Europe's resurgence and new cycle of growth

Europe’s repricing moment

After nearly two decades of relative underperformance, Europe is re-entering the spotlight. Since mid-2008, US equities consistently outpaced European markets, fueled by falling bond yields, dominant tech leadership, and more recently – supportive fiscal policy. But that narrative is beginning to shift. As concentration risk in US indices rises and domestic policies show signs of fatigue, investors are turning their attention to new growth stories.

Europe, long held back by structural inertia, is now embracing an aggressive fiscal agenda aimed at reigniting growth. A widespread surge in defense spending, Germany’s infrastructure push, and a clear shift toward strategic autonomy are reorienting the continent’s investment landscape. With valuations still reasonable and the Euro gaining momentum, the setup for European assets is more compelling than it’s been in years.

Fiscal rearmament

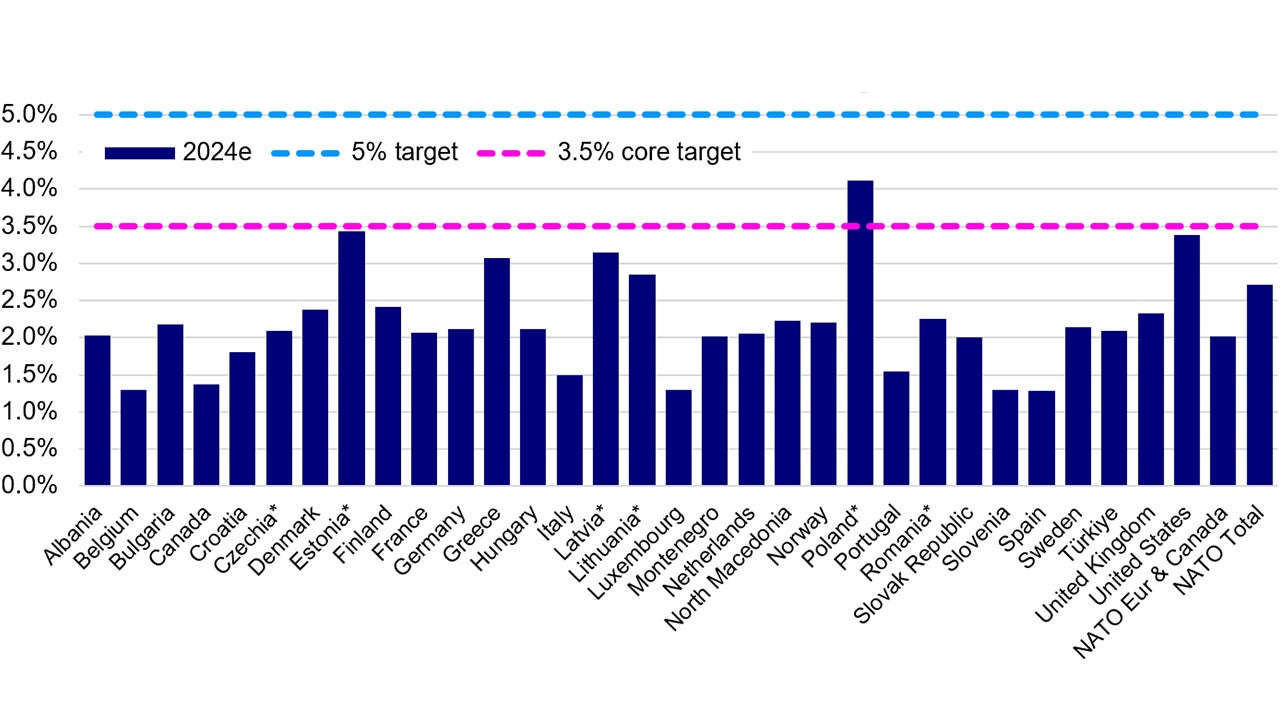

At the June 2025 NATO Summit, member states collectively committed to a material structural increase in defense outlays, targeting total defense and security expenditures of 5% of GDP by 2035 – a sharp departure from previous norms. The new framework distinguishes between core defense spending of 3.5%, which aligns more closely with the traditional 2% NATO guideline, and an additional 1.5% allocated to broader security-related initiatives, including infrastructure and cybersecurity.1

Europe is now expected to reap the benefit of US disengagement on the military front. European countries are being forced to boost military spending and their desire to become more self-sufficient in the supply of military goods suggests they will need to broaden and deepen the European military industrial complex.

We anticipate that these developments will serve as a tailwind for the European economy. While European aerospace and defense companies have already experienced positive momentum since 2022, we expect the benefits to extend across the broader industrial complex – including construction and capital goods – as increased defense spending drives new facility construction and equipment investment.

