How to beat cash: Fixed income and alternative opportunities

The US bond market has recently experienced quite a bit of volatility – with all bond maturities along the US yield curve having touched 5%.

This development has uncovered some pockets of interesting investment opportunities.

Even though long duration US government bonds and USD cash deposits are generating healthy yields, investors may consider other fixed income assets that could add diversity and potentially higher returns to a neutral asset allocation portfolio, such as emerging market (EM) government bonds, US bank loans and private credit.

Much of this will depend on where the US economy and interest rates head to in the coming months and into 2024.

Outlook on Treasury yields

To sum, my expectation is that the 10yr UST yield is unlikely to trudge significantly higher from current levels because core inflation and growth are likely to decline in the coming months – this is why I favor extended duration.

It’s possible to imagine that the 10-year UST fair value yield over the coming year to be around 4.5%, this comes from adding the real short rate (r*) of 1%, plus a term premium of 1% and expected average inflation of 2.5% for 2024.

A pessimistic assumption that the 10y bond yield could be north of +6% comes from higher inflation, neutral rate and term premia assumptions, which I think are unlikely both on a historical basis and our economic outlook for the coming year.

The 4.5% yield scenario takes into consideration a macro environment which calls for a bumpy landing or mild recession in the 1H of 2024 that would open the door for the Fed to start cutting rates perhaps sometime in the middle of next year.

Another reason why I don’t believe yields are likely to move meaningfully higher, is that the real UST 10yr, which factors in inflation, has recently moved to 2.5%, on-par with it’s historical average over the past 200 years or so.

Investment Implications

Because the global economy continues to decelerate, it makes sense to continue maintaining a fairly defensive posture.

Markets could be entering a period of consolidation among cyclical assets and higher for longer interest rates could pressure equities.

Cash rates are higher than normal and within our Invesco model asset allocation portfolio, we are overweight cash at a 10% maximum allocation.

Bank loans

The recent rise in interest rates have propelled bank loans yields and we prefer bank loans offer better value than high yield bonds (chart).

The bank loans asset class has a cyclical element due to the risk of defaults – our projections show that high current yields offer sufficient compensation for the default risk that we envisage. Once central banks start to cut rates, then HY bonds would become more attractive.

EM soft currency government bonds

I also favour EM soft currency government bonds with generous yields and I believe the USD is likely to depreciate next year with cuts to the Fed’s policy rate around the middle of the year.

I recently wrote about the attractiveness of Indian government bonds, which yields +7% and has recently been included in a major EM bond index.

Private credit

Alternative investments such as private credit are also appealing in a high interest rate environment.

Historically, on an unlevered basis, yields for this asset class ranged from 7.5 to 8.0%1 but over the course of the last 18 months, interest rates have trudged upwards and today, the unlevered yields for direct lending asset class generally range from 12-13%2.

The opportunity set for direct lending in the US continues to remain significant. On the supply side, there are over 200,000 middle market companies in the US that represent one-third of private sector GDP and employ nearly 50 million individuals3.

