Uncommon truths: Alternatives under the microscope 2024

Alternative assets were mixed in 2024, with Bitcoin and private equity at the top of the rankings, and direct real estate and wine at the bottom. I expect monetary easing and accelerating economies to help private equity in 2025. I also favour bank loans, MLPs and direct real estate.

I am often asked for my views on alternative assets, which I assume means non-liquid assets that are usually beyond the reach of the average investor. Examples could include direct real estate, private equity and many hedge fund strategies (distressed assets, merger arbitrage etc.). Commodities may also fall into this category, given the difficulty of delivery and storage. I also include cryptocurrencies such as Bitcoin in this alternative basket. Many such assets have now become more accessible (REITs, private equity funds, publicly traded hedge funds, commodity funds and certificates etc.) but many investors still consider them to be non-conventional.

There is, of course, another category of alternatives which can best be described as collectibles: real assets that are often collected for reasons other than financial gain. However, they often rise in price over the long term. Examples include fine wines, rare stamps and coins, art, jewellery, baseball cards etc. Collectibles for the most part lack a liquid market and the worth of such assets is often judged by the most recent sale price of an equivalent.

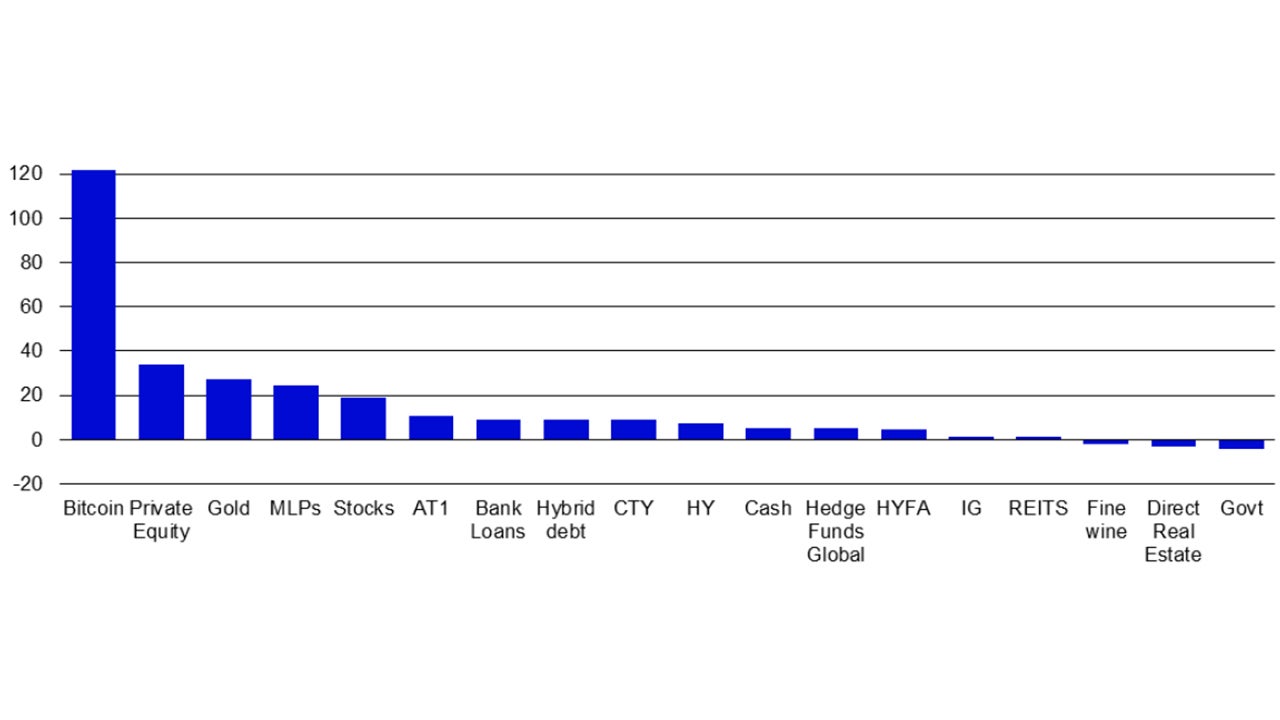

Figure 1 shows how some alternative assets performed in 2024 and makes a comparison to some more conventional assets. It would appear that alternatives had a mixed year, with Bitcoin, private equity, gold and MLPs leading the way, while direct real estate and wine struggled. It was the second year in a row that Bitcoin topped the rankings (see Figure 4), with private equity, gold and MLPs again featuring in the top-five of our asset universe (this was the fourth year in a row that MLPs have generated strong returns). At the other end of the spectrum, direct real estate (“property” in Figure 4) suffered for the second year in a row, while wine experienced the third successive negative year.

