Key takeaways from China’s April economic data

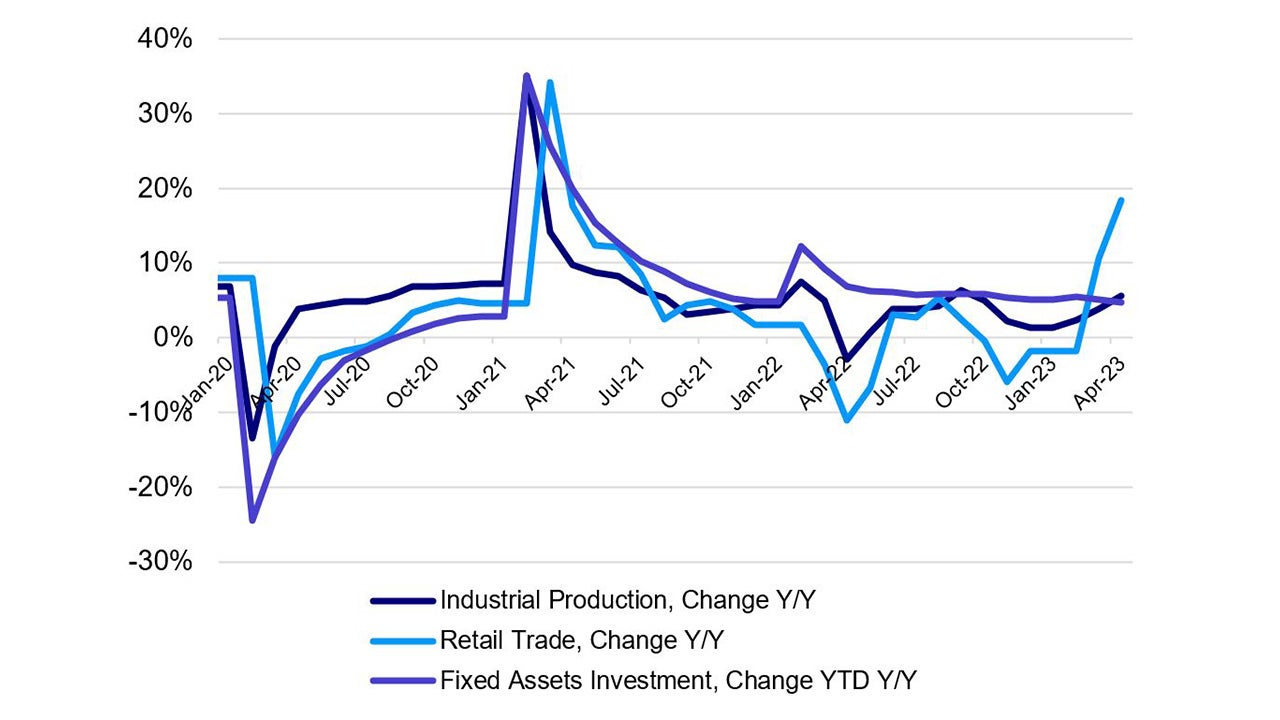

April’s monthly economic data show China’s economic rebound has lost a bit of steam as the global environment remains challenging and domestic demand is still relatively weak.1

The silver lining in the soft data could mean further policy support. We expect a near-term cut in the RRR (the amount of capital that the PBOC requires banks to hold) though further cuts in the loan rate are unlikely. This could be the next positive catalyst that investors look forward to.

- Industrial Output +5.6% y/y (vs cons 10.9%)

- Retail sales +18.4% y/y (vs cons 21.9%)

- Fixed Asset Investment +4.7% YTD y/y (vs cons 5.7%)

Our take

While the numbers showed impressive y/y growth, most of it has been due to low-base comparisons (Shanghai lockdown and strict COVID controls started in March of last year) so a m/m or multi-year average could be more accurate – which shows that growth impulse is slowing a bit.

The industrial production miss is a clear indication of softening global macro demand. Industrial production has been a key driver of China’s growth over the past couple of years though this propeller could start to slowdown as Western economies face greater growth headwinds for the remainder of the year.

Earlier trade data had revealed an exports value decline from China to major trading partners in sequential terms, indicating that the momentum in industrial production could well slow further.

April’s retail sales showed strength in jewelry, hotels and restaurants sales. These are the covid-sensitive sectors that were more heavily impacted by lockdowns last year.

The consumption data confirms what we saw through the long golden week holiday – an upwards trend in services sales while goods sales lag somewhat, much like what we are witnessing in major economies post reopening.

A possible RRR cut

The PBOC pumped 125bn through the medium-term lending facility, which is 25bn more than the amount maturing in May, though they kept the 1-year loan rate at 2.75% for 9 straight months; this suggests that the PBOC remains supportive via other tools other than interest rates.2

We think the PBOC is set to cut to the RRR rates soon because of the combination of decelerating credit growth and muted inflation in April.

Youth unemployment rate remains key since 11.58mn students are expected to graduate university and college this year; this rose to 20.4%, the highest on record, so the PBOC is unlikely to cut loan rates but possibly the RRR.3

Weak investment

While residential property sales have improved, property investment declined -6.2% YTD y/y which is worse than the -5.8% YTD y/y a month prior. Property investment is a leading indicator, and the deterioration doesn’t bode well for the all-important sector trying to find a bottom.4

The residential property market showed some signs of improvement in the first quarter of this year, though the most recent property investment data shows that the market has recently deteriorated again.

Manufacturing investment also inched down to 6.4% YTD y/y, likely in part due to weaker profitability and an uncertain outlook.5

More proactive measures are expected

Policymakers are apt to focus their efforts on improving consumer and private business sentiment. Their tone strikes as erring on the cautious side and we expect they will likely react more proactively going forward.

Chinese equities traded lower, though initial movement was inconsistent as market participants digested the full implications of a dataset coming off a low base.

Source: National Bureau of Statistics (NBS). Data as of April 2023.