The Big Picture: Global asset allocation 2025 Q4

On the positive side, we think the global economy could accelerate (despite a slowing US economy) and that the Fed is about to embark on rapid easing. However, we also believe that inflation is no longer trending down, that some central banks are near the end of their easing cycles and that geopolitical risks remain high. After recent strong gains on some assets, we reduce risk within our Model Asset Allocation by cutting high yield to Underweight and raising cash to Neutral. Nevertheless, we maintain a slight preference for riskier assets and regions.

Model asset allocation

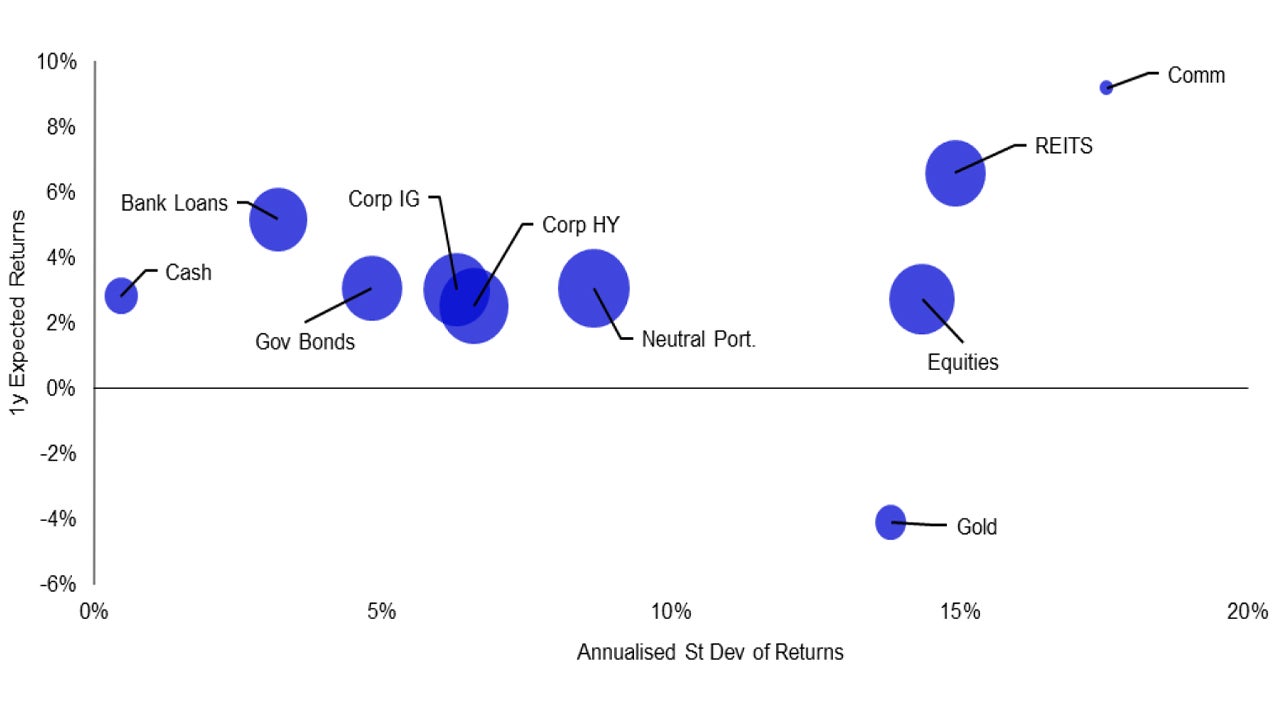

In our view:

- Commodities should benefit as the global economy improves. We stay at the Maximum.

- Bank loans offer an attractive risk-reward trade-off. We stay at the Maximum.

- Real estate (REITS) have rebounded but may benefit as rates fall. We remain Overweight.

- Government bond yield direction will be mixed. We remain Neutral.

- Corporate investment grade (IG) has a similar profile to government bonds. We remain at Neutral.

- Corporate high yield (HY) spreads have tightened further. We reduce to Underweight.

- Cash brings diversification that could be important as other assets become expensive. We boost to Neutral.

- Equities have rebounded and we remain Underweight (Underweight the US, Overweight non-US).

- Gold may be helped by a weakening dollar and geopolitics, but is expensive. We remain at Zero.

- Regionally, we favour Europe and EM.

- US dollar is likely to weaken and we maintain the partial hedge into JPY.

Our best-in-class assets (based on 12m projected returns)

- China equities

- Eurozone REITS

- Industrial commodities

- European bank loans

Based on annualised local currency returns. Returns are projected but standard deviation of returns is based on 5-year historical data. Size of bubbles is in proportion to average 5-year pairwise correlation with other assets (hollow bubbles indicate negative correlation). Cash is an equally weighted mix of USD, EUR, GBP and JPY. Neutral portfolio weights shown in Figure 3. As of 29 August 2025. There is no guarantee that these views will come to pass. See Appendices for definitions, methodology and disclaimers.

Source: Credit Suisse/UBS, ICE BofA, MSCI, S&P GSCI, FTSE Russell, LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.