Source: North Atlantic Treaty Organization (NATO). Notes: figures for 2024 are NATO estimates. *Indicates Allies have national laws or political agreements which call for 2% of GDP or more to be spent on defense annually. Data as of 17 June 2024.2

Importantly, Europe’s industrial ecosystem is uniquely positioned to respond. The region has a dense network of small- and mid-cap firms in automation, engineering and advanced manufacturing, many of which sit adjacent to defense supply chains. These companies are well represented in indices like the MSCI Europe Small Cap Index, where industrials comprise over 25%.3 European small caps tend to be domestically focused, rate-sensitive, and highly exposed to fiscal tailwinds.

Addressing Europe’s evolving defense challenges will similarly require significant technological investment and expertise. As the EU seeks to bolster its strategic autonomy, there is a clear policy focus on reducing reliance on US technology and fostering a more robust homegrown innovation environment across critical sectors.

Defense technology will likely mirror trends seen in Israel and the US, with missile shield development and advanced tracking systems becoming regional priorities. Europe’s long-overlooked tech sector is showing signs of revival, driven by defense-linked innovation. In terms of how that impacts European equities, the question is whether any new industrial and technology champions that emerge will be listed in the US or European markets.

We also shouldn’t forget that Europe’s drive to self-sufficiency extends to energy, a priority that has intensified since Russia’s invasion of Ukraine. Renewables are becoming a bigger part of the energy mix (47% of the net electricity generated in 2024) and are cheaper than gas.4 On the other hand, nuclear will eventually become a bigger part of that energy mix, and the cost implications of that are not so benign. Eurozone production costs are high partly due to higher energy costs, although it can use Eastern European members of the EU to lower that somewhat.

These shifts are being driven by a broader fiscal reorientation across Europe, and Germany is at the forefront. Chancellor Merz has outlined an ambitious roadmap to increase defense spending by over 70% by 2029, reaching €162 billion as the country works towards NATO’s 5% of GDP target.5 This initiative forms part of a broader fiscal pivot, with proposals to relax the constitutional debt brake potentially enabling up to €1 trillion in additional borrowing over the next decade. Infrastructure investment is also accelerating, with €115 billion earmarked for 2025.6

The scale of Germany’s fiscal program is likely to generate positive spillover effects across the region, as the domestic economy alone will be unable to fully absorb the proposed increase in spending.

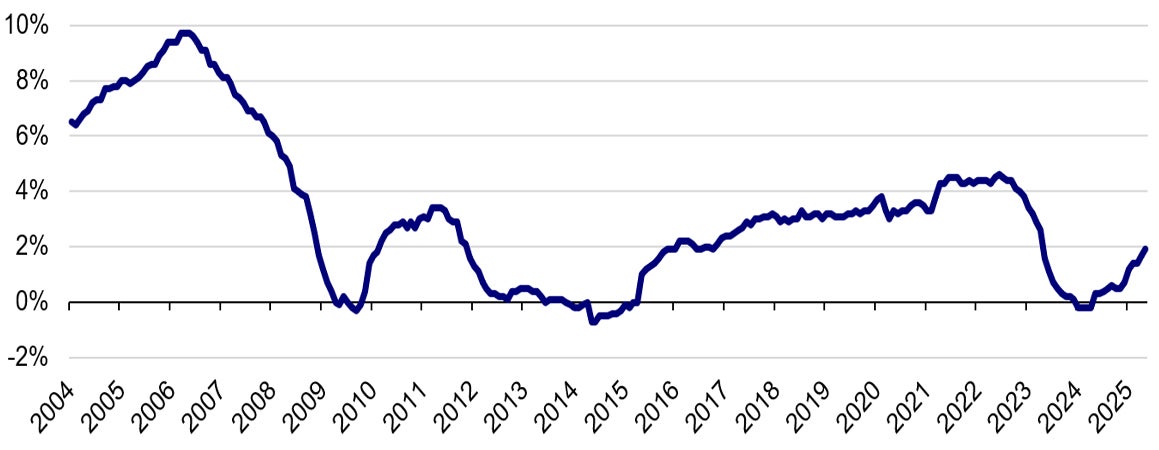

European Central Bank cutting rates

On the monetary front, the European Central Bank (ECB) is cutting rates faster than expected due to disinflationary pressures. The appreciation of the euro has contributed to moderating price levels, and in June, the ECB delivered its eighth consecutive rate cut, lowering the deposit facility rate to 2%. Europe is a more rate-sensitive market than the US, and cuts from the ECB should help to lift household demand. Recent loans data indicate that households are borrowing more.

