The outlook for US tariffs following the latest court ruling

In an unexpected twist, a 3-judge panel of the US Court of International Trade ruled unanimously that President Trump overstepped his power and declared the majority of his tariff hikes to be invalid.

As a backdrop, Trump declared the US fentanyl crisis and trade deficit to be national emergencies and imposed tariffs under the International Emergency Economic Powers Act (IEEPA).

The federal court ruled that Trump lacked the authority to impose fentanyl related tariffs on Canada, Mexico and China, as well as tariffs on Liberation Day.

The court ruling does not apply to product specific tariffs, such as on steel, aluminum, vehicles and other products still being discussed, such as semiconductors, pharmaceuticals and aircraft.

These tariffs on specific products have been imposed under a different, standard trade law and are likely to remain in place.1

Already, the Trump administration has filed an appeal to the US Court of Appeals and expectations are for the Court of Appeals to rule shortly, in a matter of weeks.

Though, whichever party loses, is likely to appeal to the US Supreme Court. The US Supreme Court will go on recess starting in July until October and so we believe that a ruling before July is likely. 2

The impact of the ruling

This ruling will certainly impact the already ongoing trade negotiations between the US and many countries.

We are already long in the tooth in the 90-day tariff pause and only a few countries have inked trade deals with the US despite the looming July 8th deadline.

We wouldn’t be surprised if we see a delay in trade deal announcements as countries take a wait and see approach on what the final ruling from a higher court will be.

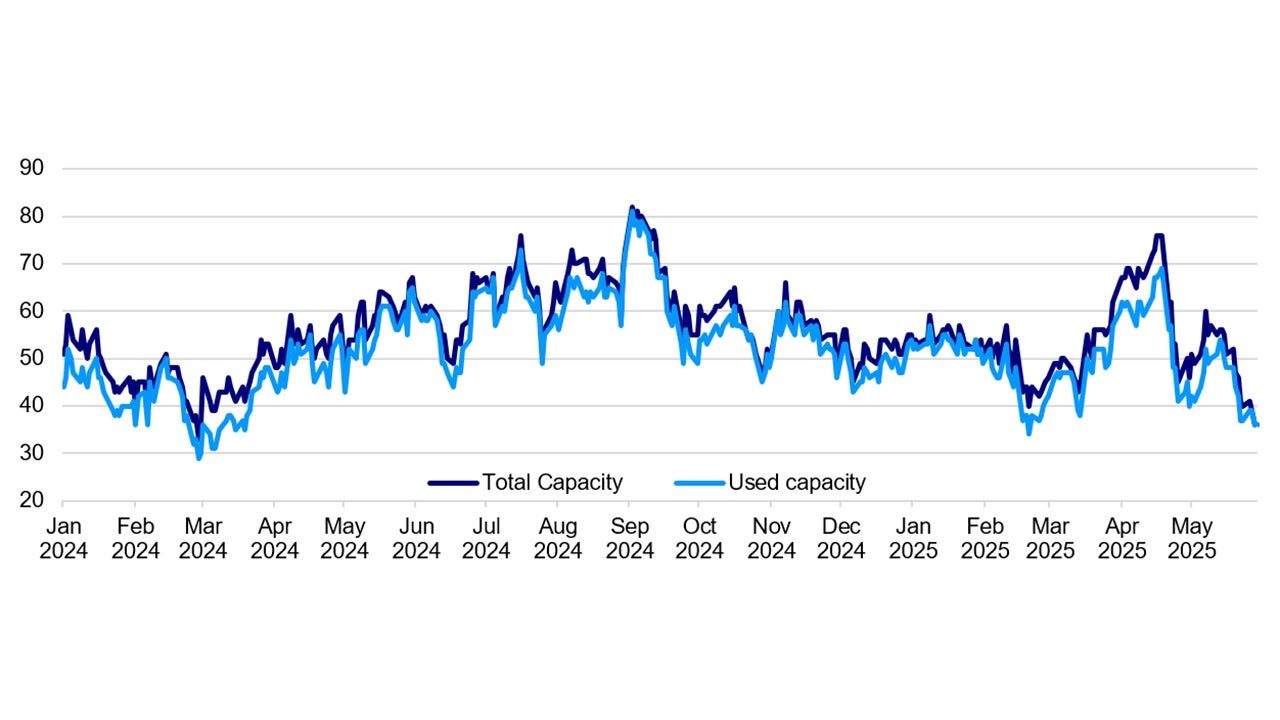

Source: Bloomberg. Data as of 27 May 2025. Note: Chart shows the estimated number of container vessels departing China for the United States, focusing on dry cargo ships. Aggregates data using a 15-day rolling average to reduce short-term volatility and provide a clearer view of broader trends in vessel activity.

