Uncommon truths: The Aristotle List: 10 improbable but possible outcomes for 2026

It is time to forget central scenarios and think about improbable but possible outcomes. A reversal of some strong and popular trends is built into my list of surprises (these hypothetical predictions are my views of what could happen even if they do not form part of our central scenario).

Aristotle said that “probable impossibilities are to be preferred to improbable possibilities”, meaning that we find it easier to believe in interesting impossibilities (B52s on the moon, say) than in unlikely possibilities. The aim of this document is to seek those unlikely possibilities -- out-of-consensus ideas for 2026 that I believe have at least a 30% chance of occurring. The concept was borrowed from former colleague Byron Wien.

I believe the biggest returns are earned (or the biggest losses avoided) by successfully taking out-of-consensus positions. A year ago, the “Trump trade” was a popular idea, so two of my ideas leant against that (“US dollar weakens during 2025” and “US stocks underperform global indices”). Those were among the five successful ideas but the same number didn’t work (“Bitcoin falls below $50,000, for example). In a world where nothing surprises me any longer, the challenge is greater than ever. Given the bullish market outcomes in 2025, I feature a reversal of some trends. Don’t look for internal consistency, as there is none.

1. US Democrats win both houses at mid-terms

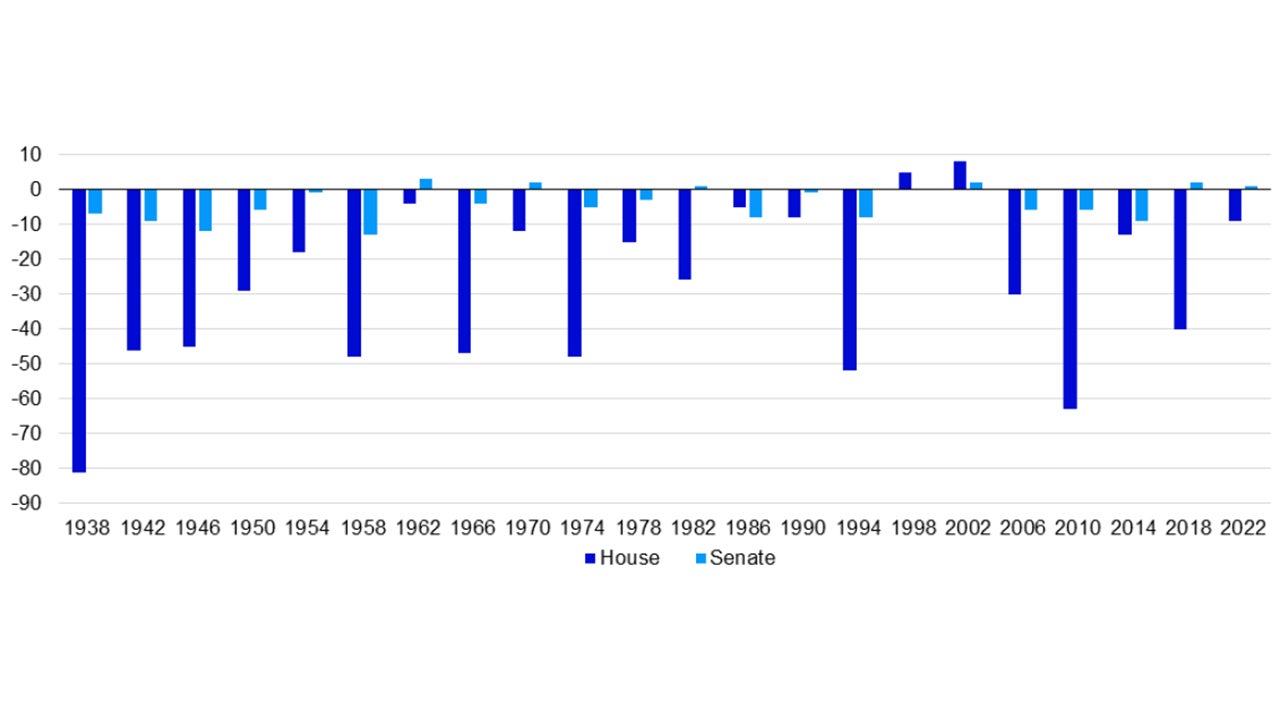

Republican control of both houses of Congress has enabled President Trump to implement his policy agenda. However, US mid-term elections are due on 3 November 2026 and the party of the president usually loses seats in both houses (see Figure 1). The only occasions when this was not true for the House of Representatives was during the second term of Bill Clinton and the first term of George W. Bush (when both had Gallup job approval ratings above 60%).

The House swinging to the Democrats is something of a consensus idea (the Republicans only have 220 seats, versus the 218 needed for a majority). However, the Senate appears more challenging, as the Democrats would need to flip four of the 22 Republican seats that are up for grabs (only 35 of the 100 senators face re-election in 2026). That is a big ask, but with President Trump’s job approval rating falling to 36%, I think a big swing against the Republicans is on the cards. This may lead to big policy initiatives in 2026 (Venezuela, Greenland, 50% boost to defence spending), as one last hurrah before Congress turns awkward or in an effort to bolster the Republican vote.