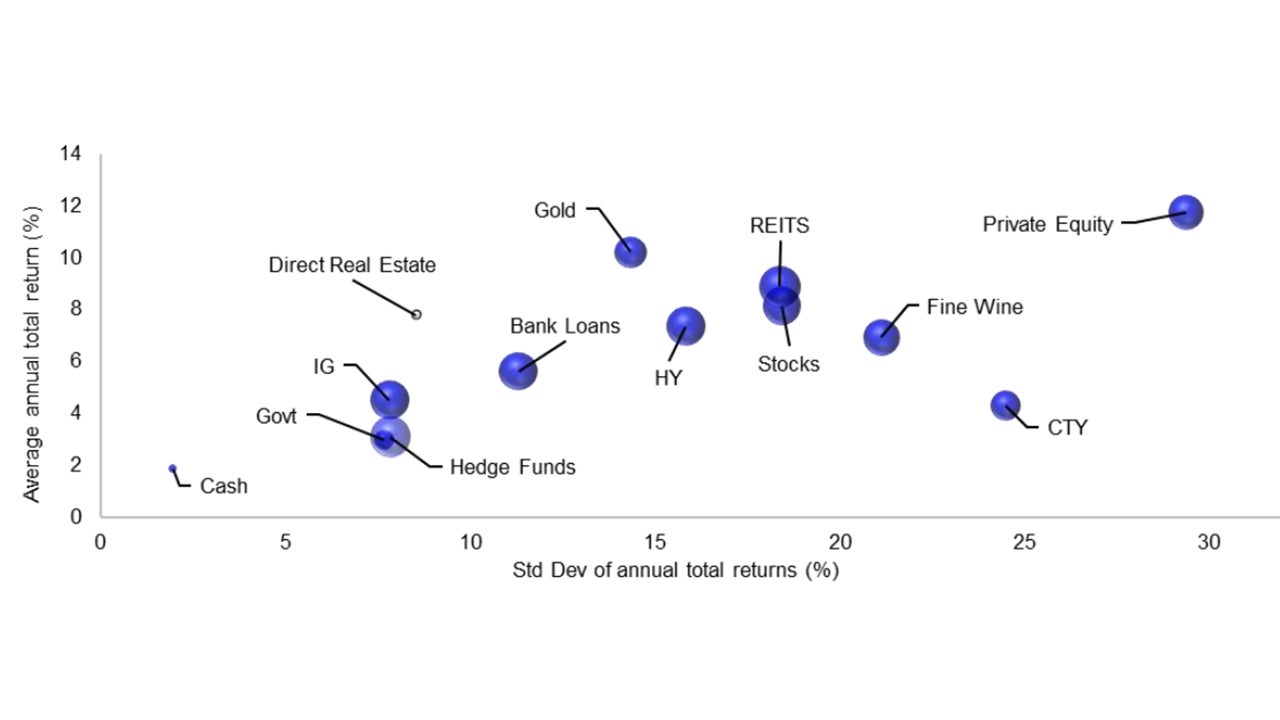

As seen in Figure 1, Bitcoin dominated the rankings, with the second consecutive year of 100% plus returns. Figure 4 suggests this is not unusual, with Bitcoin usually either at the top or the bottom of the rankings. The question now being whether 2025 will see another strong gain or one of those big downdrafts that seem to come along every three or four years. Private equity is also a high-beta version of publicly traded stocks and in recent years has inhabited the extremes of the rankings. Hedge funds are less volatile than private equity but have generated much lower returns over the long haul (see Figure 2). Indeed, hedge funds have tended to perform like government bonds but with less diversification potential due to higher correlation with other assets (see the size of the bubbles in Figure 2).

Note: Past performance is no guarantee of future results. Based on total return indices in US dollars from 29 December 2023 to 31 December 2024, except Direct Real Estate and Fine Wine (from 30 September 2023 to 30 September 2024), unless stated otherwise: spot price of gold per ounce, ICE BofA 0-3 month US treasury index (Cash), spot price of Bitcoin in USD, ICE BofA Global Government Index (Govt), ICE BofA Global Corporate Index (IG), ICE BofA Global HY Index (HY), Credit Suisse Leveraged Loan Indices (Bank Loans, with the global index constructed by Invesco Global Market Strategy Office as a weighted average of the US and Western European indices),GPR General World Index (REITS), S&P GSCI index (CTY), MSCI World Index (Stocks), Hedge Fund Research Global Hedge Fund Index (Hedge Funds Global), LPX Major Market Listed Private Equity Index (Private Equity), US NCREIF Property Index (Direct Real Estate), Liv-ex Fine Wine 100 Index (Fine wine, price index converted from sterling to US dollars), Morningstar MLP Composite Index (MLPs), FTSE Time-Weighted US Fallen Angel Bond Select Index (HYFA), iBoxx USD Contingent Convertible Liquid Developed Market AT1 with 8.5% Issuer Cap (AT1), ICE BofA Global Hybrid Non-Financial Corporate Index (Hybrid debt).