We understand why Asian markets initially rallied on this news. It could be interpreted that Trump has been handed a losing card from the courts and that his negotiating leverage with other countries has been diminished and that his administration is more likely to make deals.

The light at the end of the tariff tunnel could be an oncoming train.

The outlook on tariff

It’s entirely possible that the Supreme Court rules in Trump’s favor, handing him back the power granted under the IEEPA.

And even if the final judgement goes against the administration, Trump still has other trade levels to pull to enact his tariffs, specifically under Sections 122, 201, 338, 232 or 301 US trade acts.

While the recent court ruling may have chipped away at Trump’s negotiating hand, we don’t believe that that it reduces any uncertainty related to the ongoing tariff developments.

It’s possible that we could see Trump escalate trade tensions further in response to the court’s ruling against him.

It’s this uncertainty of not knowing what’s going to happen next, that we fret about the most as it’s likely to reduce both business and household sentiment which could lead to diminished capex expenditure and consumption behavior.

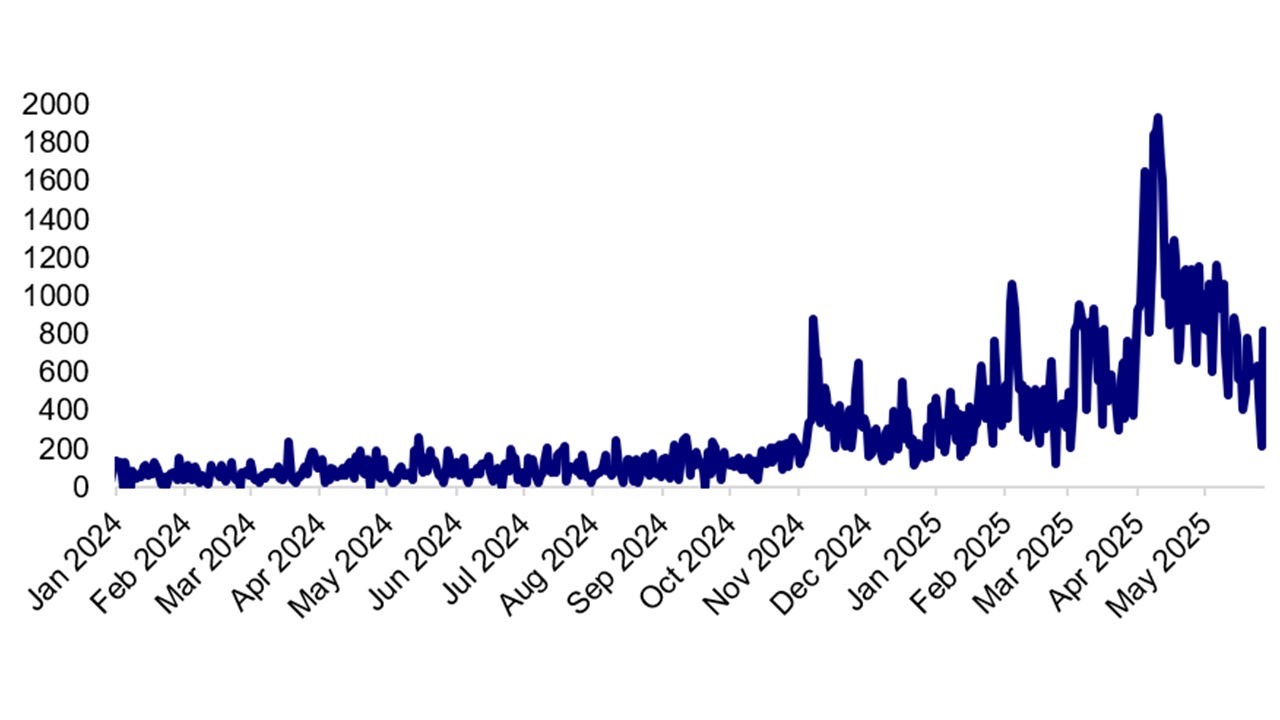

Source: Macrobond, Federal Reserve and Matteo lacoviello. Note: Index based on automated text searches counting the monthly frequency of articles discussing trade policy uncertainty.

Investment Implications

Our base case remains that we continue to be in a market environment punctuated by escalating and de-escalating tariff measures.

Markets have recently rallied due to a “tariff de-escalation” narrative though we continue to be wary of the economic headwinds to both growth and inflation that increased tariffs could bring.

Non-US assets are increasingly attractive and poised for continued outperformance. We view this as an opportunity for investors to diversify their portfolios across regions and asset classes as well as to reduce concentrations.

This may help them to weather volatility better while also allowing them to benefit from potential upside surprises.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.