2026 Investment Outlook – Japan Equities

Key Takeaways

- Historic market rally: Japanese equities surged in 2025, with both the TOPIX and Nikkei 225 indexes hitting a record high, accelerated by optimism around Prime Minister Sanae Takaichi and her pro-growth policies.

- Macro tailwinds for 2026: Wage growth and stronger household consumption are expected to bolster domestic demand, supporting GDP growth and paving the way for Bank of Japan (BoJ) policy normalisation.

- Corporate governance reforms: Over a decade of reforms continues to gain traction, with the Tokyo Stock Exchange and Japanese Financial Services Agency (FSA) cooperating, likely enhancing profitability, capital efficiency and long-term equity performance.

- Shift from narrow trades to broader opportunities: After AI- and semiconductor-led rallies dominated 2025, market rotations are expected to broaden in 2026, favouring companies with solid fundamentals across diverse sectors.

- Long-term positive outlook: Sustained corporate governance reforms improving capital allocation, and real wage growth bolstering domestic demand, underpin our constructive view on Japanese equities, potentially offering attractive opportunities for active investors.

Japanese equity: Staged a historic rally

The Japanese equity market staged a strong rally this year, with the TOPIX index surpassing 3,0001 and the Nikkei 225 index exceeding 50,0002 for the first time. The rally was fuelled by optimism around Sanae Takaichi, the first female leader of the Liberal Democratic Party (LDP) and Prime Minister (PM) of Japan. Soon after her inauguration, she manoeuvred major international challenges, including US President Donald Trump’s visit to Tokyo, and significantly increased her cabinet’s approval rating.

Currently, the market has priced in much of the best-case scenario of her pro-growth agenda, dubbed “Sanaenomics”, including accommodative fiscal and monetary policies to stimulate domestic demand, combined with strengthening Japan’s industry competitiveness and defence capabilities under the stable government, in our opinion. For investors, the key question for 2026 is whether these policies can be implemented effectively.

Macro tailwinds for 2026: Real wage and domestic demand growth

On the macroeconomic front, while the influential “Shunto” spring wage negotiations delivered notable nominal pay rises for two consecutive years, real wage growth has lagged behind our initial expectations. This is primarily due to inflationary pressure, particularly from food prices led by rice, a staple in Japan. In fact, Japan recorded the highest inflation among the developed economies from late 2024 through the first half of 2025. The good news is that inflation has recently started to ease, with rice prices peaking.

Note: Monthly data. The period is from January 2017 to August 2025. The consensus forecast is for September 2025 and beyond, as of October 15, 2025, according to Bloomberg's tally.

Source: Created by Invesco from CEIC and Bloomberg.

Meanwhile, despite inflationary pressures, household consumption has gradually but steadily increased, contributing to Japan’s GDP growth and signaling the emergence of wage increase expectations. In the near term, policy support remains in place as Samaenomics prioritizes anti-inflation measures until real wage growth materializes, which are unlikely to be blocked by opposition parties. In the long term, given the resilience of recent Japanese corporate earnings despite the US tariff increases, combined with a severe labor shortage as the boost from rising elderly and female workforce participation fades, we expect a long-awaited wage-price cycle to finally take root, reviving domestic demand and sustaining household consumption to bolster Japan’s economic growth in 2026. This is likely to allow the Bank of Japan (BoJ) to resume the monetary policy normalisation, although the pace has been slower than expected amid rising political uncertainty in both Japan and the US.