2. Russell 2000 outperforms the Magnificent 7

Conversations with investors around the world suggest a strong consensus that US mega caps will continue to outperform, driven by the AI phenomenon. Recent history offers support for this view: in the five years to 31 December 2025, the annualised return on Bloomberg’s Magnificent 7 Total Return index was 51.2%, versus “only” 10% on the Russell 2000 index (total return). However, in 2025 the performance gap was reduced to 24.7% (Magnificent 7) versus 12.8% (Russell 2000) and the performance within the former was concentrated in two stocks (the rest had share price gains of less than 15%, with three below 10%). If the US economy accelerates, it could be time (at last) for smaller caps to shine and I think it is possible that the wheels fall off the mega cap bandwagon, especially as doubts arise about the economics of AI investments.

3. USD/JPY falls to 140

The list of surprises for 2025 contained a prediction that the US dollar would weaken, which it did, but the decline against the Japanese yen was minimal (see Figure 4). The yen is extremely weak in real trade weighted terms (more than 40% below post-1990 norms, based on Goldman Sachs indices). I think it became so because the Bank of Japan (BOJ) refrained from the global tightening of 2022/23, thus creating a wide gap between its interest rates and those of other countries. That is now changing, with the BOJ gradually normalising rates upward as many other central banks ease. In 2026, I expect the BOJ to raise its rates by 50 basis points, while I think the Fed will move in the opposite direction. At some stage, I expect that narrowing of spreads to support the yen and, given the degree of undervaluation, I think it will move rapidly. USD/JPY at 140 may seem a long way from the current 158, but it is not when considering the valuation gap.

Notes: Based on mid-term elections from 1938 to 2022. Source: The American Presidency Project and Invesco Strategy & Insights

