Does bad US economic news mean good news for markets?

There’s been talk of a recession in the US economy for more than a year. Although one hasn’t materialized yet, it’s important to remember that the economic impact of interest rate tightening by the Federal Reserve has historically lagged rate hikes by 12 to 18 months. That’s why, in our view, a mild recession may be on the horizon.

A cooling labor market

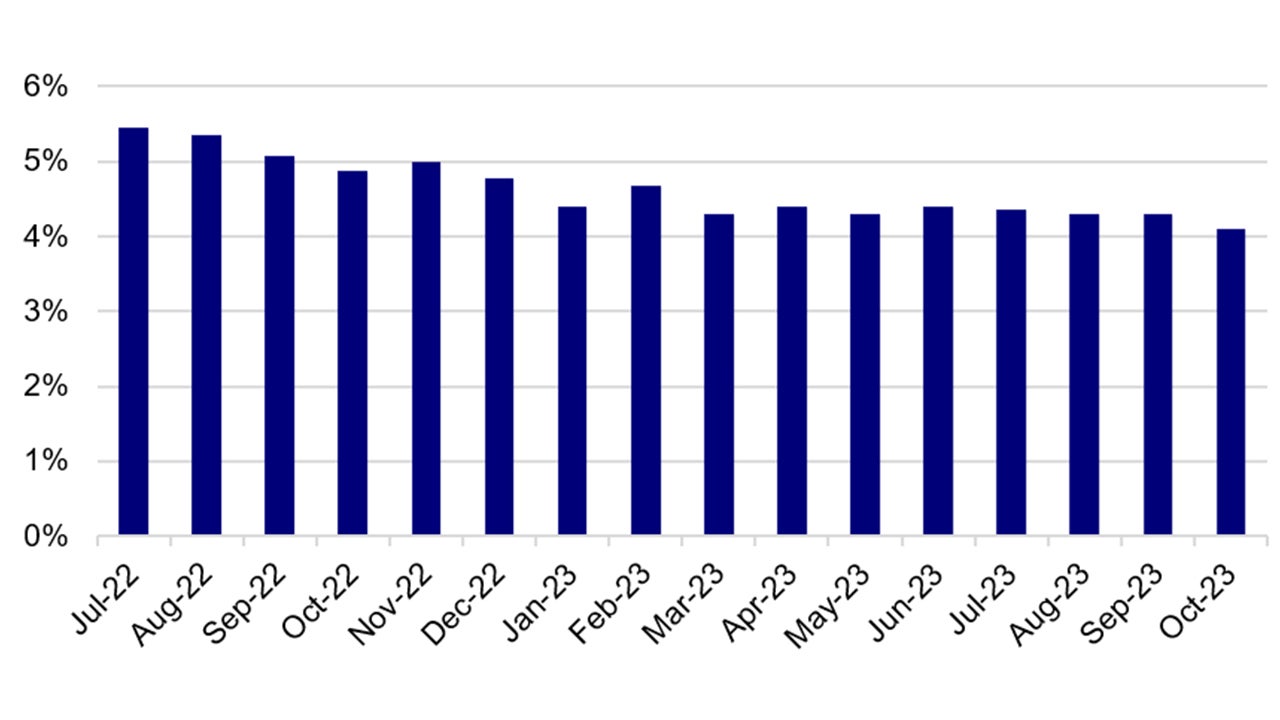

And just like that, the October US jobs report supports the view that the US economy is cooling, and the disinflationary trend is underway. Net job creation was just 150,000, with job gains coming largely from healthcare, government, and social assistance sectors.1 September nonfarm payrolls were revised downward. Labor force participation remained relatively stable, and unemployment rose slightly to 3.9%.1

Most importantly, wage growth continues to moderate. Average hourly earnings fell from 4.3% y/y to 4.1% y/y.1

Source: US Bureau of Labor Statistics as of 3 November 2023

More so, the recent ISM Manufacturing PMI clocked in at 46.7 for October, well below expectations of 49.0. And ISM Services PMI was 51.8, down from 53.6 in September.2

