Key Takeaways from China’s Q4 Economic Data

China’s economic growth softened at the end of 2022 due to COVID disruptions, though the slowdown wasn’t as severe as market participants anticipated.

Today’s better than expected economic print confirms my views that growth and corporate earnings could surprise on the upside to beat expectations in 2023 and that investors should continue to embrace China’s reopening, as the single most important catalyst for APAC markets in 2023.

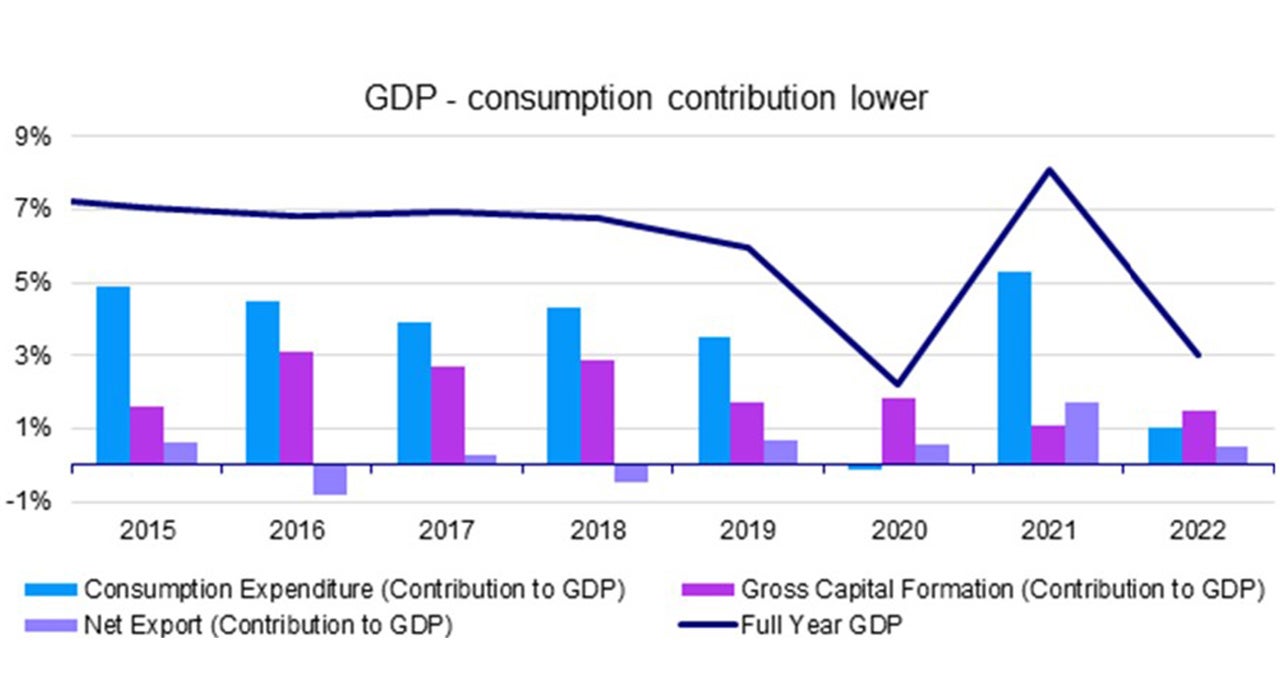

Quarterly GDP grew at 2.9% y/y (vs cons 1.6%). Overall growth for 2022 clocked in at 3.0% y/y (vs cons 2.7%) though well below the government’s official target of 5.5%.1

Source: China National Bureau of Statistics (NBS). Data as of 2022.

