Uncommon truths: French elections and Eurozone equities

French elections are upon us, with an extreme outcome possible. It is hard to call the result but we suspect a temporary solution may be found that allows us to continue favouring Eurozone equities.

We believe that elections have little, if any, long term impact on broad asset performance, even if they can bring short-term volatility. Well, elections are coming thicker and faster than expected and it is hard to resist drawing long term conclusions.

After the first debate in the US presidential race, we suspect that Democrats are in despair, while in the UK, after a flood of election debates, the electorate is in despair! There is also desperation in parts of France (and the broader European Union) about the unnecessary calling of a snap parliamentary election, the first round of which takes place today.

Acknowledging the foolhardiness of commenting while voting is taking place, I wanted to address recent questions about the attraction of Eurozone assets, especially in light of the French election. As can be seen in Figure 7, our attraction to Eurozone assets was selective, even before the calling of the French election. We are currently Underweight Eurozone bonds (government, investment grade and high yield), while being Overweight Eurozone equities (proxied by Europe ex-UK) and European bank loans (all within our Model asset Allocation).

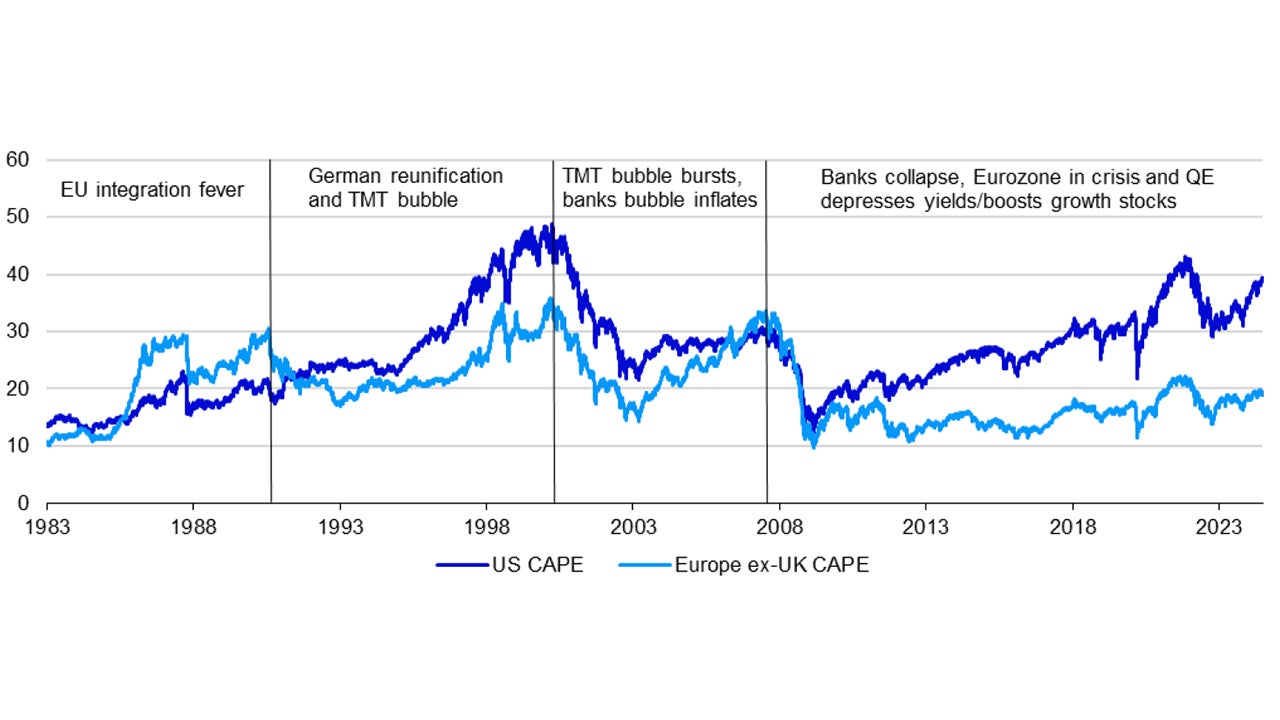

To be fair, questions in meetings usually concern Eurozone equities. Our case for being Overweight that asset class has been two-fold: first valuations and second cyclical/structural timing and market structure. Figure 1 shows that the valuation gap between US and Europe ex-UK now exceeds that which existed at the end of the 1990s technology, media and telecom (TMT) bubble. Indeed the Europe ex-UK CAPE is now 48% of that of US (as of 28 June 2024), versus a low of 61% in 1999 (the record low was 45% in September 2022).

