Uncommon truths: Fed surprises are not enough to save the dollar

A busy week included a Fed meeting that delivered several surprises. Markets have downgraded the likelihood of a December Fed rate cut but I think the broad path of rates over the next year is unlikely to change. I still expect the dollar to weaken but the arguments are more balanced.

A week dominated by “Andrew, formerly known as Prince” memes, and that did not see a change of prime minister in France, may be considered uneventful. However, there was plenty of action on the politics and policy fronts, with potential implications for global financial markets and currencies.

First, the meeting between Presidents Trump and Xi Jinping seemed to go well. It appears the US will cut the “fentanyl tariff” on Chinese goods from 20% to 10%, that China will start buying large quantities of US soybeans, that China will make it easier for the US to buy rare earth minerals and that the US will suspend an expansion of “Entity List” export controls (firms on this list face restrictions on receiving US exports). President Trump also suggested that a trade deal is close to being finalised. At the very least, the meeting seemed to improve US-China relations and the risk of a deepening trade war seems to have been averted. If that turns out to be the case, the world economy may have dodged a bullet, which I think is good news for cyclical assets (though markets didn’t reflect that).

Sticking with politics, the 29 October election in the Netherlands delivered a result that few would have predicted a week earlier. Up until that point, the far-right PVV party led by Geert Wilders looked set to again be the biggest party in the Dutch parliament (with opinion polls suggesting it would win 25-30 of the 150 seats, down from 37 at the 2023 election).

However, things didn’t go as expected. In the week running up to the election, opinion polls showed a surge in support for Democrats 66 (D66), a progressive centre-left party led by 38-year-old Rob Jetten. The latter appeared to win support after several impressive performances in TV debates (and an appearance in the final of a TV quiz show). The upshot is that D66 matched PVV in the polls, with both looking set to win 26 parliamentary seats (the ANP news agency suggests D66 will have slightly more votes). I think it will be “easier” for Jetten than for Wilders to form a coalition, with PVV unlikely to be part of the new government (other big parties refuse to work with it). Given the splintered nature of Dutch politics, it may take some time (perhaps into 2026) to negotiate a new coalition, but these elections have at least shown that the forward march of populism is far from inevitable.

