Japan bond yields surge as fiscal risks rise

Prime Minister Takaichi’s plan to cut taxes while significantly increasing government spending has ruffled bond investor’s feathers.

The yield on the 10‑year Japanese government bond has risen from 2.18% on January 16 to 2.35% by January 201, a sizable move for what is considered one of the most stable and safe assets in the world.

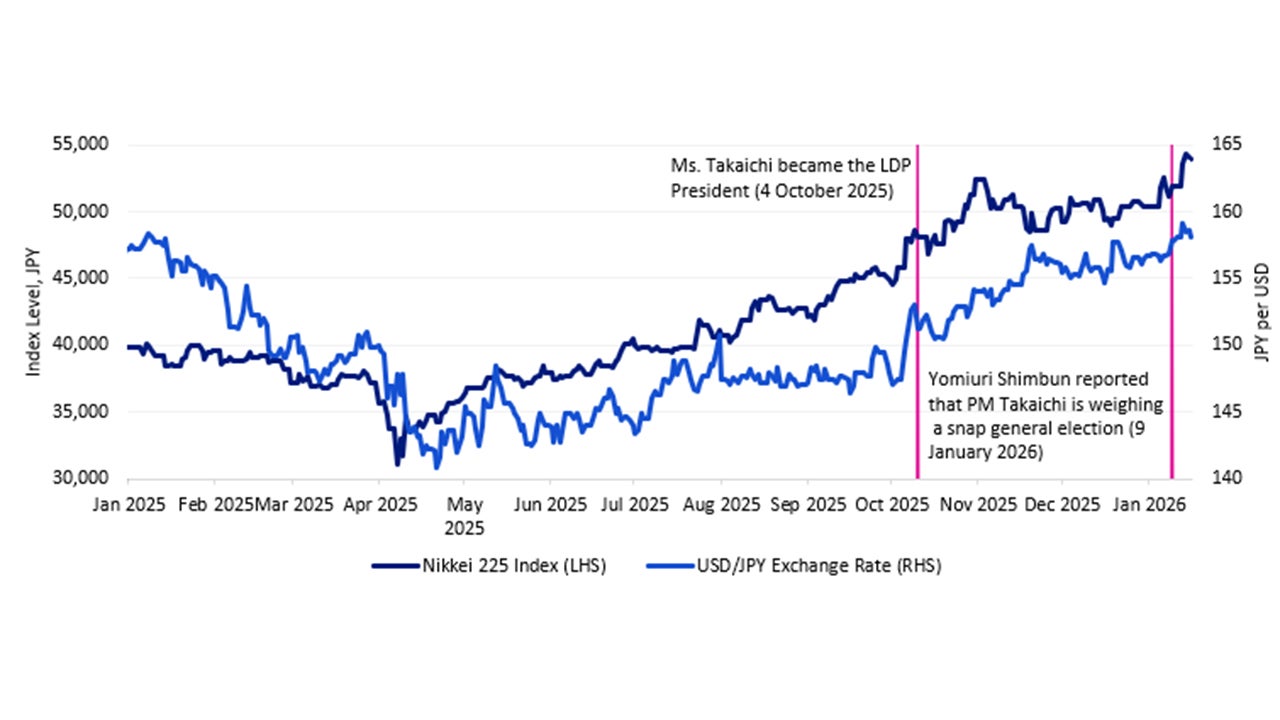

PM Takaichi’s plan to reflate the economy in 2026 is very positive for Japanese equities and the JPY, less so for Japanese government bonds.

