Uncommon truths: Alternatives under the microscope 2025

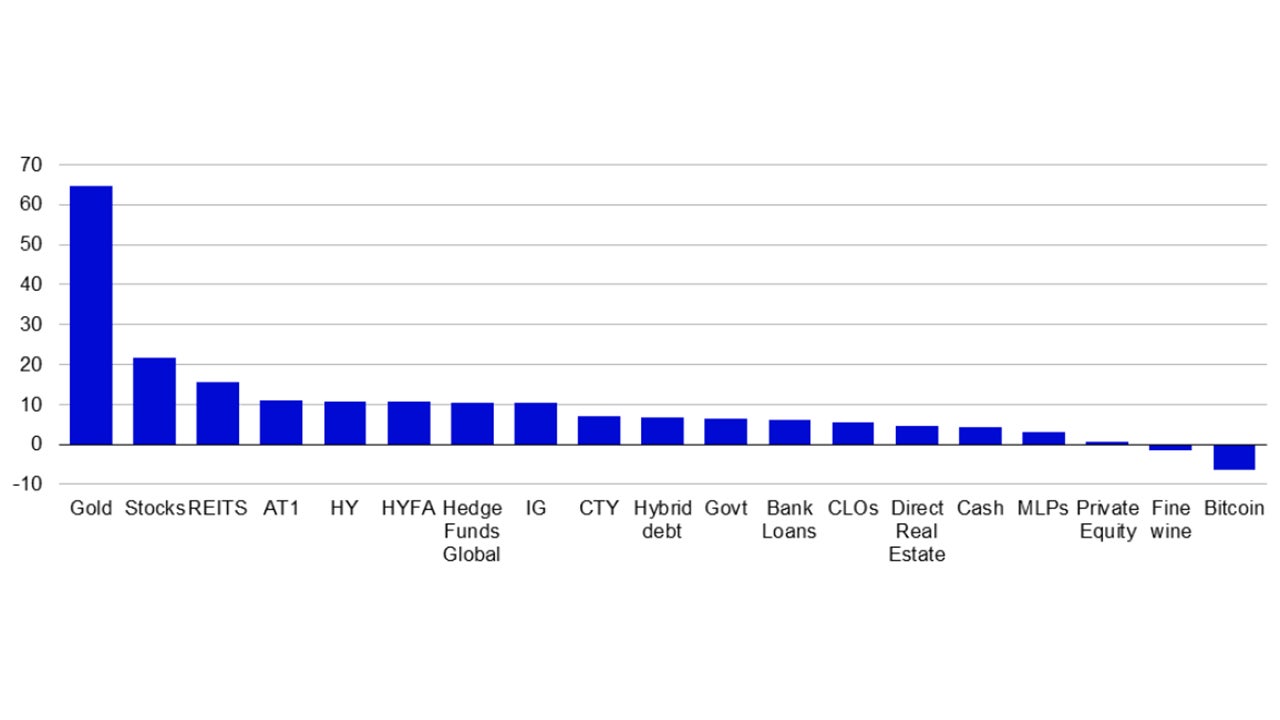

Most alternative assets performed well in 2025, with gold, hedge funds and some fixed income assets leading the way; Bitcoin, fine wine and private equity lagged. I expect accelerating economies to help industrial commodities and MLPs in 2026, but I also favour bank loans, CLOs and direct real estate.

I am often asked for my views on alternative assets, which I assume means non-liquid assets that are usually beyond the reach of the average investor. Examples could include direct real estate, private credit, private equity and many hedge fund strategies. Commodities may also fall into this category, given the difficulty of delivery and storage. I also include cryptocurrencies such as Bitcoin in this alternative basket. Many such assets have now become more accessible (via REITs, private credit funds, private equity funds, publicly traded hedge funds, commodity funds and certificates etc.) but many investors still consider them to be non-conventional.

There is, of course, another category of alternatives which can best be described as collectibles: real assets that are often collected for reasons other than financial gain. However, they often rise in price over the long term. Examples include fine wines, rare stamps and coins, art, jewellery, baseball cards etc. Collectibles for the most part lack a liquid market and the worth of such assets is often judged by the most recent sale price of an equivalent.

