Fukushima waste water discharge: possible impact on Japan’s economy

Japan’s discharge of treated waste water from the damaged Fukushima nuclear power plant has led to tensions with neighbors.

In this commentary, I aim to assess the potential spillover effects to particular industries and sectors.

China’s recent ban on all “aquatic” imports from Japan

Much has been written about China’s recent ban on all “aquatic” imports from Japan while Hong Kong and Macau have banned seafood from 10 prefectures surrounding Fukushima.

However, the ban isn’t going to have much of an impact on Japanese exports.

Even though China and Hong Kong have been the top two export markets of Japan’s marine products in the last year, taking up 22.5% and 19.5% of Japan’s USD 2.95bn/year exports, seafood exports account for only around 0.07% of GDP1.

Relatedly, Japan represents around 3% of China’s total marine life imports though only ranked 9th of its seafood imports, behind countries such as Ecuador, Russia and Vietnam2.

On the very off chance that tensions unravel to the degree that overall bilateral trade is at risk, China is Japan’s 5th largest trading partner with total trade of USD 357.9bn in the past year and commands around 6.8% of China’s imports - electrical equipment (27% of total), machinery (20%) and vehicles (8.5%) being the top sectors3. These sectors could be impacted from spillover effects.

Tourism – the possible impact

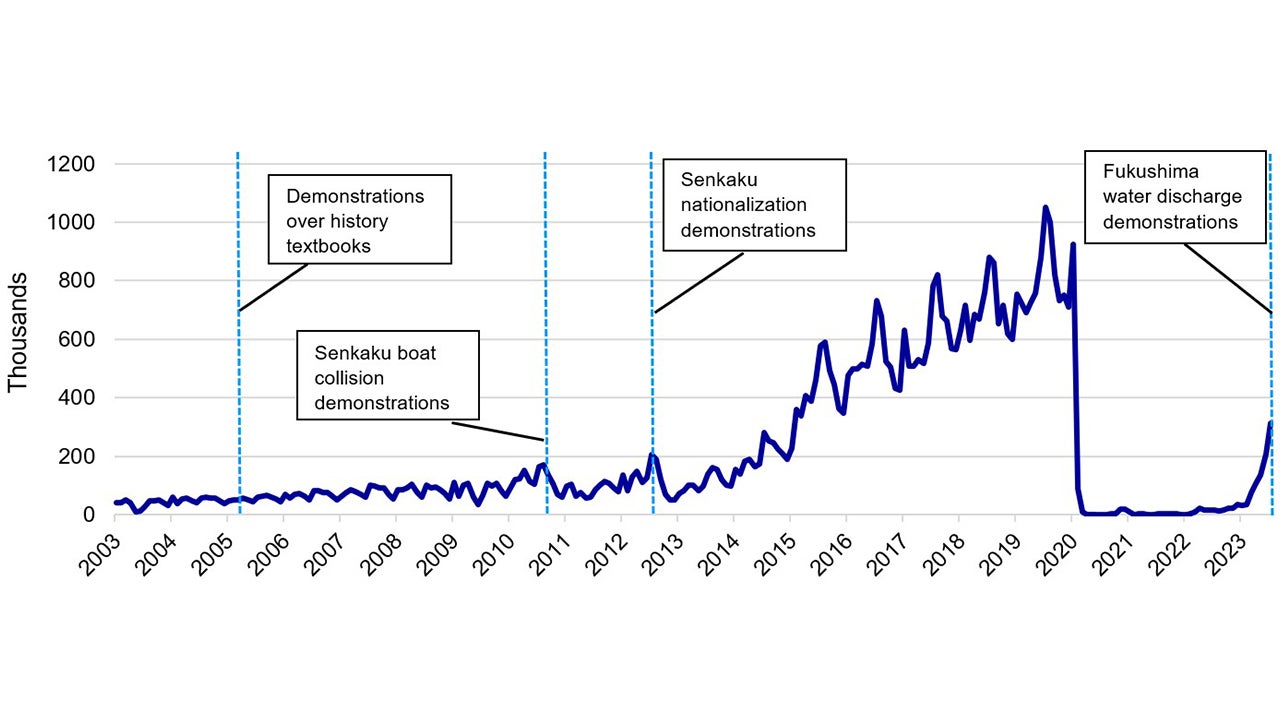

One other sector that has been impacted in the past from fraying relations is Chinese tourist arrivals in Japan.

Source: Japan National Tourism Organization and Invesco. Data as of July 2023.

Pre-COVID, Japan was the 2nd most visited international destination after Thailand4.

Back in 2019, around 9.59mn Chinese visited Japan and accounted for roughly 30.1% of foreign travelers to Japan and spent USD12.3bn or 36.8% of the total spending for inbound travelers.5

To date, Chinese travelers have only recovered to around 39.2% pre-pandemic levels as of July and flight capacity is only around 45% of pre-pandemic levels6.

Looking back, Chinese tourist levels declined approximately 30% during the Senkaku / Diaoyu Islands boat collision in September 2010 and during the Senkaku / Diaoyu Islands nationalization demonstrations August 20127.

The wastewater concern isn’t at the same degree of severity as the Senkaku / Diaoyu issue, which touches on sovereignty.

Recently, Japan was added to the batch of countries that the Chinese government now permits group tours to and around 1/3rd of Chinese tourists have been classified as being on a group tour prior to 2019.

Even though Chinese outbound tourism could take a dip if tensions flare and the approval for Chinese tour groups to go to Japan could be repealed, we haven’t seen it yet.

That said, tourists from other parts of the world are likely to take their places. Tourism in Japan is already above pre-COVID levels.

A recent weakening of JPY to 146/$, or around -33% since 2019, is ever more reason for tourists around the world to continue flocking to the land of the rising sun.

Auto sector could take a hit if relations deteriorate

Even though there isn’t a whole lot of business-to-consumer (B2C) trade between Japan and China, if there was one sector that has been dinged in the past when relations flared, it has been the Japanese auto sector.

During previous spats, there have been reported incidents of vandalism against Japanese and Korean cars in China and their auto sales fell respectively.

I believe that Chinese consumers may hesitate to purchase conspicuous Japanese brands such as autos if relations deteriorate.

Historical Precedents

When looking at previous China-Japan spats, such as in 2005, 2010, 2012 and also during the China-South Korea spat in 2017 over the THAAD anti-missile system, these heated moments had little impact to overall exports and imports.

The main reason is because trade between Japan and China primarily consists of parts and un-finished/finished products being sent back and forth between a Japanese parent company and its subsidiaries in China.

More concretely, Japanese foreign direct investment (FDI) into China is massive, Japanese corporates have established around 55,805 subsidiaries in China with a cumulative capital stock of USD 148.6bn in 20218 and mostly in autos and machinery.

Strained relations between the two countries could impact the ease of doing business in China.

Conclusion

Overall, I believe a more visible threat to Japan’s economy and markets is China’s slowdown.

For example, even before the spat over wastewater, China’s imports from Japan have already slowed over the past year, down -10.2% y/y in 2022 and -16.7% y/y for July YTD 2023.9

So while I believe the rapid devolvement of China-Japan relations is concerning, the current heated disagreement is unlikely to meaningfully impact trade between the world’s second and third largest economies and investors in Japanese markets are likely to see through the current tiff.