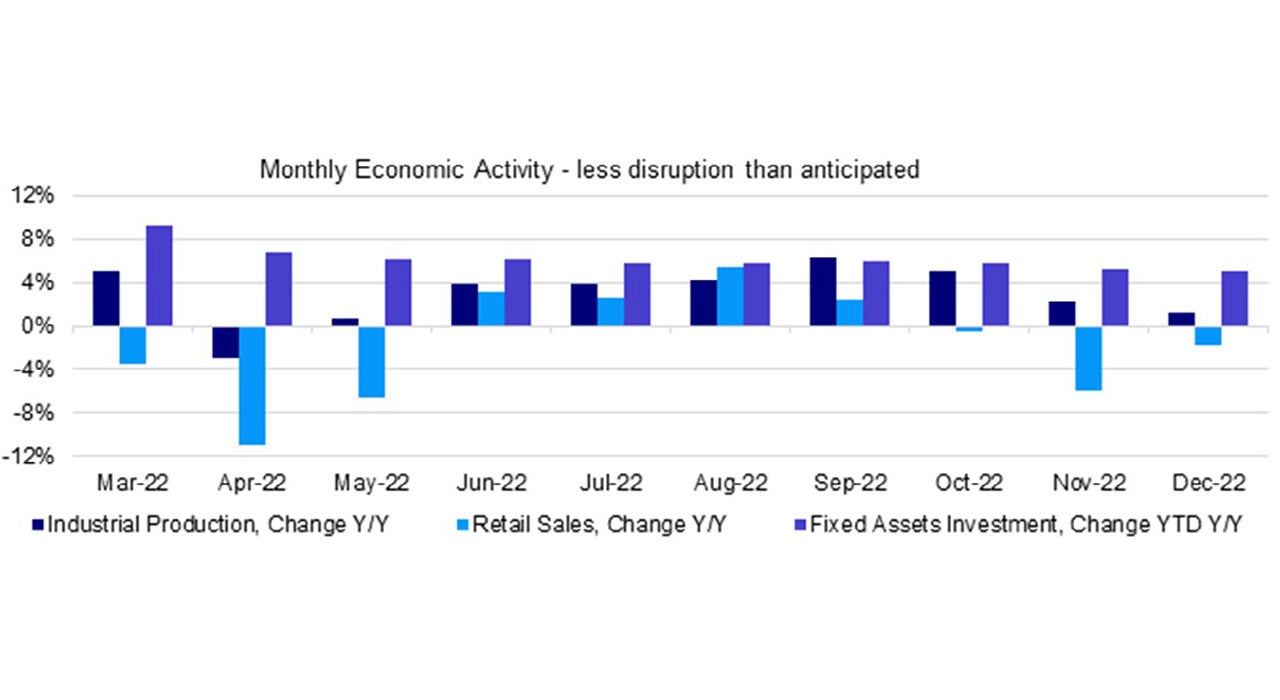

Monthly data such as industrial production and fixed asset investments grew 3.6% y/y and 5.1% y/y respectively, in line with expectations.1 The big surprise for the month came from retail sales, which only fell -1.8% in December compared to expectations of -9.0% y/y.1 The retail beat came from surprisingly strong auto sales and medicine.

December monthly data was surprisingly resilient. Though one month’s data doesn’t make a trend, it’s apparent that market fears of significant COVID disruptions have been misplaced.

Source: China National Bureau of Statistics (NBS). Data as of December 2022.

Outlook

It’s still possible that China’s abrupt reopening at the end of 2022 could lead to near-term economic disturbances. Still, today’s print shows that once this infection wave passes, it’s undeniable that the Chinese economy is likely to experience a meaningful, albeit gradual, consumption-led rebound as pandemic restrictions permanently fade away.

While official statistics on COVID cases are a remnant of the past, several academic projections suggest that the wave’s peak may occur sometime in January – February. It’s even possible that infections have already peaked.

