Strategic sector selector - A summer postponed ?

The rally in global equities narrowed further in Q2 2024, and there were signs of softening economic growth having an impact. Mega-cap technology stocks led the equity market moderately higher, while there were signs that disinflationary trends have resumed. We expect global growth to stay lower than average in the near term (although we think recession is a tail risk), and we assume that a recovery will start towards late 2024 or early 2025. We think equity markets may struggle for direction after strong returns year-to-date, although we do not expect the market expansion to end. With that in mind, we reduce our allocation to cyclical sectors slightly by downgrading industrial goods & services and consumer products & services (both to Underweight). Therefore, we keep the balance of defensives and cyclicals within our model sector allocation. At the same time, we upgrade utilities to Neutral as we expect the sector to benefit from lower interest rates.

Changes in allocations:

- Upgrades: utilities (UW to N)

- Downgrades: industrial goods & services (OW to UW), consumer products & services (N to UW)

| Most favoured | Least favoured | |

Sector

|

US retailers European healthcare |

US automobiles & parts European travel & leisure |

Sectors where we expect the best returns:

- Retailers: well-diversified sector, exposure to growth factor and potential rebound in consumer spending

- Food, beverage and tobacco: hedge against market volatility, exposure to growth factor

- Healthcare: attractive valuations, decent dividend yield, potential beneficiary of lower interest rates

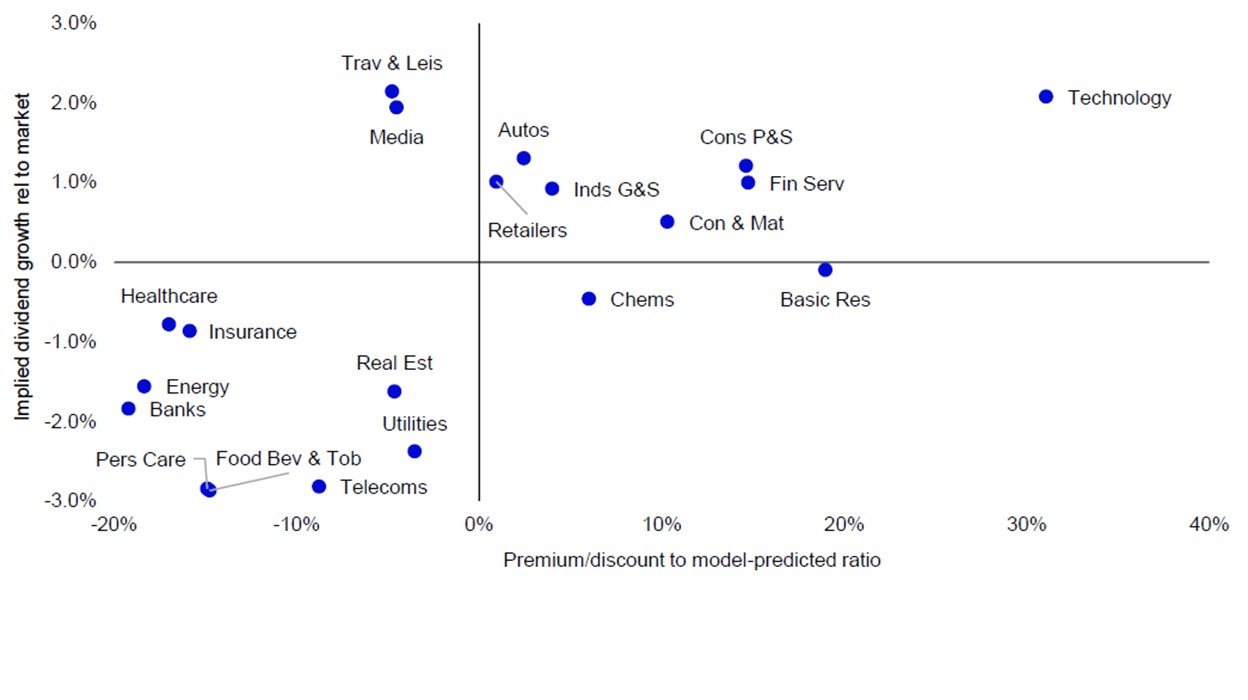

Notes: Data as of 30 June 2024. On the horizontal axis, we show how far a sector’s valuation is above/below that implied by our multiple regression model (dividend yield relative to market). The vertical axis shows the perpetual real growth in dividends required to justify current prices relative to that implied for the market. We consider the sectors in the top right quadrant expensive on both measures, and those in the bottom left are considered cheap. See appendices for methodology and disclaimers.

Source: LSEG Datastream and Invesco Global Market Strategy Office