Figure 1 shows how some alternative assets performed in 2025, along with some conventional assets. Alternatives had a mixed year, with gold and some alternative fixed income assets leading the way, along with hedge funds. Bitcoin, private equity and MLPs struggled, giving back some of the good performance seen in recent recent years (see Figure 4). I also suspect MLPs were hurt by weak oil prices. Wine, on the other hand, has been struggling for a few years and continued to do so in 2025. At the top of the rankings, gold improved on the strong gains of 2024. This continued into early 2026, until the nomination of Kevin Warsh as the next Fed Chair provoked a severe correction on Friday 30 January.

Figure 4 suggests it is not unusual for Bitcoin to swing between the extremes of the rankings. So far, it seems to have avoided the big downdrafts seen in the past, but I have a feeling the correction is not over, with further declines already seen in early 2026. The struggles of private equity are more unusual, given the strong performance of equity markets (it oftens seems to perform as a high beta version of the publicly quoted markets). Perhaps the strong asset gathering is now impacting performance due to a limited supply of investment opportunities. Recent investor meetings suggest there is an appetite for hedge funds, and they have historically been less volatile than private equity, with a risk-reward profile more akin to government bonds and investment grade credit (see Figure 2).

Note: Past performance is no guarantee of future results. Based on total return indices in US dollars from 31 December 2024 to 31 December 2025, except Direct Real Estate (12 months to 30 September 2025) and Fine Wine (12 months to October 31 2025), unless stated otherwise: spot price of gold per ounce, ICE BofA 0-3 month US treasury index (Cash), spot price of Bitcoin in USD, ICE BofA Global Government Index (Govt), ICE BofA Global Corporate Index (IG), ICE BofA Global HY Index (HY), Credit Suisse Leveraged Loan Indices (Bank Loans, with the global index constructed by Invesco Strategy & Insights as a weighted average of the US and Western European indices), JP Morgan AAA Collateralised Loan indices (CLOs, with the global index is constructed by Invesco Strategy & Insights as a weighted average of the US and European indices), GPR General World Index (REITS), S&P GSCI index (CTY), MSCI World Index (Stocks), Credit Suisse Hedge Fund Index (Hedge Funds Global), LPX Major Market Listed Private Equity Index (Private Equity), US NCREIF Property Index (Direct Real Estate), Liv-ex Fine Wine 100 Index (Fine wine, price index converted from sterling to US dollars), Morningstar MLP Composite Index (MLPs), FTSE Time-Weighted US Fallen Angel Bond Select Index (HYFA), iBoxx USD Contingent Convertible Liquid Developed Market AT1 with 8.5% Issuer Cap (AT1), ICE BofA Global Hybrid Non-Financial Corporate Index (Hybrid debt). Source: Bloomberg, LSEG Datastream, Credit Suisse, Credit Suisse/UBS, ICE BofA, MSCI, S&P GSCI, GPR, LPX, FHFA, Liv-ex, iBoxx, FTSE, Morningstar and Invesco Strategy & Insights.