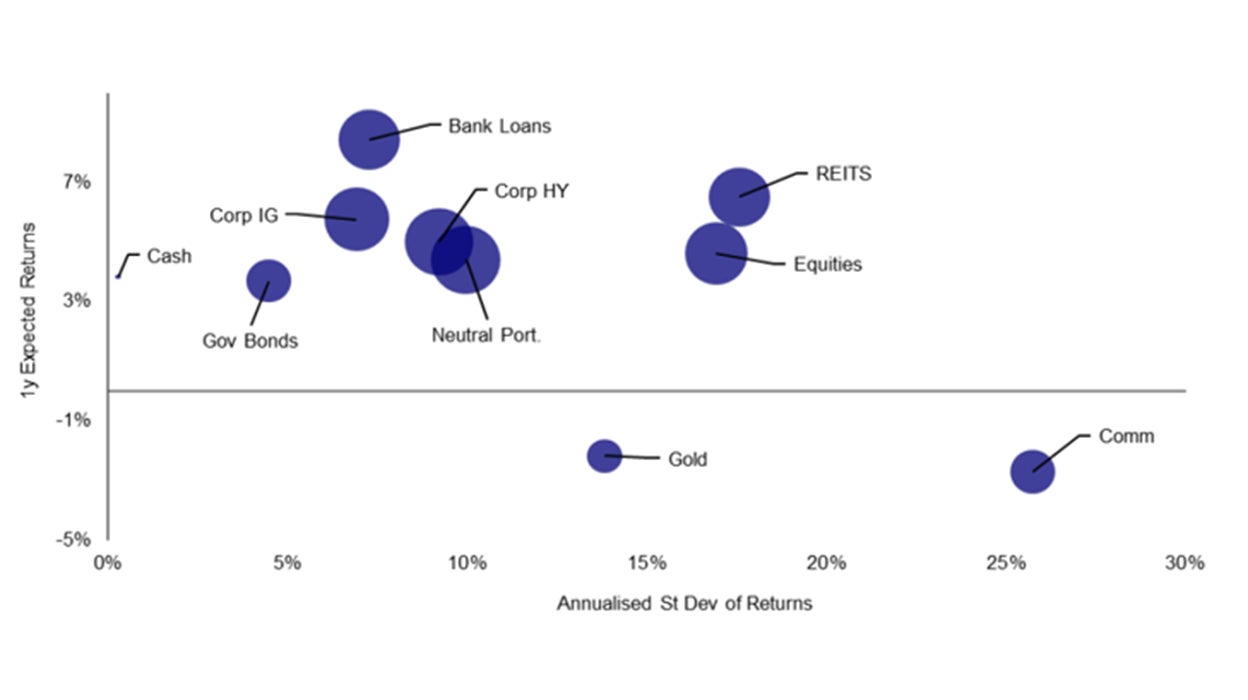

Based on annualized local currency returns. Returns are projected but standard deviation of returns is based on 5-year historical data. Size of bubbles is in proportion to average 5-year pairwise correlation with other assets (hollow bubbles indicate negative correlation). Cash is an equally weighted mix of USD, EUR, GBP and JPY. Neutral portfolio weights shown in Figure 3. As of 31 August 2023. There is no guarantee that these views will come to pass. See Appendices for definitions, methodology and disclaimers. Source: Credit Suisse, ICE BofA, MSCI, S&P GSCI, FTSE Russell, Refinitiv Datastream and Invesco Global Market Strategy Office

Appendix

Asset class descriptions and sources (we source data from Datastream unless otherwise stated)

Cash: returns are based on a proprietary index calculated using the Intercontinental Exchange Benchmark Administration overnight LIBOR (London Interbank Offer Rate). From 1st January 2022, we use the Refinitiv overnight deposit rate for euro, British pound and Japanese yen. The global rate is the average of the euro, British pound, US dollar and Japanese yen rates. The series started on 1 January 2001 with a value of 100.The same data is used to construct historical comparisons (yields within historical ranges, say).

Gold: London bullion market spot price in USD/troy ounce.

Government bonds: Historical and projected yields and returns are based on ICE BofA government bond indices with historical ranges starting on 31st December 1985 for the Global, Europe ex-UK, UK and Japanese indices, 30th January 1978 for the US and 31st December 2004 for China. The emerging market yield and returns are based on the Bloomberg emerging markets sovereign US dollar bond index with the historical range starting on 28th February 2003. The same indices are used to construct historical comparisons (yields within historical ranges, say).

Corporate investment grade (IG) bonds: ICE BofA investment grade corporate bond indices with historical ranges starting on 31st December 1996 for the Global, 31st January 1973 for the US dollar, 1st January 1996 for the euro, 31st December 1996 for the British pound, 6th September 2001 for the Japanese yen and 31st December 2004 for the Chinese yuan index. The emerging market yield and returns are based on the Bloomberg emerging markets corporate US dollar bond index with the historical range starting on 28th February 2003. The same indices are used to construct historical comparisons (yields within historical ranges, say).

Corporate high-yield (HY) bonds: Bank of America Merrill Lynch High-Yield indices with historical ranges starting on 29th August 1986 for the US dollar, and 31st December 1997 for the Global and euro indices. The same indices are used to construct historical comparisons (yields within historical ranges, say).

Bank Loans: We use Credit Suisse Leveraged Loan Indices with historical ranges starting on 31 January 1992 for the US index, 31 January 1998 for the Western Europe Index and 31 January 1998 for the Global Index (the global index is constructed by Invesco Global Market Strategy Office as a weighted average of the US and Western European indices, using market capitalisation as the weighting factor). The same indices are used to construct historical comparisons (yields within historical ranges, say).

Equities: We use MSCI benchmark indices to calculate projected returns and calculate long-term total returns with historical ranges starting on 31st December 1969 for the Global, US, Europe ex-UK, UK and Japanese indices, 31st December 1987 for the emerging markets index and 31st December 1992 for China. Equity index valuations (such as yields within historical ranges) are based on dividend yields using Datastream benchmark indices with historical ranges starting on 1st January 1973 for the Global, US, Europe ex-UK and Japanese indices, on 31st December 1969 for the UK index, 2nd January 1995 for the Emerging Markets index and 26th August 1991 for China. The same indices are used to construct historical comparisons (yields within historical ranges, say).

Real estate: We use FTSE EPRA/NAREIT indices with historical ranges starting on 29th December 1989 for the US, Europe ex-UK, UK and Japanese indices, 18th February 2005 for the Global index, and 31st October 2008 for the Emerging Markets index. The same indices are used to construct historical comparisons (yields within historical ranges, say).

Commodities: Standard and Poor’s Goldman Sachs Commodity Total Return Indices with historical ranges starting on 31st December 1969 for the All Commodities and Agriculture indices, 31st December 1982 for the Energy index, 3rd January 1977 for the Industrial Metals index, and 2nd January 1973 for the Precious Metals index. We refer to oil & gas and industrial metals as industrial commodities