Potential US government shutdown

September 30th is the deadline for the US Congress to pass a spending bill in order to avoid a government shutdown. I take comfort in knowing that previous US government shutdowns have tended to be resolved expediently with very little impact to markets.

Let me first point out that the risks from the government shutdown should not be conflated with the debt ceiling risks, the latter being much worse.

Failure to raise the debt ceiling would have been a disaster because the US government wouldn’t have enough money to pay its bills. A government shutdown means 12 federal agencies would have to stop providing non-essential services.

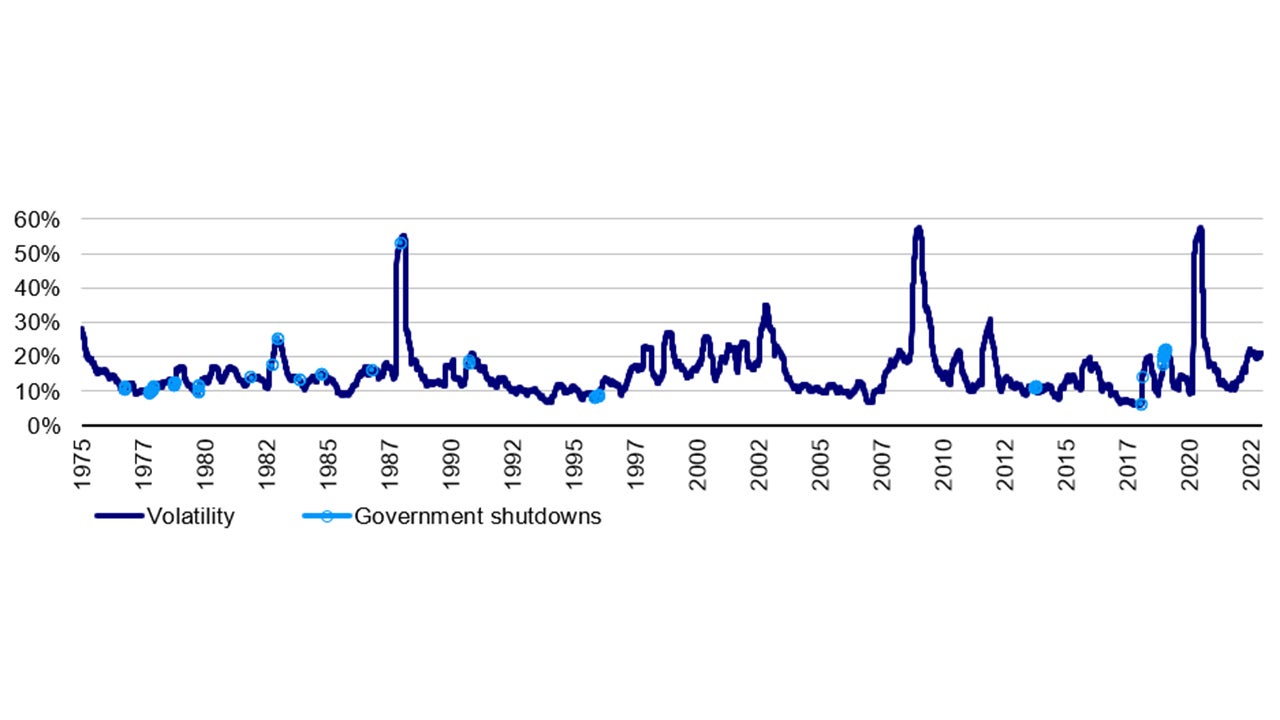

Still, the main risks to a government shutdown would be a period of policy uncertainty, which normally increases market volatility.