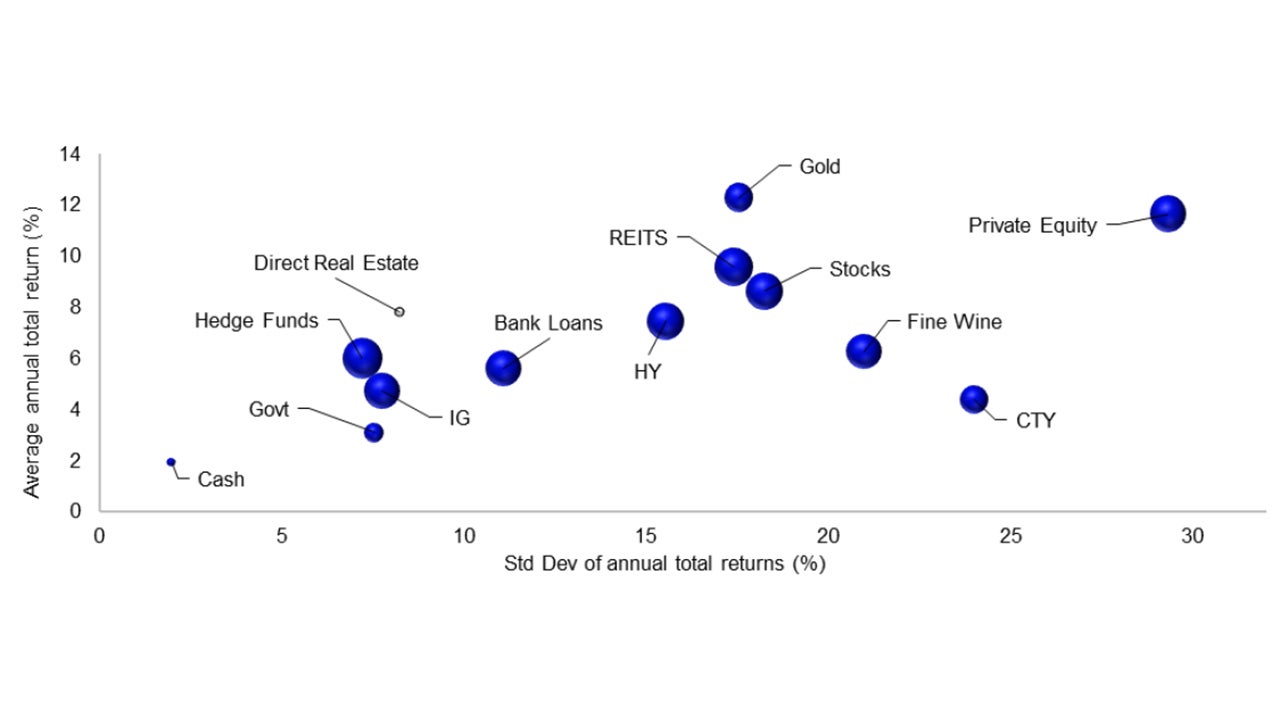

Figure 2 summarises the performance data since 2000 for those assets with a long enough data history. The size of the bubbles is in proportion to the average correlation with the other assets shown, suggesting to me that cash is a good diversifier, despite the low returns. An even better diversifier may be direct real estate (the correlation to other assets has been slightly negative, on average), while returns have almost matched equities, with lower volatility. Indeed, if we were to calculate an efficient frontier using the data in Figure 2, I think it would run from cash to gold, with direct real estate very close to the frontier.

If stocks are considered the “go-to” asset for long term investors, I draw a number of conclusions from Figure 2, assuming the future will produce similar outcomes to the period shown: first, I would prefer stocks to commodities (CTY) and wine, which have generated lower returns and higher volatility; second, I would prefer REITS and gold to stocks (they have produced higher returns with less volatility and direct real estate almost falls into that category); third, private equity has produced higher returns than stocks but with more volatility, so the choice comes down to risk-preferences and, fourth, cash, government debt, investment grade credit (IG), high yield credit (HY), bank loans and hedge funds have produced lower returns than stocks but with less volatility, so again the choice depends upon risk appetite.

Though the data reported in Figure 2 spans 26 years, we must guard against assuming that it shows a perfect template for the future. For example, I wouldn’t expect gold to always be near the efficient frontier, given the lack of income. The price of gold was below $300 at the start of 2000, which was close to the post-1971 low in real terms. It has since reached $5590 (in early 2026), which is well above the long-term historical average of around $827 when expressed in today’s prices and based on annual averages since 1833 (or around $1347 if we only count the period since 1971, when the price of gold was liberalised). As shown in the 21st Century Portfolio document (published in 2019), the positioning of gold within the risk-reward framework over the long-term is very similar to that of commodities in Figure 2, with similar volatility to equities but lower returns.

Over the period considered in Figure 2, hedge funds could be grouped with fixed income assets such as cash, government bonds and IG. As a group, hedge funds generated better returns than government bonds and IG, with slightly less volatility (so hedge funds should be preferred, in my view). On the other hand, when comparing to cash it is a matter of personal choice as to whether we prefer the higher returns of hedge funds, or the lower volatility of cash.