Source: European Central Bank (ECB) and Bloomberg. Monthly data as of May 2025, as at 23 July 2025.

Tariff risks

Trade friction remains a key headwind for Europe. US President Trump floated the possibility of a 30% tariff on European imports, subject to negotiation and further policy development. Still, the region – like China – is now less dependent on the US than in past decades. Direct exports to the US account for only around 3% of Europe’s GDP.7 Europe is also adapting and pivoting away from US demand.

Within the Euro Area, Germany remains most exposed to US tariff disruption, followed by Switzerland (with its pharma-heavy export base) and Sweden (an open, industrial economy). Southern Europe seems to be relatively insulated. Ireland is also highly exposed through its exports of pharmaceuticals and may also face risks if US multinationals no longer deemed it an attractive base for tax reasons.

Fiscal sustainability

Europe’s push toward higher defense and infrastructure spending may be exposing fiscal fault lines. The differences in spending capacity and political will are becoming increasingly visible. Notably, Spain has formally rejected the 5% target, with Prime Minister Pedro Sánchez warning that such a commitment would devastate the country’s welfare state.

The UK has signed on to the 5% target, but its fiscal and political position is more precarious. The government had to walk back on a relatively small £5 billion in welfare cuts, and the UK government borrowed a higher than forecasted £20.7 billion in June.8

Germany’s spending plans look to be the most ambitious but is in a much stronger position. Despite relaxing its constitutional debt brake, Germany’s debt to GDP ratio sits at roughly 65%, much lower than European peers such as France at 113% or the US at 122%.9

Many European governments now face a choice between cutting welfare spending to stabilize debt levels, increase bond issuance (potential upward pressure on yields), or higher taxes (politically sensitive).

More broadly, while debt levels are rising across Europe, they’re being matched by a corresponding pickup in growth, which should help stabilize debt to GDP ratios over time. For equity markets, this dynamic is broadly supportive, as stronger demand and investment offset public borrowing concerns.

European equities have already staged a strong rebound this year. The STOXX 600 Index is up by over 25% year-to-date in USD terms, and roughly 11% in Euro terms. While the performance was largely down to re-rating and dividends, European equities are still inexpensive compared to other markets with a trailing 1-year PE ratio of 15x. The much-improved growth outlook will likely give earnings a bit of a kick going forward.10

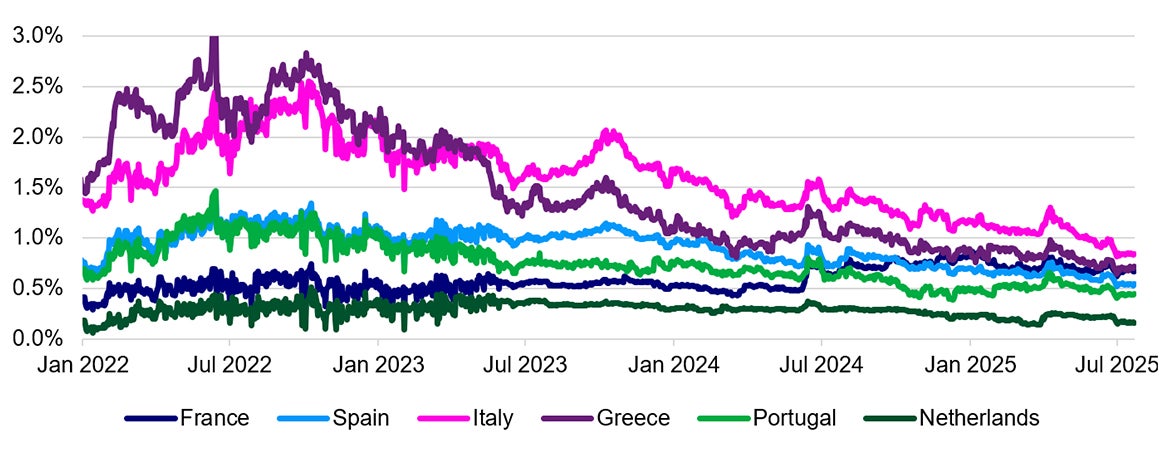

The implications for fixed income are more nuanced. Still, the spread between German bunds and peripheral sovereigns already reflects differences in fiscal credibility. Germany’s front-loaded issuance is being absorbed with minimal disruption, reinforcing its role as the region’s benchmark.

In contrast, countries with tighter fiscal space may face upward pressure on yields if markets question the sustainability of their long-term commitments. As fiscal policy becomes more active, credit differentiation within the Euro area will likely intensify.

Source: Macrobond. Daily data as of 22 July 2025.

*With contributions from Thomas Tang and András Vig

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.