Uncommon truths: Global Debt Review 2025

Global debt-to-GDP ratios continue to come down, after the sharp rise in seen in 2020 (debt is still rising but GDP is growing faster). Elevated debt ratios continue to be mainly a developed world phenomenon. The effect of higher interest rates on debt service ratios is starting to be seen.

The man from Mars may question whether planet Earth has a debt problem (if so, to whom is it owed?). However, the global financial crisis (GFC) showed that, even if net debt is zero, it is difficult to unwind that debt when there are so many interlinkages. We therefore assume that more debt brings more risk. Hence, our annual review of global debt. Now that the Bank for International Settlements (BIS) has published its 2024 data, we are able to deliver the next instalment.

With the projected rise in US government debt and the UK’s Office for Budget Responsibility (OBR) suggesting UK government debt could rise to 270% of GDP by the early 2070s (from 94% at the end of 2024 – see the OBR’s July 2025 Fiscal Risks and Sustainability Report), it is no surprise that investors are asking questions about debt.

The good news is that most of the record gain in global debt-to-GDP ratios in 2020 had been reversed by 2024 when using PPP (purchasing power parity) exchange rates (all had been reversed when using market exchange rates). However, the decline has had more to do with rising GDP than falling debt. The global debt-to-GDP ratio fell to 229.8% in 2024 from 230.2% in 2023, based on the BIS “All Reporting Countries” non-financial sector debt-to-GDP ratio, using PPP exchange rates to convert to US dollars. That debt-to-GDP ratio was 223.7% in 2019.

We believe that using PPP exchange rates to calculate such aggregates avoids the volatility that comes with market exchange rates. For example, using market exchange rates, the BIS All-Country aggregate debt-to-GDP ratio rose from 243.2% in 2019 to 285.7% in 2020 and has since fallen back to 235.9%.

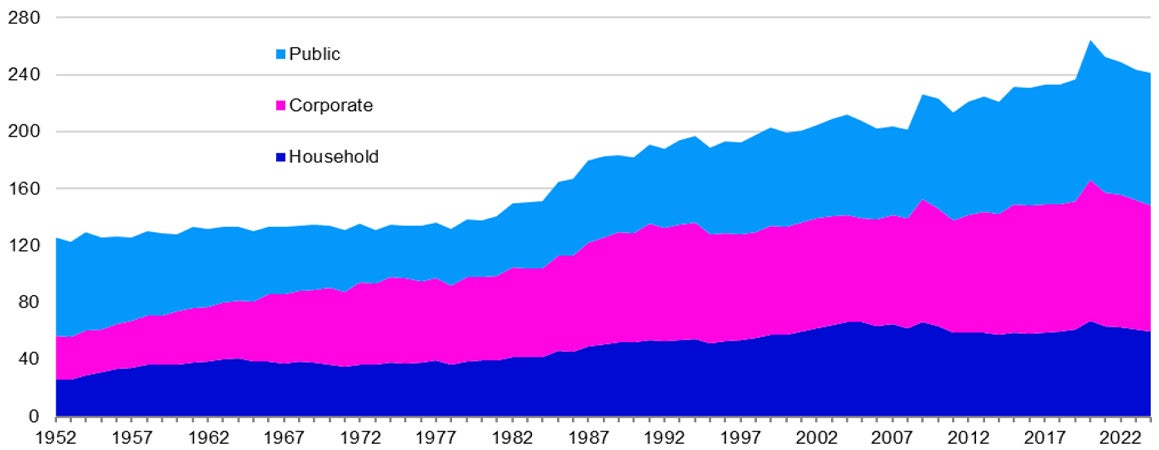

As the BIS All Reporting Countries aggregates only go back to 2002, we have constructed our own global ratio based on the world’s 25 largest economies (judged by GDP in 2019-24), which accounted for 84% of World GDP in 2024, based on IMF data. Figure 1 shows the results and suggests that, after reaching a new high of 264.9% in 2020, the global debt-to-GDP ratio had fallen to 241.4% in 2024 (it was 236.7% in 2019). Our measure is based upon market exchange rates, so we use a smoothing process to dampen the effect of exchange rate swings (see the note to Figure 1).

On that basis, global debt-to-GDP ratios declined in household and corporate sectors in 2024 but climbed in the public sector, though debt increased in all three categories, especially the public sector.

Note: Based on annual data for the 25 largest economies in the world (as of 2019-2024). Data was not available for all 25 countries over the full period considered. Starting with only the US in 1952, the data set was based on a successively larger number of countries until in 2008 all 25 were included in all categories. The data for all countries is converted into US dollars using market exchange rates. Unfortunately, debt is a stock measured at the end of each calendar year, whereas GDP is a flow measured during the year so that when the dollar trends in one direction or the other it can distort the comparison between debt and GDP. To minimise this problem, we use a smoothed measure of debt which takes the average over two years (for example, debt for 2024 is the average of debt at end-2023 and at end-2024).