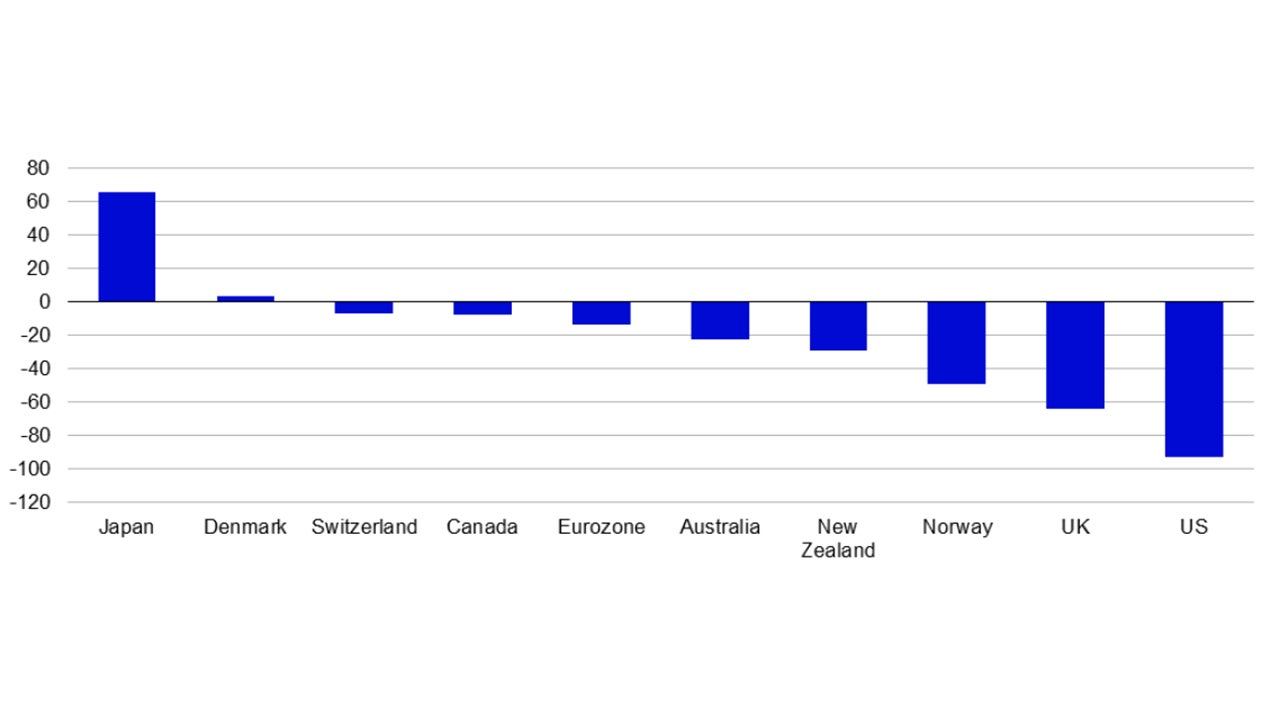

However, I think the biggest policy events of the week came from central banks. Some because of what they did and others for what they didn’t do. Those not taking any action included the ECB and the BOJ, which came as little surprise. Having cut rates four times in the first half of 2025 (taking the Deposit Facility Rate to 2.00%), the ECB has made no changes at the last three meetings (including that of 30 October 2025). Figure 1 suggests that financial markets anticipate little in the way of ECB policy changes in the period to end-2026. I think that is about right (there may be room for one more rate cut, in my opinion, but I wouldn’t expect more than that unless there is recession). I believe that ECB rates are already below the long-term neutral point, which I suspect is around 3.00%, and it may be time to allow the eight rate cuts since mid-2024 (and upcoming German fiscal expansion) to have their effect on the Eurozone economy.

Note: Based on calculations by LSEG Refinitiv (except for New Zealand which is based on Bloomberg calculations), concerning changes in central bank policy rates using interest rate futures or overnight index swaps. Changes are up to the final central bank meeting of 2026, except for New Zealand which is up to September 2026. As of 31 October 2025.

Source: LSEG Refinitiv, Bloomberg and Invesco Strategy & Insights.

Nor was the BOJ expected to make any changes, though the direction of travel is likely towards tightening (the policy rate is only 0.5%, compared to a September CPI inflation rate of 2.9%). The recent change of prime minister may complicate BOJ decisions, with Sanae Takaichi appearing to favour low interest rates and a weaker yen (though the US wants the opposite). On the other hand, the mooted fiscal expansion could require more BOJ tightening, which I think could support the yen. The BOJ vote was split 7-2 at the 30 October meeting, with two members voting for a 25 basis point rate hike. Figure 1 suggests that markets expect two-to-three rate hikes between now and the end of 2026. I expect two, a view affirmed by our Japan expert, Tomo Kinoshita.

The rate cuts that came last week, from the Bank of Canada (BOC) and the Fed, were widely anticipated. With its target rate at 2.25%, the BOC is perhaps approaching the end of its easing cycle (the first cut came in June 2024, and the rate is down a long way from its 5.00% peak). Figure 1 shows that markets anticipate BOC rates to be stable to the end of 2026.

Turning to the Fed, though the 25 basis point rate cut was anticipated (taking the upper-end of its policy range to 4.00%), there were a number of surprises at the 29 October meeting. First, it was announced that the programme of quantitative tightening (reduction of securities holdings) will stop on 1 December. This ends a form of tightening. Second, it was revealed that two Fed members dissented from the decision to cut by 25 basis points (ten were in favour). The first was no surprise, with Stephen Miran again voting for a 50 basis point reduction. The other was more revealing, with Jeffrey Schmid voting for no change. That may suggest some resistance to future rate cuts. Indeed, the third surprise was Chairman Powell saying during his press conference that a December rate cut “is not a foregone conclusion, far from it”.

The upshot is that financial markets now believe a December Fed rate cut is less likely (a 68% probability versus 92% on the day before the Fed meeting, according to Bloomberg calculations based on Fed Funds futures). Yields rose by around 10 basis points along the treasury yield curve (up to 10 years), driving losses on US bonds for the week, though US equities did relatively well, driven by the performance of mega caps (see Figures 3 and 5).

