Japan bond market volatility and monetary policy outlook

Japan’s 10-year government bond yield rose to 1.95% as speculation builds that the Bank of Japan (BOJ) is likely to raise rates when it meets on 18th December. The yield is up 90bps year-to-date and its highest level since 2007.1

BOJ Governor Ueda recently indicated in a speech that the central bank would make an appropriate decision on a potential rate hike at its upcoming policy meeting. Ueda also expressed optimism about Japan’s economic outlook and pledged to weigh the pros and cons of a hike before acting.

Shortly thereafter, Finance Minister Katayama reiterated that the implementation of monetary policy rests entirely with the BOJ. Reports indicate that key members of Prime Minister Sanae Takaichi’s government would not oppose a December hike, though some senior officials remain cautious on timing.

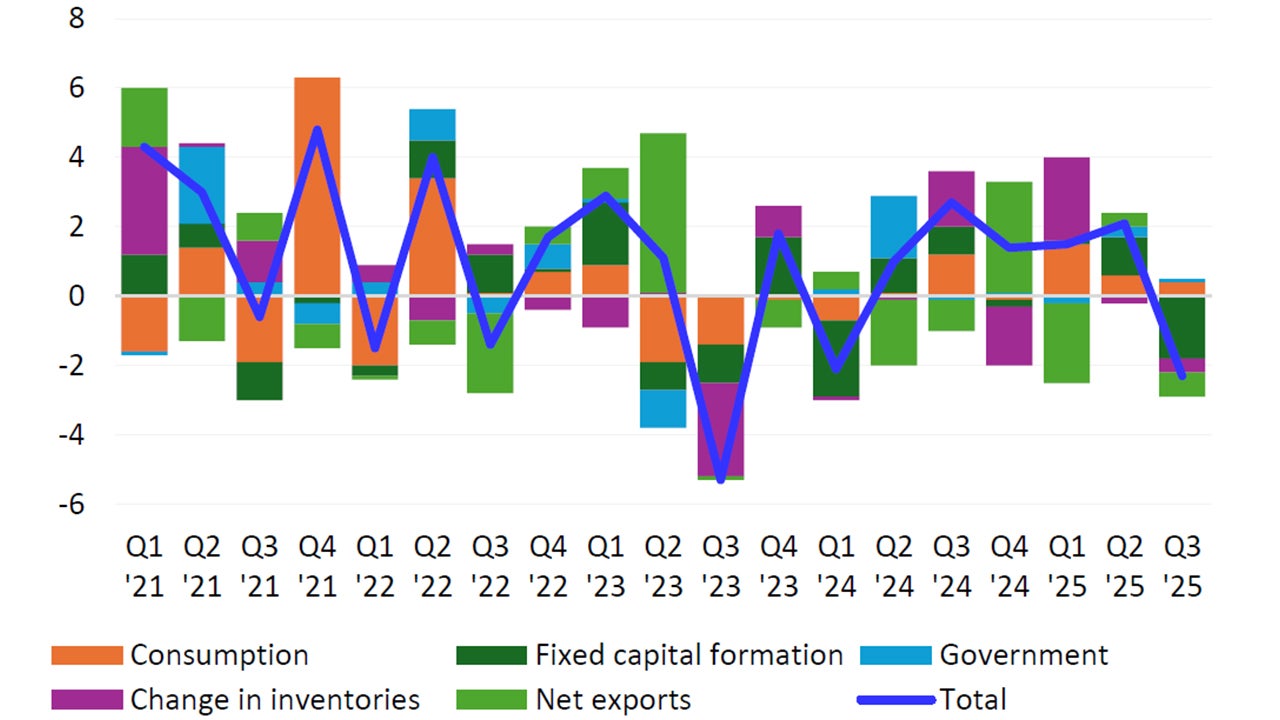

Weak GDP adds complexity to the BOJ’s policy meeting

The latest revised GDP figure shows a -2.3% drop on a QoQ annualized basis, compared to the preliminary reading of a -1.8% decline.2 The weakness was mainly driven by a sharp fall in private residential investment (contracted due to tighter energy-efficiency regulations introduced in April) and a decline in net exports following earlier front-loading.

Source: Japanese Cabinet Office (CAO). Quarterly data as of Q3 2025, as of December 8, 2025.

The weak data point adds some complexity to the BOJ’s policy meeting next week, but it is unlikely to derail its gradual tightening path. On the other hand, it could bolster Prime Minister Sanae Takaichi's push for a large-scale stimulus package.

