FOMC decision and US equity market outlook

US stocks are near record highs and resilient in other geographies. The big question is whether the rally can continue or will it succumb to inflation, slowdown or economic uncertainties due to the tariffs. Which is more correct?

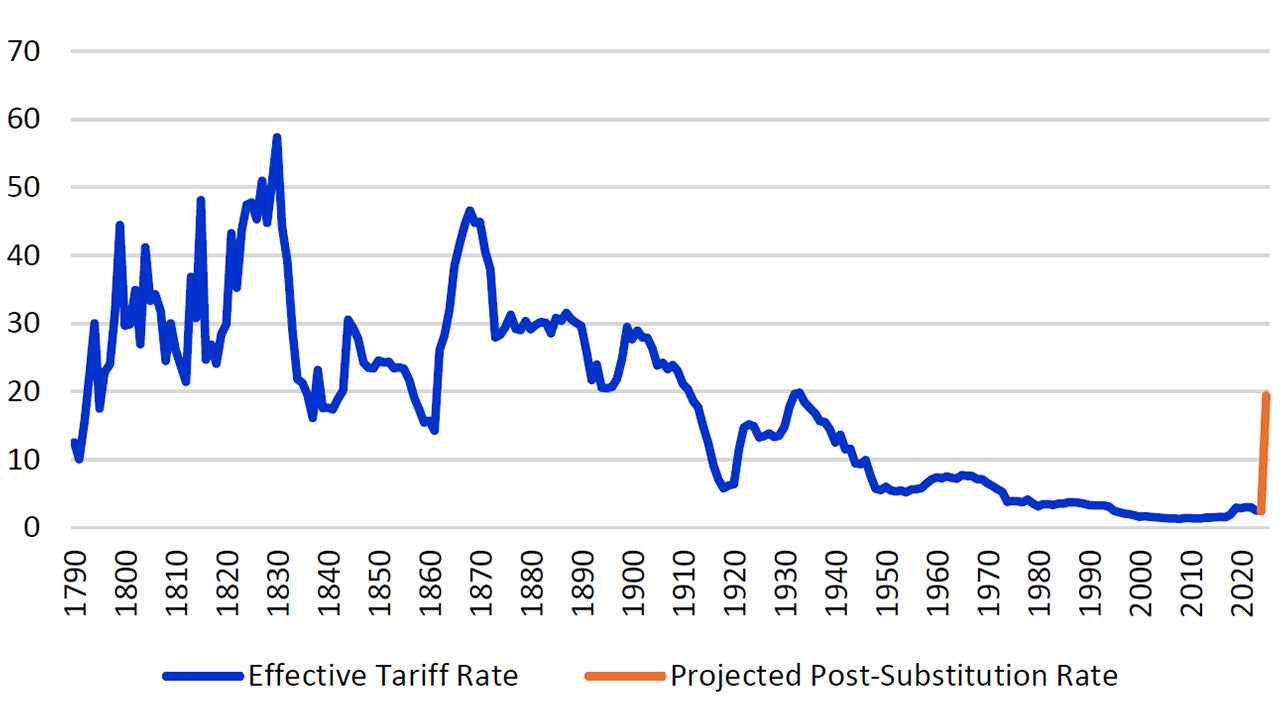

We side with the markets but acknowledge the risks, and the primary risk stems from the yet-to-be-felt economic impact from the tariffs. The Yale Budget Lab puts the current effective US tariff rate at Great Depression levels after adjusting for spending patterns.

Sources: Historical Statistics of the United States Ea424-434, Monthly Treasury Statement, Bureau of Economic Analysis, The Yale Budget Lab, Invesco, annual data as at 25 July 2025.

Despite similar tariff levels, the US economy today is a far cry from the 1920s. Today, the US economy relies on far higher share of public spending and spending on services which implies a much lower exposure to tariffs. Agriculture is more stable and smaller as a percentage of GDP than in the Great Depression.

