Uncommon truths 2025: a year in review

Despite the angst about tariffs, 2025 was a good year for most global assets, especially metals and equities. The performance of my my Aristotle List of 10 surprises was more nuanced.

A year ago, we were expecting central bank easing and more economic growth, which led to our optimism about market outcomes (see 2024 in review). Central banks did ease but economic growth disappointed. Nevertheless, asset returns were healthy.

The best performing global assets in 2025 were metals and equities (see Figure 3). The only assets to generate negative returns in USD were energy and agriculture. The 7.8% USD total return on our neutral portfolio in 2024 (11.0% in local currency) was followed by 16.3% so far in 2025 (+12.8% in local currency), the highest since 2019. The neutral portfolio is a static mix of global cash, fixed income, equity, real estate and commodity assets (see Figure 6 for weightings).

As a reminder of events, here are Bloomberg’s most-read articles during 2025 (paraphrased):

1. Trump says market response expected (Apr 3)

2. “Can’t imagine further tariff increase on China” Trump (Apr 9)

3. Trump U-turns on Powell, China (Apr 24)

4. Trump’s tariffs send shockwaves (Apr 3)

5. Air India crash kills 241 (Jun 12)

6. AI stock rally hurt by Chinese upstart (Jan 27)

7. Trump pauses tariff hikes; ups China rates (Apr 10)

8. “My bad”: Bill Ackman on failure on Trump (Apr 8)

9. Bessent: Japan may get priority response (Apr 7)

10. Best stock rally since 2008…(Apr 9)

As usual, bad news sells and the majority of the most-read stories were on the negative side. Most came in the days following the 2 April Liberation Day tariff announcement (note that in 2024, tariffs were not mentioned in the top 20 most-read stories). The first mention of a military conflict came in item #14, and the second Fed mention wasn’t until #38, with mention of President Trump’s attempt to fire Governor Lisa Cook.

I think the positive market outcomes owe much to the resilience of the global economy and the ongoing easing by most central banks. Tariffs and other geopolitical factors brought only temporary volatility (see Figure 2). Major idiosyncratic themes have been AI and gold, based on conversations with investors around the world. Bonds may have lagged equities but the returns were respectable, in my opinion, especially when measured in US dollars (see Figure 3). Strong returns were seen in US bonds but were matched by emerging markets and bettered by Europe (in USD).