Still, I believe that one quarter's data doesn't call for a trend and that the declines in housing construction and exports seen in the past quarter are only going to prove to be temporary. Tariff uncertainties are fading and Japanese corporate earnings are improving which should mean that the recovery is likely to regain momentum.

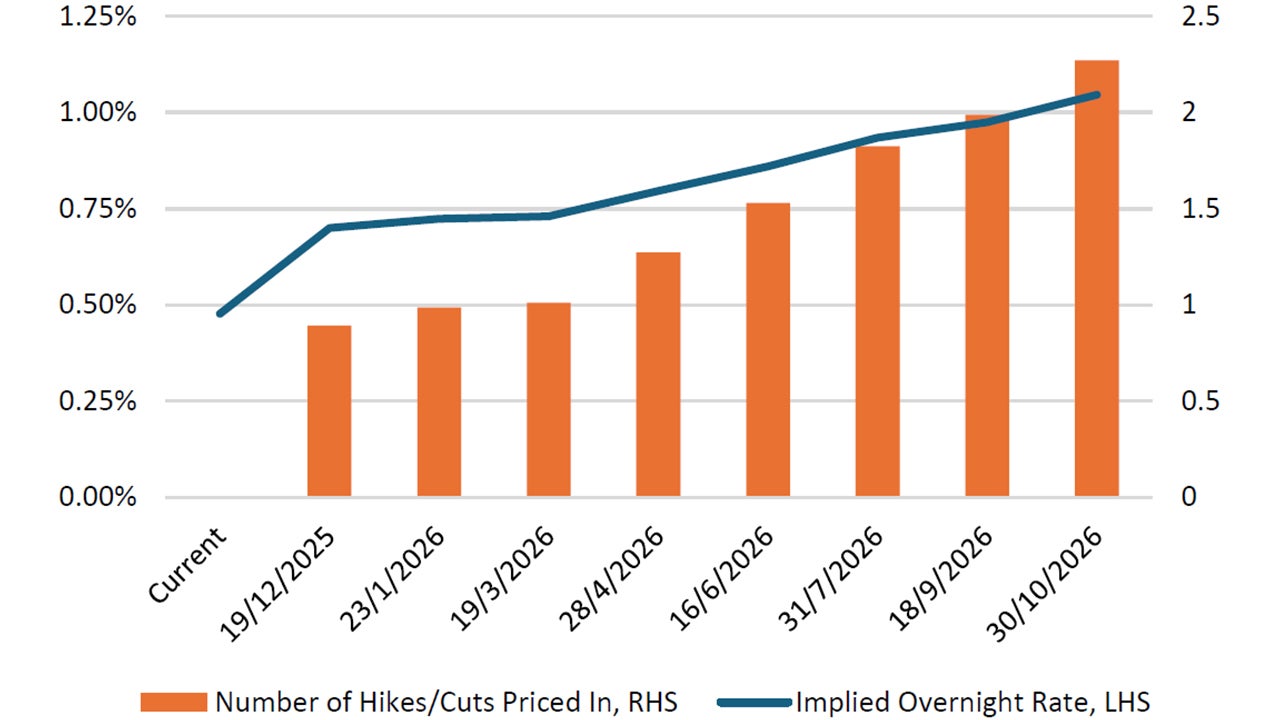

We expect a December rate hike and further tightening in 2026 due to an improving macro backdrop and strong prospects for next year’s spring wage negotiations. Real wages have fallen for ten straight months and are due for a meaningful catch-up while Japan corporate profitability has rebounded in the past year.

Source: Bloomberg. Data as of 9 December 2025. Note: Implied rate based on Overnight Index Swaps pricing.

Prefer equities over bonds

Meanwhile, volatility in Japan’s long-term government bond market is expected to remain elevated in the near term as markets fret over Prime Minister Takaichi’s jumbo stimulus plan and whether the private sector could absorb the JGB issuance to finance it.

We are not too worried that this plan will negatively impact Japan’s fiscal position. The Japanese economy is set to reflate in the coming year boosted by fiscal stimulus and better domestic consumption. Thus, we prefer equities over bonds.

Rate hikes could also boost financial stocks such as banks as they can command higher lending rates and also provide a floor to a very under-valued currency.

With contribution from Tomo Kinoshita & Thomas Wu.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.