Trade deals are being concluded rather than a tit-for-tat escalating trade war. Fiscal stimulus and domestic demand should support global growth.

Last but not least, the Q2 corporate earnings season has been much better than expected and the AI/tech revolutions are likely to support strong demand for leading-edge stocks.

Fed decision: holding steady, but growth concerns emerge

As widely expected, the Federal Open Market Committee (FOMC) kept the policy rate unchanged at its July meeting. However, the decision was not unanimous—Governors Bowman and Waller dissented, favoring a 25 basis point cut1.

While the Fed maintained its view of the labor market as “solid” and inflation as “somewhat elevated,” there was a subtle shift in tone: the Fed now describes economic growth in the first half of 2025 as having “moderated.”

We believe this shift reflects growing concern over a potential consumer-led slowdown, which we explore further below.

Although payroll data—particularly in the private sector—have shown signs of softening, Chair Powell reiterated that the Fed’s dual mandate is centered on maximum employment and stable prices, rather than growth per se.

Notably, while job creation is slowing, the labor supply is also easing, helping to keep the unemployment rate relatively steady. On the inflation front, core Personal Consumption Expenditures (PCE) rose 2.7%2, and services inflation continued to ease. However, tariff-related price pressures are beginning to emerge in certain goods categories.

GDP: headline strength continues to mask underlying softness

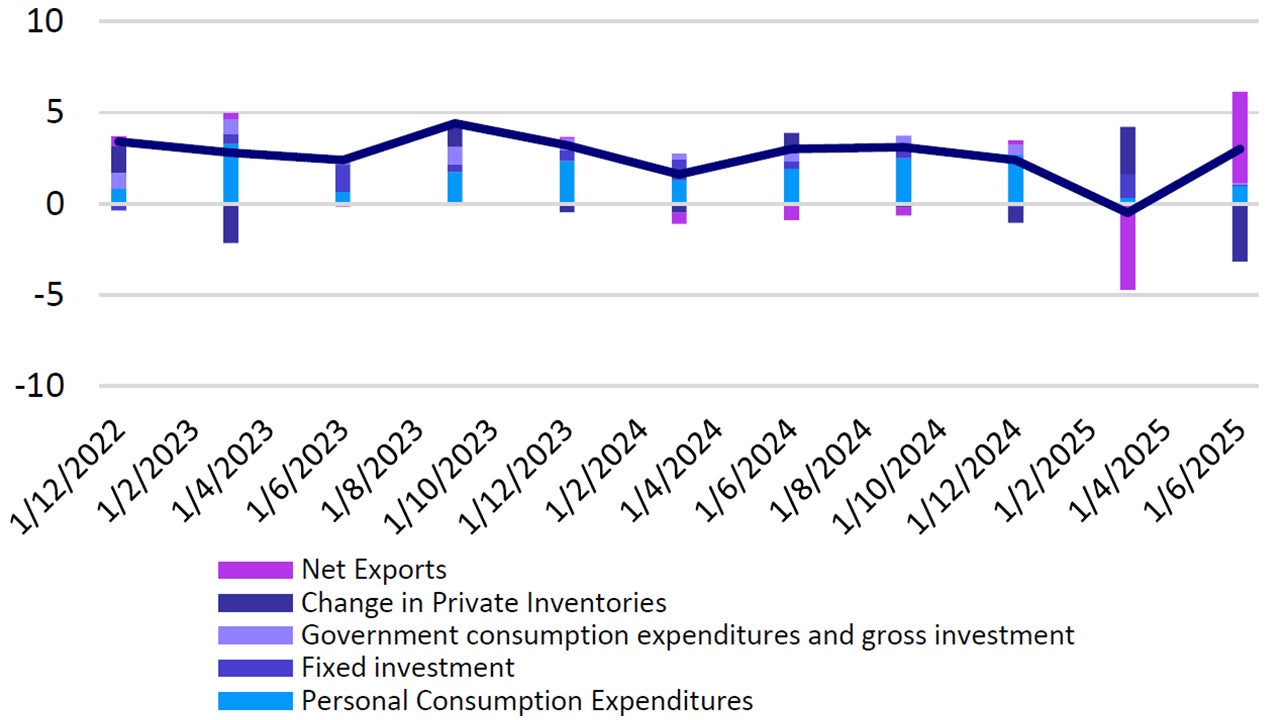

The advance estimate for Q2 GDP showed a strong 3% quarter-on-quarter annualized growth, a sharp rebound from the -0.5% contraction in Q13.