4. UK 30-year yield ends 2026 below that of the US

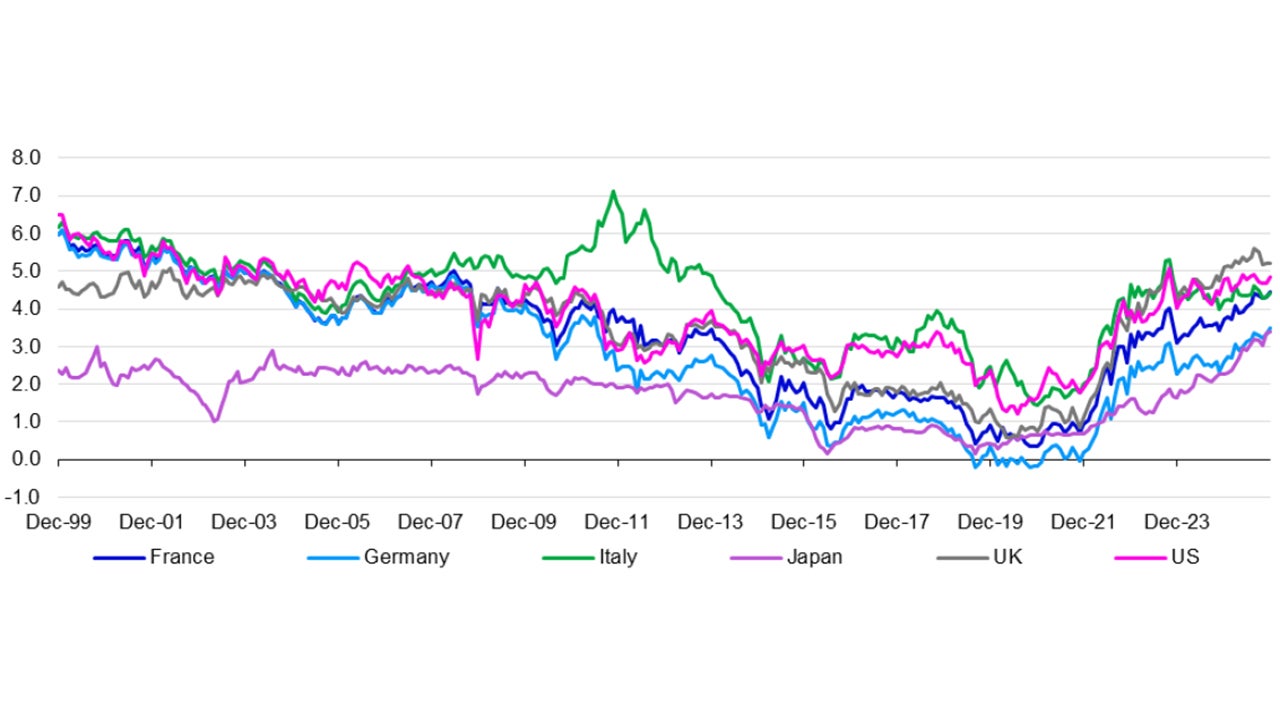

30-year government yields appear to have normalised upward from the post-GFC and pandemic lows (see Figure 2). Whether they have now reached long-term norms is hard to know but I suspect they are close (based on notions of long-term nominal GDP growth and appropriate term premia). There have also been some interesting relative moves: Japanese yields have caught up with those of Germany; French yields are now closer to Italian than German yields and US yields are again above those of Italy. Highest of all is the 5.12% seen in the UK (as of 9 January). Despite political instability, I expect the UK 30-year yield to finish 2026 below that of the US. First, UK long rates have often been lower than those of the US and should be so (in my opinion) because long-term nominal GDP growth is likely to be lower in the UK. Second, the US fiscal position appears more precarious than in the UK, especially given the desire to boost the popularity of Republicans ahead of the mid-term elections (see the recently proposed 50% boost to defence spending) and this could raise US long yields.

5. Keir Starmer survives the year

To those outside the UK, it may seem odd that we are talking about the demise of Prime Minister Keir Starmer (his Labour Party won 411 out of 450 parliamentary seats in July 2024) and he is playing an important role on the global stage). But to those in the UK, his demise is widely anticipated. His government has upset businesses, farmers, junior doctors, pensioners, the disabled, those wanting a firmer stance against the US and those wanting nothing to do with the EU. His government has been forced into a number of embarrassing U-turns by its own backbenchers and it’s YouGov net approval rating has collapsed from a post-election peak of -2% to -59% (they are usually negative). That is worse than any rating given to Boris Johnson, and close to the worst suffered by Theresa May and Rishi Sunak (the Liz Truss low was -76%). With the Reform Party of Nigel Farage leading in every opinion poll since May 2025, and Labour recently losing ground to the Green Party, I think it likely that it will suffer in the 7 May local elections. Whether before those elections or after, there may be a growing desire within the Labour party for a leader who can give a better sense of direction. However, a challenger would need the open support of 81 sitting Labour MPs before a leadership contest could be launched (and support will be split across numerous potential candidates). That may prove an insurmountable hurdle.

