In Focus: AI after DeepSeek

On Monday, 27 January, markets woke up to a panic in a seemingly consensus investment narrative. A little-known Chinese start-up by the name of DeepSeek published a model (named R1) on 20 January that showed cutting edge performance alongside significant efficiency gains. These impressive results challenged the assumption that AI would require ever-greater investment in computing capabilities to power improvements.

AI promises to revolutionize our lives across work and home with the potential for greater economic outcomes. To power this, large technology companies have invested billions of dollars into R&D and infrastructure to support the development of better AI capabilities. Equities of large tech companies, semiconductors designers, and even utilities have benefitted substantially on this theme. So what’s next in AI after DeepSeek?

R1 is reported to have required 50% less in computing costs versus OpenAI’s GPT-4o model while achieving virtually the same performance.1 The directionality of incremental improvements in AI is no longer defined by a linear relationship between cost and performance. Recent model advancements have maintained or improved performance while significantly reducing costs.

We think the AI competitive landscape is changing, with a renewed focus on efficiency and with more entrants into the market. Value capture from the IP of models may be shifting as open source models become more powerful. Yet, with cheaper models, we expect adoption to accelerate, which should maintain demand for computing power and the enables of AI that have so far benefitted from the boom in the technology.

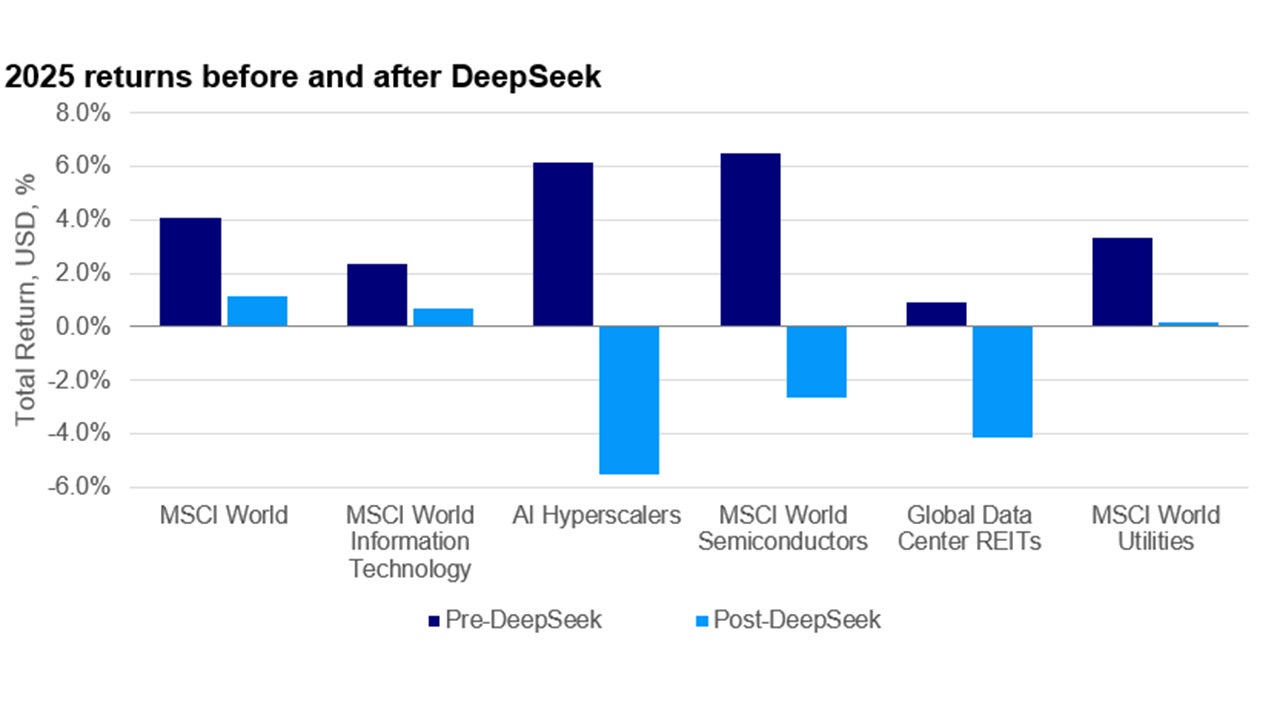

Note: Pre-DeepSeek includes year-to-date returns through 24 January 2025. Post-DeepSeek includes performance from 24 January 2025 to 14 February 2025. “AI Hyperscalers” is a market capitalization-weighted composite of Oracle, Microsoft, Alphabet, IBM, and Amazon. Global Data Center REITs = FTSE EPRA Nareit Developed Data Center Index. Past performance does not guarantee future results. An investment cannot be made directly in an index.