However, this may reflect more of a mechanical rebound driven by a narrowing trade deficit than genuine underlying strength. For example, imports surged 37.9% in Q1 due to tariff frontloading, then dropped 30.3% in Q2—likely distorting the headline figure4.

Source: Calculated by Bloomberg using data from Bureau of Economic Analysis, as at 31 July 2025.

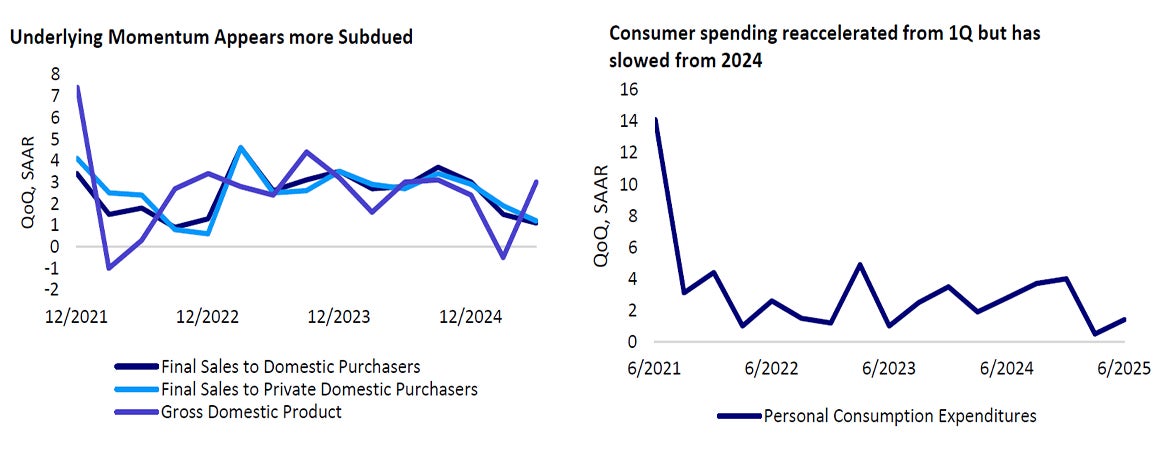

When stripping out volatile components such as trade, inventories, and government spending, the underlying momentum appears more subdued. Key indicators point to softness: final sales to domestic purchasers slowed to 1.1% (from 1.5%), while final sales to private domestic purchasers—excluding government activity—fell to 1.2% (from 1.9%)5.

Consumer spending rebounded modestly in Q2, but the H1 pace remains just 1%, a sharp slowdown from the 3.1% average in 20246. Business investment also showed signs of easing.

Source: QoQ% SAAR Figure, Bureau of Economic Analysis, as at 31 July 2025

September meeting: a high bar for a cut

Looking ahead, we believe the Fed will remain cautious. While tariff pass-through has begun, uncertainty around its full impact persists. The Fed will likely monitor whether long-term inflation expectations remain well anchored.

On the labor side, a more pronounced slowdown in employment growth—enough to push the unemployment rate higher—may be necessary to justify a rate cut in September.

Overall, while the Fed’s tone has tilted slightly dovish, the bar for a September cut remains relatively high.

Trade: limited clarity

Recent trade deals have helped ease market concerns around trade uncertainty, but they also reflect a growing trend of ambitious yet loosely defined commitments. The feasibility of the EU’s $250 billion energy purchase target7 is under scrutiny, especially given current supply-demand dynamics. Meanwhile, Japan’s $550 billion pledge has raised questions8, as much of it appears to be in the form of loans rather than direct investment.

