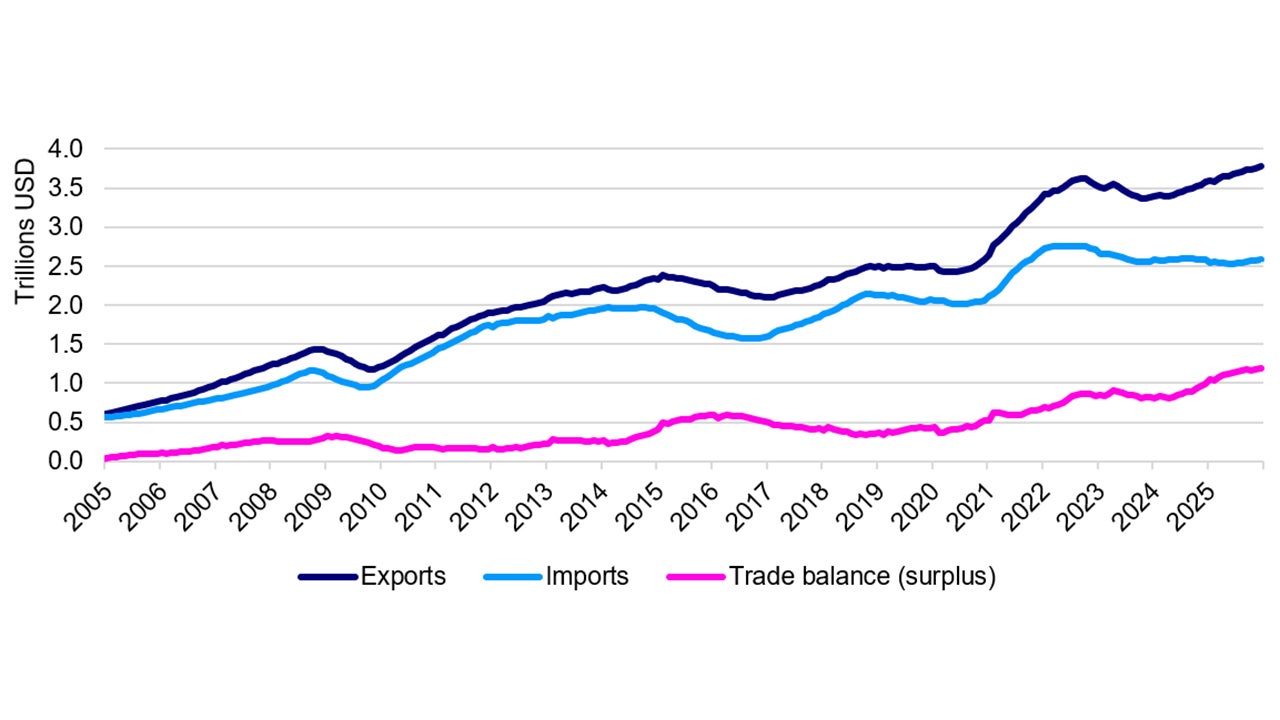

China’s record trade surplus driven by strong exports, competitive RMB, and global trade shifts

China’s trade surplus in 2025 hit USD1.2 trillion, marking the first time China’s annual trade balance has crossed the trillion-dollar threshold. The expansion was driven entirely from exports growth which rose 5.5% on a full year basis while imports remained broadly flat, underscoring the resilience of the external sector even in the face of tariffs and other headwinds.

Source: China General Administration of Customs (GAC). Monthly data as of December 2025.

Underscoring the scale of global trade rebalancing that is occurring, exports to the US fell by 20%, yet shipments to the rest of the world more than counterbalanced the difference. The Peterson Institute for International Economics estimates that the average US tariff rate on China exports sits at roughly 47.5%.1 This already elevated tariff number could be subject to further increases. US President Trump recently indicated than countries trading with Iran face additional tariffs of 25%, though the actual implementation details were not clear.

Is China facing a trade imbalance? While the absolute size of the surplus is historically unprecedented, China’s current account surplus relative to GDP has stabilized around 2–3%, which remains within a range that is internationally reasonable. By comparison, Japan and Germany have maintained far larger surpluses relative to GDP.

Still, the absolute size of China’s trade surplus in dollar terms is the largest in history and has a disproportionately large impact on the global economy due to the sheer size of China's overall GDP. The trade imbalance is also notable in how it mirrors the large deficit of the US and other major economies.