- DeepSeek’s model performance has sent shockwaves through AI-related stocks. Over the past two years, investors have piled into the so-called “picks and shovels” approach to AI, which has included hyperscalers (tech companies with large cloud computing operations), semiconductors, data centers, and utilities. All but utilities have suffered since news of DeepSeek rattled markets.

- Investors are questioning whether the AI narrative is permanently changed. We think there are new wrinkles, but that many of yesterday’s winners remain well-placed to benefit from the theme.

- In particular, we believe that AI adopters should begin to stand out as beneficiaries of this theme as costs fall while capabilities improve.

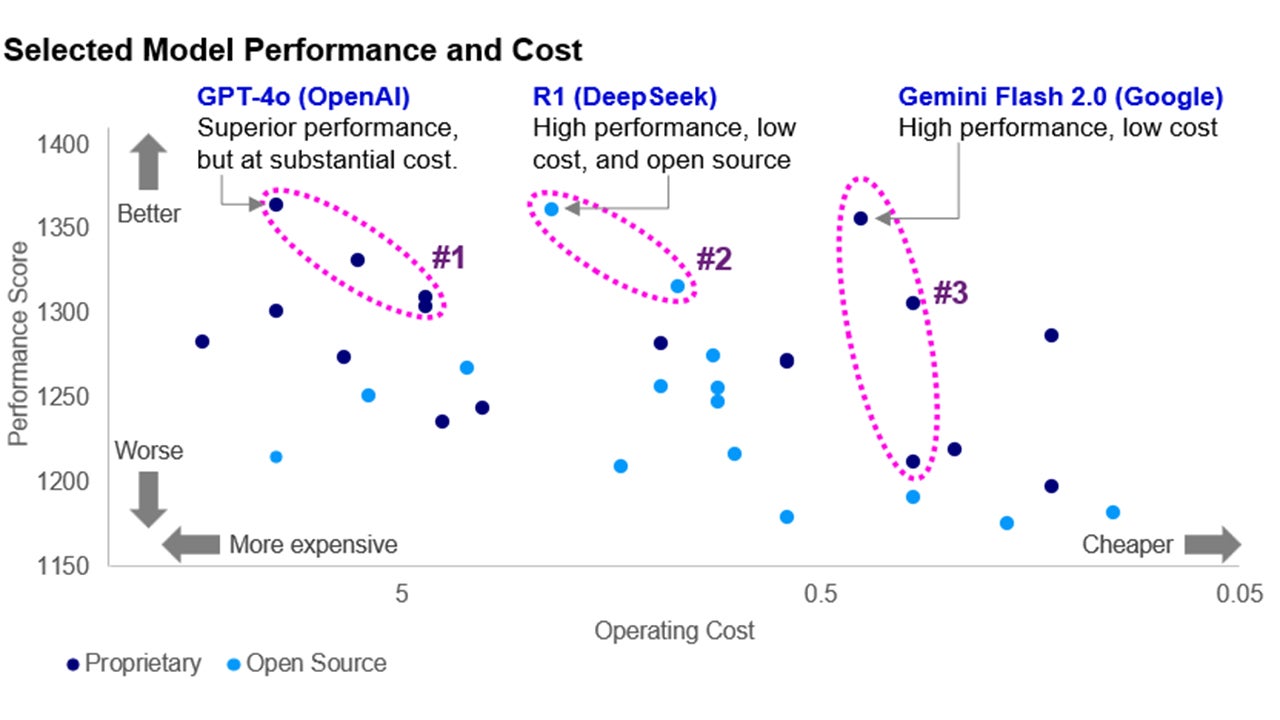

Note: #1 = OpenAI models GPT-40, o3-mini, 01-mini; #2 = DeepSeek models R1 and V3; #3 = Google models Gemini 2.0 Flash, Gemini 2.0 Flash-Lite, Gemini 1.5 Flash-8B. Plotted performance and cost based on available data as of 14 February 2025. Sources: OpenAI, DeepSeek, Google, and various sources via LMSys and Chatbot Arena: An Open Platform for Evaluating LLMs by Human Preference, Chiang et al. Reported Operating Cost = Cost per million tokens, based on output tokens only. Performance Score = elo scores from Chatbot Arena across all modalities and tasks. “Open Source” = Freely accessible to download model for personal or commercial use.

- The AI competitive landscape has been turned on its head with the release of DeepSeek and a step up in offerings from Google. Our key observations:

#1 – OpenAI has focused on a premium approach to AI, with superior performance but at a cost. Their mass market approach may focus on managing costs moving forward.