Figure 1 breaks down the period since 1983 into phases of European multiple expansion or contraction versus the US. In the 1980s, Europe ex-UK valuations were boosted by enthusiasm about EU integration (remember the 1992 project), which coincided with the arrival US investment banks (I started my career at Morgan Stanley in London in 1986). That phase came to an end as euphoria about German reunification gave way to the realisation of what it would cost, followed by the late 1990s TMT bubble that favoured US indices (given the weighting of those sectors).

That bubble eventually burst to be followed by a credit and banking bubble. Given the weighting of banks in European indices, this pre-GFC euphoria was to the benefit of European indices. However, that in turn came to an end (in spectacular fashion), to the detriment of European indices, which were then handicapped by the Greek and Eurozone crises. Even worse, successive rounds of quantitative easing (in the aftermath of the GFC, Eurozone crisis and Covid pandemic) depressed bond yields (to extreme lows), which boosted the valuation of growth stocks and the valuation of the US market relative to Europe.

So, a particular set of circumstances have contributed to the valuation discount of Europe ex-UK equities versus the US and we suspect some may be reversing. First, we think the growth-stock boosting trend decline in bond yields is over and, second, we believe the eventual upturn in global growth will be to the benefit of value (and small) stocks, which could favour European markets. Hence, our Overweighting in Eurozone stocks.

Note: Past performance is no guarantee of future results. CAPE = Cyclically Adjusted Price/Earnings and uses a 10-year moving average of earnings. TMT is technology, media and telecoms. Based on daily data from 3 January 1983, using Datastream indices. As of 28 June 2024. Source: LSEG Datastream and Invesco Global Market Strategy Office

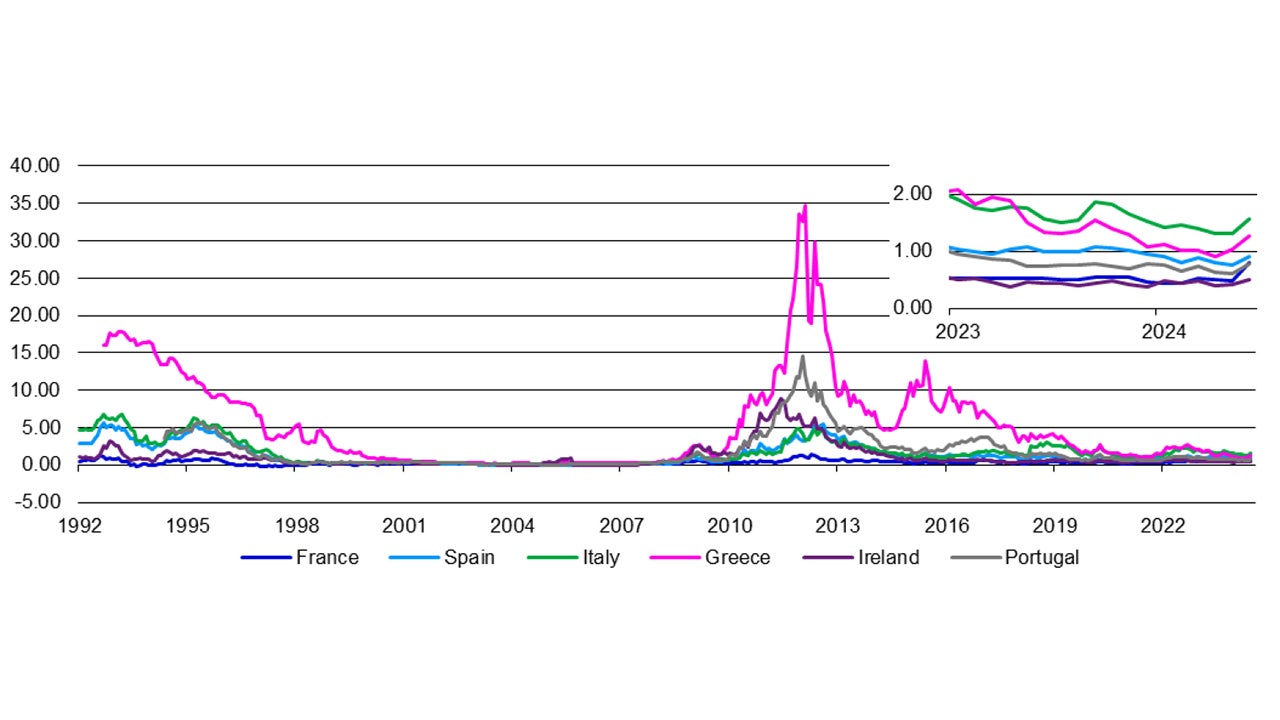

So, are the French elections giving us pause for thought? Well, French bond and equity markets reacted negatively to the calling of the election, with an immediate widening of the bond yield spread versus Germany and an underperformance of French stocks. There was also a broader widening of the spreads on peripheral Eurozone bond markets, a weakening of Eurozone stocks and a dip in the euro. However, as suggested by Figure 2, the widening of spreads has so far been minimal compared to what was seen during the Eurozone crisis. Nevertheless, the spread on French 10-year bonds has risen from 48 bps at the start of June 2024 to 80 bps on 28 June 2024, the highest since mid-2012 (the peak was the 189 bps seen on 16 November 2011).