Source: BIS, IMF, OECD, Oxford Economics, LSEG Datastream and Invesco Global Market Strategy Office

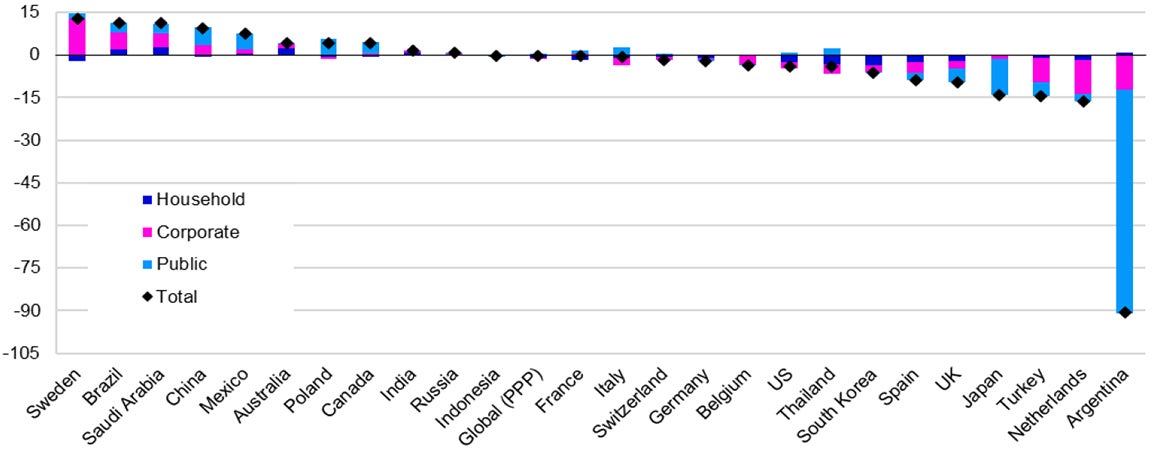

Not surprisingly, given the size of its economy, the biggest contributor to the gain in global debt in 2024 (in US dollars) was the US, with a rise of $2.9trn, followed by China with a gain of $2.4trn. However, Figure 2 shows that the US debt-to-GDP ratio fell by 3.9 percentage points (ppts), while that of China rose by 9.3 ppts. The reason for the discrepancy is that growth in nominal GDP in the US was greater than the growth in debt, while the reverse was true in China (nominal GDP growth was also stronger in the US than in China, when measured in US dollars).

The BIS All Reporting Countries global debt ratio fell by 0.4 percentage points (ppts), with declines in the household and corporate debt-to-GDP ratios offset only partially by a rise in the public sector debt ratio. Total debt ratios increased in 10 of the 25 countries that we follow, with the biggest gains in Sweden, Brazil and Saudi Arabia. Public sector debt played a role in all three, but the rise in corporate debt was the main contributor, especially in Sweden. At the other end of the spectrum, Argentina, the Netherlands and Turkey saw the biggest declines in overall debt ratios, with falling corporate debt a big factor (though in Argentina a reversal of the big 2023 increase in the public sector debt ratio was the dominant factor).

Looking to longer term trends, total debt ratios have risen in the last 10 years. The global debt-to-GDP ratio increased by 14.0 ppts in the 10 years to 2024 when using PPP exchange rates (or 15.8 ppts using market exchange rates). Most of that rise was already in place by 2019. The 10-year rise was largely due to public sector debt, though household and corporate debt ratios were also up.

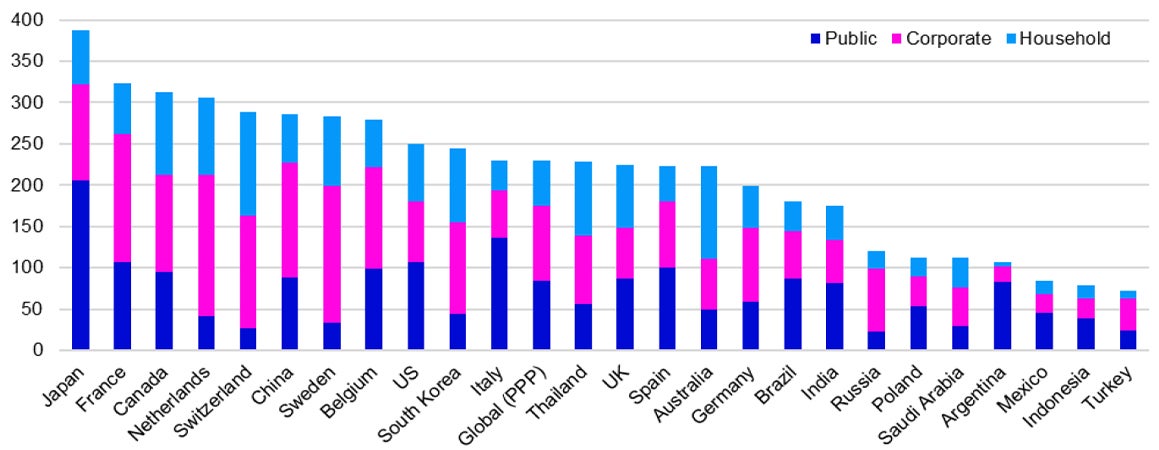

15 of the 25 countries that we highlight experienced a rise in their total debt-to-GDP ratio over the last 10 years, China being the most extreme with a gain of 75.2 ppts to 286.5% (largely due to public sector and household debt), followed by Saudi Arabia with a gain of 63.2 ppts to 111.8% (mainly the result of rising public sector and corporate debt).