#2 – DeepSeek has achieved excellent performance, affordable cost, and is from a non-US competitor.

#3 – Google’s models have quickly stepped up performance while managing computing costs. Their latest model, made public in early February, has set a high bar for low cost and performance.

- Recent model releases highlight that the rapid growth of AI computing requirements is slowing. 2023 and 2024 focused on improving capabilities no matter the cost. Now we’re seeing a step-up in efficiency gains—a good thing for future AI adoption.

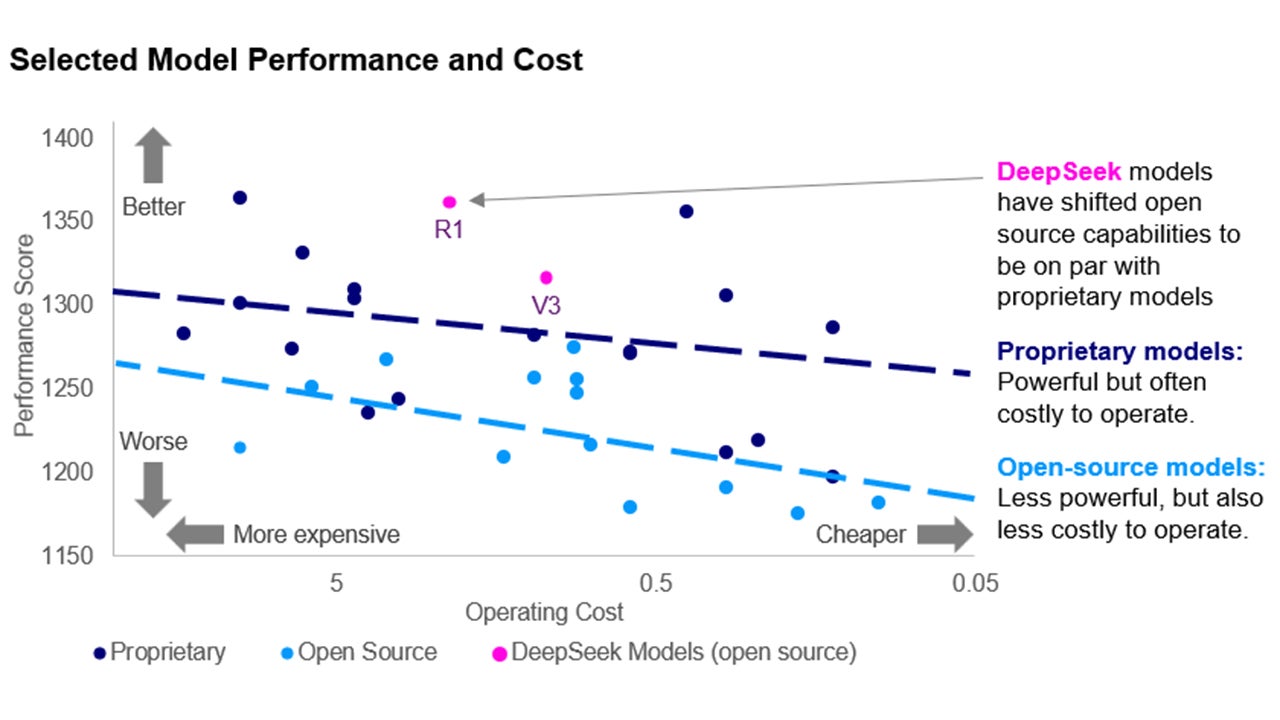

Note: Based on a limited set of models released since 2023. Plotted performance and cost based on available data as of 14 February 2025. Sources: OpenAI, DeepSeek, Google, and various sources via LMSys and Chatbot Arena: An Open Platform for Evaluating LLMs by Human Preference, Chiang et al. Reported Operating Cost = Cost per million tokens, based on output tokens only. Performance Score = elo scores from Chatbot Arena across all modalities and tasks.

- DeepSeek’s impressive results are also notable because the company chose to publish its model open source. In other words, it is free to access and anyone can download and run it on their computer.

- This may indicate a potential shift in value capture in the development of AI models. To date, proprietary models have led the cutting-edge in AI technology, but these models typically require licensing agreements and are more costly (though they come with extra bells and whistles, such as offering dedicated support and often top-of-the-line capabilities).

- However, AI adopters may wish to apply and fine-tune models from the open-source community which are generally less costly and free of licensing and exclusivity agreements. In other words, DeepSeek may be eroding some of the value of AI intellectual property.

Investment risks

Indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. Past performance does not guarantee future results.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.