Corporate governance reform: More than a decade of transformation

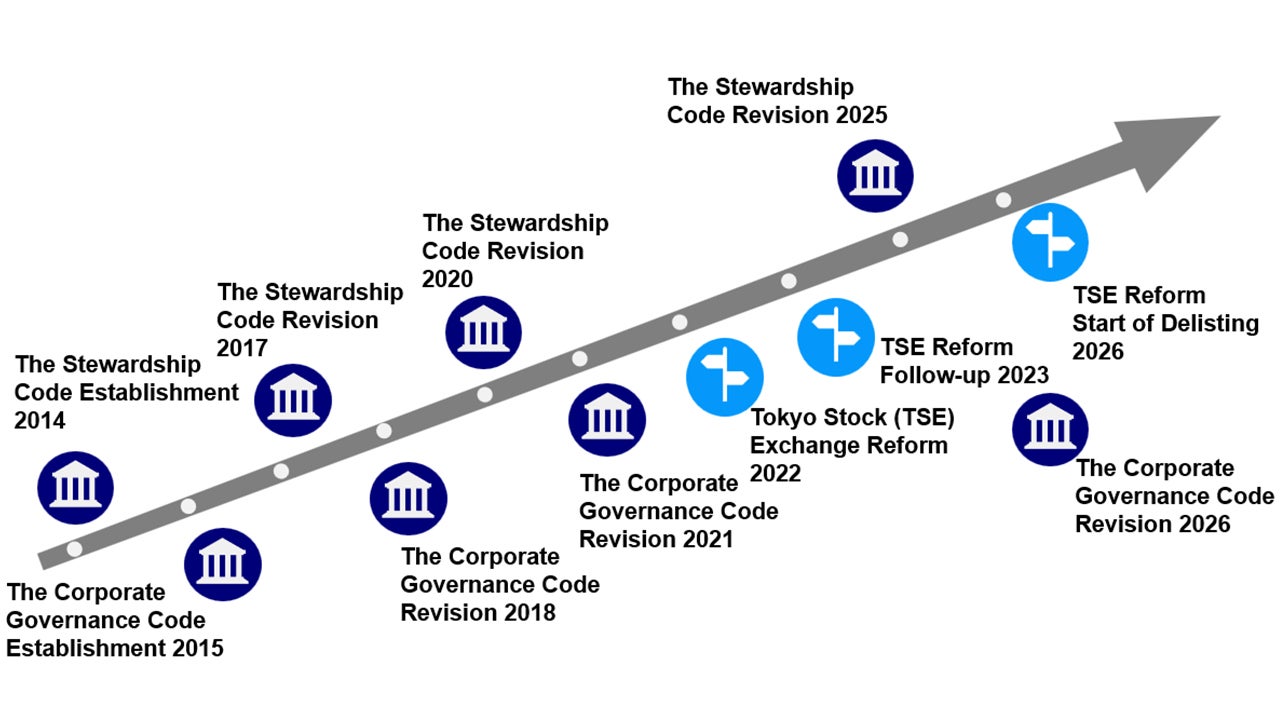

Corporate governance has been advancing for over a decade, since Japan introduced the Stewardship Code in 2014 and the Corporate Governance Code in 2015. In terms of capital market practices, since 2023, the Tokyo Stock Exchange (TSE) has intensified its market restructuring efforts to promote capital efficiency and improve stock price among listed companies. These efforts initially focused on the Prime and Standard markets.

From 2025, the TSE entered the second phase, shifting its focus to the functionality of the Growth Market listing start-ups and high-growth companies. The exchange also ended the transition measures introduced in 2022 for companies failing to meet the listing requirements.

In 2026, the TSE will take the final step in its restructuring plan by initiating the delisting procedures for companies that have not made sufficient improvements.

In alignment with the TSE, the Japanese Financial Services Agency (FSA) finalized the third revision of Japan’s Stewardship Code this year to strengthen engagement effectiveness and accountability. The FSA plans to revise Corporate Governance Code next year, with key agenda items including effective capital allocation and better utilization of cash for investment.

We expect the continued progress in corporate governance to drive improved capital efficiency and profitability, underpinning the long-term performance of Japanese equities.

Source: Japan Exchange Group, Japan’s Financial Services Agency, October 31, 2025.

Active investment implications: From narrow trades to broader opportunities

Since April, amid top-down, theme-driven factors such as US trade policy reversals following US President Donald Trump’s reciprocal tariff announcements, expectations for Federal Reserve rate cuts and an AI-driven investment boom, narrow trades concentrated in AI and semiconductor-related stocks led the market gains in Japan. Foreign investors returned to Japanese equities and market enthusiasm surged following Takaichi’s victory in the LDP leader and PM election in October.