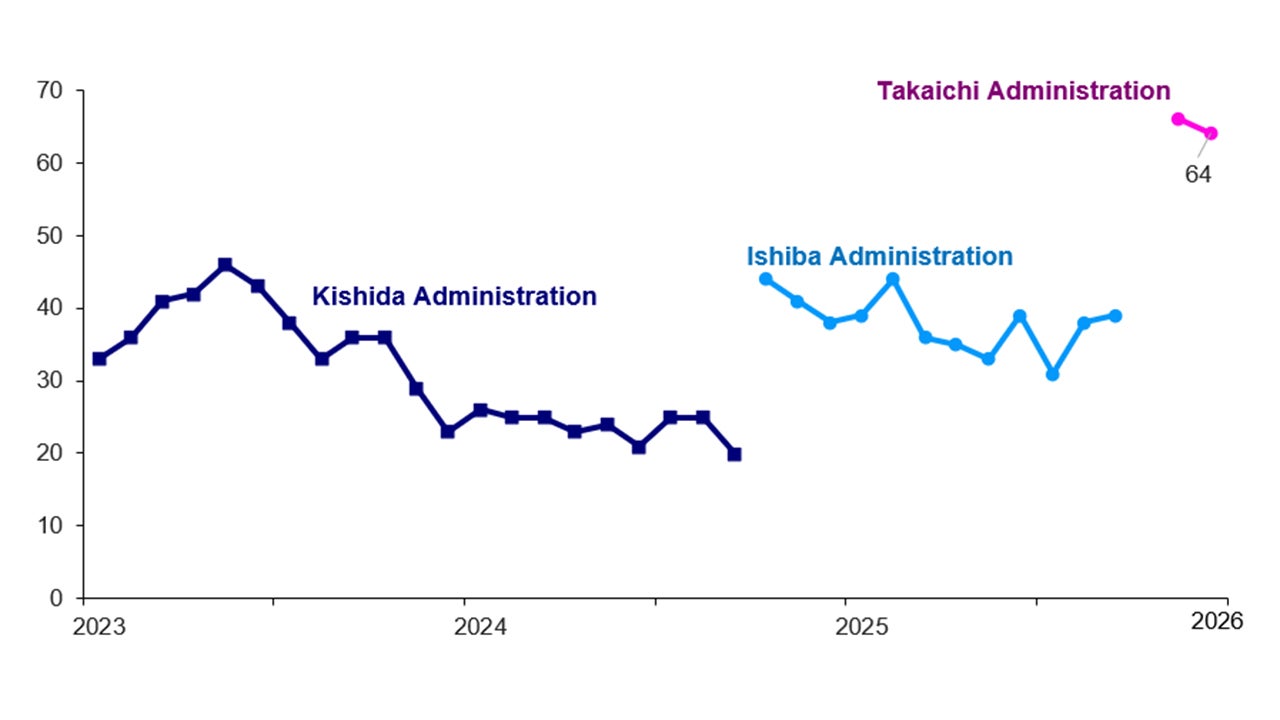

PM Takaichi calls a snap election to garner more political support

Riding high on public opinion, PM Takaichi decided to dissolve the Lower House of Parliament on the evening of January 19 in hopes of garnering more political support in the upcoming general election.

Source: Invesco from NHK. Daily data as at 10 January 2026.

In conjunction with this announcement, PM Takaichi also unveiled an election pledge to reduce the consumption tax on food - from the current 8% to zero - for the next two years.

The cost of eliminating this tax is estimated at around ¥5 trillion per year, equivalent to roughly 0.8% of Japan’s 2024 GDP.2 With no clarification on how the proposed tax cuts would be financed, the prevailing assumption is that the government would have to issue more bonds.

Moreover, the widely held perception is that a temporary tax cut on food would be politically difficult to reverse after two years. If these tax cuts do indeed become permanent, they will weigh on Japan’s fiscal situation. Already, Japan’s gross government debt stands at 229.6% of GDP at end‑2025.3

Thus, concerns over the Japan’s future fiscal health has led to an upwards trudge in long-term yields, which exacerbates fiscal pressures even more through higher debt-servicing costs.

Outlook – Market attention is likely on potential stabilization measures

At present, it appears unlikely that PM Takaichi will roll back its proposal to cut the consumption tax. Consequently, near‑term market attention is likely to focus on potential stabilization measures that may be announced by the Ministry of Finance (MoF) or the Bank of Japan (BoJ).

Possible options include buybacks of long‑term government bonds by the MoF, as well as adjustments to the BoJ’s quantitative tightening (QT) policy.

There is a possibility that at the Monetary Policy Meeting scheduled for January 22–23 the BoJ could slow the pace of balance‑sheet reduction which should stabilize the JGB market though carry the risk of further yen depreciation.

Looking further ahead, the outcome of the House of Representatives election scheduled for February 8 will be a key driver.

Once the election outcome is known and the post‑election governing structure and policy direction become clearer, the government bond market is expected to move gradually toward stabilization.

Investment implications – A constructive view on Japanese equities and Japanese Yen; cautious on Japanese government bonds

Our constructive view on Japanese equities remains intact. In 2026, Japan’s economy is expected to experience a recovery in domestic‑demand‑led growth, supported by a return to positive real wage growth as inflation pressures ease.

This improvement in the macroeconomic backdrop should provide a favourable environment for equity performance.

In stark contrast to Japanese bond investors, Japanese equity investors cheered Prime Minister Takaichi’s decision to dissolve the Lower House and resulting policies to reflate the economy.

By contrast, a more cautious investment stance is warranted toward Japanese government bonds, given the risk that long‑term interest rates may continue to rise.

With respect to the yen, we maintain the view that the ongoing narrowing of the Japan–US interest‑rate differential - reflecting expectations of Federal Reserve rate cuts alongside further policy normalization by the Bank of Japan - will continue to support appreciation of the Japanese currency.

Source: Invesco from Bloomberg. Daily data as at 16 January 2026. Past performance does not guarantee future results. An investment cannot be made directly into an index.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.