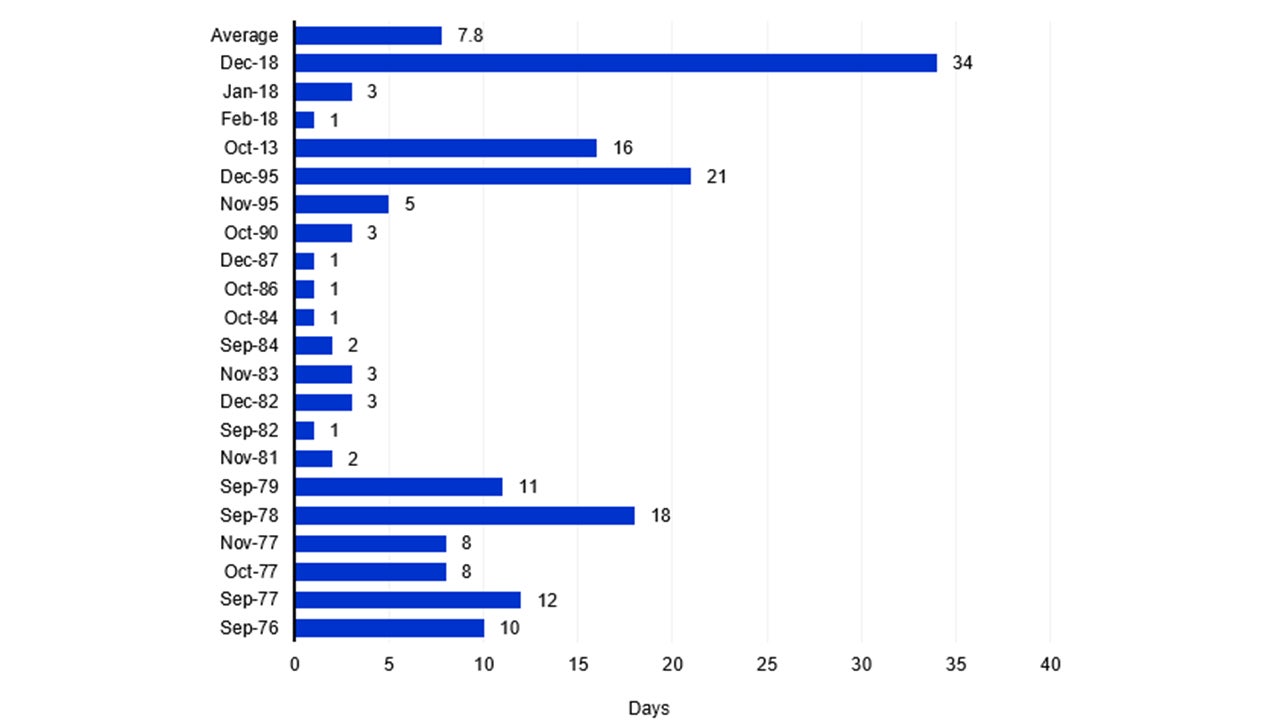

Firstly, government shutdowns are relatively common and tend to be resolved quickly.

Source: US Treasury, 31 Aug 2023.

There have been 21 government shutdowns in US history. They’ve been resolved, on average, within eight days.

Secondly, essential services operate during government shutdown including, air-traffic control, border patrol, federal prisons, power grid, mail delivery, disaster relief, food-safety inspections, military, and tax collection.

Seniors continue to receive Social Security and Medicare benefits. Veteran and unemployment benefits, and food stamps aren’t affected. Non-essential federal workers will be furloughed, and non-essential government activities will cease.