Source: Bloomberg, LSEG Datastream, Credit Suisse/UBS, ICE BofA, MSCI, S&P GSCI, GPR, LPX, FHFA, Liv-ex, Hedge Fund Research, iBoxx, FTSE, Morningstar and Invesco Global Market Strategy Office

Figure 2 summarises the performance data since 2000 for those assets with a long enough data history. Bearing in mind that the size of the bubbles is in proportion to the average correlation with the other assets over the period shown, cash stands out as an asset with low returns, low volatility and low correlation to other assets. This is why I consider it to be a good diversifier. Indeed, if we were to calculate an efficient frontier based on the information shown in Figure 2, I think it would run from cash to private equity, with direct real estate and gold very close to the frontier.

If stocks are considered to be the “go-to” asset for long term investors, a number of conclusions fall from Figure 2, if we assume the future will produce similar outcomes to the period shown: first, I would prefer stocks to commodities (CTY) and wine, which have generated lower returns and higher volatility; second, I would prefer direct real estate, REITS and gold to stocks (they have all produced higher returns with less volatility); third, private equity has produced higher returns than stocks but with more volatility, so the choice comes down to risk-preferences and, fourth, cash, government debt, investment grade credit (IG), high yield credit (HY), bank loans and hedge funds have produced lower returns than stocks but with less volatility, so again the choice depends upon risk appetite.

Though the data reported in Figure 2 spans 25 years, we must guard against assuming that it shows a perfect template for the future. For example, I wouldn’t expect gold to always be near the efficient frontier. The price of gold was below $300 at the start of 2000, which was close to a multi-decade low in real terms. It has since approached $2800, which is well above the long-term historical average (since 1833) of around $772 when expressed in today’s prices and based on annual averages (or around $1232 if we only count the period since 1971, when the price of gold was liberalised). As shown in the 21st Century Portfolio document (published in 2019), the positioning of gold within the risk-reward framework over the long-term is very similar to that of commodities in Figure 2.

Over the period considered in Figure 2, hedge funds could be grouped with fixed income assets such as cash, government debt and IG. However, they could be said to have been dominated by IG, which offered more return with less volatility. Nevertheless, hedge funds did offer an option versus cash – it is a matter of personal choice as to whether we prefer the higher returns of hedge funds, given that they come with higher volatility than cash.

Figure 2 doesn’t seem very encouraging for hedge funds but it may be argued that it is possible to find individual funds or strategies with much better performance profiles. However, when we analyse different hedge fund strategies since 2000, the only one that is above the cash-stocks efficient frontier is merger arbitrage. This suggests it is hard to find strategies that perform consistently better than a mix of cash and stocks.

Note: Past performance is no guarantee of future results. Based on calendar year data from 2000 to 2024 (except Direct Real Estate and Fine Wine, for which the 2024 data is from 30 September 2023 to 30 September 2024). Area of bubbles is in proportion to average pairwise correlation with the other assets in the chart. Calculated using total return indices in US dollars unless stated otherwise: spot price of gold per ounce, ICE BofA 0-3 month US treasury index (Cash), ICE BofA Global Government Index (Govt), ICE BofA Global Corporate Index (IG), ICE BofA Global HY Index (HY), Credit Suisse Leveraged Loan Indices (Bank Loans, with the global index constructed by Invesco Global Market Strategy Office as a weighted average of the US and Western European indices), GPR General World Index (REITS), S&P GSCI index for commodities (CTY), MSCI World Index (Stocks), Hedge Fund Research Global Hedge Fund Index (Hedge Funds), LPX Major Market Listed Private Equity Index (Private Equity), US NCREIF Property Index (Direct Real Estate), Liv-ex Fine Wine 100 Index (Fine Wine, price index converted to US dollars). Source: Bloomberg, LSEG Datastream, Credit Suisse/UBS, ICE BofA, MSCI, S&P GSCI, GPR, LPX, FHFA, Liv-ex, Hedge Fund Research, Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.