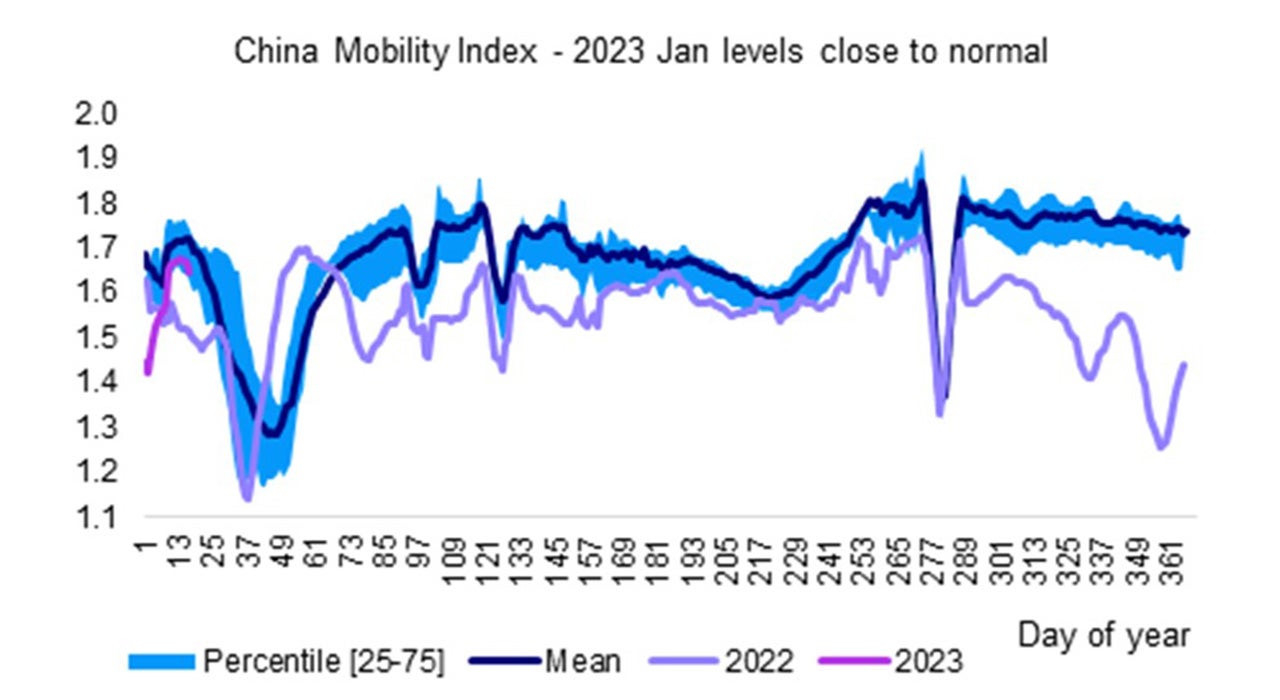

Instead, other high frequency metrics such as mobility tracking and weekly commercial activities could be a more accurate indicator to predict when to expect a post-wave recovery. The traffic congestion index in major cities in China already show a pickup for the first week of January. Auto sales volume and new homes sales have both ticked up over the past few weeks while Baidu search frequencies for COVID-related keywords have been replaced with reopening-related keywords.

Source: China Ministry of Transport. Data as of 16 January 2023.

Chinese consumer holds the key to economic recovery

The single most important driver for China’s economic recovery this year will come from the Chinese consumer. Since the pandemic began in 2020, domestic consumption has been consistently below trend and been a drag on the overall economy’s growth rate.

The reimposition of lockdowns in the Spring of 2022 was what really led to a collapse in consumer confidence and household expectations. The NBS survey shows consumer confidence plunged after the Spring 2022 and it could take a few more months before confidence starts to recover.

A key ingredient to the consumption-led recovery is the excess savings that Chinese households are sitting on. Amassed during the pandemic, this pile of cash - around RMB 2trn in excess savings from last year while bank deposits have growth by almost 50% since the start of the pandemic.

It’s likely that they will start to spend this stockpile as sentiment improves on discretionary items and put some capital to use in the property market or other assets such as the domestic stock market.

Investment Implications

Even though certain China indexes have already moved significantly, I believe that there’s still room for upside especially for onshore stocks – as policymakers roll out additional growth-boosting measures to support the economy and especially for the all-important property market.

It’s also becoming clear that we are almost completely out of the regulatory woods for many industries – as the government prioritizes stabilizing growth for the coming year.