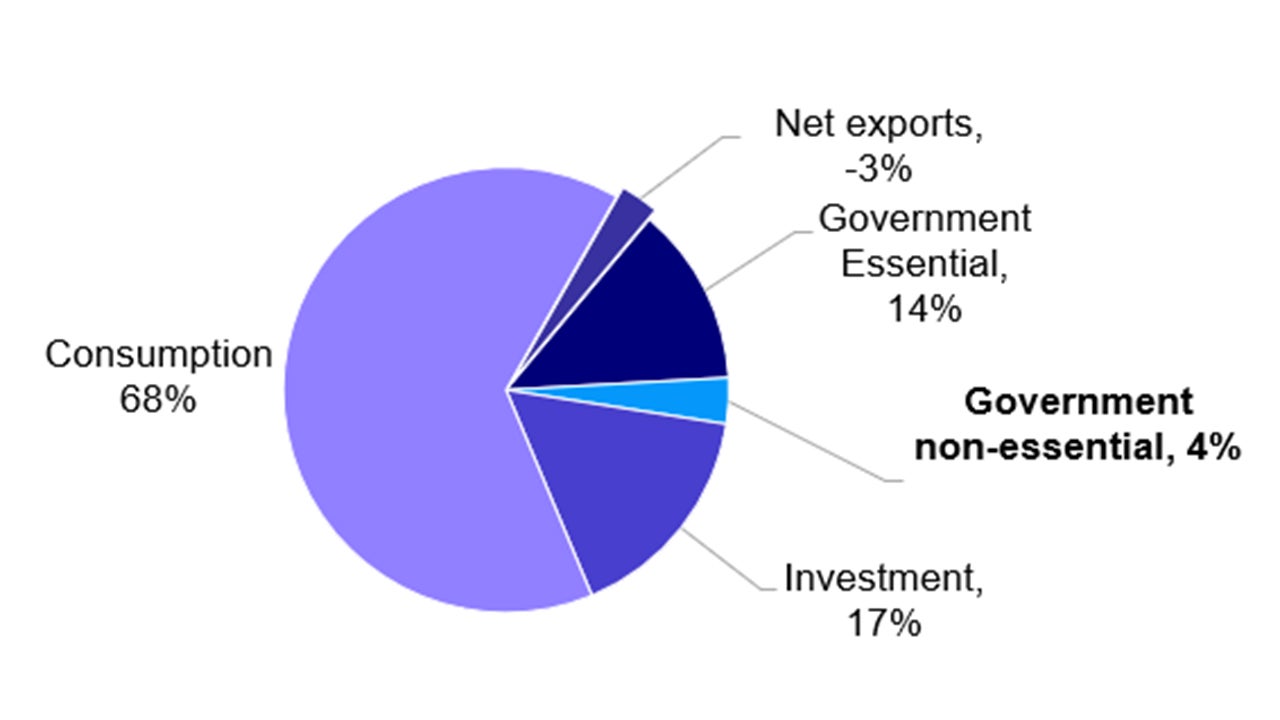

The likely direct economic impact of a government shutdown is difficult to quantify, but it’s relatively small.

Sources: US Treasury, US Bureau of Economic Analysis, US Census Bureau, 30 Jun 2023. Gross domestic product is the total value of goods and services produced in a year.

Government spending is roughly 17% of the $26.5 trillion US economy; however, only about 4% is non-essential spending.1

The ratio of federal government employees to the total workforce, however, is at the lowest on record, also suggesting that the impact would likely not be large.

Investment Implications:

In past government shutdown periods, market volatility has increased some of the ties, but not all. For the most part, markets have generally been benign during shutdown.

Sources: Source: Bloomberg L.P., 12/31/22. The Dow Jones Industrial Average is a price-weighted index of the 30 largest, most widely held stocks traded on the New York Stock Exchange. Volatility is measured by the standard deviation of price moves on returns of the index. Standard deviation measures a range of total returns for a portfolio or index compared to the mean. An investment cannot be made into an index. Past performance does not guarantee future results.

The S&P 500 Index, on average, has seen a bit of volatility in the days leading up to government shutdowns and during government shutdowns, only to have advanced in the aftermath.

Conclusion

Thus, while a possible government shutdown implies policy uncertainty which could pressure markets in the near-term, I believe that the bigger policy concern is whether the Federal Reserve chooses a “higher for longer” path for 2024.

If economic news over the coming months continues to be resilient, this could fan the fear for more rate hikes and that the US Treasury 10-year yield has more upside risk. My attention is focused more on the upcoming inflation data prints.

With contribution from Brian Levitt