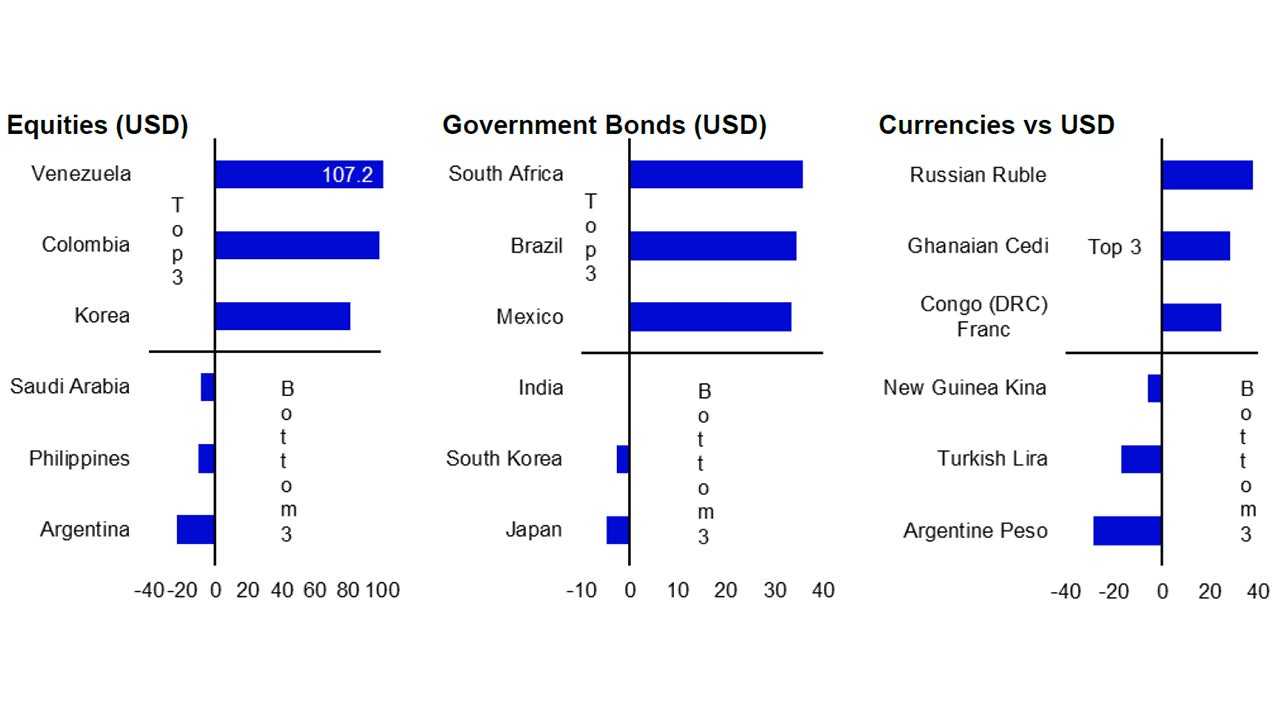

Figure 1 shows the results of our annual ranking within asset groups. As is often the case, emerging markets dominate both ends of the spectrum, though Japanese government bonds appear in the bottom three for the third year in a row. Venezuela topped the equity league table, on both a local and a common currency basis (China was the best performing big stock market). Otherwise, positive returns on Argentinian stocks turned negative when measured in USD. Despite stabilising during Q4, the Argentine peso fell more than 20% during 2025 (versus USD) and the Turkish Lira was likewise penalised by a high inflation rate. After a strong year, the Russian Ruble is close to pre-war levels.

Past performance is no guarantee of future results. As of 12 December 2025. Equity data is based on Datastream indices; government bond indices are supplied by ICE BofA; currencies are based on WM/Refinitiv exchange rates.

Source: LSEG Datastream and Invesco Strategy & Insights.

In a repeat of what happened in 2024, markets had to wait until September for the first Fed rate cut of the year (the ECB cut rates four times in the first half of the year). However, once Fed easing started, it went quickly with three 25 basis point (bp) cuts at successive meetings. The latest presidential appointee to the Fed (Stephen Miran) has voted for 50bp cuts at each of those three meetings. With Chair Powell’s term due to end on 15 May 2026, and President Trump about to announce his replacement, it will be interesting to see how Fed dynamics change (if at all) during 2026.

Elsewhere, the future path of central bank rates appear less clear cut, with the ECB easing cycle close to an end (in my opinion), while in Australia the RBA is now expected to tighten, rather than ease, and the BOJ is gradually normalising rates upward.

Central bank decision making has been complicated by the flattening of inflation. However, the US avoided the 4.0% inflation rate I predicted in item #1 on my list of 10 surprises for 2025 (published on 12 January 2025 - see The Aristotle List). The outcomes of much of the rest of the list remains to be decided (TBD), as shown below (with my self-evaluation in blue):

1. US CPI inflation goes above 4.0% during 2025 (No)

2. President Macron steps down after elections (No)

3. US dollar weakens during 2025 (TBD)

4. EU discord causes widening of spreads (TBD)

5. US stocks underperform global indices (TBD)

6. Turkish govt. bonds outperform global indices (TBD)

7. EU carbon price goes above €90 per tonne (TBD)

8. Kenyan stocks outperform major indices (TBD)

9. Bitcoin falls below $50,000 (TBD)

10. Europe wins the Ryder Cup (Yes)

Remember, this list does not represent my central scenario but is rather an attempt to identify non-consensus ideas that I believe have a reasonable chance of occurring (thereby surprising most investors). They must therefore be put in the context of the prevailing sentiment at the start of the year (“Trump trade” optimism about US stocks and the dollar, say).

