Strategic Sector Selector: Is the juggernaut getting tired?

It may seem that global equities are poised to continue marching higher after a strong first half in 2023. However, we think that the road ahead could prove bumpier and that returns will moderate coupled with higher volatility. We expect the main focus for markets to shift from inflation to economic growth, which we think will increasingly feel the impact of high interest rates. In our view, this implies that the early-cycle phase may start drawing to a close in the second half of 2023, which tends to be followed by a meaningful pullback. We think the time has come to reduce our allocations to sectors that led the market higher year-to-date, including downgrading technology and consumer products & services to Neutral and automobiles & parts and media to Underweight. We balance this by increasing our allocations to both defensive sectors through upgrading telecommunication to Overweight, and the value factor by upgrading basic resources and banks to Neutral and real estate to Overweight.

Changes in allocations:

- Upgrades: basic resources, banks (UW to N), real estate, telecommunications (N to OW)

- Downgrades: automobiles & parts, media (N to UW), consumer products & services, technology (OW to N)

| Most favoured | Least favoured | |

Sector

|

US healthcare US real estate |

US automobiles & parts European travel & leisure |

Sectors where we expect the best returns:

- Healthcare: exposure to moderating rate expectations, defensive sector, strong pricing power

- Retailers: resilient in economic downturns, may outperform in cyclical upswing, exposure to growth factor

- Real estate: attractive valuations, high dividend yield, exposure to eventual recovery in housing markets

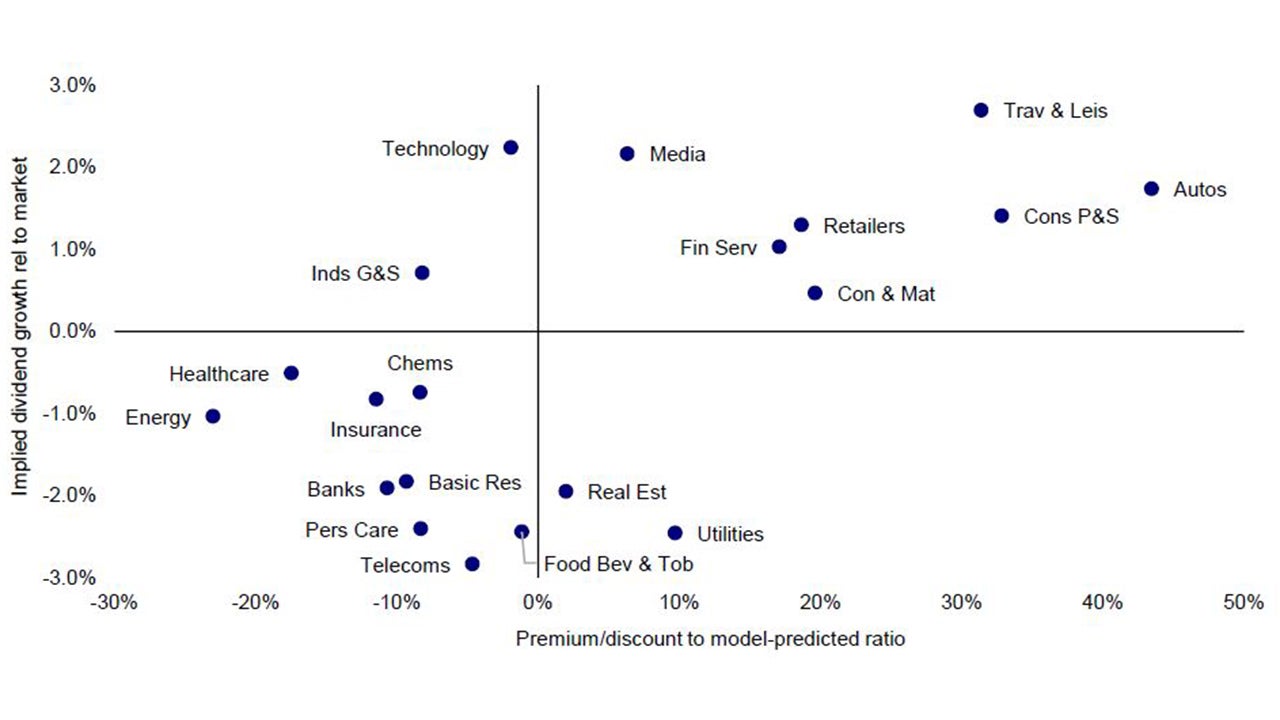

Notes: On the horizontal axis, we show how far a sector’s valuation is above/below that implied by our multiple regression model (dividend yield relative to market). The vertical axis shows the perpetual real growth in dividends required to justify current prices relative to that implied for the market. We consider the sectors in the top right quadrant expensive on both measures, and those in the bottom left are considered cheap. See appendices for methodology and disclaimers. Source: Refinitiv Datastream and Invesco