FX Pulse: 2025 Q4

Paul Jackson in Invesco’s GMS Office shares his quarterly outlook on the currency markets. Find out more.

USD weakened over recent months and we expect that to continue, as the Fed eases more than other central banks. We think JPY will be the strongest major currency over the next year, followed by EUR.

| Favoured currency | Hedge from | Hedge to | |

| 3M view | JPY, EUR, AUD | HKD, CHF | JPY, EUR |

| 12M view | JPY, EUR, AUD | HKD, USD | JPY, AUD |

Note: Please refer to the appendix on page 6 of the PDF for abbreviations of currencies and central banks.

Source: Invesco Strategy & Insights.

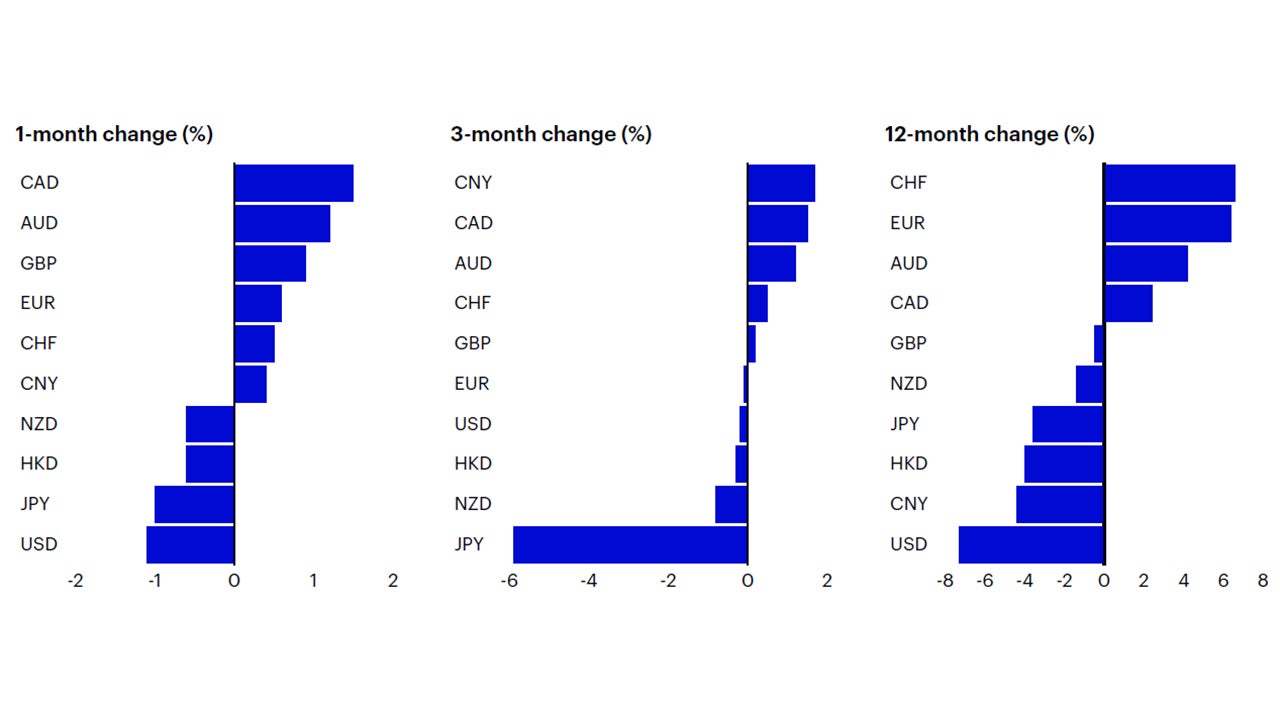

The Fed made its third rate cut of 2025 on 10 December, the third successive meeting at which it eased. Five of the 10 central banks featured in this document eased during the quarter, while the BOJ tightened. As we suggested in the October edition of FX Pulse, USD reverted to a weakening trend during Q4, notably in December (see Figure 2).

Though 3-month rates have fallen in all of our sample of countries since the start of 2025 (except Japan), the pattern was mixed during Q4. For example, rates were largely stable in China, the Eurozone and Switzerland, while they rose in Japan and Australia (the latter in reaction to higher than expected inflation which we think could result in RBA tightening). US 3-month rates fell more than those of most other countries in Q4, perhaps explaining dollar weakness.

Yield curve steepening has been accentuated in many countries by a rise in longer term rates. For example 10-year yields rose during 2025 in six out of 10 of our sample of countries (notable exceptions being the US and Hong Kong). Japanese yields led the way, with a rise of 99 basis points (bps), 42 bps of which came during Q4 (the UK was one of only two countries to see a decline in 10-year yields during Q4). 10-year spreads moved against the US dollar during 2025 for all counterparts except Hong Kong.

Among other currencies, the strongest in recent months have been CNY, CAD and AUD. 10-year yields rose relatively strongly during Q4 in Australia and Canada. In our view, CNY has been helped by the perception that PBOC rates have limited downside potential, and improved sentiment towards Chinese stocks.

The weakest currencies during Q4 were JPY and NZD. The New Zealand economy has been weak and its central bank has cut rates aggressively. We suspect JPY has suffered from market disappointment that BOJ tightening is progressing slowly, along with concern that the new Prime Minister favours a dovish BOJ.

Over 12 months, CHF and EUR have been the strongest, despite aggressive central bank easing (the SNB policy rate is now zero, while the ECB Deposit Facility Rate is 2.00%). We think this currency strength could reflect optimism about future European growth (on the back of increased military spending and German infrastructure spending). It may also reflect some positive currency fundamentals such as current account surpluses, positive net international investment positions and relatively healthy government finances (Please refer to the page 3 of the PDF for Figure 3 image). These factors could help when investors are searching for so-called “safe havens”.

USD was the weakest of our currencies during 2025, which we think reflects a combination of expensive valuations and poor fundamentals (Please refer to the page 3 of the PDF for Figure 3 image). It may also be due to the uncertainties resulting from the new administration’s policies. The fates of HKD and CNY are tied to USD (via exchange rate mechanisms), hence it is no surprise to see they also weakened. More surprising to us is the weakness of JPY, despite rising interest rates and yields.

In breaking news, the early January 2026 US intervention in Venezuela has raised geopolitical uncertainties, in our view. That appeared to offer initial support to USD, but we doubt that will persist. First, we believe that geopolitical effects on markets tend to be short-lived. Second, if the US is the source of the instability, we are not convinced that is a recipe for dollar strength.

Notes: Past performance is no guarantee of future results. As of 31 December 2025. Based on Goldman Sachs Nominal Trade Weighted Indices.

Source: Goldman Sachs, Bloomberg and Invesco Strategy & Insights.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Paul Jackson in Invesco’s GMS Office shares his quarterly outlook on the currency markets. Find out more.

Paul Jackson in Invesco’s GMS Office shares his quarterly outlook on the currency markets. Find out more.

Paul Jackson in Invesco’s GMS Office shares his quarterly outlook on the currency markets. Find out more.