Uncommon truths: Tumbling European inflation is good news

Last week brought good news on US inflation but the declines were even more dramatic in Europe. However, core inflation in the Eurozone has yet to peak. We believe it will follow headline inflation lower but the ECB may want to tighten for longer than the Fed. We expect the euro to strengthen.

After recent banking inspired excitement, “normality” seemed to break out during the last week. The CBOE VIX Index of implied volatility on S&P 500 options dipped below 20 (having peaked at 30.4 on 13 March), while the equivalent for US treasuries (ICE BofA MOVE Index) fell to 136 (after peaking at 199 on 15 March). Bank sector credit default swap spreads have also come down from recent peaks, though like the MOVE index they remain higher than normal.

It has been our observation over the years that the VIX index follows a cyclical pattern: it tends to be highest during times of recession and lowest during times of prosperity (perhaps linked to profit cycles). Data released in the past week pointed to underlying weakness in the US economy. First, revised GDP data for the fourth quarter of 2022 showed that consumer spending growth was weaker than previously thought (1.0% annualised quarterly, down from the initial estimate of 2.1% and the 3.1% recorded a year earlier). Of the 2.6% growth in GDP during Q4, 1.5 percentage points came from inventory accumulation. Hence, real final sales (GDP excluding inventories) grew by only 1.1%, down from 4.5% in the previous quarter and 1.9% a year earlier.

Second, February data suggests that the 2.0% jump in both US personal disposable income and spending in January were one-offs related to fiscal transfers. Disposable income growth fell to 0.5% in February, while spending growth was limited to 0.2%. Hence, after pausing in January, the personal savings rate continued the climb seen over recent months (to 4.6% in February, from 4.4% in January and the low of 2.7% in June 2022). This suggests to us that US consumer spending will continue decelerating over the coming months and quarters. In fact, when adjusted for inflation, personal spending declined in three of the four months to February. Further, our analysis of Datastream index data suggests that US earnings per share have been falling since 2022 Q3 and have been weaker than in the other regions that we follow.

Such a slowdown in the US economy and profits may be considered bad news (leading to more financial market volatility). However, under the current circumstances, a slowdown may prove to be good news if it helps control inflation. Along with the personal income and spending data came the personal consumption expenditures (PCE) price index measure of inflation, the core version of which is closely followed by the Fed. The 12-month change in the PCE deflator fell to 5.0% in February, from 5.3% in January and the recent peak of 7.0% (June 2022). Core PCE inflation has been more stubborn but still fell to 4.6% from 4.7% (the recent peak was September’s 5.2%).