As can be seen in Figure 4, riskier assets have on the whole outperformed more defensive options during the last three calendar years. I think this was due to the anticipation of and execution of central bank easing. This gave rise to hopes of global economic acceleration, which was perhaps enough to overcome concern about the impact of tariffs.

Note: Past performance is no guarantee of future results. Based on calendar year data from 2000 to 2025 (except Direct Real Estate, for which the 2025 data is from 30 September 2024 to 30 September 2025 and Fine Wine, for which 2025 Data is from 31 October 2024 to 31 October 2025). Area of bubbles is in proportion to average pairwise correlation with the other assets in the chart. Calculated using total return indices in US dollars unless stated otherwise: spot price of gold per ounce, ICE BofA 0-3 month US treasury index (Cash), ICE BofA Global Government Index (Govt), ICE BofA Global Corporate Index (IG), ICE BofA Global HY Index (HY), Credit Suisse Leveraged Loan Indices (Bank Loans, with the global index constructed by Invesco Global Strategy & Insights as a weighted average of the US and Western European indices), GPR General World Index (REITS), S&P GSCI index for commodities (CTY), MSCI World Index (Stocks), Credit Suisse Hedge Fund Index (Hedge Funds), LPX Major Market Listed Private Equity Index (Private Equity), US NCREIF Property Index (Direct Real Estate), Liv-ex Fine Wine 100 Index (Fine Wine, price index converted to US dollars). Source: Bloomberg, LSEG Datastream, Credit Suisse, Credit Suisse/UBS, ICE BofA, MSCI, S&P GSCI, GPR, LPX, FHFA, Liv-ex and Invesco Strategy & Insights.

Importantly, we expect the US Fed to continue easing throughout 2026, though the appointment of “hawk” turned “dove” Kevin Warsh as the next Fed Chair may have clouded the picture. His recent calls for more Fed easing, have been mixed with calls for balance sheet shrinkage (suggesting to me upward pressure on long rates and yield curve steepening) and a return to monetarism (which could suggest higher Fed rates, given the recent uptrend in US money supply growth). Despite his calls for interest rate cuts, the collapse of gold and silver at the end of last week could suggest markets are now less concerned about a loss of Fed independence and excessive easing.

