US policy gridlock: Historical trends and market implications

The US federal government entered a shutdown at midnight on the 1st October —the first time in seven years—after the US Congress failed to pass a funding bill.

Government shutdowns in the US tend to have a limited impact on the stock market, interest rates and the yield curve. The 10-year Treasury typically remains stable, as such events rarely alter broader economic conditions or influence Fed policy.

That said, market volatility could increase if sentiment worsens or if furloughed workers face permanent layoffs—reportedly under consideration by the Trump administration.

Essential services and key financial functions such as Federal Reserve operations and Treasury auctions will remain operational.

However, the Department of Labor has confirmed that the weekly jobless claims report will be suspended during the shutdown, and the September employment report is unlikely to be released as scheduled on Friday.

Investment Implications

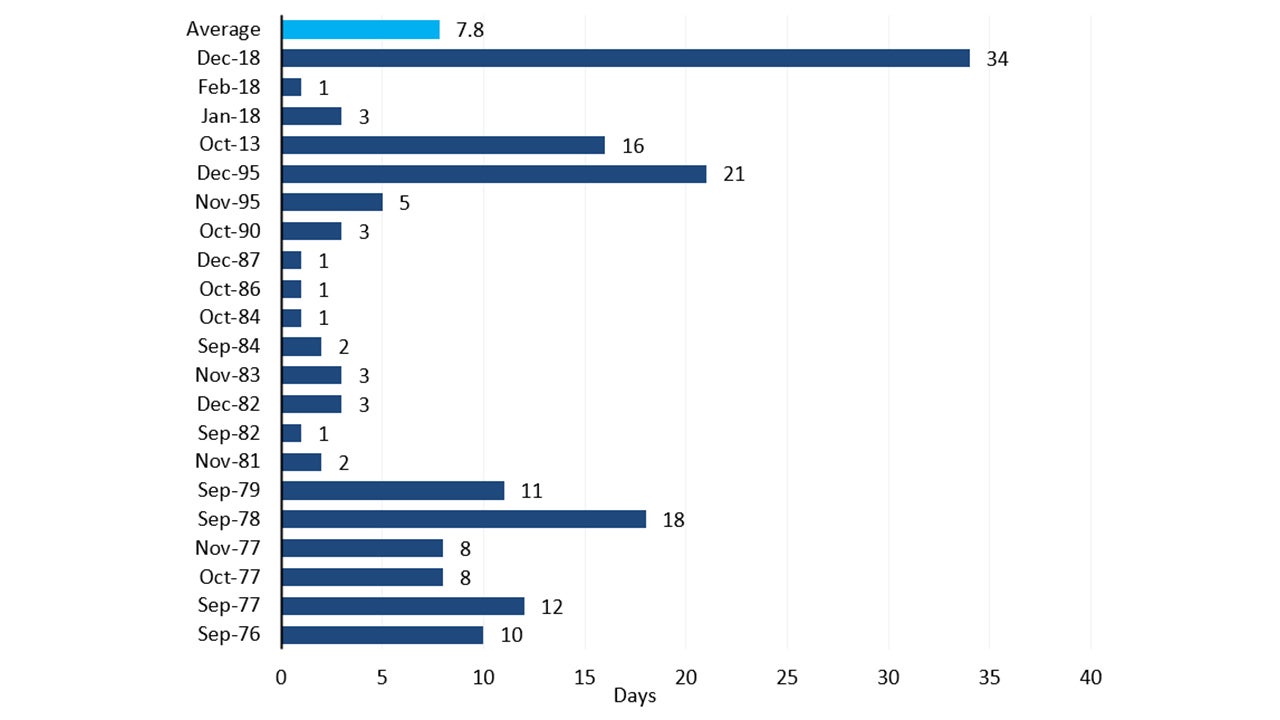

According to our historical analysis, government shutdowns are relatively common and tend to be resolved quickly. Specifically, there have been 21 government shutdowns in US history. They’ve been resolved, on average, within eight days.

Source: US Treasury, as of Sep 25, 2025.

The likely direct economic impact of a government shutdown is difficult to quantify, but it’s relatively small.

- Government spending is roughly 17% of the $30 trillion US economy; however, only about 3% is non-essential spending.

- Non-essential federal workers will be furloughed. Essential workers will receive IOUs instead of payments. More than 2.9 million Americans will be impacted.

The ratio of federal government employees to the total workforce, however, is at the lowest on record, also suggesting that the impact would likely not be large.