6. Argentine govt. bonds outperform global indices

The three best performing government bond markets in 2025 (among the 35 that we follow, in local currency terms and based on ICE BofA government bond indices), now have USD denominated 10-year yields of 5.9% (Mexico), 6.1% (South Africa) and 6.6% (Turkey). They are interesting but I am not convinced the spread is enough versus a US 10-year yield of 4.17%, so have chosen to go with the 9.8% available on Argentina’s USD denominated 10-year bonds (NY Law). Given the USD denominated nature of these bonds, the risks are focused on default and IMF forecasts suggest the gross debt to GDP ratio will fall to 74% in 2026 (from a recent peak of 155% in 2023). The big opportunity may have gone (the recent peak was 31% in October 2022), but with enthusiasm for Milei’s reforms and support offered by the US, I suspect the returns will be hard to beat.

Note: Past performance is no guarantee of future results. Based on monthly data from December 1999 to December 2025 (as of 31 December 2025). Source: LSEG Datastream and Invesco Strategy & Insights

7. EU carbon price goes above €100 per tonne

ESG may no longer be fashionable but I believe climate change is the biggest externality we face and that making the polluter pay is the most efficient way to deal with it. The EU’s Emissions Trading System tries to set appropriate pricing signals by systematically reducing the volume of CO2 emission allowances. The rate of reduction in the allowances cap has been doubled from 2.2% per year in the 2021-23 period to 4.3% from 2024 to 2027, which should support the price of allowances (carbon price). The EU carbon price bottomed at €56 per tonne in February 2024 and recently peaked just below €89 (just short of my 2025 target of €90). An upturn in the EU economy (which I expect) could boost demand for allowances, just as supply falls more rapidly. So I am doubling down and predicting that the EU carbon price will go above €100 in 2026.

8. Kenyan stocks outperform for third year in a row

In my search for exotic stock market opportunities, I usually look for the holy grail of a dividend yield that exceeds the price/earnings ratio. The options are very limited this year, with Botswana and Romania the only markets I can find that meet the above criteria when using historical valuation ratios. However, after a 51%local currency gain in the Nairobi All Share Index (NAS) in 2025, I stick with Kenya. The estimated 2026 NAS P/E is 7.2 and the 2026 dividend yield is 7.4% (as of 9 January 2026, according to Bloomberg consensus estimates). Usually, whenever valuation metrics are at such levels it signifies either that a big opportunity has presented itself or that something is about to go very wrong. Bloomberg consensus estimates suggest that both earnings and dividends are expected to rise in 2026 and 2027. So, no problem there. Also, the usual macro metrics (growth, inflation and economic balances) do not signal big problems, and in 2025 the shilling was broadly stable against the US dollar. The drawback is a market capitalisation of only $21bn.