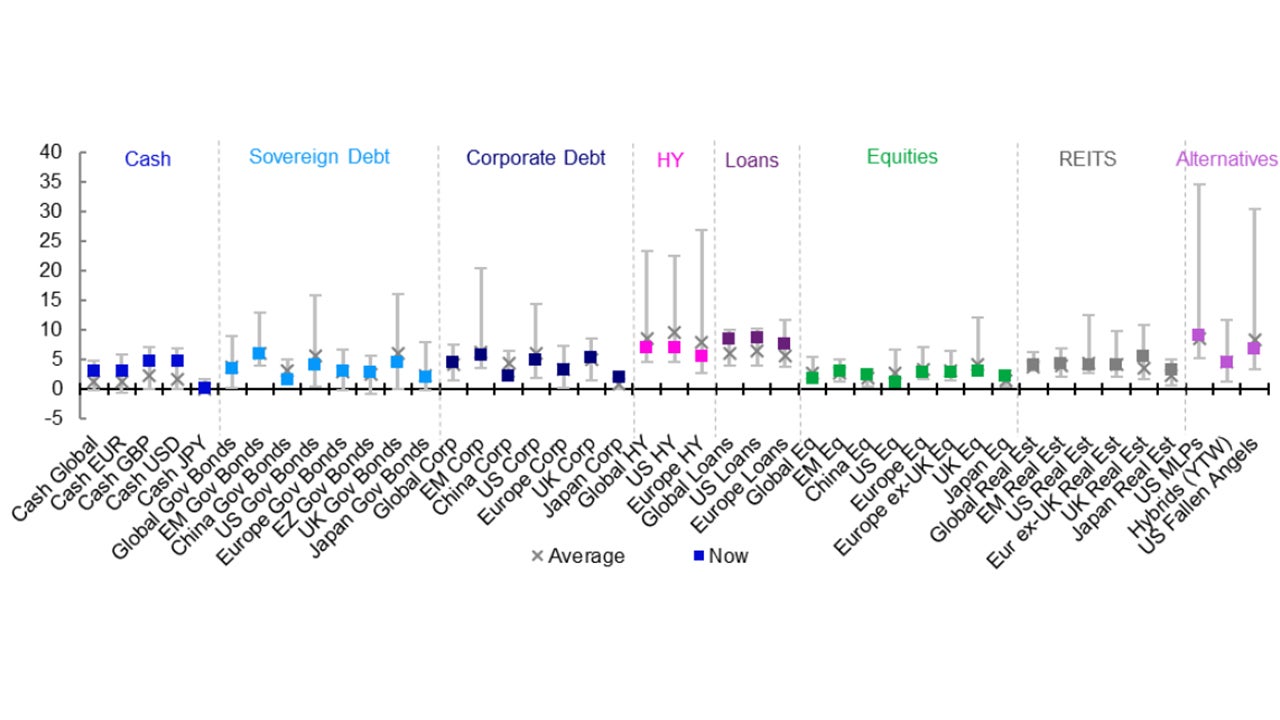

Nevertheless, we expect global economic growth to be higher in 2026, on the back of past central bank easing, upcoming fiscal easing in some regions and the ongoing rise in real wages. We think this will allow most assets to generate positive returns in the year ahead and that, in general, riskier assets will deliver the best returns. However, we doubt the outcomes will be as strong as in 2025 and I now have a barbell approach within my Model Asset Allocation, with the preference for commodities, REITs and non-US equities balanced by overweight allocations to the historically more stable AAA CLOs and bank loans (see Figure 8). Interestingly, the rates available on short duration assets such as cash, CLOs and bank loans remain above historical norms (see Figure 3).

The problem is that after three years of strong returns, it could be argued that a lot of good news is already in the price. However, Figure 3 suggests that few assets have yields much lower than historical norms (HY, Chinese bonds and US equities are examples of those that do). As is often the case, some of the highest yields are to be found in alternative categories (bank loans have already been covered). Importantly, the yield on MLPs is above historical norms. Though not included in the Model Asset Allocation framework, I suspect that MLPs could benefit from rising energy prices if we are right about global acceleration.

Given their volatility (see Figures 2 and 4), Bitcoin and private equity are the most difficult assets from a tactical perspective. A year ago, I suggested that Bitcoin could struggle in 2025, and early 2026 has seen an extension of that downtrend (falling to around $78,000 on 1 February 2026). I am no technical analyst, but I suspect that if $77,000 is broken, the next technical support would be around $70,000 and then $60,000-$65,000. I think private equity may fare better if we are right about the global economy.

There are, of course, ways to console oneself if things go wrong. Figure 2 suggests that fine wine investments have performed somewhere between equities and commodities since 2000 (and have just suffered four negative years in a row). If delivery can be taken in kind, investment could turn to consumption!

In summary, 2025 was a good year for most alternative assets. We expect cyclical assets to outperform over the course of 2026. I favour industrial commodities within my Model Asset Allocation (MAA), along with the less volatile bank loans and CLOs (see Figure 8). Among other alternatives (not in the MAA), I favour MLPs and direct real estate. Precious metals are universally liked by the investors I meet but have become very expensive and have just shown the risks of speculative excess. Cryptocurrencies are too volatile for my liking and may be experiencing an “emperor has no clothes” moment.

All data as of 30 January 2026, unless stated otherwise.

Notes: Past performance is no guarantee of future results. As of 31 December 2025. US MLPs is based on the Morningstar MLP Composite Index (starting 15 June 2001). Hybrids (YTW) is a yield-to-worst measure based on the ICE BofA Global Hybrid Non-Financial Corporate Index (starting 31 December 2001). US Fallen Angels is based on the FTSE Time-Weighted US Fallen Angel Bond Select Index (starting 2 January 2002). See appendices for definitions, methodology and disclaimers (especially for details of indices used for assets not mentioned above).

Source: ICE BofA, Bloomberg, Credit Suisse/UBS, FTSE, ICE, Morningstar, LSEG Datastream, Invesco Strategy & Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.