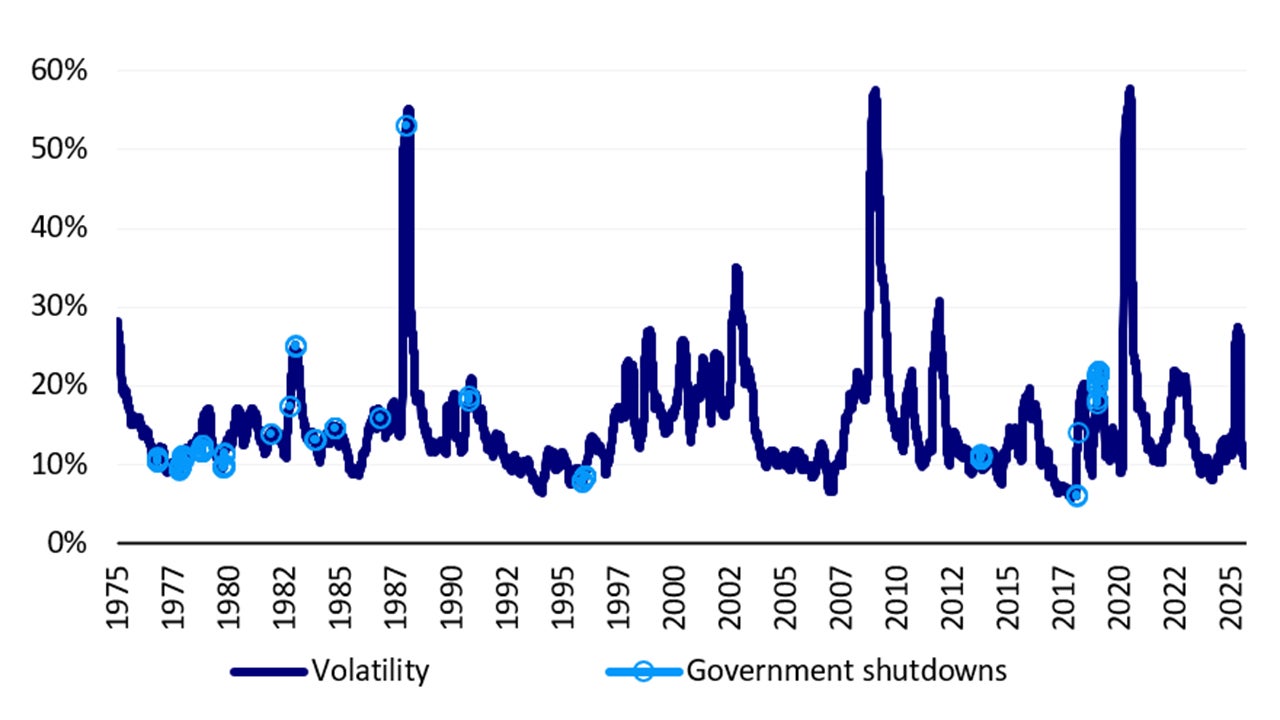

Market volatility often results from policy uncertainty. While there are examples of heightened volatility, for the most part, it has been generally benign during government shutdowns.

Source: Bloomberg L.P., 1/2/75 - 9/23/25. Volatility is measured by the standard deviation of price moves on returns of the index. Standard deviation measures a range of total returns for a portfolio or index compared to the mean. An investment cannot be made into an index. Past performance does not guarantee future results.