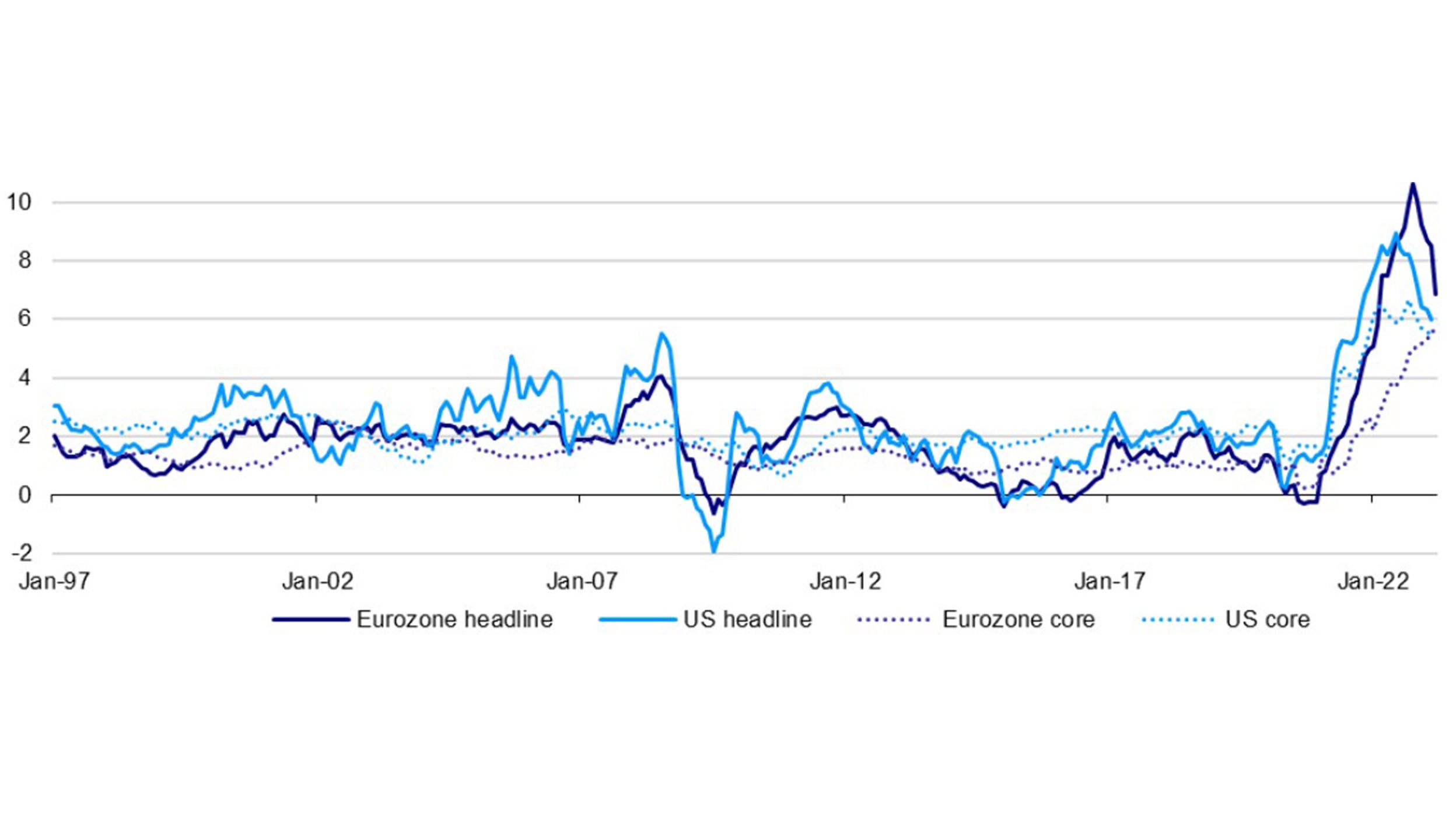

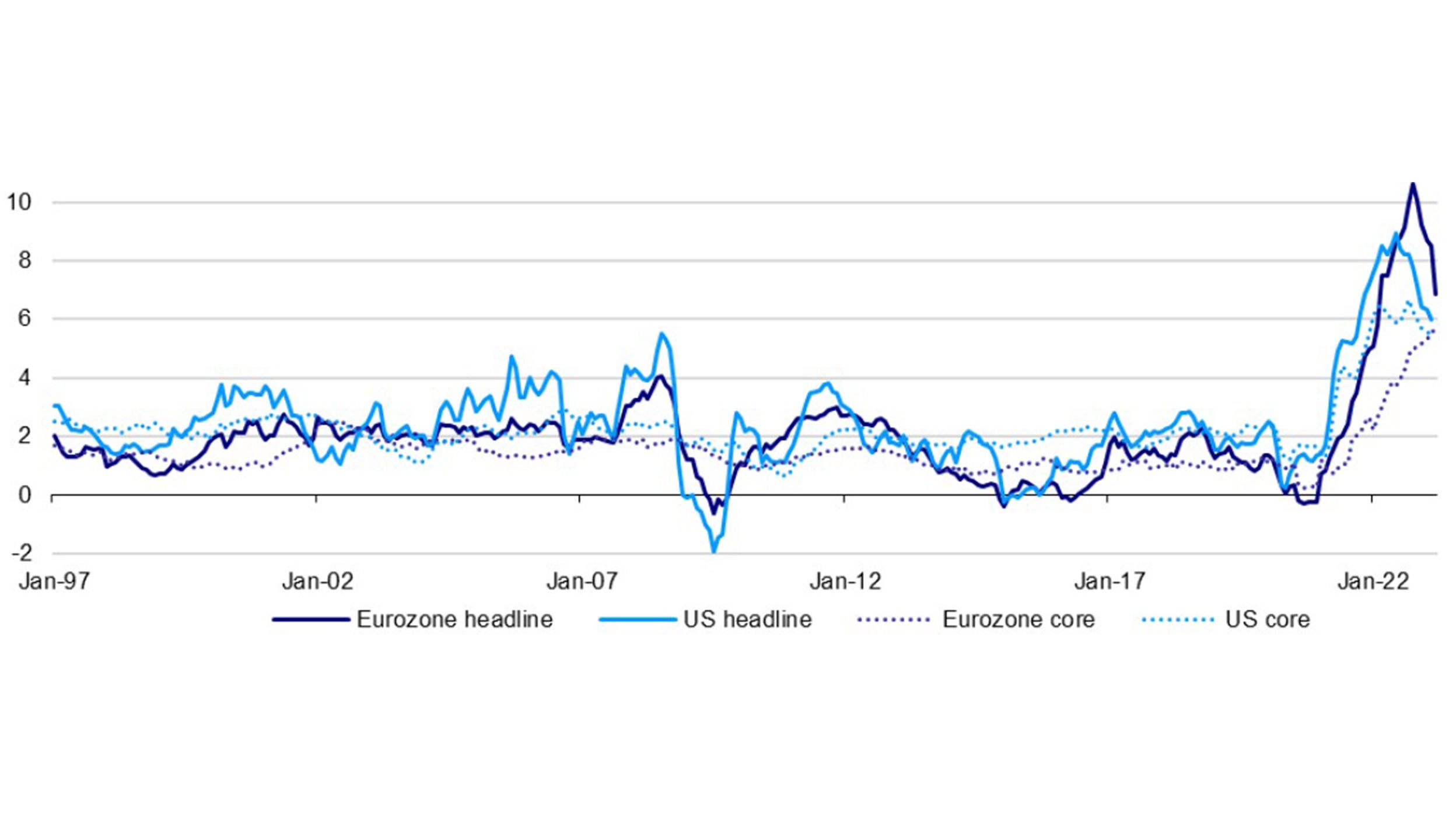

That decline in inflation was reported on Friday and may have contributed to the buoyancy of US equity and bond markets as the week closed. March data for the more popular consumer price index is due on 12 April but was published last week for many European countries. Given that we are now more than 12 months on from the commodity price jump that followed the invasion of Ukraine, there was a big drop in headline inflation in most of Europe in March. Figure 1 shows the extent of the recent decline in Eurozone headline inflation. It also shows how Eurozone inflation has lagged US inflation over recent years (perhaps due to the petrol/gasoline tax wedge being larger in Europe, which reduces the effect of oil price gains on inflation).

Notes: Monthly data from January 1997 to March 2023. “Core” excludes food & energy.

Source: Refinitiv Datastream and Invesco

However, European inflation was eventually pushed above that of the US by two factors, in our opinion. First was dollar strength (the Fed tightened well before the ECB), which by itself tends to increase imported inflation in Europe. Second, was the rise in European natural gas prices, which had a big knock-on effect on utilities prices. Both factors have reversed to some extent and we expect them to continue to do so. Hence, we think Eurozone headline inflation will fall below that of the US in 2023.

By country, there were dramatic declines in the month of March. For example, Dutch CPI inflation fell to 4.5% from 8.9% in February and the peak of 17.1% in September (based on the EU harmonised consumer price index). Spain also saw a dramatic decline to 3.1% from 6.0%, versus the July peak of 10.7% (again on an EU harmonised basis). These sharp declines came as a relief after the upward blip in February.

Of course, the picture is not the same in all European countries, with March EU harmonised inflation of 7.8% in Germany (down from 9.3% in February) and 6.6% in France (7.3%). For the Eurozone as a whole, headline inflation fell to 6.9% from 8.5%. Many governments subsidised the consumption of energy but to differing degrees. Hence, the peak in inflation varied by country, as has the rate of decline in recent months. Nevertheless, the March data suggests the direction of travel is downward and we believe headline inflation will continue to decline as base effects wane and natural gas prices normalise.