It looks as though 2025 will prove to be a mixed year for the Aristotle List. I am reminded of the words of Rudyard Kipling: “If you can meet success and failure and treat them both as impostors, then you are a balanced man...”, which is good to remember in good times and in bad.

I will publish the selections for 2026 in early January. I have met many investors over recent weeks and months which helps to judge the prevailing mood. I am hoping a break over the Christmas and New Year period will provide some inspiration.

I continue to believe the main driver of returns will be economic and policy cycles. I expect the global economy to accelerate on recent and future central bank easing (and some fiscal impulse). As outlined in Big Picture 2026 Outlook, that leads me to be relatively optimistic about multi-asset returns during 2026 (though 2025 will be hard to match). I believe the big questions facing investors are whether there will be a change of equity market leadership (performance across the Magnificent 7 was already mixed in 2025) and whether precious metals can repeat the stellar performance of 2025 (I am sceptical).

On that note, all that remains is for Andras and I to wish you and your loved ones a happy holiday season.

Unless stated otherwise, all data as of 12 December 2025.

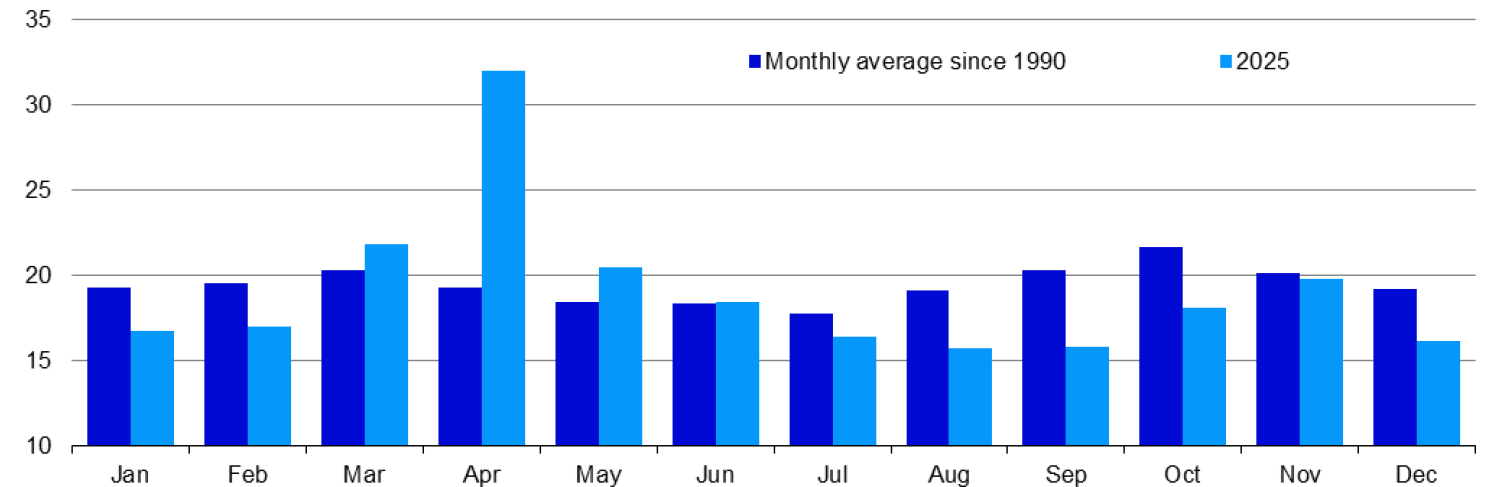

Notes: past performance is no guarantee of future results. Based on daily data from 3 January 1990 to 12 December 2025 (as of 12 December 2025). The chart shows the monthly averages for the VIX index, both for all months since 1990 and for 2025. VIX is the CBOE VIX Index and is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options. Source: Bloomberg and Invesco Strategy & Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.