US July CPI and investment implications

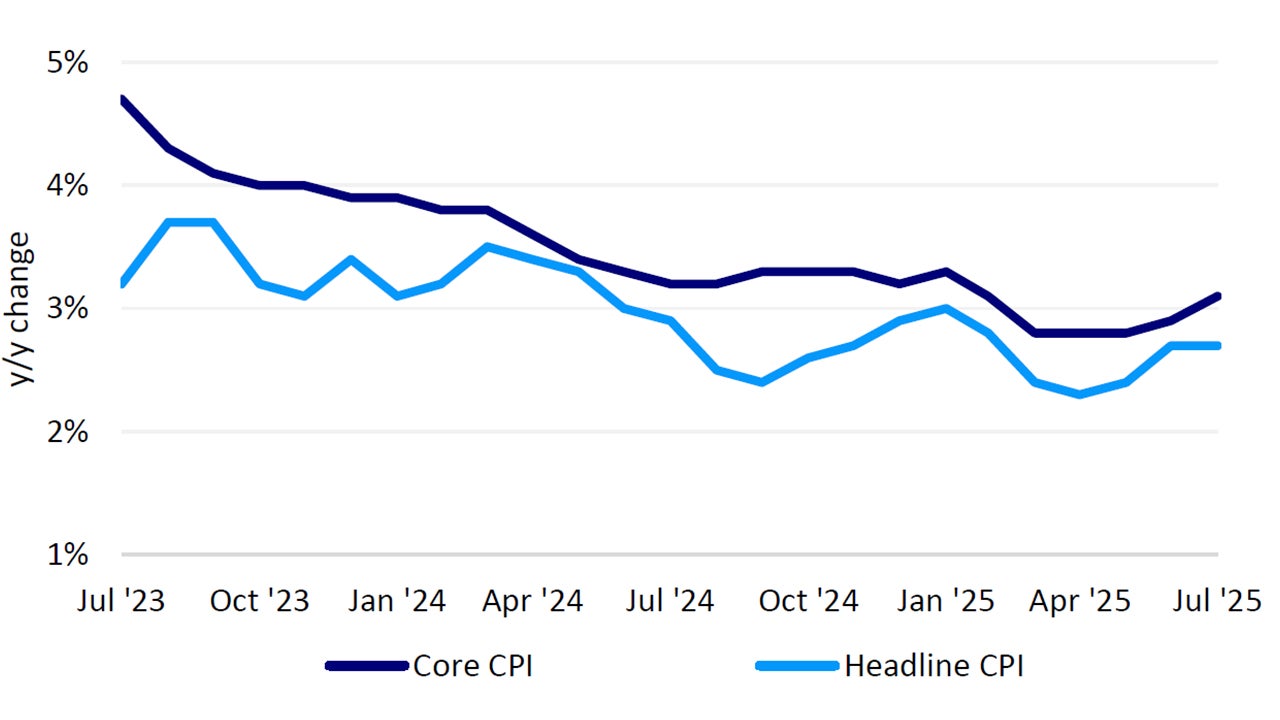

July’s inflation print in the US came in-line with expectations, with headline Consumer Price Index (CPI) at 2.7% y/y and core CPI (excluding food and energy) at 3.1% y/y.1

The not-too-hot CPI print has relieved investor concerns that President Trump’s tariffs could drive higher inflation.

Core goods prices went up only by 0.2% m/m, the same as the month before.1 The barely perceptible inflation impact suggests that investor fears may have been misplaced.

The softness in goods inflation in July was contrasted by a 0.4% gain in services prices in things like airfares, which rose 4.0% m/m.1

Source: Bureau of Labor Statistics, as of August 12, 2025

While Fed Chair Powell used the July Federal Open Market Committee (FOMC) press conference to justify a wait-and-see approach, citing a resilient labor market and unresolved upside risks to inflation, this latest subdued inflation print coupled with last month’s weak employment report now support the case for monetary easing.

Markets will be closely watching Powell’s keynote next week at the Jackson Hole Symposium, which traditionally serves as a bellwether for the Fed’s policy direction in the coming months.

Our base case remains for the FOMC to implement two 25bps rate cuts by the end of this year as the US economy slows and tariffs have only a momentary blip on US inflation’s longer-term trajectory. The depth and credibility of the easing cycle will matter more than its timing.

Investment Implications

Expectations for lower policy rates should have led to lower long-end Treasury yields – but that’s not what happened. Instead, the US yield curve has steepened since the CPI print.

Much of the “twist steepening”, when short-term yields fall and longer-term yields rise, could be attributed to Trump’s accompanying social media commentary and the threats made to Powell’s position.

We’ve seen this twist steepening before back in July, when media first reported that Trump suggested removing Powell.

Powell still appears likely to serve out the remainder of his term, which ends in May 2026. However, recent market reactions to President Trump’s escalating criticism of the Fed Chair raise market risks should Powell be removed - more so if the White House intensifies efforts to influence monetary policy.

Meanwhile Trump’s appointment of E.J. Antoni to lead the Bureau of Labor Statistics (BLS) following the abrupt firing of Erika McEntarfer has further unsettled markets by calling into question the Fed’s historical independence.

The BLS plays an important role in shaping monetary policy through its release of key data such as payrolls and inflation. Given that CPI figures directly influence payouts on fixed income products such as TIPS, even the perception of political interference in BLS outputs could undermine confidence in long-term Treasuries.

More broadly, long-end yields could rise even if the FOMC resumes rate cuts later this year - particularly if those cuts fall short of the ~125bp currently priced into money markets.

A similar dynamic played out last year: the Fed delivered only 100bp of easing versus nearly 200bp expected, and the 10-year Treasury yield rose from ~3.7% in September to ~4.6% by year-end.2

While a repeat of that magnitude seems unlikely, I see no compelling reason to be overweight the long-end of the Treasury yield curve. Yields are cheap and likely to remain cheap.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.