Unfortunately, core inflation appears to be more stubborn, with core CPI inflation in the Eurozone rising to 5.7% in March (from 5.6% in February) and apparently yet to peak. If, as is commonly supposed, core inflation is the stable anchor around which headline inflation swings, then this is worrying.

However, we believe that headline inflation has a big effect on the path of core inflation. Figure 1 shows that US and Eurozone core inflation lagged headline inflation over the last two years. We think this makes sense: many service sector pricing contracts refer to headline inflation (see the shocking rise in UK telecom and media tariffs at the moment), while wage negotiations will often be impacted by prevailing headline inflation. The good news is that as headline inflation crumbles (also aided by the removal of supply chain obstacles), then so should the upward pressure on many of the contributors to core inflation. Even better, as house prices fall (as they are in many countries) the housing or shelter components of national price indices will decelerate.

Hence, we believe that core inflation will eventually follow headline inflation lower, as has often happened in the past (see Figure 1). Nevertheless, many national labour markets are tight, which could keep upward pressure on wages. Figure 2 shows the historical relationship between German unemployment (inverted in the chart) and core inflation. There was a decent relationship before the global financial crisis (GFC), with low unemployment associated with high core inflation and vice-versa. However, the link has been less obvious since the GFC and the most recent rise in core inflation may be largely due to factors other than the labour market. Nevertheless, the ECB may feel more comfortable once unemployment rises.

We believe the sharp decline in European headline inflation is good news and will eventually lead to lower core inflation. However, the ECB may need to see a decline in core inflation before concluding that its work is done and we expect it to stick with tightening longer than the Fed (which we think is just about done), which we think will continue to support the euro.

All data as of 31 March 2023, unless stated otherwise.

Note: Quarterly data from 1974 Q1 to 2023 Q1. “Core” excludes food and energy.

Source: Refinitiv Datastream and Invesco