Why are markets showing any sign of concern? Put simply, it is because of the risk of a switch from a minority centrist government (Macron’s Ensemble party won 245 seats out of 577 in 2022) to a far-right government (Marine Le Pen’s National Rally (RN) and allies could win 200-295 seats, according to recent opinion polls). Even more disturbing is that the second largest bloc could be the far-left New Popular Front (NFP) alliance, with opinion polls suggesting they could win 120-240 seats. President Macron’s Ensemble appears likely to come in third, with 65-130 seats.

Hence, a move away from the centre and towards the extremes seems on the cards, with the far-right making impressive gains since 2022. Further, it seems unlikely that any party or alliance will be able to form a majority government, so the situation could be very messy (especially since parliament cannot be dissolved again for 12 months after the election). That is good news in that it could prevent a lurch to the extremes but is also bad news because it could leave France (and the EU) in limbo. All of a sudden, the UK looks like a sea of calm, despite the likely change in government.

Given the rushed nature of the election, the parties have prepared relatively short policy documents but the programme of RN is similar to the 2022 presidential manifesto of Marine Le Pen (much of what follows is based on a comparison of policy programmes by Le Monde). Both far-left and far-right governments would likely increase the budget deficit, which was already 5.5% of GDP in 2023. The difference is that the NFP is emphasising higher spending (eventually €150bn or 5% of GDP above today’s levels), financed by higher taxes, while the RN is emphasising tax cuts (though they want to increase defence spending to €55bn in 2027 versus €44bn in 2023 and would renationalise autoroutes).

Despite promises not to raise budget deficits, the fear is that both right and left would do just that, especially with the NFP planning to raise taxes and render the economy less efficient (more regulation, more progressive income tax with 14 tax bands, tax “super profits” in certain industries, 32 hour work week for some, target retirement at 60…). This raises fears of a “Liz Truss” moment in government finances and markets, as noted by Finance Minister Le Maire.

Even worse, this could put France on a collision course with the EU, which is already demanding action to get the fiscal situation under control. A 5.5% budget deficit in 2023 and a debt/GDP ratio of 110% are well beyond the limits laid down by the EU Treaty (maximum deficit/GDP of 3% and debt/GDP of 60%). Though President Macron would still control foreign policy (including relations with the EU), a French government that increases an already excessive deficit would not go down well in Brussels. And it is hardly likely that such a government would care, as neither the RN nor the NFP are big fans of the EU (the RN wants to reduce French payments to the EU by €2-3bn, while the NFP wants to reform the EU’s agricultural policy). This could jeopardise progress on the EU project.

Note: Past performance is no guarantee of future results. Based on monthly data from January 1992 to June 2024 (as of 30 June 2024). The smaller inset chart shows monthly data from January 2023 to June 2024 (as of 30 June 2024)

Source: LSEG Datastream and Invesco Global Market Strategy Office

Unfortunately, it is hard to forecast the outcome, given the two-round election process and opinion poll data. There are 577 constituencies and the first round of voting on 30 June is to reduce the number of candidates in each constituency to those with at least 12.5% of the first round vote (usually only two or three candidates), unless one candidate gains more than 50% of the first round votes. The second round of votes on 7 July will then determine the candidate for each constituency and the composition of parliament.

Though the first round of votes is in no way decisive, it will give some idea of voting intentions and put an upper limit on the number of seats for each party. However, tactical voting in the second round (to block the far-right candidate, say) could be a complication.

