Strategic Sector Selector: Unmoved by uncertainty

The decent returns on global equities during Q4 2025 masked significant volatility as concerns around valuations in the technology sector and the US economy remained in the headlines. Market leadership stayed narrow with basic resources, healthcare and banks leading global equities higher partly driven by surging gold prices and signs of resilience in the global economy. We think the probability of global recession remains low, although a reacceleration could imply stickier inflation than previously assumed (especially if the impact of tariffs on the US economy spills over into 2026). We think there may be some volatility in the short term, but we see upside in the next 12 months as the global economy moves towards trend growth. With that in mind, we think no significant changes are necessary, although we reduce the allocation to defensive sectors slightly by downgrading healthcare to Neutral. At the same time, we maintain the exposure to cyclicals and upgrade financial services to Overweight from Neutral as we expect outperformance from the sector in this mature phase in the market cycle.

Changes in our Model Sector Allocations:

- Upgrades: financial services (N to OW)

- Downgrades: healthcare (OW to N)

| Most favoured | Least favoured |

| US banks | US media |

| US energy | North America basic resources |

Sectors where we expect the best returns:

- Banks: steepening yield curve, attractive valuations, exposure to potential financial deregulation

- Energy: attractive valuations, exposure to reaccelerating economic growth, improving earnings momentum

- Real estate: attractive valuations, exposure to value factor, rental growth could cushion inflation risk

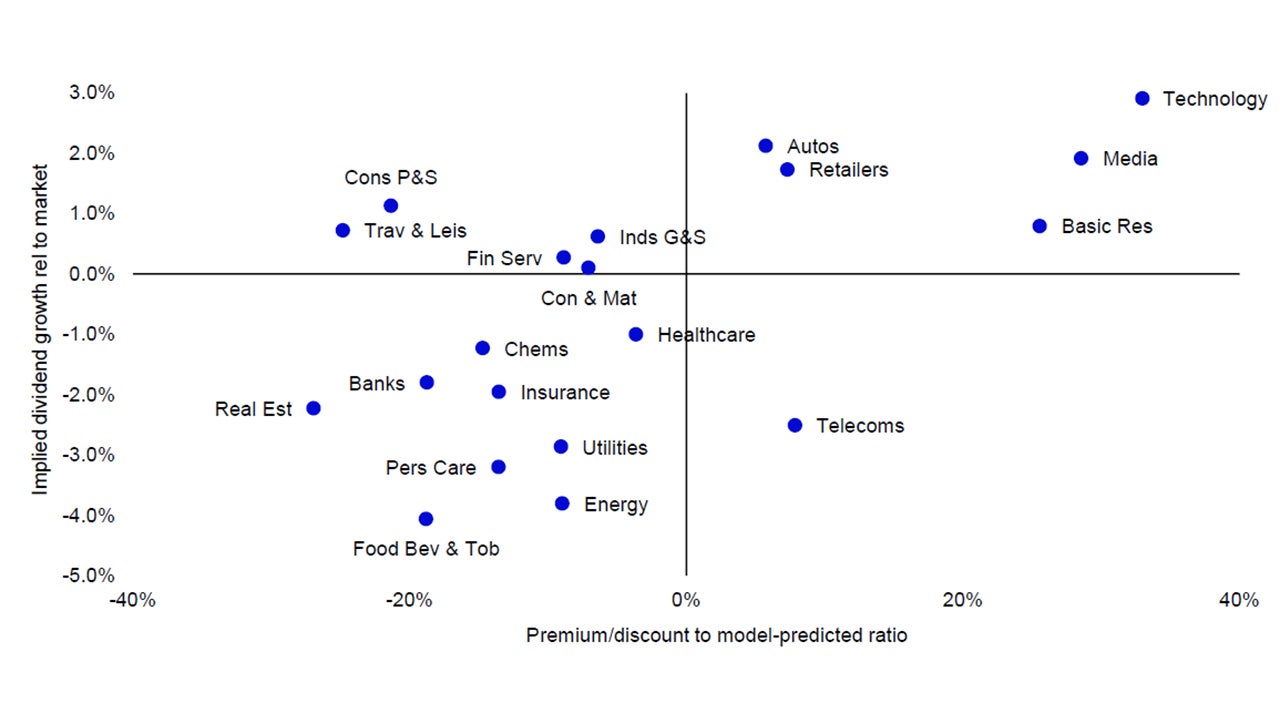

Notes: Data as of 31 December 2025. On the horizontal axis, we show how far a sector’s valuation is above/below that implied by our multiple regression model (dividend yield relative to market). The vertical axis shows the perpetual real growth in dividends required to justify current prices relative to that implied for the market. We consider the sectors in the top right quadrant expensive on both measures, and those in the bottom left are considered cheap. See appendices for methodology and disclaimers.

Source: LSEG Datastream and Invesco Strategy & Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.