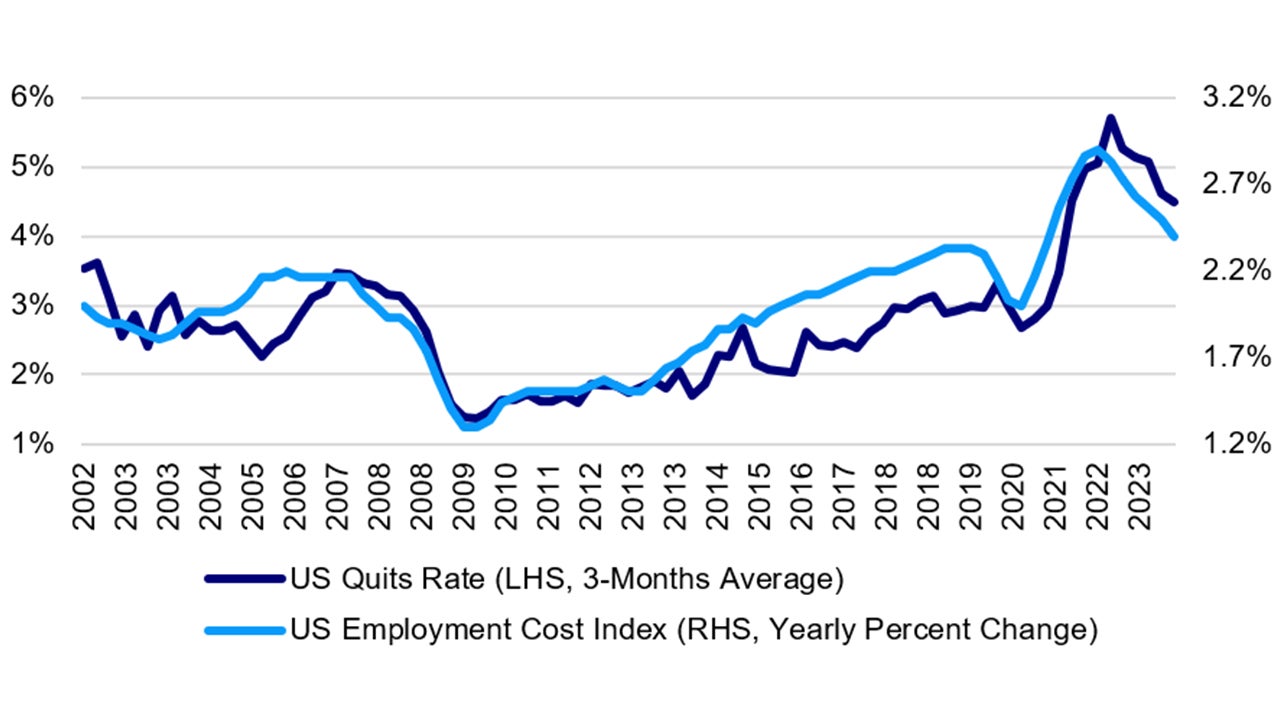

There are other data points that would suggest that the US job market appears to be loosening. The US job quitting rate is slowing, a sign that the US job market is becoming less tight, as US wages and salaries are also easing.

Source: US Bureau of Labor Statistics as of 30 September 2023.

Could the cooling labor market data coupled with the disappointing PMIs be seen as the canary in the coal mine for a looming bumpy landing? Quite possibly.

Other signs pointing to a mild recession

Already, there are other signs that the consumer is weakening on the margins - for example, auto loan delinquencies are on the rise - and that should result in some softening of demand going forward. The reinstatement of student loan payments will also put pressure on consumption.

The Fed’s recent switch to what seemed like a “dovish pause” was justified by weak ISM Manufacturing data and the soft October Employment Report.