These developments suggest that while deal-making is accelerating, the lack of detail and enforceability warrants close attention.

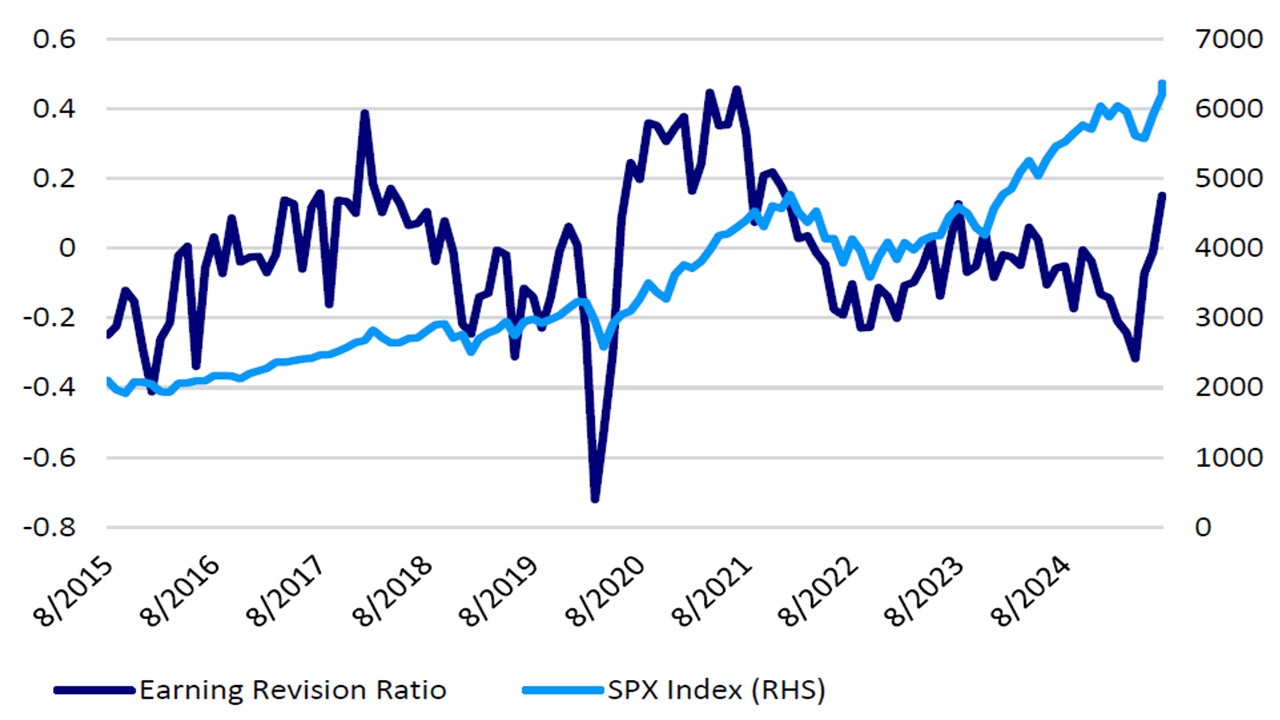

US equity

In the equity market, there are signs of a positive catalyst. Earnings guidance trends appear to have bottomed, and earnings revisions breadth is continuing to improve. Several tailwinds could support equities in the near term: accelerating AI adoption, a weaker dollar, and cash tax savings from the One Big Beautiful Bill Act. A potential Fed rate cut would further bolster sentiment.

Source: Bloomberg L.P., monthly data as of 25 July 2025. Notes: Earning Revision Ratio is calculated as the difference between total upward and downward revisions to next fiscal year EPS estimates, divided by the total number of revisions, based on a rolling 4-week period on the S&P 500.

With contribution from Thomas Tang

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.