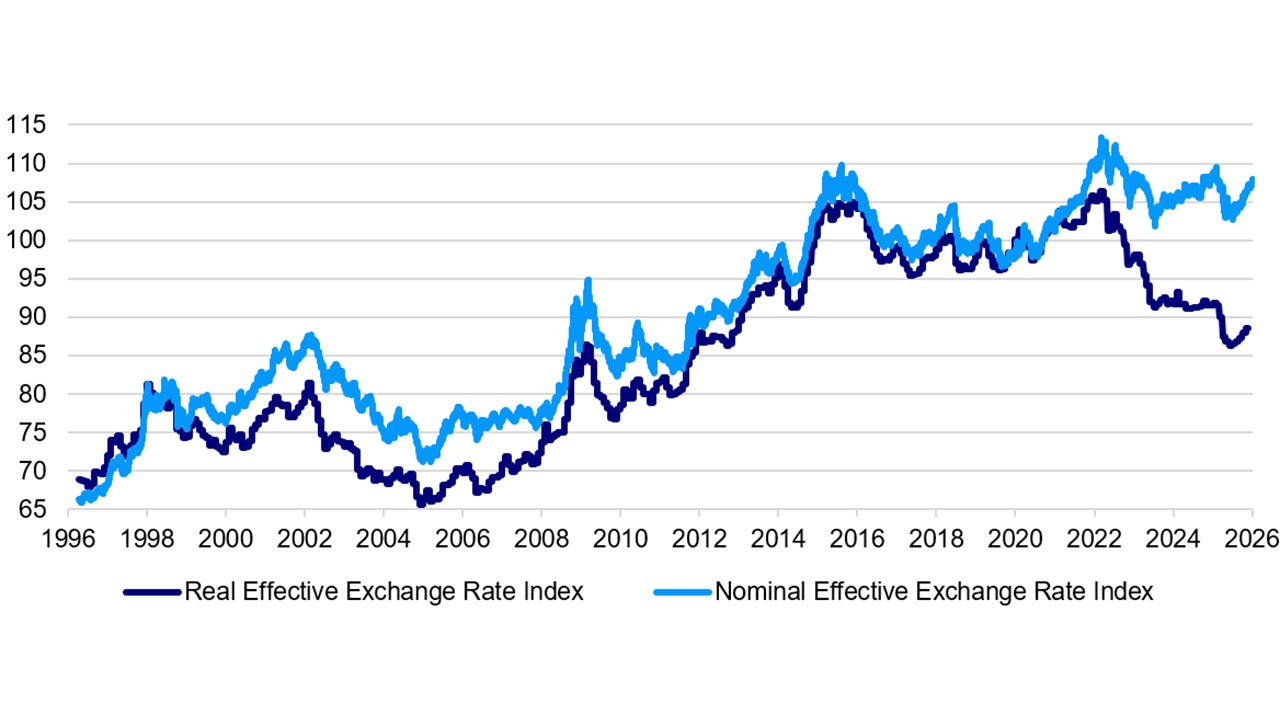

A key driver behind the surge in Chinese exports last year is straightforward: the RMB has been more competitive in real terms than headline exchange rates imply. While the nominal effective exchange rate (the actual value of the currency against a basket of trading partners) has hovered around the same level due to China’s currency fixing, the real effective exchange rate, which adjusts for inflation differences, has fallen much more sharply.

Source: The Bank for International Settlements (BIS). Daily data as of 6 January 2026.

The reason is that inflation in China has been significantly lower than in many of its trading partners including the US. Chinese goods have become cheaper relative to global competitors, making exports stronger than the nominal exchange rate alone would suggest.

Chinese policymakers have recently signalled tolerance for a stronger renminbi, which aligns with its broader macro-objective and may help to ease trade relations to some degree. The onshore USD/CNY spot recently climbed past the 7-threshold for the first time since 2023.

Still, any moves in the RMB fixing would be gradual. Above all the People's Bank of China (PBOC) prioritises stability. The Chinese central bank pledged in a December statement to ““maintain the basic stability” of the RMB at a “reasonable and balanced level”.

Chinese officials have also noted that export controls on high-tech products from trading partners are limiting China’s ability to import more advanced goods. On the upside, such restrictions underscore the urgency and investment opportunities around China’s push for self-sufficiency, while on the downside, further illustrates that ongoing trade tensions with advanced economies remain unresolved.

The robust strength of China’s export machine Shows that export-heavy sectors could be more resilient than anticipated, but ultimately a shift towards domestic growth drivers from policymakers suggest new drivers for the economy are on the horizon. We think investors should maintain focus on opportunities in China’s domestic markets, which are more influenced by idiosyncratic factors, and could potentially form a relative “safe haven” or at least a useful source of diversification.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.