Strategic sector selector - Spring fatigue

Global equities rallied further in Q1 2024 despite an aggressive repricing of interest rate expectations. Although economic data remained more robust than expected, especially in the US, market breadth decreased, and mega-caps outperformed. We expect global growth to moderate from current levels in the near term (although we think recession is a tail risk), and we assume that a recovery will start in late 2024. We think equity markets may consolidate after strong returns in the last two quarters, but they will remain in the mid-cycle phase of the equity market cycle, in our view. Therefore, we keep the balance of defensives and cyclicals within our model sector allocation. While we maintain our exposure to defensive growth through consumer staples and healthcare, we reshuffle our allocations within cyclicals by upgrading basic resources to Neutral, and financial services and retailers to Overweight. At the same time, we downgrade media and real estate to Neutral, and insurance to Underweight.

Changes in allocations:

- Upgrades: basic resources (UW to N), retailers (N to OW), financial services (UW to OW)

- Downgrades: media and real estate (OW to N), insurance (N to UW)

| Most favoured | Least favoured | |

Sector

|

US retailers European healthcare |

US automobiles & parts European travel & leisure |

Sectors where we expect the best returns:

- Retailers: well-diversified sector, exposure to growth factor and potential rebound in consumer spending

- Food, beverage and tobacco: hedge against market volatility, exposure to growth factor

- Healthcare: attractive valuations, decent dividend yield, potential beneficiary of lower interest rates

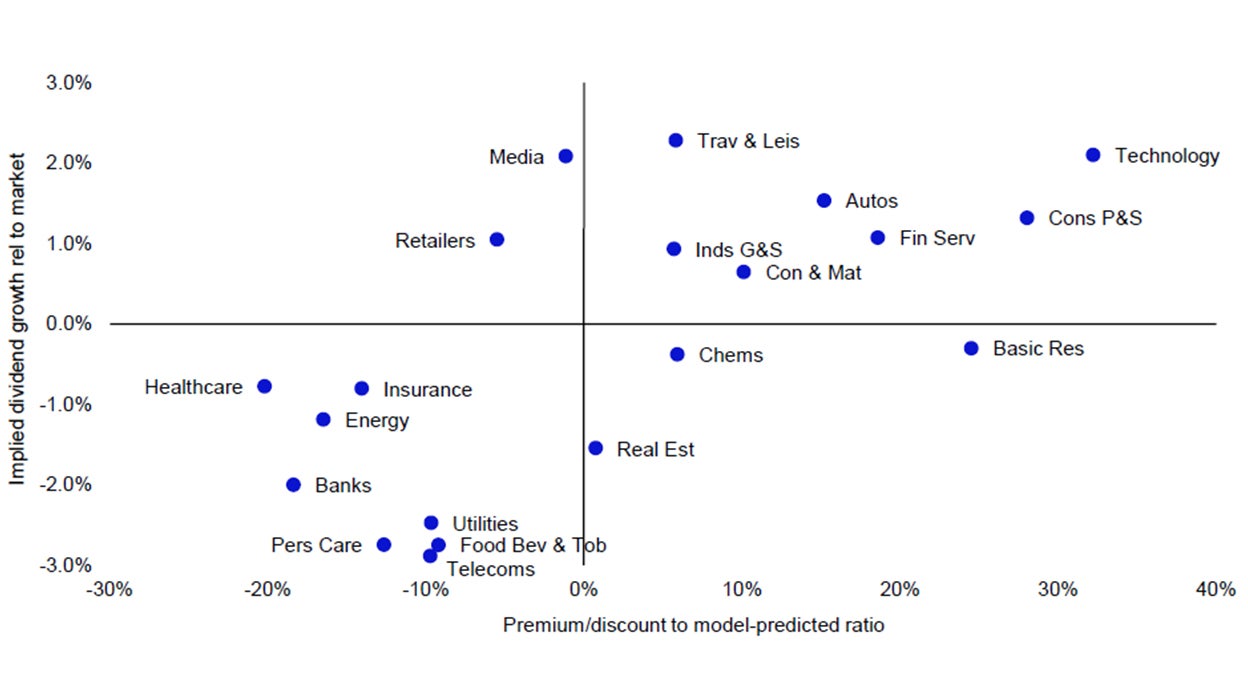

Notes: Data as of 31 March 2024. On the horizontal axis, we show how far a sector’s valuation is above/below that implied by our multiple regression model (dividend yield relative to market). The vertical axis shows the perpetual real growth in dividends required to justify current prices relative to that implied for the market. We consider the sectors in the top right quadrant expensive on both measures, and those in the bottom left are considered cheap. See appendices for methodology and disclaimers.

Source: LSEG Datastream and Invesco Global Market Strategy Office