9. Gold falls below $3,500

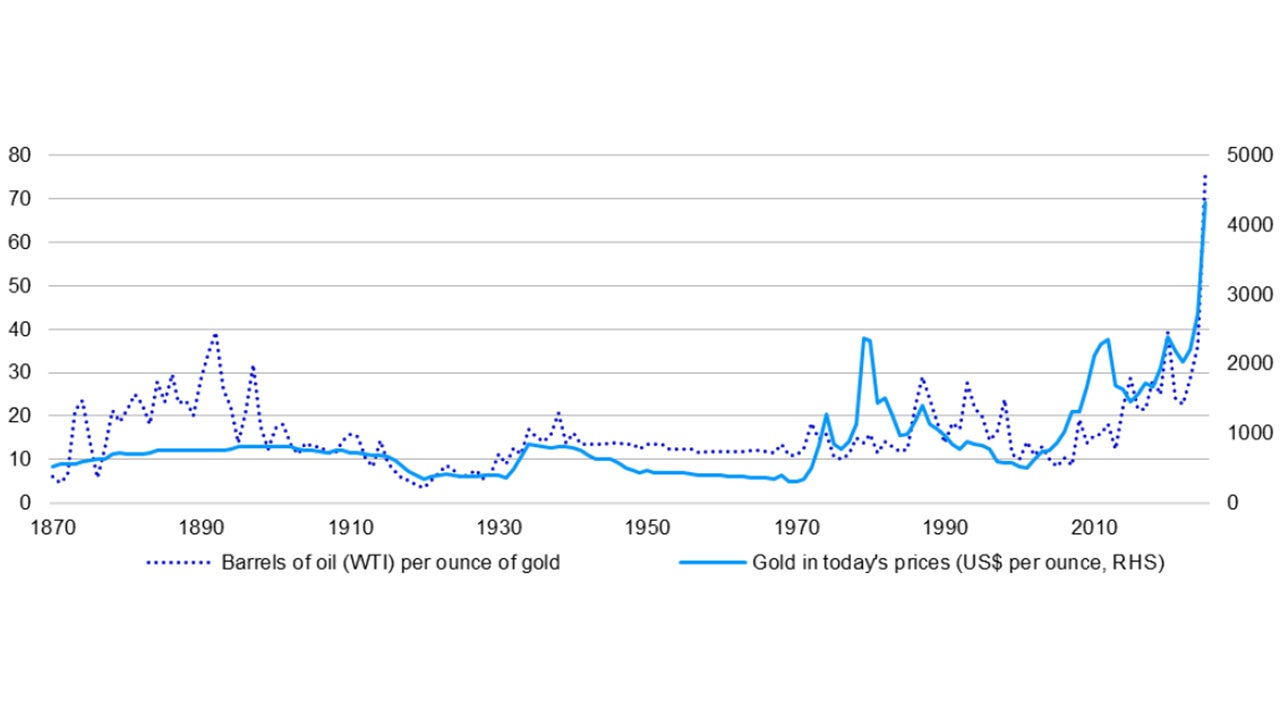

Everything seems to favour gold at the moment: mounting government debt, rising geopolitical tensions and a weakening dollar. Most of the investors that I meet like gold: understandably given the doubling of its price in less than two years (see Figure 3). But I would expect demand to fall when prices rise so much. Indeed, World Gold Council data shows the following year-on-year declines in the first three quarters of 2025: central bank purchases -13%, jewellery demand -20%and technology demand -1%. The only component of demand to rise was investment (+87%), largely on the back of a reversal of ETF outflows. I am concerned that, at some stage, investors will start to focus on the level rather than the momentum of prices. When that happens, I think the fall could be rapid.

10. England reach the FIFA World Cup final

FIFA’s 2026 World Cup in Canada, Mexico and the US could be one of the more chaotic given US visa requirements, eye-watering ticket prices, the expansion to 48 teams, the lack of attention to player and spectator welfare (too hot!) and the heightened security whenever the US president attends. As for the football, FIFA has rigged matters so that the top 4 ranked teams can’t meet until the semi-finals (if all goes to plan). With the information currently available, I think those four teams will contest the semi-finals. En route, I have England beating Mexico in the round of 16 (in Mexico City) and Brazil in the quarter final. Then for the big surprise: I expect England to beat Argentina in the semi-final, thus reaching the final for the first time since 1966. Unfortunately, I think they will then face #1 ranked Spain, who I think will prevail.

As a gift for the new year, Figures 4, 5 and 6 show long term data across assets, sectors and factors.

Unless stated otherwise, all data as of 9 January 2026

Notes: Past performance is no guarantee of future results. Based on annual data from 1870 to 2025 (as of 31 December 2025).”Gold in today’s prices” deflates historical gold prices using the US consumer price index, so that historical prices are expressed in 2025 prices. Barrels of oil (WTI) per ounce of gold, is derived by dividing the price of an ounce of gold by the price of a barrel West Texas Intermediate oil (using spot prices in both cases). Source: LSEG Datastream and Invesco Strategy & Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.