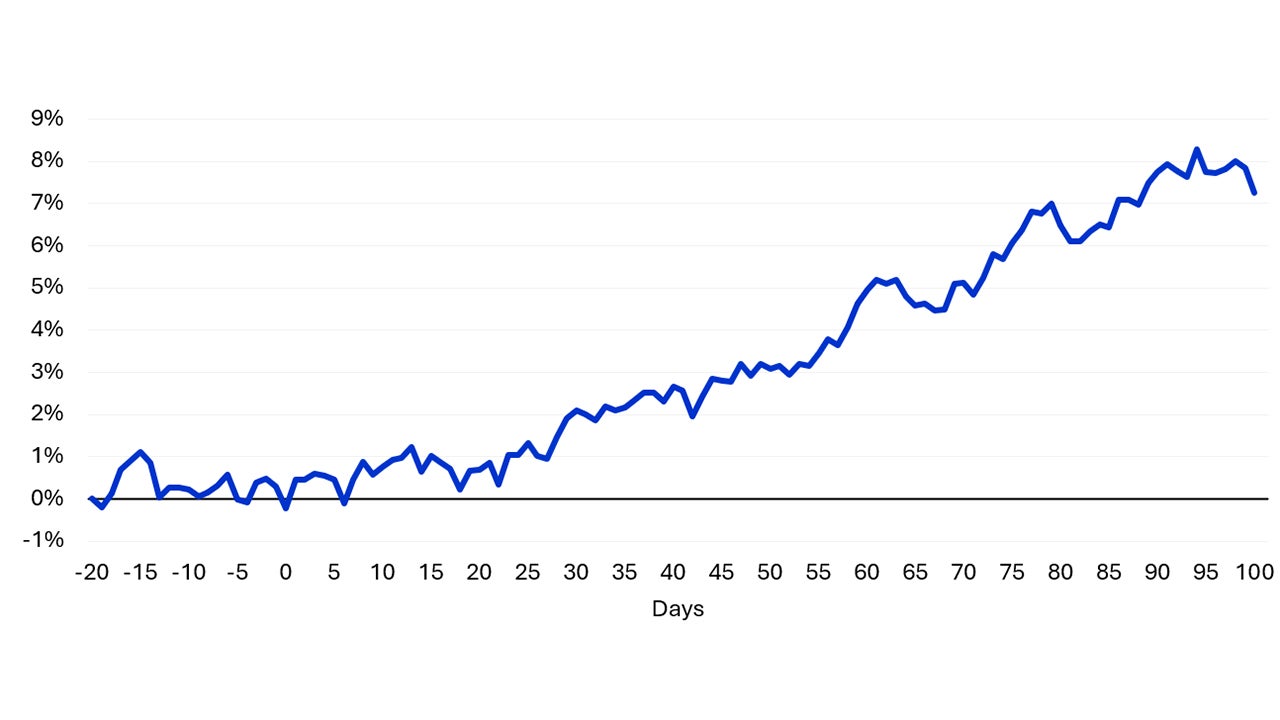

The S&P 500 Index, on average, has churned in the days leading up to government shutdowns and during government shutdowns, only to have advanced in the aftermath.

Source: Bloomberg L.P., 9/10/76 - 12/31/24. There has not been a government shutdown since the one that began in 2018. An investment cannot be made into an index. Past performance does not guarantee future results.

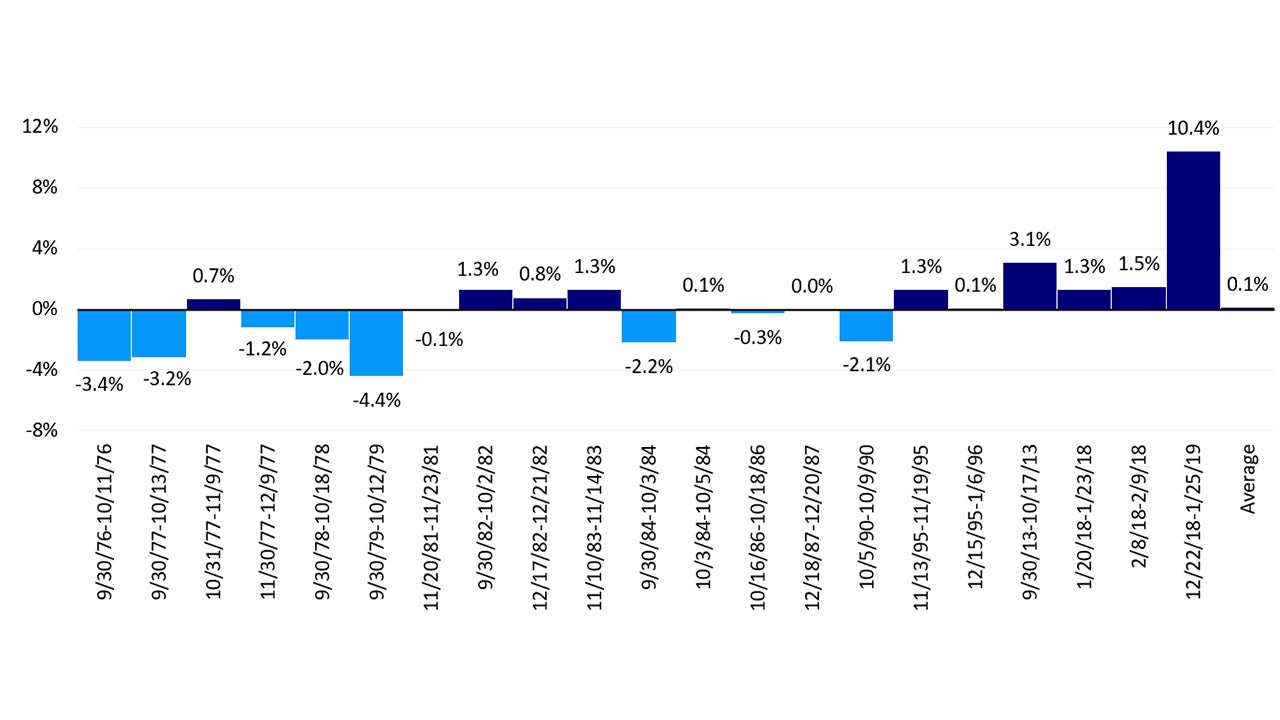

The US equity market, represented by the S&P 500 Index, posted positive returns over 12 of the 21 government shutdowns. The average return during the shutdowns is 0.1%.1

Ultimately, I would expect the debate over the shutdown, or a potential shutdown itself, to end without significant incident to the market or the economy. As Winston Churchill may have said, “Americans always do the right thing, but only after exhausting all other options.”

With contribution from Brian Levitt

Source: Bloomberg, L.P. 12/31/24. An investment cannot be made into an index. Past performance does not guarantee future results.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.