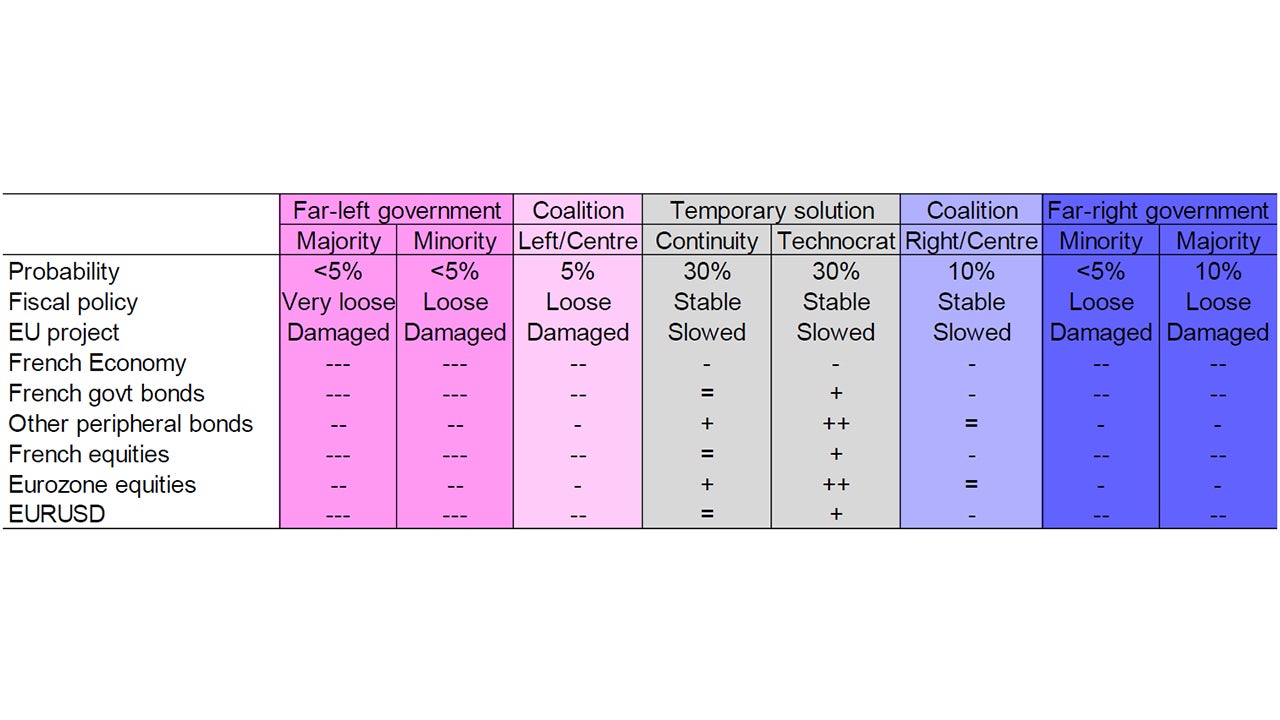

In truth, there are a large number of possible outcomes. Figure 3 shows my assessment of the most likely, along with potential implications.

Far-right majority (10% probability, in my view): though Marine Le Pen’s RN party is ahead in the opinion polls, it seems an outside possibility that they will gain an overall majority (starting a period of cohabitation). I fear the fiscal approach and attitude to EU budgetary controls would worry financial markets.

Far-right minority (<5%): this is a likely outcome based on opinion polls but the RN’s candidate for PM (Jordan Bardella) has ruled out this possibility, in the belief it would be subject to an immediate vote of no-confidence (thus refusing to fall into one of the traps set by President Macron when he called the election).

Far-left majority (<5%): I believe this would be a major concern to financial markets given the fiscal approach and attitude to the EU. However, I think it unlikely.

Far-left minority (<5%): though such a government would have less degrees of freedom than a far-left majority, I suspect it would still frighten markets. I don’t think the NFP has the necessary support for this.

Left/Centre coalition (5%): By this I mean a marriage of convenience between Macron’s Ensemble and the New Popular Front, designed to block the far-right. This would be less problematic for markets than a far-left government but would still bring risk, in my view.

Right/Centre coalition (10%): a partnership between RN and Les Republicains (descendants of De Gaulle and Chirac). Les Republicains have dismissed the idea but the chance to participate in government could turn heads. This may take some of the hard edges off the RN programme and calm markets.

Temporary solution (60%): looking at the reality of the situation, some sort of temporary solution designed to allow a government to pass necessary legislation until further elections (not before 12 months). This could be a technocrat PM (Michel Barnier, for example) or a continuation of the current government (as seen in countries such as Spain, Belgium and the Netherlands). I think this would be the most reassuring outcome for markets, but would just delay the issue.

I assume that President Macron would stay in office until mid-2027 (as he has vowed). As seen in Figure 3, I can imagine some positive outcomes for French and Eurozone assets. I think they are also the most likely, so my positive view on Eurozone equities may not need adjustment. However, if French public opinion remains as it is, 2027 could see Marine Le Pen elected as president, accompanied by a far-right government. That would give me pause for thought.

Unless stated otherwise, all data as of 28 June 2024

Note: “Far-left government” is the New Popular Front. “Far-right government” is National Rally plus allies. The Left/Centre coalition option imagines New Popular Front working with Ensemble. Right/Centre coalition imagines National Rally working with Les Republicains. “Continuity” imagines the current government continuing to operate with a limited and temporary mandate. “Technocrat” imagines the appointment of a non-political prime-minister and government to steer France through a period until further elections are held. “Probability” is the author’s subjective probability of the various scenarios. Items with “-“, “+” or “=” signs are the author’s appraisal of the likely impact on the variables concerned (the opinions about bonds concern the impact on returns and not spreads). These views may not come to pass. Source: Invesco Global Market Strategy Office