FOMC December 2025 rate cut: One and done?

The Fed (Federal Reserve System) delivered a 25bps cut to its benchmark funds rate to 3.5 – 3.75% in its December 2025 meeting, in line with market expectations.

With three dissenters, the decision was not unanimous. Given the division among FOMC (Federal Open Market Committee) members, it’s no surprise that the accompanying policy statement signaled that the Fed is non-committal about future easing and in a wait-and-see mode.

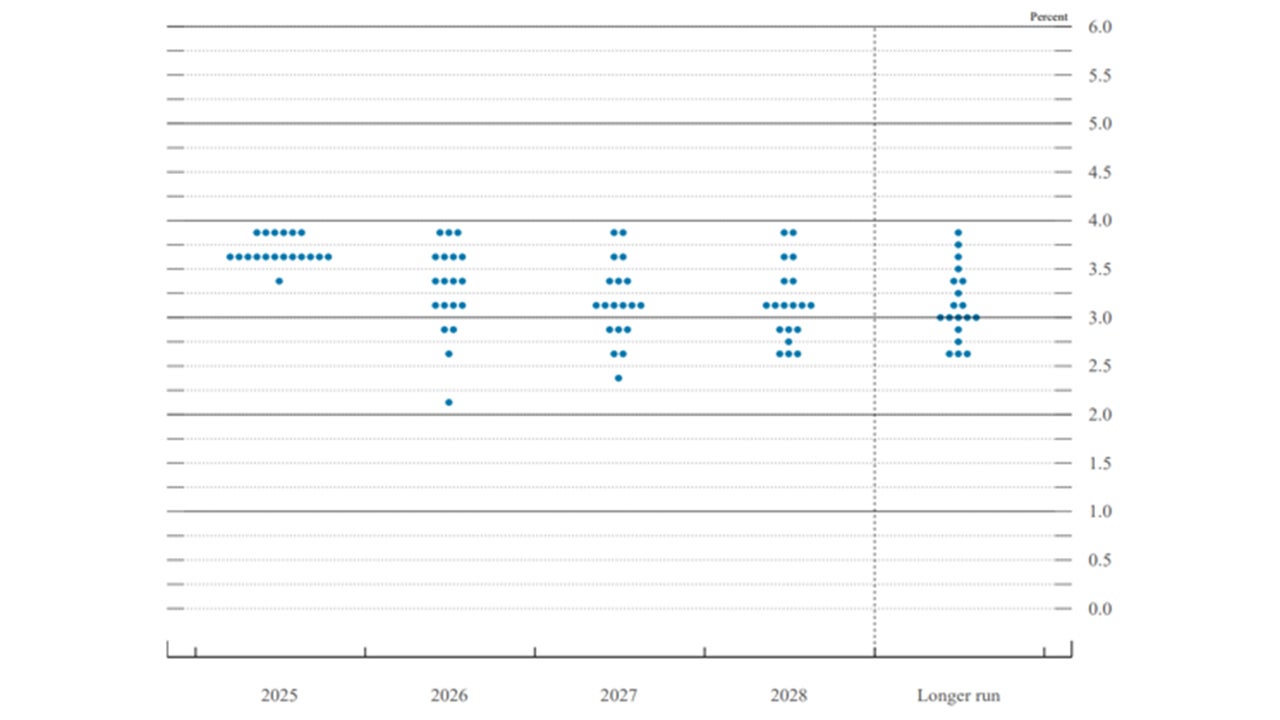

The “dot plot” forecast for interest rate cuts in 2026 remained unchanged, with one more cut expected in the coming year.

Source: Federal Reserve. Data as of 11 Dec 2025.

The outlook for future rate cuts

The policy statement and Chair Jay Powell’s remarks underscored that the federal funds rate is now close to the Fed’s neutral estimate and that any future rate cuts would likely occur only if there is a significant weakening in labor market conditions.

For now, the labor market is cooling but not too cold. Powell highlighted that job growth continues to be overstated by around 60,000 / month, which means that recent job growth has been negative.

I expect labor market softness to persist until the full impact of tariff pass-through has been absorbed.

On inflation risks, Powell sounded sanguine about the possibility of tariff-related inflation becoming persistent.

In addition to the rate cut, the Fed also announced a change to its asset purchases. The central bank plans this week to resume its purchases of shorter-dated Treasures. The volume of purchases is quite high and could put downward pressure on yields.

I’m also keeping a close eye on the political pressures for the Fed to cut rates. FOMC member Stephen Miran, a recent President Trump appointee, voted to cut rates by 50 bps and President Trump himself quickly complained that the 25bps cut should have been bigger.

Trump also mentioned that he will be meeting potential candidates for Fed Chair, with Powell slated to retire on May 15, 2026. Needless to say, the political pressure on the Fed is unlikely to recede for a while.

Investment Implications

Even though the Fed has signaled that there may be fewer rate cuts in the coming year than what markets currently expect, I believe that the economy will remain sufficiently resilient.

The “One Big Beautiful Bill” is expected to contribute to growth next year and could even be a bigger boost than expected.

I expect the US stock market rally to continue into 2026 with a broadening out of market leadership.

The Fed rate cuts, coupled with an improvement in nominal US growth, is positive for small and mid-cap companies.

Fed rate cuts could also further weaken the USD, which remains expensive on a historical basis. While most major central banks have finished their rate cutting cycle, the Fed continues to ease.

A weakening USD tends to be beneficial to emerging market equities and local currency bonds.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.