The Netherlands (-116.8 ppts) and Spain (-86.9 ppts) experienced the most impressive declines in debt ratios over the last 10 years, with falling corporate debt ratios playing the biggest role in both countries.

So where does this leave accumulated debt across countries? The countries with the biggest debt burdens are to be found in the developed world (see Figure 3), with Japan once again leading the way, though its debt-to-GDP ratio fell once again, to 387.0% in 2024 from 401.1% in 2023 and a peak of 422.5% in 2020, according to BIS data. France is next in line (as last year), while Canada moves from #4 to #3 (switching places with the Netherlands).

At the other end of the spectrum, the three countries with the lowest debt ratios (Turkey, Indonesia and Mexico) were also in the bottom three last year, though Turkey and Mexico have switched places. Otherwise, countries with big moves in the rankings in 2024 are Argentina (from 17th to 22nd) and Italy (from 14th to 11th).

Note: Based on year-end local currency non-financial sector debt-to-GDP ratios. “Global (PPP)” uses BIS “All reporting countries” data, using PPP exchange rates (it is based on a larger sample of countries than is shown in the chart). The change is calculated as the end-2024 debt-to-GDP ratios minus those of end-2023. The countries shown are the 25 largest in the world by GDP, as of 2019-24 (using IMF data). Source: BIS, IMF, LSEG Datastream, and Invesco Global Market Strategy Office

So, despite the angst about debt in some countries, the global picture continues to improve (slowly) after the sharp rise in debt ratios in 2020 and subsequent declines in 2021 and 2022. If economies continue to expand, we would normally expect a decline in debt ratios as public sector expenditure declines and public and private sector revenues increase. Though we expect economic acceleration outside the US, it is hard to be certain in the current environment.

Of course, debt only becomes a problem when debt service ratios increase. The rise in debt-to-GDP ratios during the global financial crisis was easily absorbed because bond yields fell to historical lows in the developed world. However, the sharp rise in yields during 2022/3 may have changed that. Governments have the luxury of being able to use the tax system to increase revenue if debt service ratios increase. The private sector has no such ability (raising prices may damage sales), so it is perhaps more important to focus on the affordability of private sector debt.

China is a good example of how rising debt over the last 10 years didn’t turn into a financing problem, probably because interest rates have fallen. BIS private non-financial sector data shows that China’s debt service ratio (interest payments plus amortisations divided by income) increased by only 0.8 ppts (from 17.7% in 2014 Q4 to 18.5% in 2024 Q4), despite a 26.2 ppt increase in the private sector debt-to-GDP ratio (to 198.1%).

However, interest rates and bond yields have risen in other countries, which could boost debt service ratios, once old debt is refinanced. Over the last three years there were noticeable gains in private sector debt service ratios in Russia (+11.0 ppts to 23.2%), Turkey (+10.3 ppts to 29.6%) and Brazil (+5.9 ppts to 26.3%). The rise in private sector debt service ratios in Russia and Turkey came despite a fall in debt-to-GDP ratios.

Among the 25 largest economies, the only one to enjoy a sizeable decline in the private sector debt service ratio was the Netherlands (-3.9 ppts to 26.4%). This reflects a 57.4 ppts decline in the private sector debt-to-GDP ratio to 264.1%, with the corporate sector accounting for around three-quarters of that (and it also experienced a bigger decline in the debt service ratio than the household sector).

For the most part it is not the household sector that faces high debt service ratios. More problematic is corporate debt and we suppose the biggest threat would be in countries where service ratios are the highest. As of 2024 that list of countries would be France (non-financial corporations debt service ratio of 60.6%), Canada (58.6%), Sweden (52.5%) and the Netherlands (49.8%). For the most part, those are the countries in which corporate sector debt is the most elevated (unfortunately, the BIS does not show the split between household and corporate sector debt service ratios in China or Switzerland).

So, global debt ratios appear to have stabilised but gains have recently been notable in Sweden, Brazil and Saudi Arabia. On the other hand, private sector debt service ratios have climbed in some countries, especially where interest rates have risen sharply.

Note: “Global” uses BIS “All reporting countries” data and is calculated using PPP exchange rates (it is based on a larger sample of countries than is shown in the chart). The countries shown were the 25 largest in the world by GDP, as of 2019-2024.

Source: BIS, LSEG Datastream and Invesco Global Market Strategy Office

Unless stated otherwise, all data as of 11 July 2025.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.