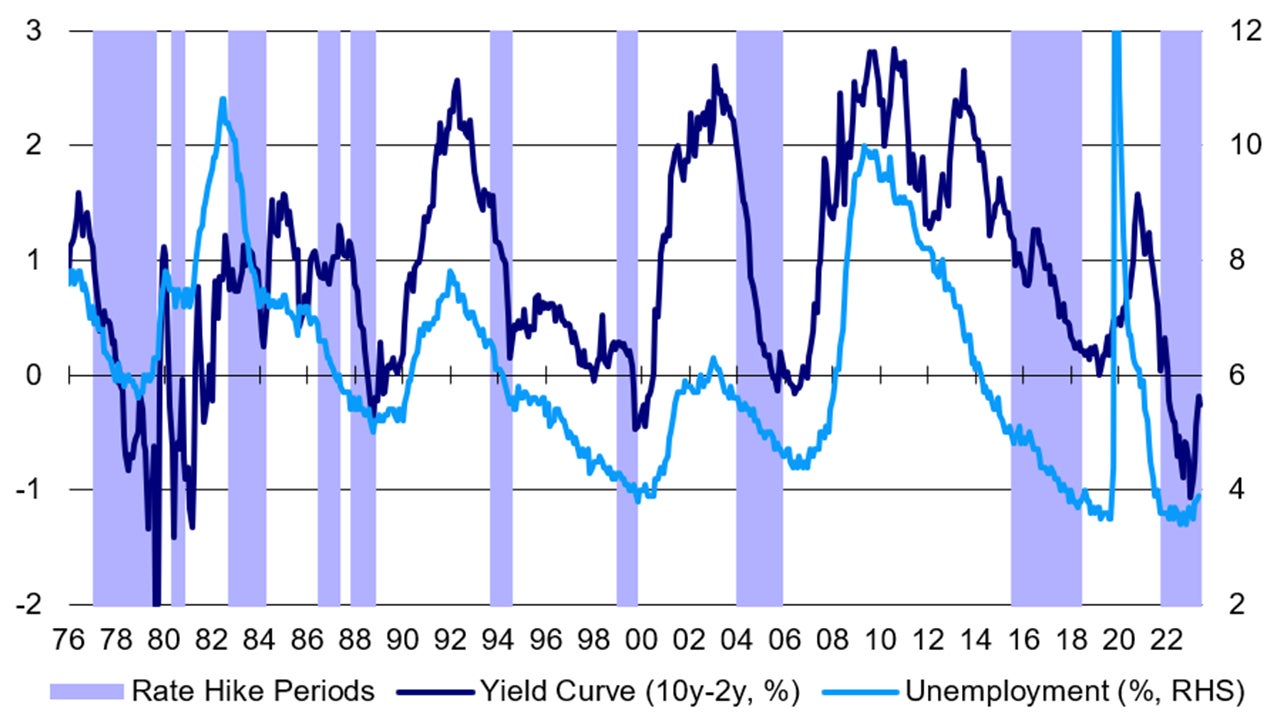

Source: LSEG Datastream and Invesco Global Market Strategy Office

Why bad news could be good news?

The chart shows that the Fed has typically stopped raising rates by the time unemployment bottoms. I suspect the July hike will prove to be the last of this cycle. Even so, the Fed has continued tightening further into the cycle than is usual (perhaps because it delayed the tightening for so long).

The chart also shows the yield curve typically steepens when unemployment rises. Recent steepening has been of the unusual bear variety. However, I would expect bull steepening over the next 12 months as rates fall across the maturity spectrum and would prefer longer maturities.

It’s possible that a bad-news-is-good-news dynamic may boost bonds and risk assets. The October US Non-Farm Payrolls release boosted the bond/risk-asset rally and dollar softening sparked by the Fed’s dovish hold at its November FOMC, raising hope for a soft landing. Historically, peak inflation, peak tightening, and peak interest rates has been positive for US equities over the subsequent years.

With contribution from Kristina Hooper, Arnab Das, Brian Levitt, Paul Jackson