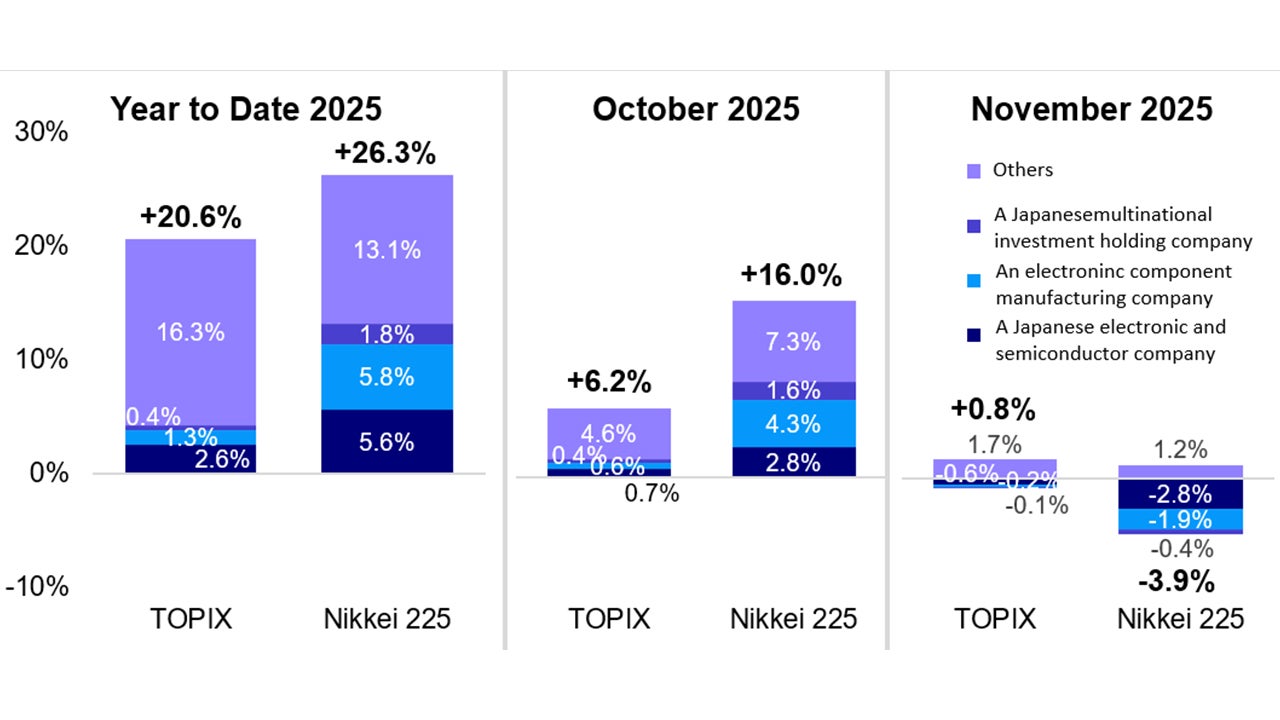

The Nikkei 225 index, a price-weighted index with greater exposure to high-priced AI and semiconductor production equipment (SPE) stocks, outperformed the broader TOPIX index, with just three companies - a Japanese multinational investment holding company, an electronic component manufacturing company and a Japanese electronics and semiconductor company - accounting for more than 50% of Nikkei Index returns. In November, however, we started to see unwinding of these crowded, narrow trades.

Source: Nomura Securities, based on JPX Market Innovation & Research, and Nikkei data, as of November 14, 2025.

After witnessing the extreme rallies this year, we expect market rotations to broaden beyond top-down themes, with investors shifting their focus towards individual company fundamentals. This suggests that investment opportunities in 2026 are likely to emerge among stocks with robust company-specific long-term earnings prospects across sectors once again.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.