Japan election update and market implications

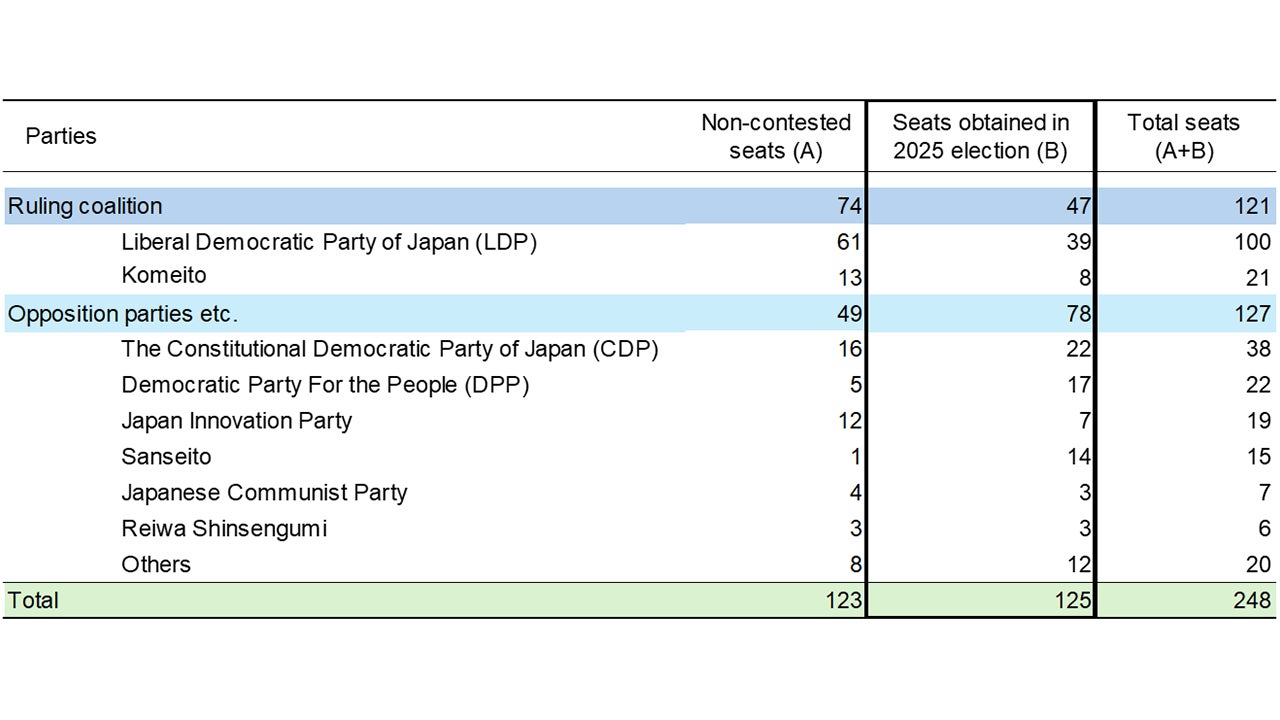

In Japan’s Upper House election on July 20, the ruling coalition of the Liberal Democratic Party (LDP) and Komeito secured 47 seats, a sharp decline from the 66 they previously held. As anticipated by markets, the coalition has now lost its majority in the Upper House—mirroring its earlier loss in the Lower House—and marking a pivotal shift in Japan’s political landscape. This development enhances the influence of opposition parties in shaping policy.

Source: Invesco from NHK. Data as at July 21, 2025.

Despite Prime Minister Ishiba’s insistence that he will not resign, internal pressure within the LDP is mounting. There is a real risk of a change in prime minister or even coalition membership that could unsettle markets as political uncertainty mounts.

This heightened uncertainty could complicate the policy environment and weigh on investor sentiment. Moreover, the increased political fragility is likely to constrain the Bank of Japan’s ability to tighten monetary policy in the near term, as it may be reluctant to add further pressure to an already volatile landscape.

The election outcome is also likely to shape the direction of Japan’s fiscal policy. Opposition parties are advocating for consumption tax cuts to support households, while the ruling LDP-Komeito coalition favors fiscal discipline and a one-off targeted cash transfer. This divergence underscores the growing policy uncertainty and the potential for a more expansionary fiscal stance if opposition influence continues to rise.

Investment Implications

The election results have far-reaching implications for Japan’s macroeconomic policy landscape—spanning fiscal strategy, political stability, and the Bank of Japan’s monetary policy path and the result is highly consequential for financial markets and investor sentiment.

With many opposition parties favoring aggressive stimulus, inflationary pressures could begin to re-emerge, further complicating the Bank of Japan’s policy outlook. While a looser fiscal stance could provide support for equities, it could also raise concerns about fiscal sustainability, potentially pushing long-term interest rates higher and strengthen the Japanese Yen. Investors should closely monitor Japan’s financial markets following the national holiday on 21 July 2025.

Investment Risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.