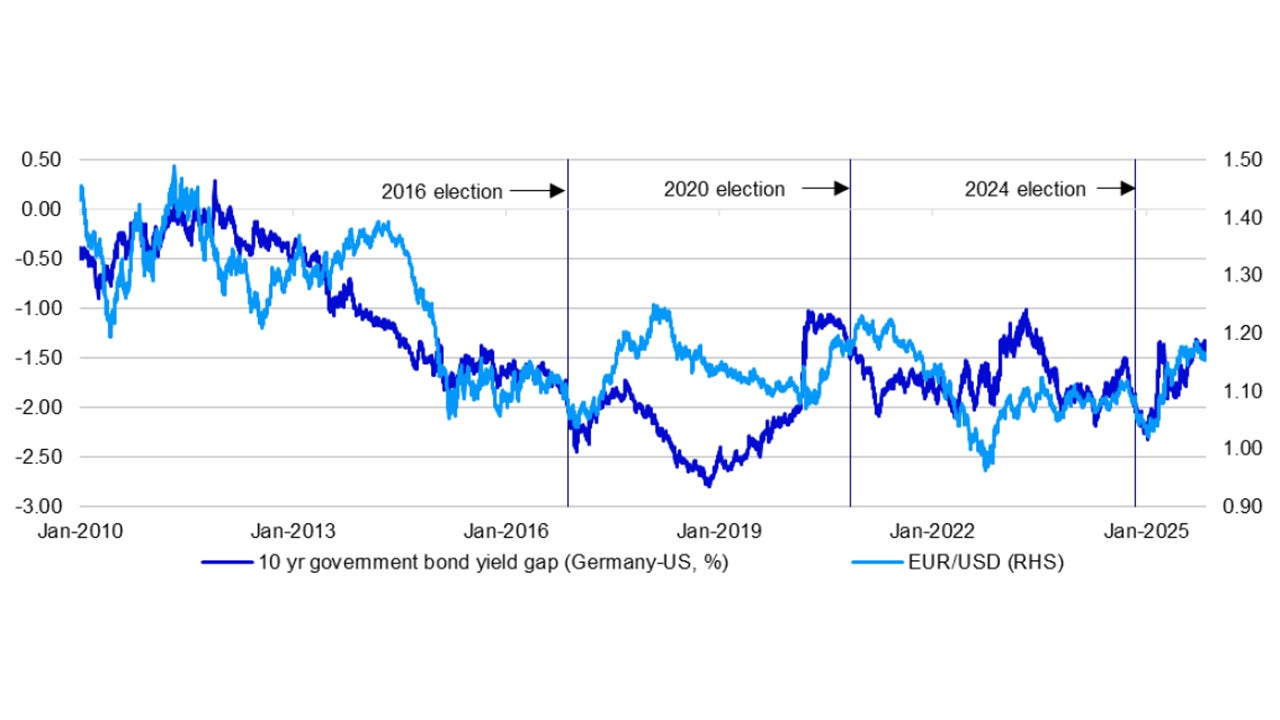

Figure 3 also shows that the dollar strengthened, which should be no surprise given the tempering of market expectations for a rate cut at the next Fed meeting. I continue to believe that the dollar will weaken over the coming year (see FX Pulse) but the arguments now appear more balanced. Against dollar weakness is the renewed optimism around the US economy and anything to do with AI (which is a disproportionate benefit to the US stock market). In particular, a 10-year treasury yield below 4.00% seemed unsustainable to me and I wouldn’t be surprised to see a bit more upside (into the 4.25%-4.50% range over the course of 2026). I don’t see the same scope for European yields to rise, which could argue for a weaker EUR/USD (see Figure 2).

However, I think the dollar remains expensive (based on real trade weighted indices) and I agree with the broad message contained in Figure 1 that the Fed will ease more than other major central banks. That could narrow the interest rate spread that I believe has supported the dollar over recent years, thus reducing the attraction of short-term US assets, while lowering the cost of hedging out of the dollar. On balance, I think dollar weakening has further to go, especially against the Japanese yen. By end-2026, I expect EUR/USD to be in the 1.20-1.30 range, GBP/USD to be 1.35-1.45 and USD/JPY to be 130-140.

Unless stated otherwise, all data as of 31 October 2025.

Note: Past performance is no guarantee of future results. Based on daily data from 1 January 2010 to 31 October 2025 (as of 31 October 2025). “2016 election” etc. show the dates US presidential elections.

Source: LSEG Refinitiv and Invesco Strategy & Insights.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.